Galeanu Mihai

Investment Thesis

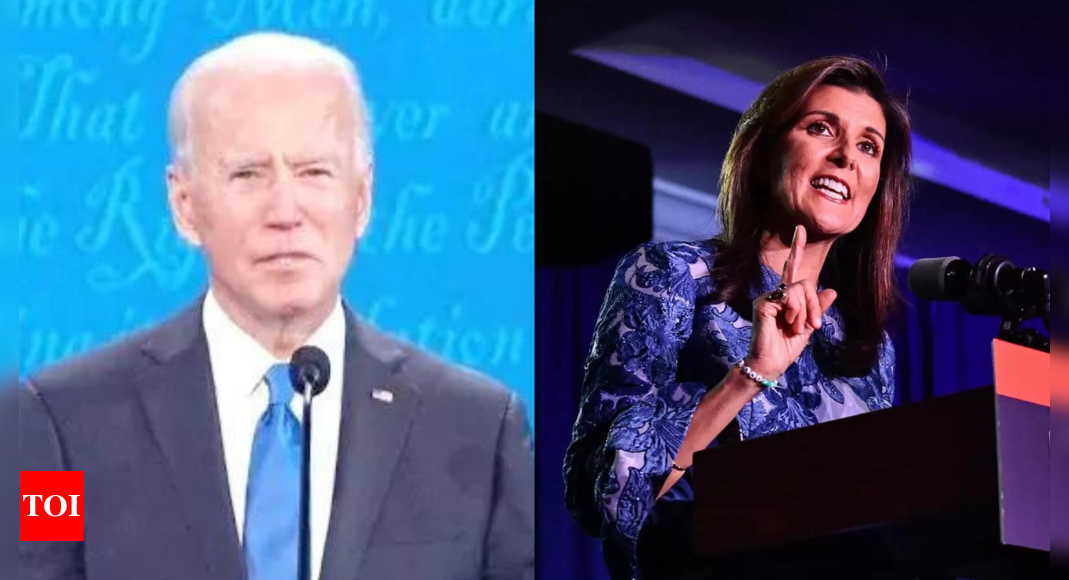

Automatic Data Processing (NASDAQ:ADP) is the global leader in human capital management, with over 1 million customers in over 140 countries and continuing to grow. ADP management forecasts its total addressable market to be $150 billion and growing at a 5%-6% annual rate over the next few years.

ADP has adapted to changing technology and trends exceptionally well. It operates in two main segments: Employer Services and Professional Employer Organization (PEO). ADP has consistently adapted and invested in R&D to ensure that it has the best technology for payroll, benefits management, human resources, and much more. Its constant pursuit of adapting and adjusting to market needs has led to continued growth and made it one of the biggest brand names and most recognizable companies worldwide.

ADP Overview (ADP Investor Relations)

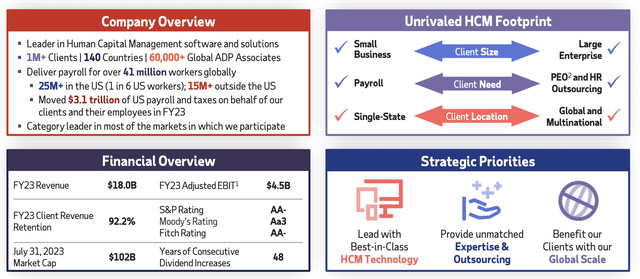

ADP has seen a 5-year compounded annual growth rate (CAGR) of 6.29% in sales and 12.60% in net income. Management excels at offering new services, gradually raising prices, and increasing efficiency and reliance on technology. This has resulted in a highly diversified product portfolio and multiple revenue streams.

I believe ADP’s ongoing commitment to investing in the company will lead to continued growth and the development of the best products. Cloud integration and the adoption of AI will be significant catalysts, making ADP more accessible, affordable, and cost-efficient, which will boost sales, earnings, and the stock price.

ADP Sales Growth (ADP Investor Relations)

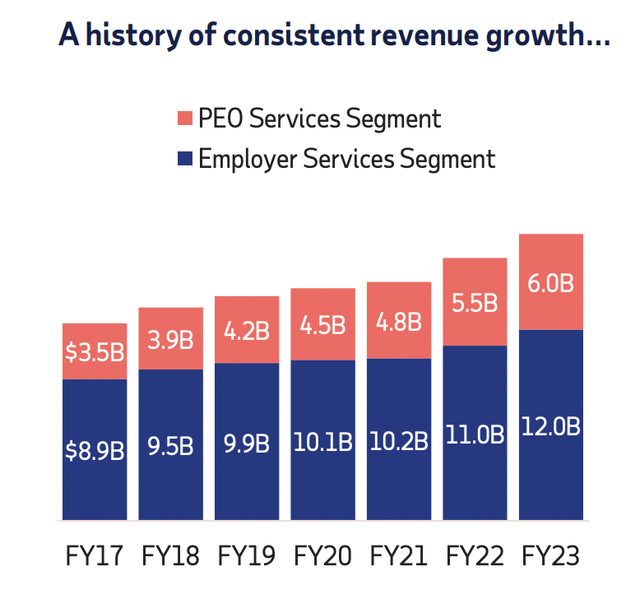

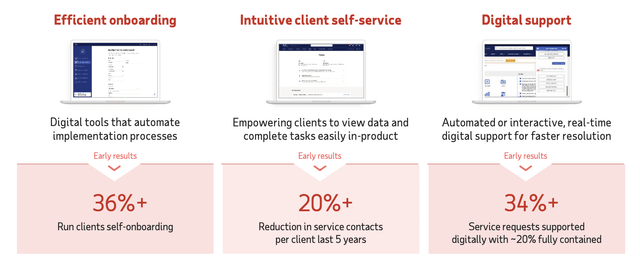

ADP is improving its operations through a number of technology-driven initiatives. The company is complex, operating in multiple segments of the human capital management field. However, it is becoming more dominant and effective in each segment.

The next two graphics show some of the tools and impacts of new technology on ADP’s production and financials.

ADP New User Experience (ADP Investor Relations) ADP Efficiency Increasing (ADP investor Relations)

ADP is taking every step possible to stay competitive and on top. It offers top-tier products and services that deeply integrate it into the heart and soul of thousands of workplaces and businesses. This gives ADP a remarkable 90%+ customer retention rate, as customers have high switching costs and the time and work involved in switching to a competitor is not worth it for most.

ADP has built a household brand name that thousands of businesses rely on. It has evolved its customer offerings beyond just one product or service. Service is key for a company like ADP, and it has done a great job of maintaining high-quality technology and workers to help customers smoothly.

ADP is one of my favorite stocks for long-term value investors. It has 48 consecutive annual dividend increases and is poised to become a Dividend King. It has a low beta (low volatility) for risk-averse investors and has doubled the S&P 500’s total return over the past 10 years. I believe that ADP’s brand equity and continuous investment in the future will allow it to continue to be a safe winner for long-term holders.

The valuation may seem high, but ADP is rewarded for trading at a premium to its peers due to its industry dominance in products and services and profitability margins.

Balance Sheet & Cash Flow

ADP has very strong cash flows. It currently has $4 billion in free cash flow (FCF), which is $9.71 per share and a FCF yield of 4.05%. Management has done a tremendous job of increasing FCF and cash from operations over the years.

ADP’s excess cash flow allows it to do three things:

ADP Capital Expenditure (ADP Investor Relations)

1. Reinvesting profits back into the company through R&D is key for ADP to continue to compete in an ever-evolving world. To remain competitive, ADP must continue to offer the fastest and best services and technology for customers.

2. ADP has acquired 21 companies in its history for roughly half a billion dollars. It has acquired companies in all sorts of enterprise technology fields, including HR tech and SaaS. ADP uses M&A to add to its already great services and offer more that is user-friendly.

3. ADP has a respectable 2% dividend yield, an adequate 58% payout ratio, and has reduced its share count by 14% over the past 10 years. ADP is currently executing the $5 billion share buyback program it announced last year. I expect the firm to continue to raise and pay its dividend and reduce shares outstanding by 1% a year.

Finally, ADP’s debt is manageable. It currently has $3.5 billion in debt, which is even with its debt levels over the past 3 years. ADP is not heavily leveraged, which is good news for investors. It has an interest coverage ratio (EBITDA/Interest expense) of 19.5x, showing that it has more than enough cash to pay off its debt expenses. In my eyes, ADP has no risk of solvency and is using its equity and cash flow to reinvest and grow the business, not debt.

Price Target and Valuations

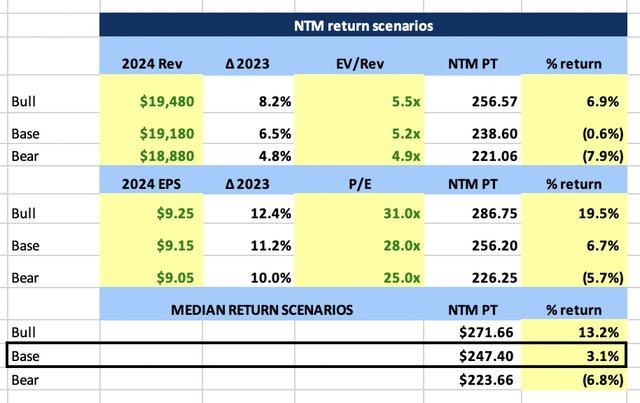

ADP is currently trading at a price-to-earnings (P/E) ratio of 26x for 2024. While this may seem expensive compared to its peers (sector median P/E of 16x), it is actually below the company’s five-year average P/E of 29.3x. ADP has historically traded at a higher valuation than its peers due to its brand awareness and dominance in the industry.

On an enterprise value to sales (EV/S) basis, the stock does not look as cheap, trading at 5.2x. In fact, it looks overvalued, trading above its five-year average EV/S and sector median.

I have used the company’s historical valuations and trends along with analyst estimates to create a next twelve months (NTM) price target scenario table. The table shows that the stock is trading at a 3% discount from my base case fair value and has an acceptable 2x risk-to-reward ratio.

ADP NTM Price Target Scenario (Author Calculations Based on Analyst Estimates From Data On Koyfin)

With a low beta and an undervalued stock, ADP is on my watchlist. Any dip below $234 would be a strong buy. ADP is an old, boring company that many people overlook as a stock, yet use its services and products in one way or another.

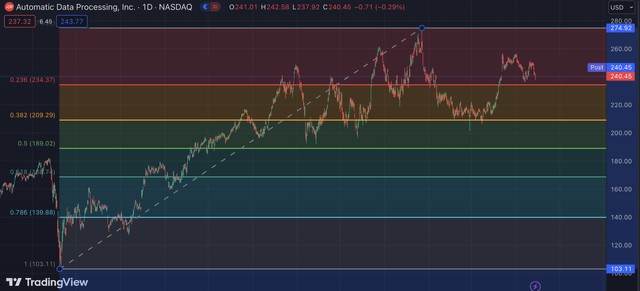

Looking at the chart, the stock has been pulling back with the overall market. The key level to watch for support is $234. If the stock breaks through that level, I would highly suggest buying and entering the stock, as the risk-to-reward ratio is now 3.5x+. If the stock does not break through that level, it is a sign that support is strong and it may be bottoming out or waiting for its next catalyst to move the stock higher. No matter what, I like the stock at $240, but a chance to buy it even lower would be a gift to value investors.

ADP Chart (Trading View)

Risk

ADP has diversified its services across multiple markets and has thousands of different customers with varied needs, which has helped to mitigate risk. However, there are still a few minor risks worth noting.

First, ADP has access to and contains millions of people’s personal information and data, making it susceptible to data privacy and cybersecurity risks. With hackers becoming more sophisticated and using advanced technology, ADP must remain vigilant in protecting its information and keeping others out. ADP invests heavily in itself and its technology to mitigate this risk.

Second, ADP is exposed to the economy and labor markets. When companies are laying off employees, not hiring, and spending less, ADP’s numbers will also decline. ADP makes money from customers paying for its built-in services or help with the onboarding/offboarding process, which all take place when the economy is strong and people are not concerned about overspending.

The final risk is valuation. While I believe ADP deserves to trade at a premium to its peers, the question is how much of a premium. If ADP does not consistently increase revenues, EPS, and margins, that premium valuation spread may fade, which would decrease the stock price. This is a long-term trend to keep in mind when investing in ADP, as I do not believe a P/E of 28-29 will be rewarded to the stock for another 5-10 years. Unless growth picks up from the 6%-10% range, top and bottom line valuations may contract over the years.

Despite these risks, I still believe ADP’s brand name and consistent innovation in the best products will drive the stock higher.

Conclusion

ADP is a blue-chip company that is not going anywhere anytime soon. It has built a moat by integrating itself into the heart of thousands of businesses. It offers a comprehensive suite of human capital management products, which has made it the largest service provider in the world. Customers have high switching costs and must deal with the time and work required to switch.

ADP offers investors a steady dividend that has increased every year for almost 50 years, and it has room for continued growth given its high cash flow and respectable payout ratio.

Management is disciplined, returning capital to shareholders and investing in R&D and M&A to spur growth. I believe this, combined with ADP’s established brand reputation, will allow shareholders to continue to be satisfied holding ADP stock for the long term. I highly suggest that risk-averse value investors consider adding ADP to their portfolios, especially if the stock dips below $234.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!