zhongguo/E+ through Getty Photos

Overview

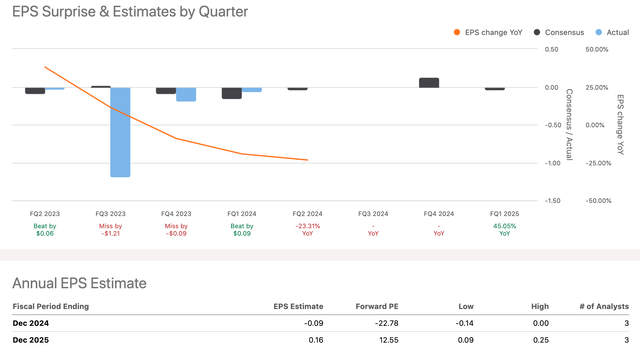

The run-up within the share worth of Babcock & Wilcox Enterprises, Inc. (NYSE:BW) in July ’24 makes this a profit-taking alternative, igniting our Promote ranking, right now. There’s a Robust Purchase consensus among the many few analysts following BW. They forecast greater earnings over the following few quarters based mostly on administration’s assertion to shareholders as a result of the corporate expects to generate adequate income whereas pursuing higher-margin contract work and reducing overhead. We consider adjustments in path will take longer than a couple of quarters to influence the financials and lift the share worth to a talked-about goal of $5 per share. Right here is how Searching for Alpha foresees the EPS:

EPS Estimates by Quarter (Searching for Alpha)

BW is a 155-year-old power and environmental options firm working in three segments. Its inventory slumped over the past 5 years and is down ~68% in 12 months. The inventory is unstable. Its Levered/Unlevered Beta is 2.22 over 24 months in keeping with Searching for Alpha and three.30 at the moment. Our February article assessed the inventory as a Maintain however probably a average purchase at ~$1.05. On information of an asset sale, the shares popped in July to $2.07. The value will most likely wander on this neighborhood for some time, suggesting to us that it is a potential Promote alternative.

Share Worth Strikes (Searching for Alpha)

Shares topped $9 every in Could 2021. The value finally collapsed to a 52-week low of $0.75. It didn’t climb a lot after administration stated in April ’24 that they had been adjusting the FY ‘24 EBITDA goal from $105M to $115M. The value held regular in Could when the corporate introduced working revenue in Q1 ’24 was $4.3M in comparison with $1.3 in Q1 ’23. The CEO added thrilling information that the corporate signed $500M in new contracts in Q1 ’24, double over Q1 ’23. Backorders topped $800M, or 29% greater than the backorders reported within the first quarter of the prior 12 months. The inventory worth floated between $1 and $1.20 per share, forwards and backwards, as buyers seemingly ignored the CEO’s optimistic steerage.

Profile

Babcock and Wilcox designs, sells, and installs clear power tools, tech R&D for power and different corporations, and providers and maintains and converts tools to adjust to authorities rules and legal guidelines.

BW’s Companies & Industries (Babcock & Wilcox)

The share worth floated in Could between $0.92 and $1.20. The Q1 earnings announcement and optimistic steerage from administration didn’t influence the share worth:

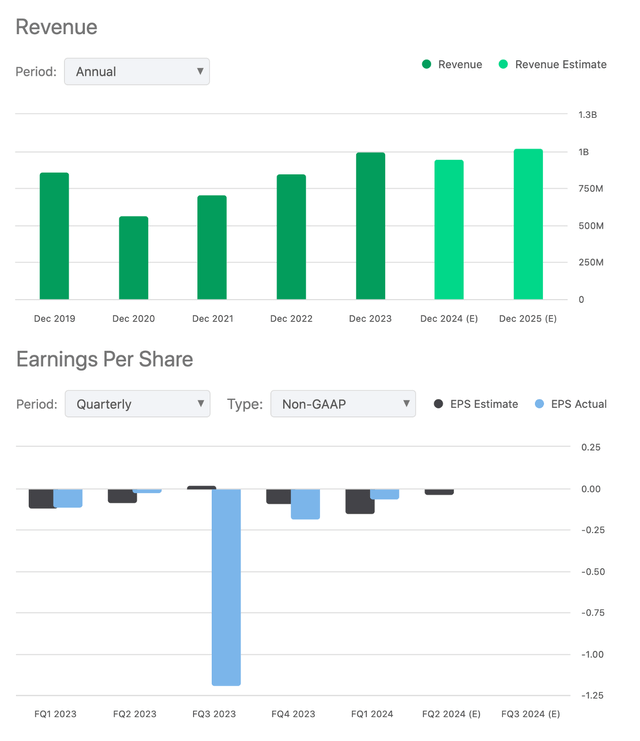

- Q1 ‘24 income ($207.6M) was lower than Q1 ’23. Analysts anticipated higher outcomes, although BW was extra selective in pursuing higher-margin contracts.

- BW’s gross revenue margin has been about 22.4% over the previous 2.5 years. The Oil & Fuel Gear and Companies trade’s g. p. averages 28%.

- The corporate’s web lack of $15.8M in Q1 ‘24 included a $5.1M loss on debt extinguishment; the online loss in Q1 ’23 was $12.7M. The trade web revenue averages 4.5%.

- EPS was -$0.22 in comparison with -$0.18 Y/Y per quarter.

- Adjusted EBITDA of $12.5M was lower than the $13.6M the 12 months prior.

- In December ’23, complete debt was $379.5M ($437.1M TTM) and money, equivalents, and receivables hit $335.5M ($305.7M TTM).

On July 1, ’24, the corporate introduced the sale of its Denmark-based unit for $87M in money at closing on June 28. Administration will use the cash to pay down debt and enhance liquidity, and its working capital. Little different info has been launched. Shares had been up 34% that day. Company insiders had been exercising choices and buying shares in bulk for the reason that closing months of 2023.

Danger

We’re impressed with the gross quantity of newly signed contracts; we fear that the again orders are lagging success as a result of the corporate is pursuing cost-cutting measures that may delay order success. We’re skeptical of any severe turnaround in earnings over the following few quarters. And if the Republicans win in November, excessive on the agenda are environmental regulation cutbacks that may negatively have an effect on BW’s future income.

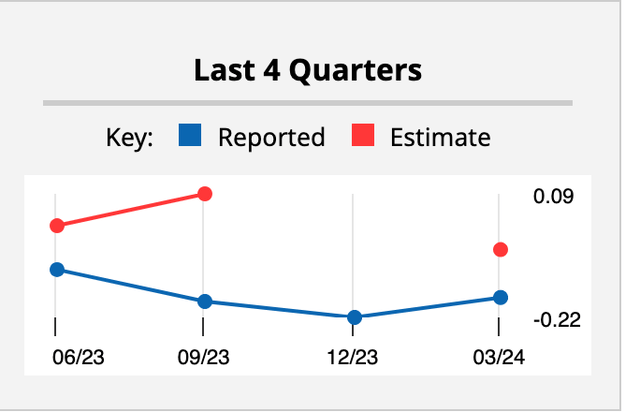

Earnings to Estimates (Barchart)

Regardless of extra income, the Q1 ’24 precise earnings of $-0.22 EPS missed estimates by $0.09. The corporate continuously misses quarterly estimates of GAAP EPS per Searching for Alpha charting reveals.

Income & Earnings (Searching for Alpha)

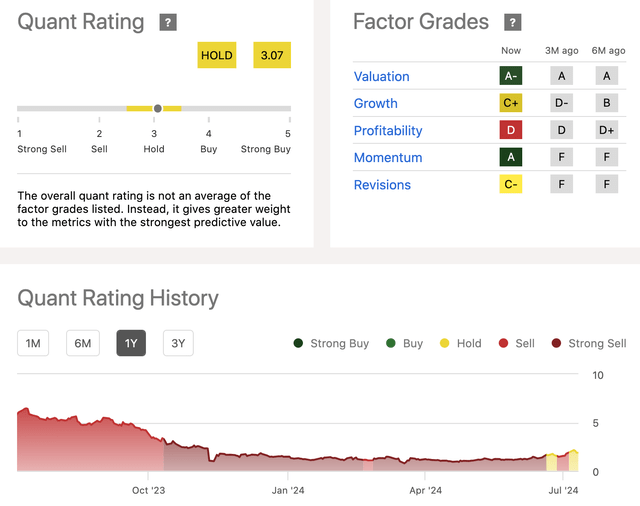

Momentum not too long ago surged. The Issue Grade improved from Fs to an A. Grades for Valuation, Development, and Profitability slipped from 6 months prior. Even now, there doesn’t appear to the Relative Energy in BW in comparison with RSI.

Searching for Alpha has maintained a long-term Quant Promote Ranking of BW inventory till the announcement of the sale. However the slide bar nonetheless tilts in that path. The glittering generalities of how administration plans to make use of the $87M might be telling. $87M added to the $335.5M in money, equivalents, and receivables practically equals the corporate’s debt load.

Quant Ranking & Issue Grades (Searching for Alpha)

Valuation

BW pays no dividend. BW doesn’t fee a PE ratio as a result of it has no sustained earnings. The excessive Issue Grade for Valuation is predicated on its Enterprise Worth-to-Gross sales and Worth-to-Gross sales. EV-to-EBITDA (TTM) will get a failing grade. We consider the A Issue Grade for Momentum will tumble once more until there may be help for one more money sale of one other main firm asset or a takeover supply.

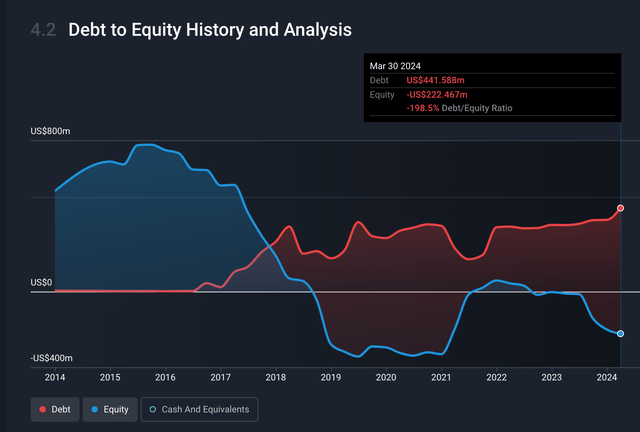

BW’s progress in gross sales in comparison with main opponents is woeful. BW’s price-to-sales ratio is 1.9% versus 10.4% P/S amongst BW’s 4 prime friends. Trying again on the debt and shareholder fairness, the corporate’s debt-to-equity ratio hovers round -200%. Quick-term liabilities outstrip short-term property.

Debt to Fairness (Merely Wall St)

Earlier than snagging $87M in money, the corporate’s register was on the trail to being drained. Free money circulation might need lasted 10 to 12 months if administration’s machinations didn’t kick in. We should wait a number of quarters to be in a liminal state earlier than definitively realizing the money runway. If administration can improve margins and scale back prices, then the long run appears brilliant and value resisting our ranking close to the top of the 12 months.

Takeaway

In our opinion, BW charges a Promote after the share worth practically doubled for the reason that sale of its Denmark operations had been bought. The share worth fell from $2.07 to $1.87 in lower than per week and moved up 8 cents to shut final week, reflecting the inventory’s volatility over the earlier 24 months. It may not tumble to $1, however we don’t see an incentive undergirding the $5 goal worth this 12 months. Administration unlocked capital with the sale (and there could also be extra actions like this to come back) however we await to study taxes, commissions, and bonuses to be paid. We have no idea what the appraisal was for the operations.

Whereas Wall Road analysts fee the inventory a Robust Purchase with a goal worth consensus of $5.00 over the following 12 months, the banking and funding agency Craig-Hallum introduced in July a ranking improve of BW with a $2 goal worth; in April the shares bought for ~$1 when the agency made a $50M transaction supply to buyers.

Mark Twain’s quip is an efficient reminder to present and potential BW retail worth buyers, “What will get us into hassle isn’t what we do not know. It is what we all know for positive that simply ain’t so.”