tomos3/iStock via Getty Images

The last three years have seen a significant strain on global energy supplies. Between the pandemic, lockdowns, and geopolitical conflict (the war and trade disputes), worldwide energy production has been hampered. The transportation of fossil fuel supplies from producing countries to consuming regions has faltered. The most significant impact has been seen in the natural gas market, as fewer Russian sources flow to Europe, causing a global shift in natural gas exports. That change led to a general increase in demand for thermal coal in Asia as less US (liquid), and Middle Eastern natural gas flowed in that direction. Europe also slightly increased thermal coal consumption last year to offset lost natural gas supplies.

Late last year, thermal coal import demand globally declined from high levels. More recently, coal prices crashed in China and India as demand fell amid a slowdown in Europe’s energy crisis. As discussed in “UNG: Expect ‘Lower For Longer’ Natural Gas As Europe Avoids ‘Cold Winter,” Europe largely avoided an energy crisis this winter as the continent’s weather has been abnormally warm. Further, US natural gas production has risen exceptionally quickly, and Middle Eastern supplies have dramatically shifted toward Europe, offsetting lost Russian sources. Thus, the global electricity supply of fossil fuels is far more vital today than it was over the last three years.

I believe coal companies are at a critical transitional point today. Many of these stocks, such as Alliance Resource Partners (NASDAQ:ARLP), are still trading at lower “P/E” valuations, have very high yields, and have seen immense growth in recent years. That said, if the underlying pressure benefiting thermal coal fades, coal may quickly revert to pre-pandemic levels. Before 2020, coal was unpopular due to its weak ESG status, and most coal producers were at high bankruptcy risk. Of course, fundamental secular trends may benefit thermal coal, namely critical risks within the natural gas sector and the general shortcomings of renewable production (at sufficient capacity to end fossil fuels). If so, then ARLP could eventually rise higher as the coal shortage may continue.

The Potential Long-Term Future(s) of Coal

I have been bullish on ARLP since early 2020. The stock has delivered a roughly 613% total return since my first bullish article and ~772% since my second, though it is only slightly higher than I covered last year (after dividends). For the past six months, ARLP has been in a tight consolidation pattern as the price of thermal coal peaked in most regions. However, the stock bounced up around 9% on Monday as the company announced a nearly 50% YoY sales growth rate with a strong 2023 outlook.

My core thesis behind ARLP is that the global natural gas supply system is not as robust as many believe, opening the door to significant shortages. Since coal is a far more reliable, exportable, abundant, and cheap energy source, it is the go-to alternative to natural gas. Notably, US coal consumption has declined over the past fifteen years due to a sharp rise in natural gas consumption, while renewable’s growth has played a minor role. Natural gas is marketed as a “cleaner” alternative to coal. However, it is significantly more abundant, cheaper (and more economically stable), and has far fewer infrastructure needs (making it more exportable). While natural gas creates ~45% less CO2 on combustion, natural gas fracking likely creates earthquakes and (potentially dangerous) chemical water supply pollution. Additionally, coal has become cleaner and may become far cleaner due to promising advancements in carbon-capture technology, SO2 scrubbers, and smoke-stack capture.

Adding troubling local health impacts from natural gas fracking, coal may be the healthier option overall. Solar obviously produces no emissions directly but is far costlier, challenging to scale, creates environmentally damaging chemicals, and its supply chain often uses forced labor in China and Africa. With proper investment and regulation, coal could also be much cleaner than it is, though many energy producers are not making any new “clean plants” due to its unpopularity.

While there is a strong consensus against coal today, the debate may not be as simple as “coal bad, natural gas good.” In my opinion, when it comes to weighing economic burdens on households (higher renewables and natural gas), pollution (which could be minimized), and total reserves (which are immense for coal), thermal coal appears to be a vital energy source. Is coal ideal? No, but its alternatives do not appear to be either. This argument is essential for Alliance Resource Partners because many investors price the stock as if it will be forced out of business in years due to the regulatory shift against coal. For ARLP to have value, investors must expect it to be a “going concern” that should produce cash dividends indefinitely.

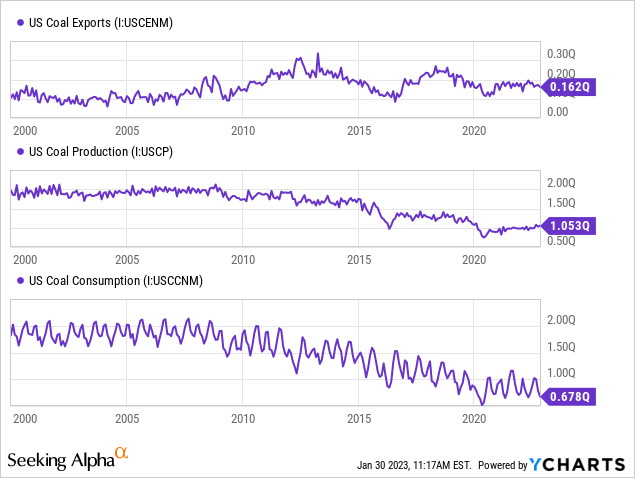

US coal production and consumption have created a firm bottom since 2020, while exports have been generally steady. See below:

The decline in coal production creates excellent opportunities for surviving companies like Alliance. Competition is low, and demand may be rising. While the increase in US natural gas supplies may upset coal’s bull market, that does not necessarily change the long-term potential for the relatively few remaining US thermal coal miners like Alliance.

In my view, despite the immediate risks to ARLP, its long-term potential is far more robust than many suspects. Unless significant scientific and technological improvements are made in renewables (such as fusion), I believe coal has a place in the US energy grid. Additionally, as risks in natural gas, such as infrastructure issues and health risks, are better understood, I believe many regulators and investors may positively re-evaluate thermal coal. Of course, in the long run, the most considerable risk to ARLP is a continued decline in US and global coal consumption if the consensus does not shift.

What Is ARLP Worth Today?

Alliance Resource Partners is a cash cow at its current price and revenue level. The company had a Q4 EPS of $1.63 at $700M in sales, up 48% YoY. The stock’s current forward “P/E” is only 4.8X, while its dividend yield is an excellent 9.66% after its recent dividend raise. Alliance also expects a sustainable, productive environment, with a 37M production target and a $67/ton price – meaning its overall sales should continue to reflect Q4 levels. If the company indefinitely has an EPS as high as it is, the stock would be undervalued today, particularly given its low debt level.

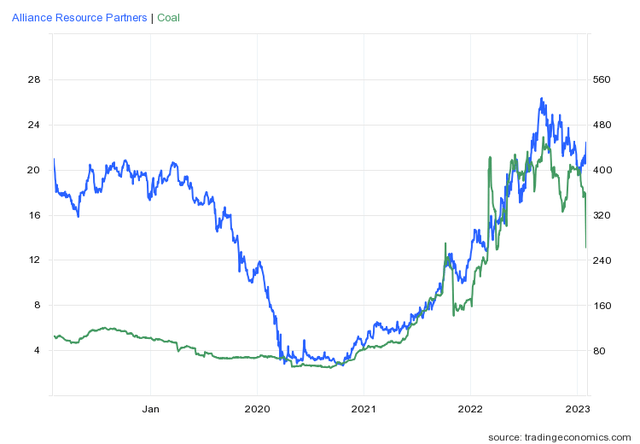

The most significant immediate risk to Alliance is the decline in international coal import demand. This is reflected in Newcastle coal futures which reflect coal prices in Australia’s largest export location, mainly toward China and India. ARLP tracked Newcastle closely since 2020, but the two have diverged rapidly over the past two weeks. See below:

Newcastle Coal Price vs. ARLP (Trading Economics)

The considerable divergence between ARLP and Newcastle coal is somewhat concerning since the two were closely linked. My core thesis for ARLP is that coal is in a global shortage due to the underlying shortage in natural gas. However, the natural gas shortage appears to be over as global supplies return and benefit from the US and Europe’s abnormally warm winter weather. The general infrastructure and supply issues in natural gas and the volatility from the Russian war could easily cause the natural gas shortage to return. However, in the immediate term, the global thermal coal shortage is likely reaching its end.

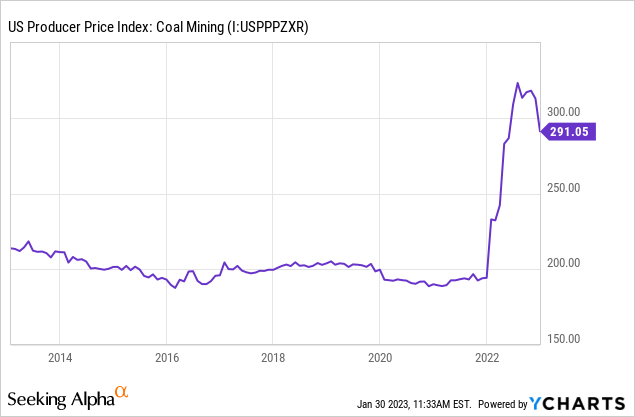

Of course, Alliance does not sell at Newcastle’s price; it sells at US prices which are much lower. The US Northern Appalachian coal price fell around 45% during the start of the year, while Illinois Basin and Central Appalachia lost about 32%. The chief cause is the warm weather and improvement in natural gas supplies that led to a staggering ~70% decline in Henry Hub natural gas spot prices late last year. The US coal miner PPI (a lagging reflection of US coal prices) has also waned. See below:

In my view, this data presents strong evidence that Alliance’s strength will wane dramatically this year. While the company gave strong guidance following spectacular Q4 results, US and international thermal coal prices plummeted over the past month due to a dramatic shift in circumstances. Since I believe natural gas will likely remain “cheap” for most of this year, thermal coal should also fall further than gas since it has become a “backup” power source for most utility companies.

The Bottom Line

On the one hand, ARLP is a very cheap stock with a low valuation and high yield. The company also gave strong 2023 guidance, making it seem like its valuation will remain intact. On the other hand, the economic fundamentals do not support coal in the short run and have already spurred significant price declines that will most certainly harm Alliance’s profits. Although the stock is cheap, its EPS fluctuates dramatically with the price of coal. Further, it is potentially mispriced since ARLP has risen significantly this month despite a significant decline in coal prices, mainly due to a buying spree following its Q4 report.

From a long-term standpoint, ARLP is still interesting since it may play a significant role (and benefit from) an increase in coal use, potentially aided by the various deficiencies in natural gas and technological improvements. However, in the immediate term, coal is avoided by most utilities (both in the US and Europe) due to ESG concerns, negatively impacting coal consumption given the sharp improvement in natural gas production.

While I believe ARLP is substantially overvalued, I would not buy the stock, and I am no longer bullish on it due to the sharp change in fundamental economic circumstances. If the natural gas shortage returns, I may quickly become bullish again, but I do not believe ARLP offers sufficient upside potential for now. Further, I believe ARLP may be at risk of reducing its dividend following the recent hike if its profits sharply reverse during the first half of 2023, as I suspect.