Alex Souto Maior

(Note: all ‘$’ figures are CAD, not USD, unless stated otherwise.)

Introduction

A&W Revenue Royalties Income Fund (TSX:AW.UN:CA) is an income fund that owns the trademarks and royalties of over 1000 A&W locations. Its chain of restaurants are all independent franchises except for 10 restaurants that are operated corporately, all of which are in the Ottawa market. A&W is well-known for its burgers and root beer, and also sells fries, chicken nuggets, onion rings, and other related fast food.

A&W well known for its commitment to sustainability and has made efforts to reduce its environmental impact by using renewable energy sources and reducing waste. For example, on the food front, beef is grass-fed and raised without artificial hormones or steroids, chicken and pork are raised without the use of antibiotics, and its root beer is made with natural cane sugar and all-natural flavours. It was also one of the first companies to begin using Beyond Meet patties at its restaurants and was one of the first fast food chains in Canada to ditch plastic straws and use compostable cutlery. With these values and sustainable practices, A&W is seen as a greener, healthier option in the fast-food market when compared to competitors.

As you might expect, A&W’s food items are more expensive compared to peers like McDonald’s (MCD), Burger King, and Wendy’s. While individual food items vary based on location and discounts, a single A&W cheeseburger may cost around $3.99 to $4.99, while a combo meal that includes a cheeseburger, fries, and a drink may cost around $7.99 to $8.99. A similar order at a McDonald’s would be nearly double that. By using higher quality ingredients in its menu items, A&W can charge more for its menu items than some of its competitors. With higher quality ingredients seen as healthier, fresher, and more flavorful than low quality ingredients, A&W can differentiate itself from competitors and appeal to customers who prioritize quality over price and can enhance the overall customer experience and increase customer loyalty.

Franchise Model

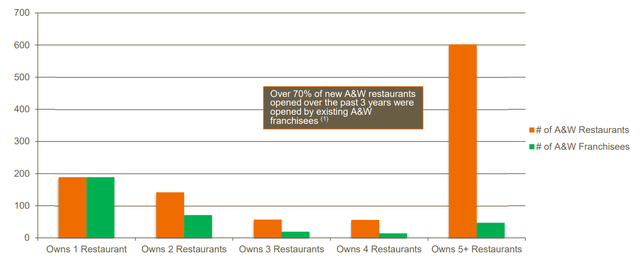

A&W has an experienced franchise base, with over 70% of new restaurants opened by existing franchisees. According to its Franchise Disclosure Document, the company’s royalties are based on 3% of the franchisee’s net sales plus an advertising fee of 5% of net sales. In return, A&W allows franchisees to use its brand, benefit from existing customer loyalty and supplier relationships, and access to training and support. One important thing to note is that the A&W Revenue Royalties Income Fund only takes the 3% of the net sales of the restaurants in the royalty pool and the fund’s expenses only include the minimal costs to maintain its Trade Marks and any interest on the Trade Marks’ term debt less income taxes. I view this as extremely attractive for unitholders as the fund’s distributions are not subject to the variability of earnings or expenses associated with an operating business and can still receive monthly distributions.

Franchise Base (Investor Presentation)

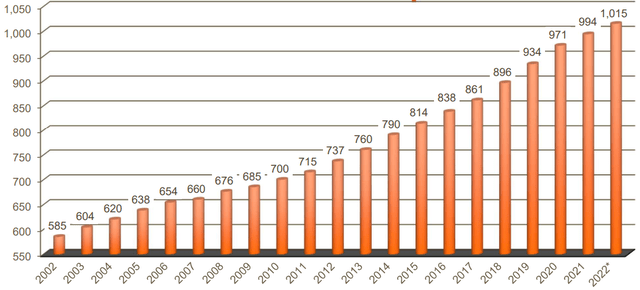

Over the last 20 years, A&W has steadily grown its number of restaurants at a CAGR of 2.4% per year. Since 2002, it has successfully grown gross sales reported by restaurants in its royalty pool at a 12.9% CAGR to $1.74 billion in 2022. I attribute this growth to several factors including A&W’s strong brand recognition, its focus on quality food and service, and its effective marketing campaigns. Additionally, A&W’s franchise model has allowed the company to expand rapidly and efficiently, with franchisees contributing to the growth of the brand and the company’s overall success.

Number of Restaurants in Royalty Pool Since Inception (Investor Presentation)

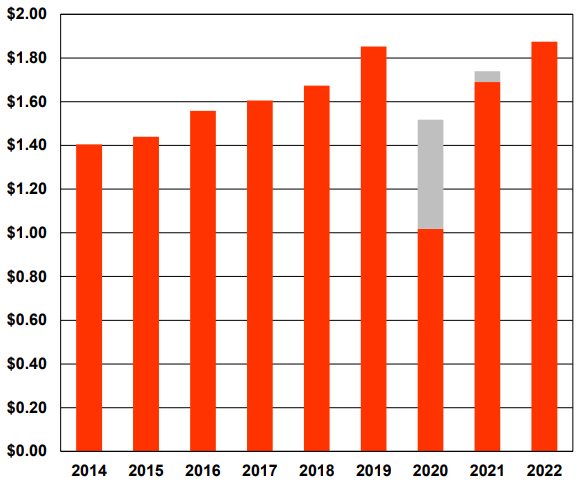

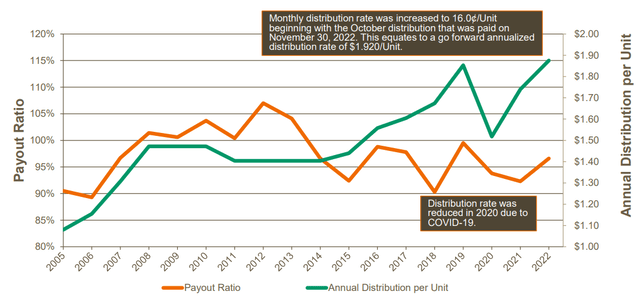

A&W’s consistent performance and growth over the last two decades are a testament to the effectiveness of its business model and its ability to adapt to changing market conditions. For example, in Q1 2020 when 230 restaurants were shut down, same store sales grown fell 14.3%, before rebounding 14.0% the following year. While the company temporarily cut their distributions, it did pay some special distributions (shown in grey on the chart below). As shown below, distributions are now back above pre-pandemic levels at $0.16 per month per unit, or about $1.92 annually.

Distributions to Unitholders (Investor Presentation)

Menu Innovations

A&W has always been an innovator when it comes to adding new items to its menu. It recently started offering cod burgers, Beyond Meat nuggets, and recently rolled out its Brew Bar nationally, where it will offer frozen beverages as well as hot and cold espresso-based beverages. One of the things A&W does well at is testing out a concept before making it widespread across its locations. For example, the Brew Bar was previously available two years ago in Victoria, Montreal, and Ottawa, but after seeing it succeed, the company decided to introduce it nationally. In my view, by staying ahead of emerging food and beverage trends and carefully testing and refining its new offerings before introducing them on a larger scale, A&W is able to reduce the risk of introducing unpopular or unsuccessful items and ensure that its menu innovations resonate with customers.

Distributions

A&W Revenue Royalties Income Fund has had a history of paying consistent distributions and has had a payout ratio of nearly 100%, given the minimal costs of the fund structure. At a $37 share price and a monthly distribution of $0.16, shares are currently yielding 5.2% annually. Since inception, the fund has grown at a CAGR of 14%, all while offering a safe and attractive yield.

Annual Distributions and Payout Ratio (Investor Presentation)

When considering how the A&W performed in the last recession, increasing its royalties in each year of the financial crisis, I view A&W as a relatively safe place to park some cash and earn a decent yield. In its most recent quarter, the fund saw royalty same store sales growth of 4.3% in the fourth quarter, which brought the annual royalties to the same store sales growth to 7.4% for the year. In my view, this shows that A&W is able to grow in a low growth environment and highly competitive industry. As the fund takes a percent of net sales from the top line, unitholders don’t need to worry about how SG&A costs increasing faster or slower could affect profitability. Hence, A&W Revenue Royalties Income Fund is somewhat insulated as an inflation hedge.

Conclusion

In summary, A&W Revenue Royalties Income Fund is an attractive investment for investors looking for both yield and capital appreciation in their portfolios. With its consistent track record of growing restaurant locations and increasing its royalty pool base, A&W has garnered customer loyalty and brand recognition through its sustainability efforts and innovative menu offerings by capitalizing on emerging trends. Through its franchise model, the fund only takes 3% of net sales so unitholders don’t have to worry about operating costs under it. Overall, A&W’s franchise model and commitment to sustainability and innovation make it an attractive investment option for those seeking long-term growth and stability in their portfolios.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.