Nikada

Expensive co-investor,

2024 was a 12 months of sowing. Following the harvests of 2021 to 2023 (+122% in Azvalor Worldwide, +71% in Managers, and +64% in Iberia), in 2024 we sowed once more the returns that we’ll reap sooner or later.

We closed 2024 with 2.920 billion euros AUM and greater than 75 million euros of internet inflows, making us the worth investing supervisor with the best progress on this sector (see information). Greater than 2,500 new co-investors joined Azvalor throughout this era, including as much as over 27,000.

The macroeconomic context is already effectively analysed and now we have little so as to add. As all the time, we give attention to constructing a portfolio for any state of affairs, fairly than predicting the particular future state of affairs (which nobody will get proper in a constant method). We’re notably involved about sovereign debt (within the West). The USA has by no means had such a big price range deficit with such low unemployment. If unemployment rises, how excessive will the deficit go? Subsequently, we don’t consider that holding bonds as a long-term funding is a sound technique immediately.

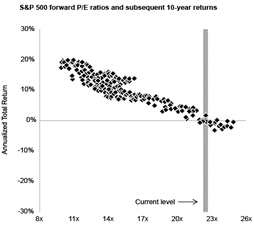

Nonetheless, after virtually 30 years of investing, we do think about ourselves specialists to find the funding alternatives that the market presents. The present menu is enticing and bodes effectively for the potential of our funds, in distinction to our expectations for the indices. On the finish of the 12 months, for instance, we discover the most important US indices buying and selling at excessive multiples of earnings—that are additionally excessive. If earnings come down a bit and multiples contract a little bit, we might simply see 20-30% declines within the fairness markets—and even then they’d not be considerably undervalued. Traditionally, greater beginning valuations have systematically led to decrease future returns and vice versa (see chart1).

At Azvalor, we make investments in opposition to the grain of the most important fashions and narratives: our portfolios are nothing just like the indices, and it might occur (because it did in 2022) that they carry out effectively even in market downturns. In truth, though it could be anecdotal, our portfolios have outperformed on days when the indices have fallen—for the reason that starting of 2025.

Our portfolios

Right this moment, as prior to now, our portfolios are made up of fine companies that we will perceive (for us, this implies predicting their growth over 10 years), managed by individuals who put shareholders first and, above all, purchased at enticing costs because of conditions of short-term market pessimism. Easy methods to discover these alternatives, and methods to know when issues are short-term… that’s our “Coca-Cola components”, what we name the Azvalor methodology, which is the sum of an funding philosophy and a company tradition primarily based on the coaching of funding groups, onerous work, excellence and meritocracy.

In 2024, Azvalor’s fund portfolios noticed modest progress, whereas worth creation has been outstanding. Worth is created in a number of methods: by companies rising their earnings and by capital rotation—promoting firms which have risen and shopping for others which have fallen in value with out justification. The outcome: a rise within the upside of the funds. Let’s have a look at the main points.

Azvalor Iberia

The web asset worth of Azvalor Iberia elevated by +3.4% to achieve €149.1 in 2024, giving a return of +49% from its launch to the top of the 12 months, and +60% at this letter’s time limit.

The portfolio is concentrated in a small variety of firms (the highest 10 account for round two thirds of the whole) that we all know very effectively, virtually all of them firms that now we have adopted carefully for many years and for which we subsequently have much more confidence by way of aggressive place, administration high quality and valuation.

The fund’s efficiency in recent times has been beneath our historic observe document. A few of our firms have confronted headwinds, however that is altering and the market is starting to acknowledge it.

A great instance of that is Tubacex. We invested in it virtually 8 years in the past, attracted by the numerous change in mannequin—led by Jesús Esmoris—in the direction of greater value-added merchandise, and a pretty buy value on the inventory market. COVID and headwinds drove the corporate down from €3.5/share initially of 2018 to ranges of round €1/share in March 2020, which we used as a chance to considerably enhance the portfolio place. Right this moment, it’s our prime holding, and the market has began to recognise its worth with a +40% enhance within the final 6 months alone. Nonetheless, we consider that there’s nonetheless an extended technique to go because the wind within the sector is now a tailwind and the corporate has improved rather a lot over the past 8 years. Our value goal remains to be effectively above the share value, and this doesn’t embrace the worth creation that this administration workforce might obtain by means of acquisitions.

One other instance is Prosegur Money (OTCPK:PGUCY), the place a lot of the earnings are in Brazil and Argentina, which, ought to now have a tailwind after struggling for a number of years.

We’re subsequently very assured that the portfolio will carry out positively and “reside up” to its upside, which we estimate at +80%. 2

Azvalor Worldwide

The web asset worth of Azvalor Worldwide was flat at €235 in 2024, with an amassed return of +135% on the finish of the 12 months and +143% at this letter’s time limit.

As talked about above, after years of document profitability in 2021 and 2022, 2024 was poor by way of outcomes, but very wealthy by way of “sowing”. Right this moment, the worldwide portfolio is as soon as once more clearly extra enticing than ordinary.

We’ve various world leaders buying and selling at valuations unbefitting firms of such high quality and aggressive place, and they’re doing so for cyclical causes. And now we have many different regional leaders in the identical scenario. We’ve firms with important property, others which might be unimaginable to duplicate even with limitless capital, and others which might be privileged as a result of they’re the lowest-cost producers of their class. All are buying and selling at enticing costs due to pessimism about their short-term prospects. The overwhelming majority are firms with sturdy steadiness sheets, ready for any macroeconomic or sectoral context, with just a few exceptions, that are very small in mixture and that are exceptions chosen for his or her specific attractiveness. They’re additionally overwhelmingly shareholder-focused firms, one thing we discover more and more uncommon. In virtually all of them, we both have a controlling shareholder who invests his wealth with us and is anxious about creating worth, or we see the right combination of incentives, capital allocation choices and shareholder remuneration (investments, dividends, share buybacks).

Our expertise in making use of our funding course of over a few years reveals that, within the mixture, our valuations of firms will not be solely broadly appropriate, however truly conservative: their share costs are likely to exceed our valuations over an affordable time period.

We will subsequently say with confidence that the worth of our portfolio is simply over twice the web asset worth (+105% upside). If the previous is prologue, this upside ought to allow us to generate double-digit annualised returns over the following few years.

Azvalor Blue Chips

The web asset worth of Azvalor Blue Chips fell by -2.2% in 2024, though it has amassed a optimistic return of +89% from its launch to the top of the 12 months and +92% as much as this letter’s time limit.

Azvalor Blue Chips presents the distinctive function of investing at the least 75% of its fairness publicity in firms with a market capitalisation of greater than 3 billion euros. Nonetheless, the fund presently has round 70 million euros below administration and subsequently nonetheless retains the essential benefits of a small portfolio. These benefits are, first, the power to pay attention—it’s extra concentrated than Azvalor Worldwide. The second advantge is the potential for together with some smaller firms with a related weighting (it might reap the benefits of a larger variety of alternatives), which collectively account for round 25%. And at last, as a 3rd advantage, it has the “agility” wanted to take higher benefit of market volatility by with the ability to differ the weighting of the completely different firms extra rapidly in accordance with their short-term actions.

During the last monetary 12 months now we have been notably profitable in exploiting these virtues to create worth, and that is the fund that presently presents the best upside—which we estimate at virtually +115%.

Azvalor Managers

Azvalor Managers generated a return of +12.9% in 2024, and from its inception simply over six years in the past as much as this letter’s time limit it has delivered a return of +78%, in keeping with the fund’s long-term goal. This has been achieved in an surroundings the place massive progress firms have massively outperformed smaller worth firms, by virtually 10% every year over this era. Our portfolio now trades at 9.6x earnings, a reduction of greater than a 50% relative to the worldwide fairness market, and 70% to the Nasdaq index (Morningstar information).

The portfolio has a big publicity (76%) to small and mid-cap firms, with virtually no overlap with market indices. We’ve continued to obtain takeover bids for our investments, with six firms in our portfolio topic to bids in 2024, and one within the first weeks of 2025.

Throughout 2024 Azvalor’s funding workforce added two new Managers to the fund who we consider are distinctive, complementing the present managers and bettering the long-term risk-return trade-off. The fund holds greater than 120 million euros below administration and greater than 1,600 buyers.

Azvalor International Worth (Pension Fund)

Azvalor International Worth is likely one of the few pension funds from impartial asset managers which is effectively above the 150 million euros threshold (197 million euros on the finish of 2024), having greater than 4,200 co-investors—having grown by greater than 300 new buyers in 2024.

With a mean annualised return of +18.5%, Azvalor International Worth closed January 2025 because the fund with the most effective 5-year return among the many 960 pension funds in Spain (Morningstar information).

Its portfolio, which mixes firms current in Azvalor Iberia and Azvalor Internacional, returned -2.34% over the 12 months and has amassed +93% for the reason that launch. The fund continues to have a excessive upside—of just about +115%.

What’s new at Azvalor

This 12 months we’ll rejoice our tenth anniversary. We thank all of the co-investors who’ve been with us for all or a part of this time, and in addition those that have left us—hopefully after having completed the mission of delivering the anticipated returns.

As for company information, we’re happy to announce that now we have been granted the ISO27001 high quality certification (info safety, cyber safety and privateness administration methods). This certification confirms the standard of some processes which might be important to the sleek working of the corporate.

Within the subject of sponsorship and patronage, we’re happy to announce that Azvalor has change into a benefactor of the Teatro Actual, thought of to be the main performing arts and musical establishment in Spain. In the identical vein, Azvalor has joined the inspiration “Amigos del Museo del Prado” [Friends of the Prado Museum]—an establishment with greater than 40 years of exercise centered on supporting the principle nationwide artwork gallery, carefully linked to the historical past of Spain.

Azvalor has additionally signed an settlement with Comillas Pontifical College to sponsor the Comillas Alumni Chartered Monetary Analyst (‘CFA’) Membership and a collaboration settlement with España Rumbo al Sur, a pioneering programme with 20 years of expertise in coaching younger individuals by means of journeys and sensible experiences, with the purpose of selling values corresponding to effort, the pursuit of excellence, dedication to the surroundings, entrepreneurship and long-term imaginative and prescient.

As all the time, we wish to spotlight Davalor, our venture in collaboration with África Directo, which concentrates our foremost dedication to serving to these most in want. In 2024, we contributed greater than 600,000 euros to the tasks managed by Davalor/África Directo, bringing the whole to over 4 million euros since we launched into this lovely journey, tasks corresponding to the development and reconditioning of colleges, the renovation of infrastructure in hospitals and dormitories, the development of photo voltaic vitality methods, the acquisition of instructional supplies for colleges and the funding of medical therapies. 1000’s of individuals, together with their households and communities, have benefited from Davalor’s social work. Our deepest gratitude goes out to all those that have participated in these initiatives—and to Africa Directo’s workforce.

Ultimate issues

In a world that rewards immediacy, it’s onerous to speculate long-term. Nonetheless, our co-investors have discovered that the trouble is worth it. They know that the funds which have outperformed their indices over the long run have generated their extra returns throughout simply 5% of the time. In different phrases, over this 10-year interval (120 months) the “celebration” moments account for under 6 months. Attempting to guess when these moments will arrive is futile, so our suggestion is to “make investments what you don’t want within the brief time period and overlook about it”. Those that have finished so—with us—have seen their cash multiplied by an element of two.5 over these ten years.

With humility, but in addition with pleasure, we share the information that Azvalor has been the one Spanish fund supervisor to have achieved a return of greater than 100% in 5 years (see information). That is the results of your persistence and our “Azvalor methodology”. We are going to proceed to work on these two pillars so as to generate enticing returns.

As soon as once more, we wish to thanks in your belief and invite you to contact our Investor Relations workforce for additional info on any of the above—or another subject of your curiosity.

Azvalor Asset Administration SGIIC Group

Footnotes 1Supply: All charts) IBES, LSEG Datastream, S&P International, J.P. Morgan Asset Administration. The dots characterize month-to-month information since 1988, the earliest 12 months out there. Information as at 31 January 2025. 2 The estimated values indicated all through the doc have been obtained on account of the distinction between the estimated worth of every of the underlying property of the portfolios, primarily based on our inner valuation fashions, and the costs at which every of them is presently quoted on the inventory markets. Privateness coverage & different related info Phrases of use and authorized discover |

Authentic Submit

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.