Kevin Frayer/Getty Photos Information

On this article, I analyze Baidu’s (NASDAQ:BIDU) enterprise segments individually, together with advert enterprise, cloud enterprise, autonomous driving enterprise, and iQIYI. I additionally focus on why Baidu’s model picture is enhancing, what retains the inventory value low, and what the valuation must be.

Core Advert Enterprise – Steady And Not A lot To Fear about

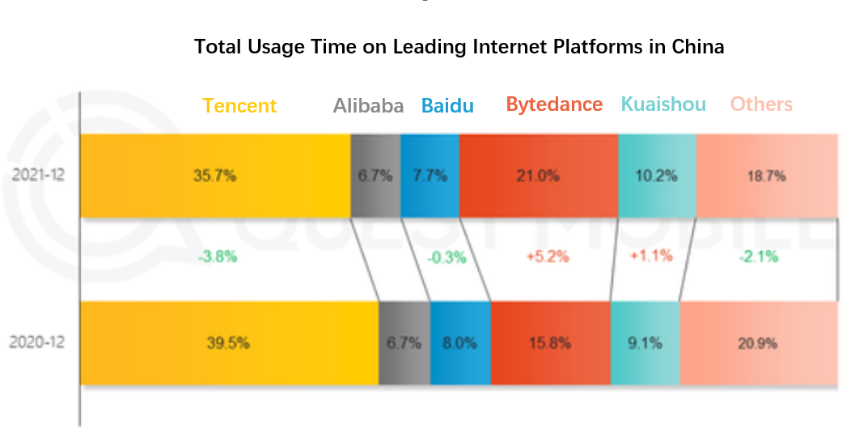

Over the previous three years, quick video platforms (resembling Douyin and Kuaishou) have captured a good portion of customers’ time and took a part of Baidu and Tencent’s (OTCPK:TCEHY) promoting enterprise. Nonetheless, the latest traits present that the quick video platforms’ development is beginning to decelerate. In line with the latest statistics revealed by QuestMobile, whole utilization time for Bytedance (together with Douyin) elevated from 12% to 21% of the entire inhabitants, and Kuaishou elevated from 4.4% to 10.2% from September 2019 to December 2021. Social communication apps resembling Tencent and different smaller gamers had been harm probably the most in utilization time. Nonetheless, we see utilization time on Baidu Group (together with iQIYI) keep comparatively secure in recent times, and the 0.3% drop was primarily from iQIYI. Serps are resilient on this competitors as individuals’s search queries keep comparatively secure.

Determine 1: Complete Utilization Time on Main Web Platforms in China

Questmobile Questmobile

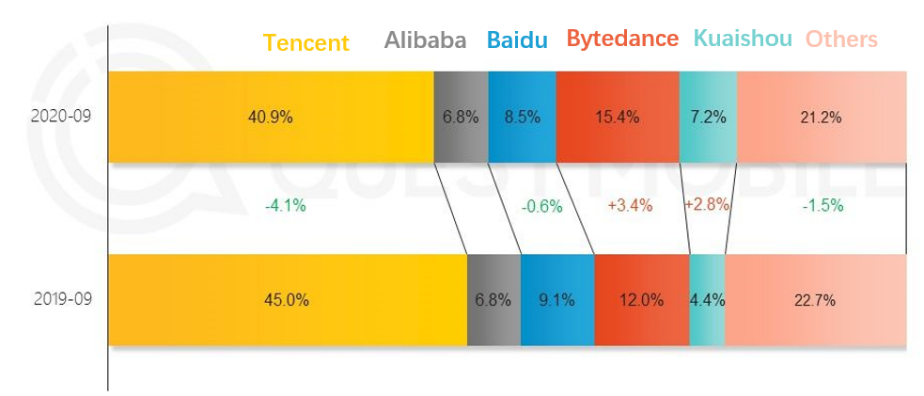

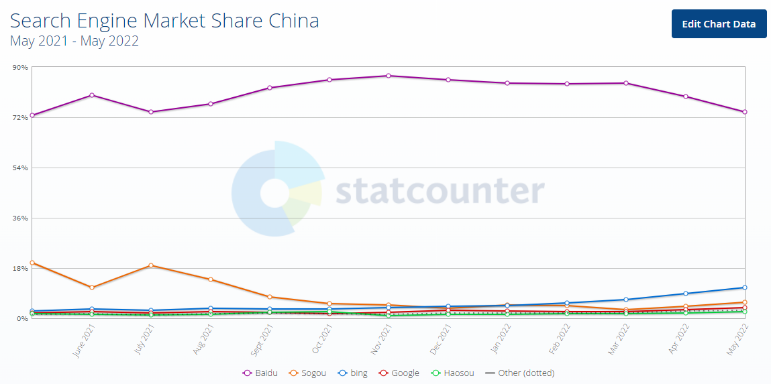

Baidu App MAU (not together with iQIYI) grew at 13% YoY in the latest quarter, which is far increased than the cellular person inhabitants development of two% YoY. Baidu App’s month-to-month energetic customers determine at the moment ranks fifth, solely behind WeChat (1b MAU), Douyin (670m MAU), Taobao (856m MAU), and Alipay (788m MAU), nevertheless it stays forward of Kuaishou and Weibo in China.

Determine 2: Baidu’s MAU

Baidu Quarterly Reviews

On the digital promoting income facet, what Baidu is dealing with is just like Google (GOOG) within the U.S. They each specialise in search advertisements and each goal audiences who’re already looking for sure services or products, which suggests they face much less of a menace in comparison with publishers that focus on “chilly” audiences utilizing feed advertisements. For instance, a hair transplant service supplier can promote its enterprise a lot better by putting search advertisements in a “hair transplant” key phrase search in contrast with concentrating on broader audiences in different publishers. Regardless of the success of quick video platforms, for sure kinds of services or products, search advertisements are all the time the most effective use of finances allocation.

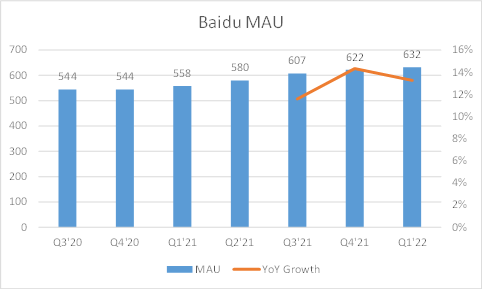

Search engine enterprise comes with vital community results, and its main place is tough to interrupt. Firstly, serps require excessive value in constructing the know-how — pure language processing, picture recognition, data graphs, and many others. — and it additionally takes years of amassing person question and person click on knowledge to optimize the algorithms. Secondly, this market problem might be demonstrated by the oligopolistic panorama in numerous nations. Google takes about 88% market share within the U.S., Yandex takes about 65% market share in Russia, Naver takes about 60% market share in Korea, Baidu takes 74% market share in China, and there aren’t any apparent rivals to problem this aggressive panorama. Regardless of that, Bytedance launched its desktop search engine Toutiao Search in 2021. The search pace is about 30% slower than Baidu, doesn’t present as a lot data as Baidu, and isn’t utilized by most people. Baidu’s search advert enterprise is protected by a deep moat, and from the present development, we solely see the moat getting deeper.

Determine 3: Search Engine Market Share in China

StatCounter

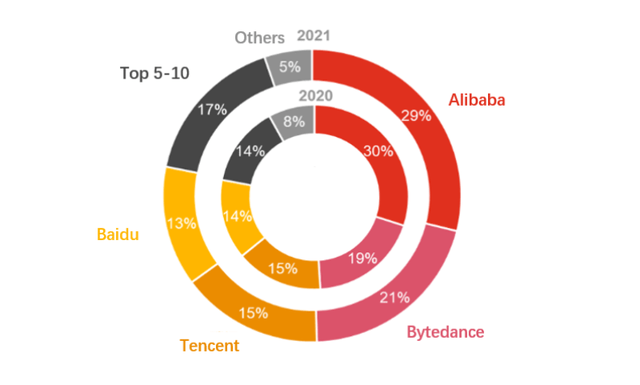

In line with IMZ Lab, the digital promoting market share is getting extra concentrated. Bytedance’s market share elevated by 2%, and the highest 5-10 gamers’ market share elevated by 3%, primarily from Kuaishou and Meituan. Regardless of Douyin and Kuaishou taking the pie, Baidu nonetheless holds its market share comparatively secure. In the latest quarter, Baidu’s advert income solely declined by 4% YoY, higher than Tencent’s advert decline of 18% YoY, however nonetheless decrease than Kuaishou’s advert development of 30% YoY. Notice that Kuaishou’s advert development is decelerating and declined from 95% development in 2021. Bytedance took a part of Baidu and Tencent’s advert enterprise, however in the present day Bytedance’s advert income is already about twice that of Baidu, and 70% of its advert income is from Douyin. We see Bytedance’s affect has decelerated, and Baidu doesn’t have a lot to fret about.

Determine 4: Digital Promoting Market Share in China

IMZ Lab

AI Cloud – Quick Rising Enterprise with a Lengthy Development Runway

Within the Baidu Q1’21 earnings name, its CEO Robin Li mentioned,

“We’ve been investing in AI for greater than 10 years, and within the subsequent three years, Baidu’s non-ad enterprise income might presumably exceed 50% of Baidu core income”.

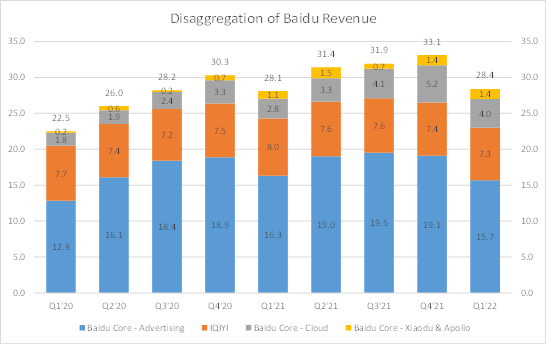

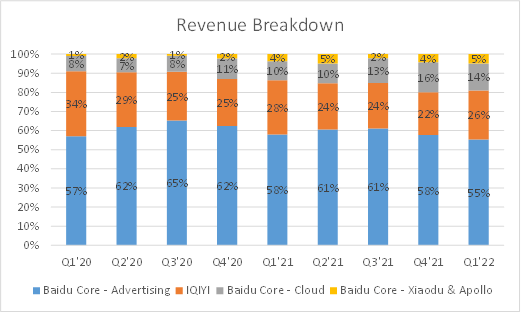

If achieved, Baidu will likely be valued by a a lot increased a number of. In the latest quarter, the non-ad core enterprise income is Rmb 5.7b, together with Rmb 4b of Cloud and Rmb 1.7b of Xiaodu (DuerOS) & Apollo mixed. At present, Baidu Cloud is rising at 45% YoY, a lot increased than Alibaba Cloud’s (BABA) development of 12%. If Baidu Cloud income retains rising at 46% YoY over the subsequent three years, it might make up 28% of the entire non-ad core enterprise in 2024. The income forecast towards the top of this text exhibits that is extremely achievable.

Determine 5: Disaggregation of Baidu Income (in billions RMB)

Baidu Quarterly Reviews

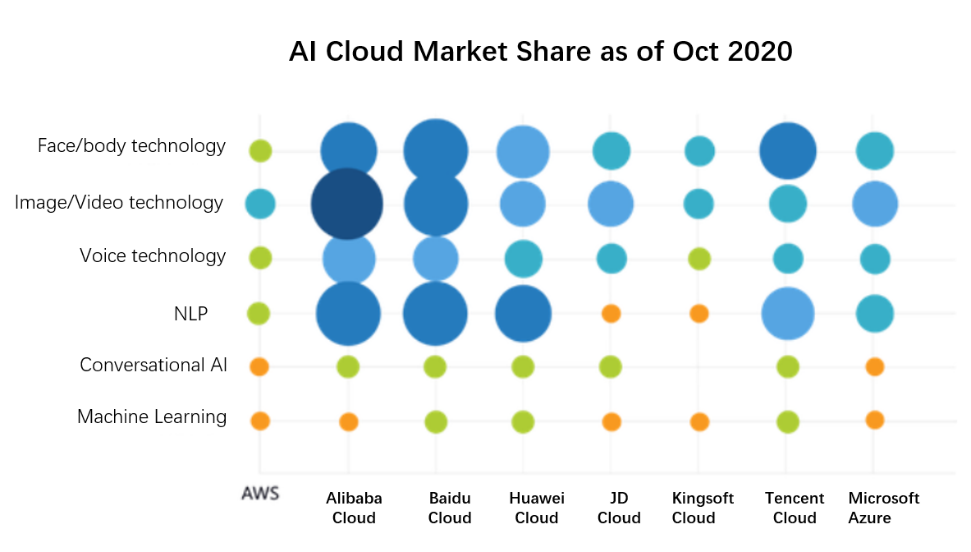

Baidu Cloud generated Rmb 9.3b income in 2020, or 16% of BABA’s cloud income in the identical interval. The ratio additional elevated to 21% in Q1’22 as Baidu Cloud’s development accelerated (+48% YoY in Q1’22). Baidu Cloud is extra centered on PaaS and SaaS, which take >50% of the entire cloud income, whereas others would solely have 30% whole cloud income from PaaS or SaaS. Baidu Cloud makes a speciality of AI, and in line with IDC, Baidu Cloud is the biggest participant in China’s AI cloud market with a 33% market share in 2020. Regardless of the AI cloud market nonetheless being comparatively small (RMB 18.7b in 2020, 15% of the entire public cloud market), it’s anticipated to develop sooner (43% vs. 35% ’20-’25 CAGR) attributable to robust demand from varied industries. IDC classifies six particular classes of AI cloud, together with video and picture recognition know-how, NLP (pure language processing), conversational AI, voice recognition know-how, face & physique recognition know-how, and machine studying. Baidu tops the particular classes of NLP, picture know-how, and face & physique recognition know-how. This success follows via to Baidu’s edge within the NLP and picture recognition know-how within the search engine enterprise.

Determine 6: AI Cloud Market Share

Supply: IDC

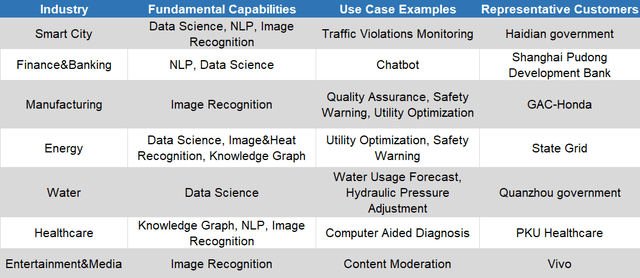

Baidu Cloud’s elementary AI capabilities — NLP, picture recognition, data graph, and many others., are extremely transferrable, and thus might be applied in varied industries. Under is a quick abstract of what Baidu AI Cloud can do in numerous industries. Wanting into the use circumstances, we discover Baidu AI Cloud is changing some low-skill labor, resembling defects inspectors (manufacturing), customer support specialists (banking), content material moderators (media), and many others. What might be anticipated is that AI capabilities have an extended runway to turn out to be smarter and extra influential in human lives. Three examples of what AI can do higher than people are proven beneath.

Desk 1: Baidu AI Cloud Use Instances

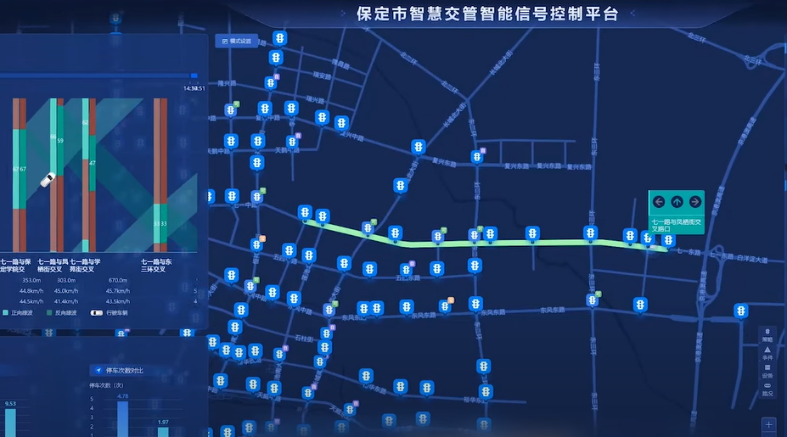

- AI Cloud Use Case Instance #1: Baoding, a metropolis of two million individuals, is among the cities that adopted Baidu’s sensible visitors (transportation cloud) system. The town first applied the system in 2019, and the protection has expanded to 176 intersections within the city areas. It detects the visitors quantity on every highway via digital camera know-how and adjusts visitors lights accordingly based mostly on its algorithm. After implementing it, metropolis drivers encounter extra inexperienced lights and fewer purple lights. The general journey time is minimize by 20%, and the common pace will increase by 6.5km/h.

Determine 7: Baidu’s Good Transportation Cloud Management Panel

Baidu YouTube

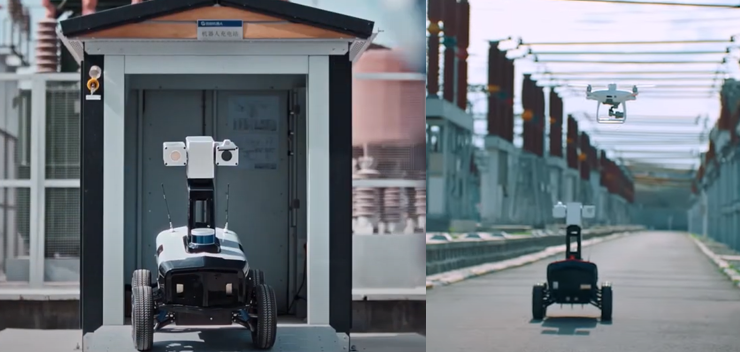

- AI Cloud Use Case Instance #2: Baidu Kaiwu, its AI Cloud product concentrating on the manufacturing and vitality fields, solves the issue of security inspections at manufacturing websites utilizing its sensible inspector proven beneath. It may possibly detect overheating issues on the grid with 95% accuracy. Baidu Kaiwu additionally claims that its sensible vitality utilization optimization can save 1.55g/kWh in energy plant coal utilization and scale back carbon emission. Notice that the present adoption charge of commercial web platforms is low. Baidu’s Kaiwu at the moment serves 300 companies in ~16 cities. China’s Fourteenth 5-Yr Plan extremely helps the event of digital transformation of commercial corporations and targets to attain a forty five% adoption charge of the trade web throughout the nation by 2025. This authorities plan creates an extended development runway for Baidu Kaiwu for at the least 5 years.

Determine 8: Baidu Kaiwu Good Inspector

Supply: Baidu YouTube

- AI Cloud Use Case Instance #3: Baidu makes use of its visible recognition know-how and its graphic-loaded visible AI fashions with zero code to carry out the standard assurance checkups of Honda Odyssey’s automotive lights in a single second. Its automated recognition accuracy is ~99%.

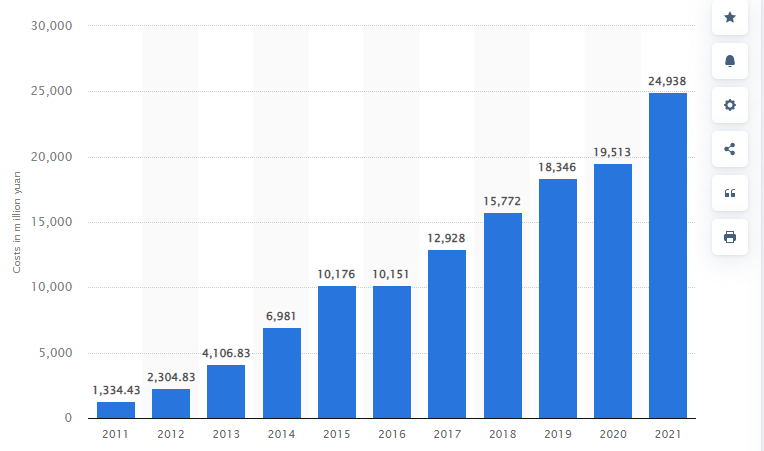

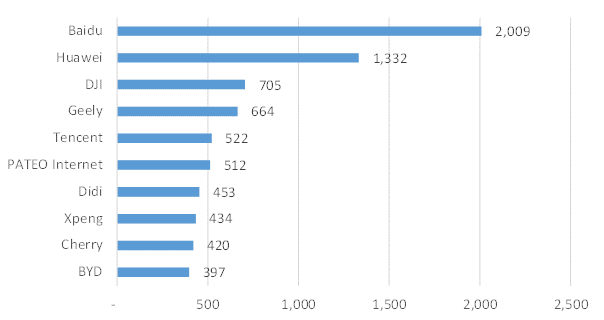

Baidu Apollo – A Clear Chief In China, And Its Robotaxi Might Monetize Quicker Than Anticipated

Baidu didn’t disclose how a lot it has invested into autonomous driving, however since 2015, which is the yr Baidu based autonomous driving unit, Baidu cumulatively invested over $17b into R&D and $7b into CapEx (2015-2021). The vast majority of the R&D funding is believed to have gone into sensible transportation and autonomous driving. Baidu’s cumulative funding in autonomous driving/sensible transportation might exceed $10b. Wanting the world over, the businesses that invested this a lot into robotaxi enterprise (Stage 4+) are solely Waymo (owned by Google) and Cruise (owned by GM), and these funding candidates are just a few within the world capital market. Each Waymo and Cruise are valued over $20b, whereas Baidu’s whole market cap is simply $50b.

Determine 9: Baidu R&D Expense(in tens of millions RMB)

Supply: Statistica

What does Baidu get out of this large funding?

- It turned one in all seven firms to have driverless permits in California.

- It turned one of many two firms to have commercialized driverless ride-hailing serving the general public in Beijing/China.

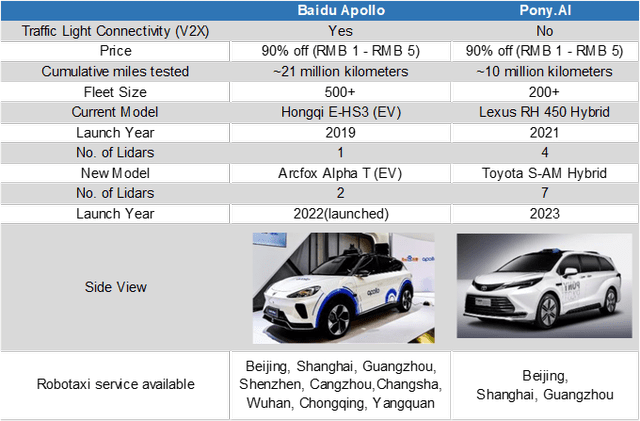

- It owns a fleet of ~500 robotaxis with cumulative testing miles of 21 million kilometers, whereas its closest competitor, Pony.AI, has a fleet of ~200 robotaxis and cumulative testing miles of 11 million kilometers. Baidu and Pony at the moment are the one two that may cost charges for robotaxi service in China. The present value is 90% cheaper than taxi fares, however they’ll positively enhance over time. Along with the size reached, Baidu additionally has the V2X know-how that may hyperlink its robotaxis to the sensible transportation cloud (ACE) product in addition to autonomous driving options to OEMs that Pony.AI doesn’t have.

Desk 2: Baidu Apollo and Pony.AI Comparability

Supply: Official web sites

- Baidu Apollo Moon, the fifth technology of its robotaxi, has a price of $72k, the bottom in China (Baidu claimed).

- One model EV, Jidu, is about to be delivered in 2023 and appears extra aggressive than Xpeng.

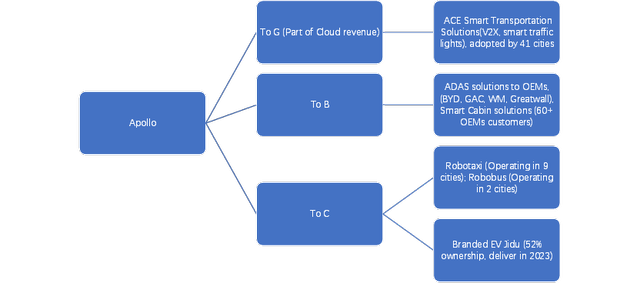

- Baidu is the one firm in China that has 4 income sources: 1) Good transportation merchandise (to serve governments), 2) Autonomous driving options (to serve automotive producers), which intention to compete with the autopilot operate of Tesla, 3) Robotaxi (to serve finish clients), and 4) Branded EV — Jidu

Determine 10: Three Income Supply of Apollo

Supply: Baidu Disclosures

- It’s working robotaxi companies in 9 cities in China (probably the most in China, adopted by Pony), and it plans to succeed in 65 cities by 2025 and 100 cities by 2030.

- It supplies sensible transportation merchandise for 41 cities, including six cities over the past quarters.

- The corporate has probably the most patents within the autonomous driving area in China.

Determine 11: Autonomous Driving Patents Rating in China

Supply: CNIPA

Baidu and Geely’s three way partnership Jidu (Baidu owns 52%) launched its first idea mannequin, Jidu Robo 1, in June 2022. This idea mannequin follows the idea mannequin Robocar that Baidu launched throughout Baidu World 2021. The highlights embody:

- Two lidars, every on the facet of the hood. These lidars come from Baidu’s investee, Hesai.

- One foldable wheel, indicating Jidu Robocar is able to full self driving.

- Full voice management/communication functionality.

- Estimated value of ~$30k to $40k.

- Futuristic design, which is interesting to the younger technology.

Determine 12: Jidu Robo 001

Supply: Information Releases

Each Apollo and Pony’s robotaxi are open to the general public in Beijing, and in March of this yr, I examined each and was impressed by each. I used to be particularly impressed by Baidu’s visitors lights and robotaxi connection functionality, permitting Baidu’s robotaxi to synchronize the counting down seconds of the visitors lights via its V2X know-how (though the visitors gentle is past detection distance), and this might make journey time extra predictable and optimize journey routes sooner or later. What may very well be improved was that Baidu typically carried out extra conservatively than Pony and had onerous breaks if different vehicles abruptly minimize into our lane, nevertheless it general met my expectation. Robotaxi’s success depends on two issues — know-how and business functionality. I imagine Baidu has a big edge over Pony.AI attributable to its enough money place, the size it has reached, and the model it has already constructed.

Autonomous driving may very well be the subsequent wave of know-how development in subsequent three years. In line with Lux Analysis, the working value of a robotaxi is simply ~$0.46 per mile within the U.S., and present fare is $2 per mile within the U.S., that means that the robotaxi supplier is ready to earn 50% gross margin from $1 per mile provided, a 50% low cost to present fare value. Furthermore, it’s additionally a lot greener, because it’s powered by electrical energy and will have a central transportation cloud to optimize routes, which might save 52% on carbon emission. If you wish to put money into autonomous driving, the most effective is certainly to put money into knowledge and algorithm house owners, resembling Tesla, Cruise, Waymo, or Baidu, relatively than lidar firms. {Hardware} can solely get cheaper, however the information/algorithm house owners have robust community results, and their benefit might solely get deeper over time. The logic is comparable with serps.

Autonomous driving may very well be commercialized sooner than anticipated. In July 2021, Beijing introduced that the brand new Daxing Airport Categorical Freeway and partial south Fifth Ring and south Sixth Ring Roads (marked in purple beneath) are included within the Autonomous Driving Demonstration Zone, which permits suppliers resembling Baidu and Pony to check robotaxis. This prepares the robotaxi companies to additional develop their working space from Yizhuang to the Daxing Airport and cost fares for the airport journeys sooner or later. The Daxing Airport lacks nighttime public transportation service after 10:30pm, and a robotaxi may very well be finest utilized then as there’s virtually no visitors on this freeway, and a robotaxi can by no means be drained at night time. With this service to be supplied sooner or later, passengers might take a robotaxi at midnight on the airport and journey to the Yizhuang space. I count on this service to be supplied earlier than the top of 2023.

In June of this yr, Cruise began to offer full driverless robotaxi service to the general public between 10pm to 6am in a partial metropolis space of San Francisco, which is an enormous step ahead in U.S. autonomous driving historical past. I count on that its service would develop to the San Francisco airport in lower than 1.5 years. Following Cruise, Baidu will present the identical sort of service in Beijing, and I imagine this can function a catalyst for Baidu’s inventory.

Determine 13: Apollo Operation Space (in Blue) and New Roads Open for Testing (in Pink)

Supply: Apollo

Public Picture Is Bettering

Individuals all the time underestimate how vital public relations is for an organization. Take Fb for example. After the Cambridge Analytica scandal in 2018, the corporate needed to do extra work to earn belief from each the customers and the federal government, which led to difficulties in launching cryptocurrency initiatives, doing M&A, having customers activate monitoring, and many others. This partially resulted in rebranding, and the corporate renamed it to Meta.

After making huge investments in AI and autonomous driving for greater than 10 years, the general public in China progressively realized Baidu is the tech large that carries the know-how innovation initiatives and receives reward. That is in distinction with the general public’s blame of different tech giants invested in leisure or zero-sum video games, resembling Tencent’s funding in video games (leisure), Bytedance’s funding within the addictive algorithm of Douyin (leisure), or Meituan (OTCPK:MPNGY) subsidizing its recent meals enterprise closely to bail out rivals (zero-sum recreation) and merging with Dianping to dominate the domestically discovered service enterprise. Regardless of Baidu’s medical advert scandal in 2016 that was broadly criticized, we see Baidu’s picture in the present day is leaning extra in direction of being a tech firm and is getting extra optimistic within the public eye. This public picture helps Baidu execute its AI cloud and autonomous driving plans in every native space, as these contain native authorities assist and the general public’s championship.

We clearly see Baidu growing its public publicity within the latest two years and changing into extra high-profile in showcasing its know-how. For instance, Baidu World 2021 was hosted on state-owned tv CCTV’s livestreaming to showcase its AI choices, which lasted three hours and lined its driverless automotive, AI cloud, and many others. Baidu launched its AI signal language anchor to supply signal language on CCTV throughout the Winter Olympics, and Baidu actively showcases what might be completed with its AI on its social media channels, together with YouTube, WeChat, and many others.

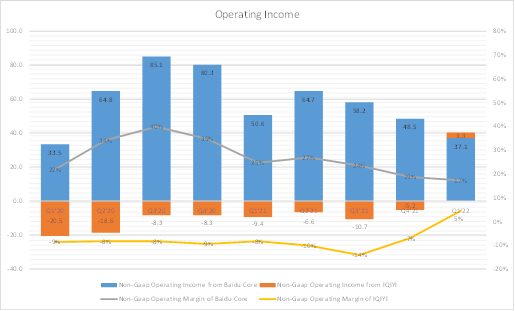

iQIYI Ends Its Loss Journey

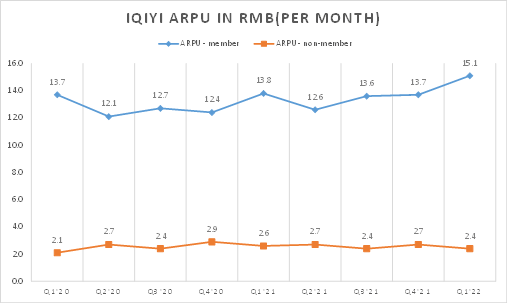

iQIYI was a money burning machine over time and had a cumulative lack of $7b in its historical past, nevertheless it turned a revenue lately for the primary time since IPO. Because of the 7.7 foundation level enhance in gross margin and 9.6 foundation level discount in working expense as p.c of income. iQIYI at the moment has a non-GAAP internet working margin of 4.5%, and Baidu holds ~57% of iQIYI.

What’s additionally optimistic about iQIYI is that its ARPPU elevated 8.8% to Rmb 15/month as a result of latest enhance in membership payment. The ARPPU elevated prior to now 9 consecutive quarters.

Determine 14: Working Revenue and ARPU of IQIYI

Supply: iQIYI Earnings Launch

Present Valuation – 100% Upside Potential

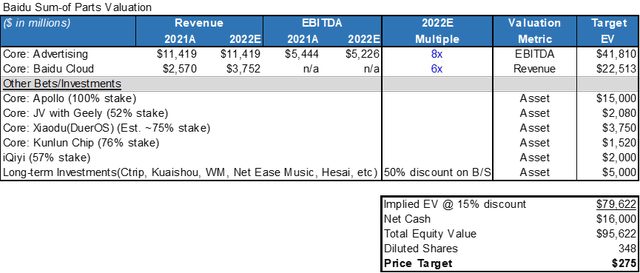

Using the sum of components valuation technique, Baidu’s goal value is $275, or $80b enterprise worth. Underneath this valuation technique, core promoting is valued at 8x EBITDA a number of, Baidu Cloud is valued at 6x EV/S, Xiaodu and Kunlun chip are valued in line with their latest financing, and Apollo is valued conservatively at ~$15b, in contrast with Waymo or Cruise at ~$20b. Baidu’s present market cap is ~$50b, solely overlaying the worth of promoting enterprise and internet money ($15b). The opposite important components (Apollo, Cloud, Xiaodu, and many others.) will not be priced in. Baidu’s long-term funding will also be valued at $5b, as these embody some high quality investees resembling Web Ease Music, Hesai, and WM Motors which are about to be public. Attributable to Baidu having to carry a sure fairness share to take care of the connection with sure companions, I give a 50% low cost to the truthful worth on stability sheet.

Steady promoting enterprise and internet money provide a really vital draw back safety, whereas Apollo and Cloud provide ultimate upside potential.

Desk 3: Sum of Components Valuation

What Retains Baidu’s Worth Low?

There are two principal elements that at the moment impacts Baidu’s valuation:

- The highest concern the market has is that the promoting enterprise will proceed to shrink and Baidu’s AI and autonomous driving are gradual to develop, resulting in no income development in subsequent three years. Nonetheless, this contradicts with what Robin predicts, which is that fifty% of income will likely be coming from AI Cloud, autonomous driving, and Xiaodu (shopper electronics) in three years. I imagine that the income development concern explains 80% of the present low valuation state of affairs right here.

- Delisting is a priority because the US-China cross-country audit issues haven’t been full resolved. As is acknowledged by PCAOB, though there have been productive discussions between U.S. and Chinese language authorities relating to the fitting to audit workpapers, vital points stay. If there isn’t a progress earlier than 2023, Baidu might face delisting. Regardless of that, Baidu can be listed in Hong Kong, and its shares may very well be transformed to HK shares. Not each fund is keen to take the HK shares, and it might create a 10-20% draw back. Nonetheless, I imagine that Baidu might turn out to be the subsequent one to be listed within the A share market. The earlier instance is Beigene (BGNE), which is listed in A share, HK, and U.S. markets. There may be additionally a latest instance of Zlab (ZLAB) finishing its conversion to dual-primary itemizing in HK, which is in preparation to be added to Shanghai-Hong Kong Join. The loss quantity within the U.S. market may very well be compensated for by the brand new shopping for quantity within the A share market or by being added into Shanghai-Hong Kong Inventory Join sooner or later. An organization’s valuation is extra decided by its fundamentals relatively than the place it’s listed.

- Some political strain is on funding in Baidu, Alibaba, and Tencent, that are seen because the AI leaders in China. SenseTime Group, an AI chief that has a surveillance enterprise, was added to the U.S.’s entity listing attributable to accusations of growing facial recognition packages that may decide a goal’s ethnicity, with a selected give attention to figuring out ethnic Uyghurs. There have been voices that say Baidu has partnered with sure analysis institutes which may have sure ties to the navy of China, though it was not confirmed, and I didn’t discover any. This may very well be one concern that retains some U.S. institutional traders away. This political facet is troublesome to measure, however I imagine it may be solved as soon as Baidu is added to the Shanghai-Hong Kong Join.

Final Ideas

Baidu has invested closely into AI and autonomous driving, which haven’t contributed a lot to the income but. As a result of lack of income development, and the market usually lacks persistence in gradual income development firms, Baidu’s valuation a number of is low. Nonetheless, within the subsequent three years, I estimate that each AI Cloud and autonomous driving enterprise will develop exponentially. In 2024, non-ad enterprise might take 50% of whole core income. Cloud enterprise might take ~28% (46% CAGR), the remainder (Apollo, Jidu, Xiaodu, Kunlun) might present the remaining 22%. Of these, Jidu might simply contribute Rmb 17b income in a yr (120k supply in a yr), or 10% of whole. Complete income might develop from Rmb 125b to Rmb 215b. By that point, Baidu may have the next valuation a number of attributable to extra tech parts. The very best buying and selling technique is to carry it for 3 years.

Desk 4: Baidu’s 2024 Income Estimated

|

In RMB |

2021 |

2024E |

|

Core – Promoting |

74b |

86b (Est. 5% CAGR) |

|

Core – Cloud |

15b |

48b (Est. 46% CAGR) |

|

Core – Apollo |

0 |

4b (2b from Robotaxi) |

|

Core – Jidu |

0 |

17b (Est.120k supply) |

|

Core – Xiaodu & Others |

5b |

15b (Est. 44% CAGR) |

|

IQIYI |

30b |

45b (Est. 15% CAGR) |

|

Complete |

125b |

215b |

%2018_04_2024..jpg?rect=0%2C30%2C1600%2C840&w=1200&auto=format%2Ccompress&ogImage=true)