Gross sales of beforehand owned houses fell 2.5% in August from July, to a seasonally adjusted annualized price of three.86 million items, in accordance with the Nationwide Affiliation of Realtors.

That’s barely decrease than what analysts anticipated. Gross sales had been 4.2% decrease than August 2023. It marks three straight months of gross sales under the 4 million mark, annualized.

This depend relies on closings — contracts that had been probably signed in late June and July, when mortgage charges began coming down however weren’t as little as they’re right this moment. The common price on the favored 30-year fastened mortgage was barely over 7% in mid-June after which fell steadily to six.7% by the top of July, in accordance with Mortgage Information Every day.

“House gross sales had been disappointing once more in August, however the latest improvement of decrease mortgage charges coupled with growing stock is a robust mixture that may present the atmosphere for gross sales to maneuver larger in future months,” stated Lawrence Yun, NAR’s chief economist. “The house-buying course of, from the preliminary search to getting the home keys, sometimes takes a number of months.”

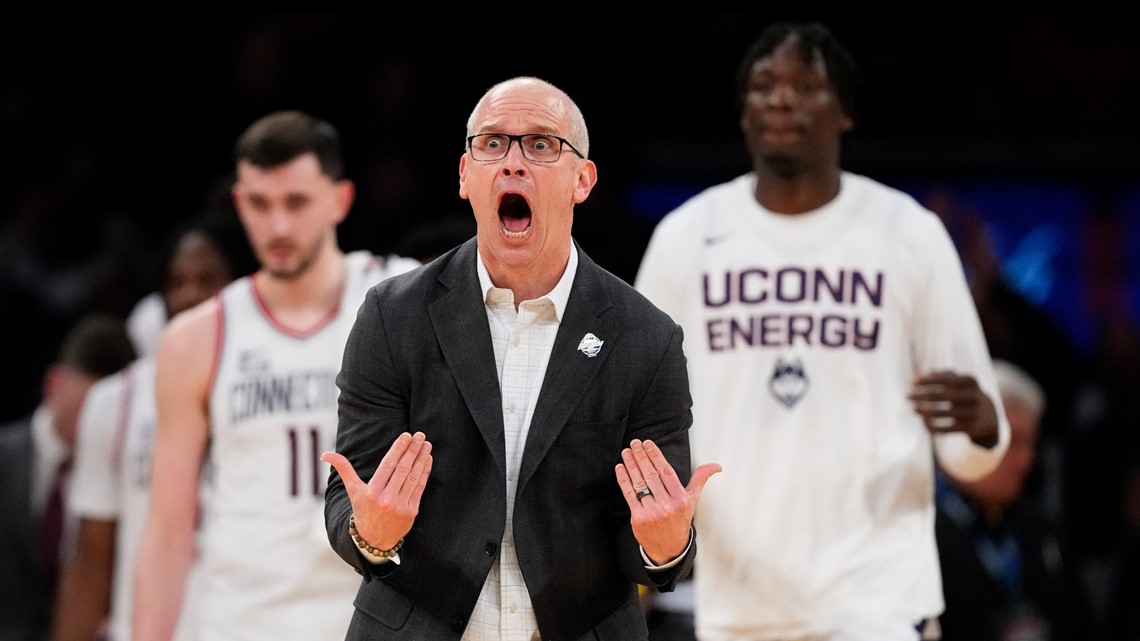

A ‘For Sale’ signal advertises a house on the market on April 20, 2023, in Cutler Bay, Florida.

Joe Raedle | Getty Photos

The stock of houses on the market is enhancing barely. There have been 1.35 million items on the market on the finish of August. That is up 0.7% from July and 22.7% 12 months over 12 months. It’s nonetheless, nonetheless, only a 4.2-month provide. A 6-month provide is taken into account balanced between purchaser and vendor.

“The rise in stock — and, extra technically, the accompanying months’ provide — implies dwelling patrons are in a much-improved place to search out the best dwelling and at extra favorable costs,” Yun added. “Nevertheless, in areas the place provide stays restricted, like many markets within the Northeast, sellers nonetheless seem to carry the higher hand.”

Tight provide is retaining the stress on costs. The median worth of an present dwelling bought in August was $416,700, up 3.1% from the identical month in 2023. That’s the highest worth ever for August.

Since it is a median, although, a part of that achieve is skewed towards what was promoting in August. Gross sales had been up considerably for houses priced above $750,000, however down for something priced under $500,000.

First-time patrons made up simply 26% of August gross sales, matching the all-time low from November 2021. All-cash gross sales got here in at 26%, which is down barely from a 12 months in the past however nonetheless excessive traditionally.

Mortgage charges continued to fall in August and September, with the 30-year fastened now sitting at 6.15%, the bottom in roughly two years.