As rising rates of interest and declining affordability have lowered housing market demand, a correction (a modest decline in housing costs) has been looming for months. On a nationwide scale, housing costs are nonetheless up nearly 11% year-over-year, however different indicators level to a housing market that’s beginning to appropriate.

On this article, I’ll dive into a number of strategies for measuring housing market well being, establish metrics to look at, and label particular markets which might be on the highest danger of seeing value declines within the coming months.

Market Knowledge

When trying on the well being of the housing market, we may study many datasets and methodologies. For the needs of this text, I’m going to take a look at three datasets:

- Yr-over-year (YoY) information (what occurred in July 2022 in comparison with July 2021)

- Month-over-month (MoM) information (what occurred in July 2022 in comparison with June 2022)

- Stock (what number of properties are actively listed on the market at a given cut-off date).

These present stability of long-term tendencies, short-term modifications, and forward-looking information.

Yr-Over-Yr Knowledge

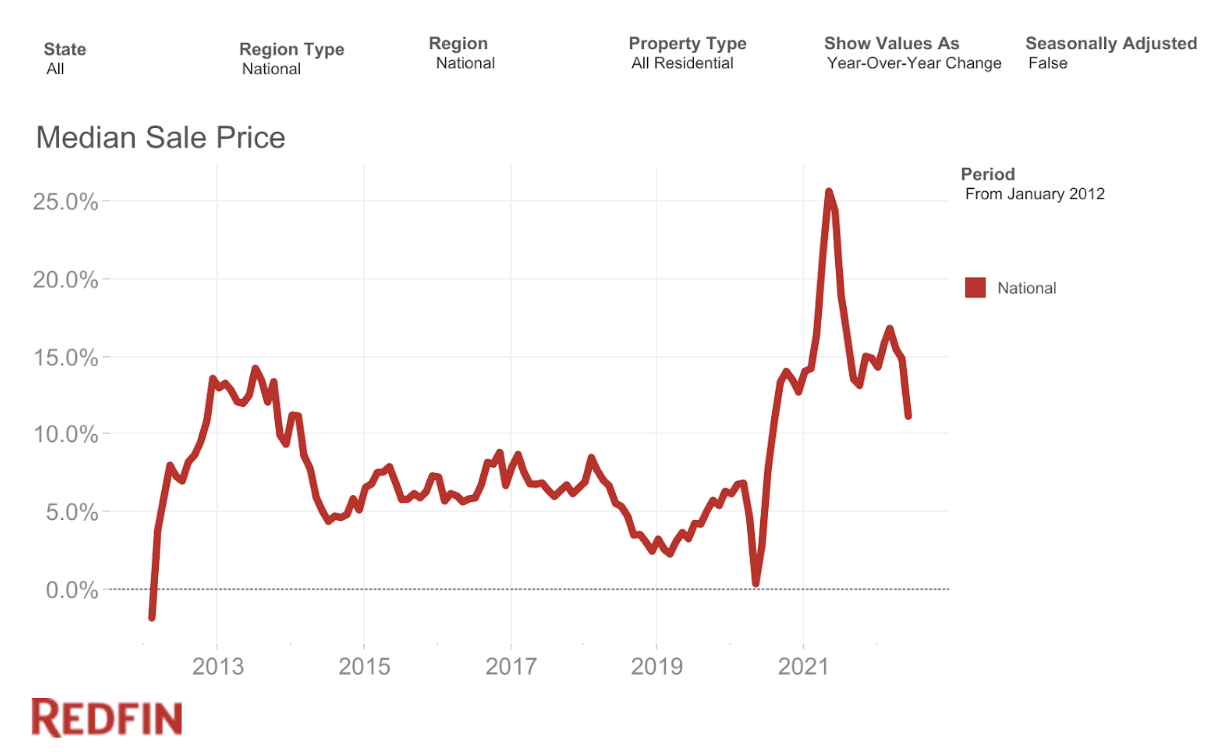

In regular instances, YoY information is one of the best ways to measure development in housing costs as a result of one, housing information is seasonal, and two, it measures long-term tendencies. Housing costs comply with the same sample yearly—they peak in the summertime and decline over the winter—which means that evaluating January’s information to June’s just isn’t useful.

The chart above demonstrates this idea nicely. Clearly, housing costs had been constantly trending upwards from 2014 to 2019, although yearly, housing costs fell from Could to February. If we had been to take a look at costs from Could 2016 to January 2017, it could present falling costs, although the market was trending upwards.

Once more, for this reason we have a look at YoY information, as a result of what occurred between July 2022 and July 2021 reveals the long-term tendencies. And as talked about above, YoY costs on a nationwide stage are nonetheless +11%. Of the highest 250 markets in america, zero have seen YoY value declines. Not one!

Having the median dwelling value enhance 11% YoY is a large quantity in historic contexts however does characterize a big cooling from the absurd development charges we noticed in 2020 and 2021. For context, through the Nice Recession, housing costs fell YoY for a number of years in a row, with costs falling greater than 10% YoY in 2009.

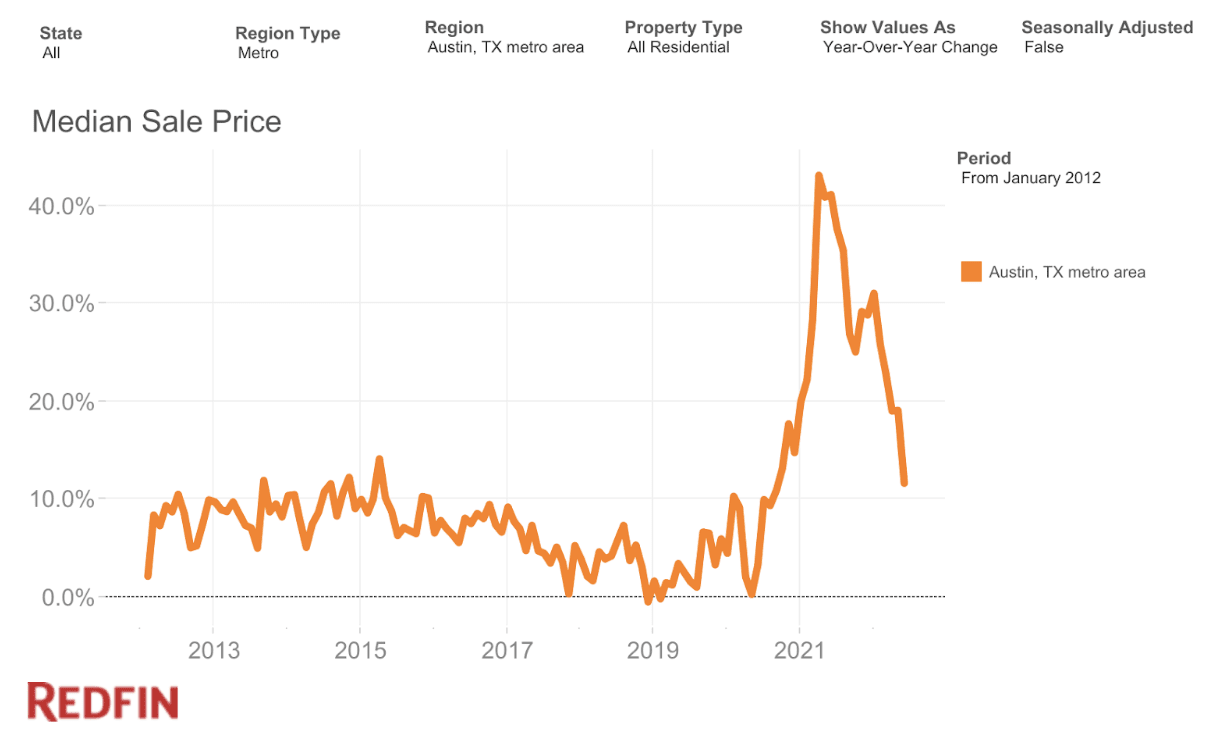

So, in right this moment’s market, the expansion charge of housing costs within the U.S. is returning to regular, however because the chart above reveals, it’s nonetheless nicely above historic norms. And though costs are nonetheless up YoY, we are able to be taught one thing from how YoY information is trending. In a few of the nation’s hottest markets, YoY development has fallen very quick, with Austin, Texas, main the way in which.

Austin grew at about 45% YoY final summer season and is now all the way down to about 11%. It’s nonetheless rising on a YoY foundation, however to me, the speedy charge of deceleration represents danger to the Austin housing market. Austin is seeing its charge of development fall sooner than another market.

Different markets which might be seeing related patterns are Seattle, Sacramento, Phoenix, San Jose, Boise, and San Diego, to call just a few. Testing the speed of change in YoY development charges is a useful factor you are able to do to higher perceive your market.

Month-Over-Month Knowledge

As I stated above, throughout a steady housing market, I personally consider YoY information to be an important and don’t spend an excessive amount of time on MoM information. However, throughout markets in transition, just like the one we’re in at present, taking a look at MoM information will be useful.

When analyzing the highest 250 markets, the overwhelming majority are nonetheless seeing will increase, however 31 of them did see declines. San Jose, California, noticed the steepest drop at -2.7%, however the common among the many 31 markets in decline was modest at simply -0.64% MoM. Right here’s a listing of the 31 markets throughout the high 250 that noticed declines:

| Market | MoM % Change |

|---|---|

| San Jose, CA | -2.70% |

| Austin, TX | -1.62% |

| Reno, NV | -1.26% |

| San Diego, CA | -1.23% |

| Santa Cruz, CA | -1.06% |

| San Francisco, CA | -0.93% |

| Boulder, CO | -0.91% |

| Seattle, WA | -0.90% |

| Provo, UT | -0.89% |

| Salt Lake Metropolis, UT | -0.83% |

| Ogden, UT | -0.81% |

| Portland, OR | -0.78% |

| Denver, CO | -0.65% |

| Boise Metropolis, ID | -0.61% |

| Atlantic Metropolis, NJ | -0.57% |

| Ventura, CA | -0.50% |

| Vallejo, CA | -0.50% |

| Phoenix, AZ | -0.42% |

| Spokane, WA | -0.35% |

| Stockton, CA | -0.34% |

| Los Angeles-Lengthy Seashore-Anaheim, CA | -0.33% |

| Medford, OR | -0.32% |

| Pittsburgh, PA | -0.30% |

| Colorado Springs, CO | -0.27% |

| Visalia, CA | -0.16% |

| Santa Rosa, CA | -0.13% |

| Lincoln, NE | -0.12% |

| Greeley, CO | -0.12% |

| Sacramento, CA | -0.09% |

| Riverside, CA | -0.08% |

| Worcester, MA | -0.06% |

However, some markets have saved rising! For instance, Miami grew 2.35% MoM. As I’ve stated for months, I consider the most probably situation over the approaching months is that some markets will continue to grow, and a few will decline. To this point, that appears to be the case.

When taking a look at MoM information, keep in mind that is only a single month and thus, doesn’t make it a development. Costs do are likely to peak in early summer season and begin to come down, and it’s far too early to know if this implies we’ll see YoY declines in any of those markets (or extra) within the coming months. That is one short-term information level that must be thought-about alongside different information.

Want an investor-friendly actual property agent to your subsequent deal? Match with an agent right this moment!

Stock

The 2 datasets we’ve checked out to this point, Yr-over-Yr, and Month-over-Month, are each backward-looking. Useful, after all, however many people need to know what may occur subsequent. To that, we have to flip to a dataset that tends to foretell the long run efficiency of housing costs: stock.

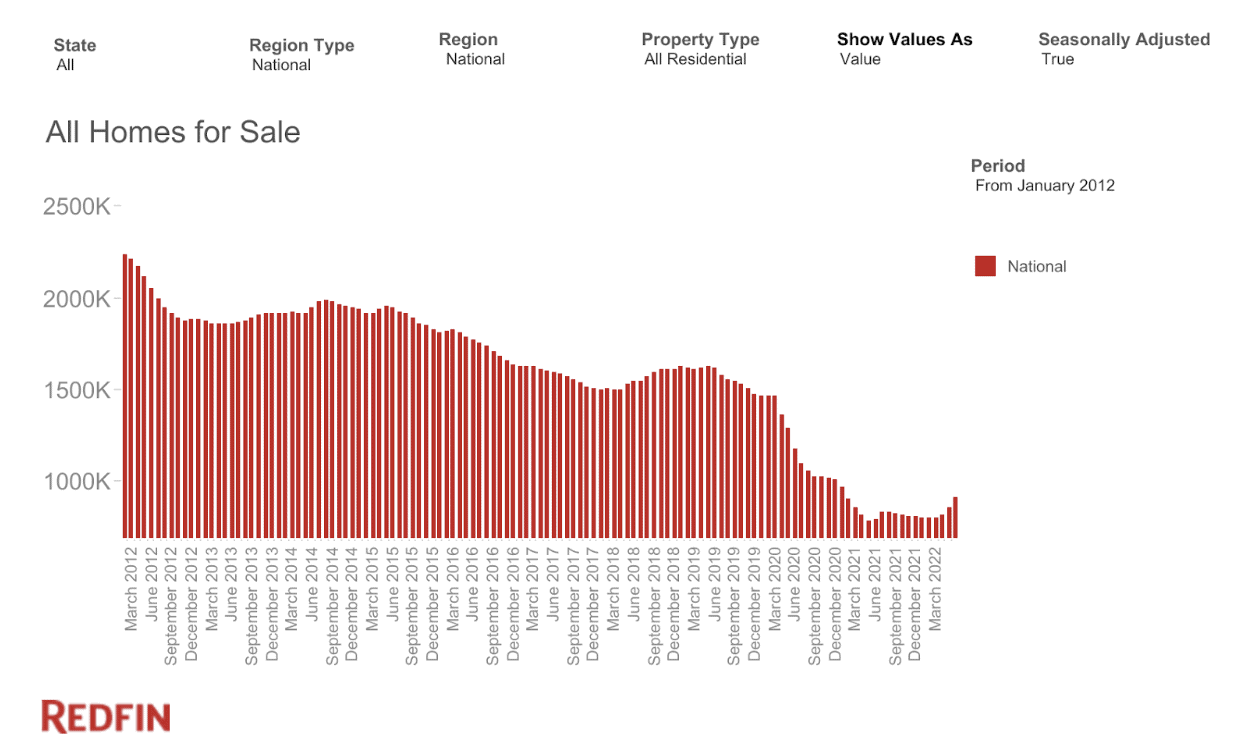

Stock measures what number of homes are on the market at a given time and is an effective measure of the connection between provide and demand. When stock is low, it’s a vendor’s market, and costs are likely to rise. When stock is excessive, it’s a purchaser’s market, and costs are typically flat or decline.

As you may see within the chart under, stock is extraordinarily low in a historic context. Usually, we’d anticipate nicely over 1.5M listings, however we’re nonetheless under 1M.

That is necessary as a result of, as I’ve written about extensively earlier than, if housing costs are going to come back down, stock must not less than method historic ranges. Clearly, from this chart, that isn’t taking place on a nationwide stage but. However the development appears to be heading in that course.

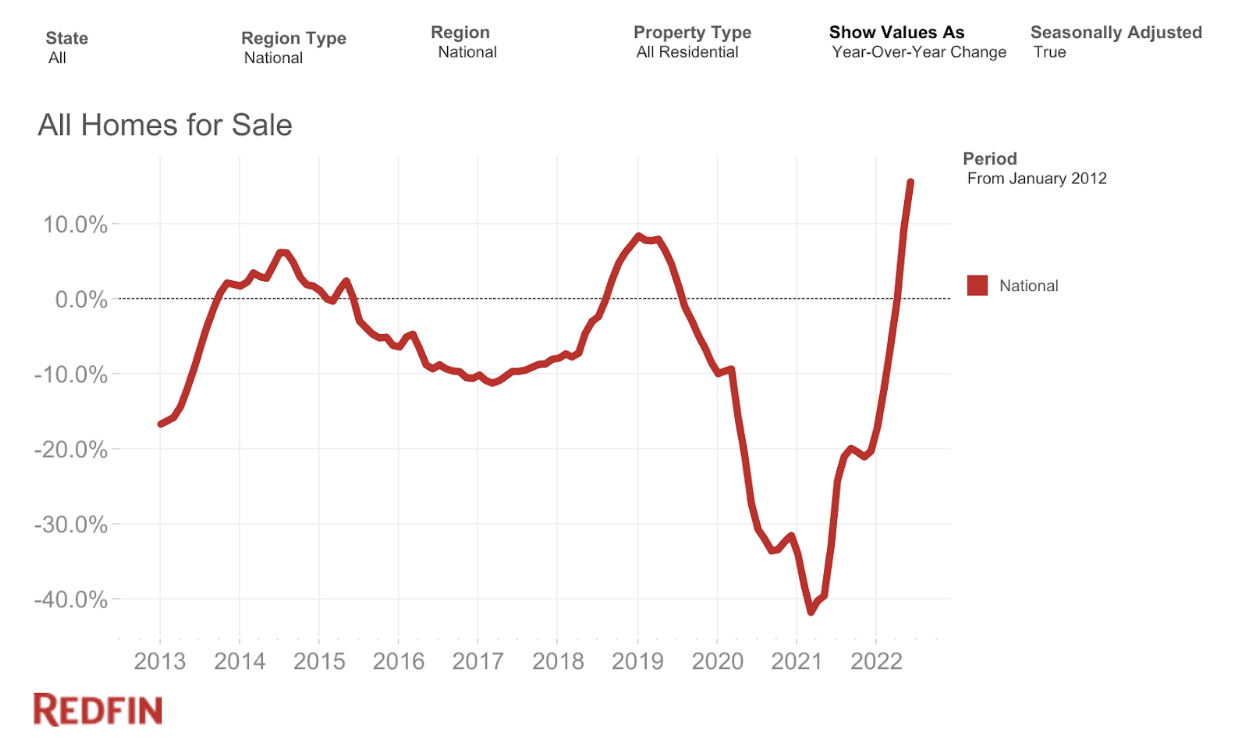

Take a look at this chart that reveals stock development YoY. For a lot of the pandemic, stock was falling constantly, however now we’re seeing it rise quickly on a year-over-year foundation.

Once more, we’re nonetheless removed from regular, however stock is trending upward. It is a key metric to look at to grasp the course of the housing market within the coming months, on each a nationwide and regional stage.

Notably, some markets are seeing stock ranges get better to pre-pandemic ranges. This means that these markets are at a excessive danger of seeing YoY value declines (which once more, we haven’t but seen in any markets) within the coming months or years.

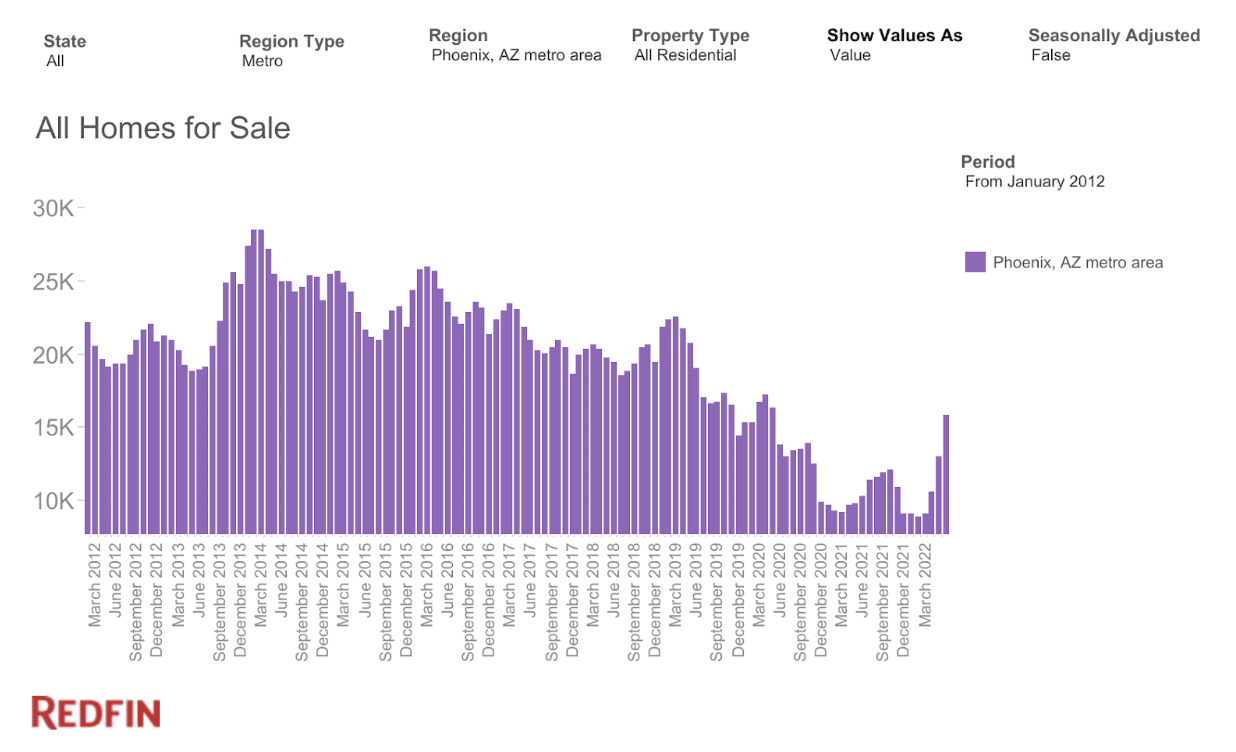

Not too long ago, San Francisco turned the primary market to formally return to pre-pandemic ranges. San Jose is true behind and simply 1% under pre-pandemic ranges, with Las Vegas, Phoenix, and Austin, heading that manner as nicely. Under you may see an instance of Phoenix, Arizona.

To me, if you wish to know what’s going to occur in your housing market within the coming months, take a look at stock and days on market. If they begin approaching pre-pandemic ranges, the chance of value declines on a YoY foundation rises considerably.

What This All Means

In fact, we don’t know which markets will decline, however hopefully the above information helps you perceive what is occurring. To offer extra context, we are able to have a look at forecasts created by Moody’s Analytics, which predict value development between now and the tip of 2023.

In response to Moody’s, three cities in Florida are poised for the best declines: The Villages, Punta Gorda, and Cape Coral. Of these, Moody’s predicts The Villages to say no by 13%. That’s a giant quantity! However keep in mind, that’s for the riskiest metropolis. Bear in mind, within the Nice Recession, costs fell 20% nationally!

Moody’s additionally predicts comparatively massive drops in Reno (-8%), Austin (-7%), San Diego (-6.5%), and Boise (-6.2%).

However, Moody’s forecast means that some cities will develop. On high of that record is Albany, Georgia (+10%), Casper, Wyoming (+8%), New Bern, North Carolina (+7.6%), Augusta, Georgia (+7.2%), and Hartford, Connecticut (+7%).

Once I have a look at all this information in combination, I consider the principle takeaways to be:

- I nonetheless consider the most probably situation is that some markets decline within the coming 12 months or so, whereas others proceed to develop, simply extra modestly than over the previous few years.

- Regardless that some markets are displaying weak spot, I nonetheless don’t consider a “crash” is probably going, and on a nationwide stage, value declines of over 10% will not be trying probably.

- Markets which might be on the best danger appear to be:

- On the western half of the nation

- Noticed huge appreciation over the past two years

- Have rising stock and days on market

- Had been massive migration sizzling spots through the pandemic

- Have the bottom affordability.

The markets that proceed to indicate up and, to me, carry the best dangers, are:

- Austin, Texas

- Boise, Idaho

- Phoenix, Arizona

- Las Vegas, Nevada

- Reno, Nevada

- Fort Myers, Florida

- Denver, Colorado

- Salt Lake Metropolis/Provo, Utah

- Spokane and Seattle, Washington

However, cities that proceed to indicate energy are:

- Hartford, Connecticut

- Baton Rouge, Louisiana

- Virginia Seashore, Virginia

- Chicago, Illinois

- Albany, New York

- Honolulu, Hawaii

- Philadelphia, Pennsylvania

So, as you navigate the transitioning market, maintain this stuff in thoughts. You’re in all probability going to see a number of sensationalist headlines within the coming months, however it’s best to maintain observe of this information for your self. You are able to do so on varied web sites like Redfin and Realtor.com, and naturally, I’ll maintain publishing my analysis and articles like this on the BiggerPockets weblog commonly.

On The Market is introduced by Fundrise

Fundrise is revolutionizing the way you spend money on actual property.

With direct-access to high-quality actual property investments, Fundrise lets you construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has shortly turn out to be America’s largest direct-to-investor actual property investing platform.

Study extra about Fundrise

An enormous thanks to Pooja Jindal for her assist researching this text!

Notice By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.