Brandon Bell

AT&T (NYSE:T) may not be the most exciting company. However, the bottom must be close when I see a 7% dividend and a 6.4 P/E ratio. Given the economic uncertainty, the slowdown effect, and other factors, AT&T’s share price has dropped by approximately 25% over the last 52 weeks. Unfortunately, we may forget how important AT&T is to the U.S. and the American people. In the previous five years, the company has invested a staggering $140 billion into American infrastructure. AT&T continues to lead the nation as the most extensive fiber internet provider while enhancing America’s “most reliable” 5G network.

Furthermore, AT&T is paying down debt and should continue doing so to secure growth and maintain its dividend. Additionally, now that AT&T is no longer in show business, it can focus on its core operations, optimizing efficiency and improving profitability as the company advances. AT&T’s stock is exceptionally cheap now, and as the company improves processes, its multiple should expand, leading to a much higher stock price in the coming years.

Finally – The Bottom Is Close

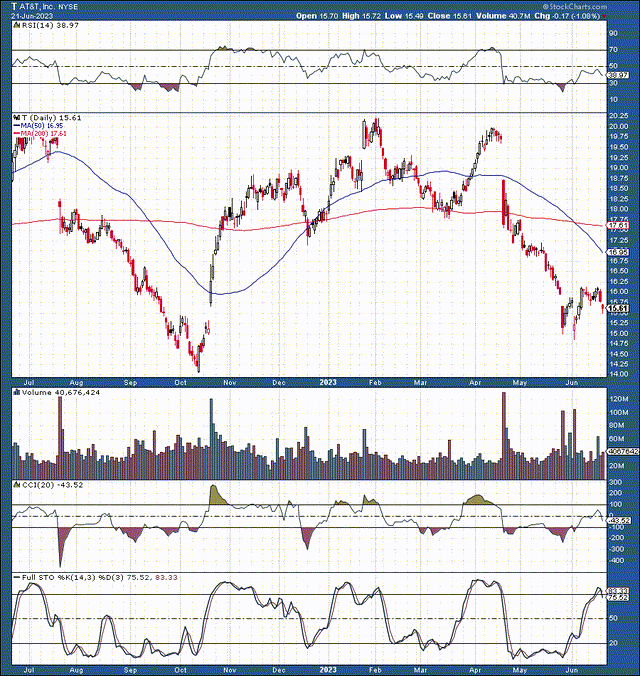

T (StockCharts.com)

$15 is the critical support level. AT&T briefly dipped below this crucial level during the height and the panic selling of the recent bear market. However, the stock returned to test the $15 mark in late May and early June. Thus, we had a test, followed by a successful retest and a significant reversal at the $15 zone. Therefore, the $15 is a significant support point, suggesting the downside is limited from here.

Moreover, the RSI went considerably below the 30 level, hitting around 20 during the recent route. These ultra-low readings in the RSI are around the levels we witnessed during the bear market bottom in mid-October last year. Therefore, from a technical standpoint, AT&T’s stock got deeply oversold recently, has a bullish (potential double-bottom) setup, and should continue moving higher as we advance.

AT&T – Paying Down Its Debt

In the last two years, AT&T sold a 30% stake in its DirecTV unit for $7.1B and spun off WarnerMedia for $40.4 billion in cash. Now, AT&T is reportedly working with Barclays to solicit bids for its cybersecurity business it acquired for approximately $600 million in 2018. AT&T reduced its net debt by about $24B in 2022 and looks to continue reducing it to roughly $100B by 2025. Paying down debt is critical for maintaining AT&T’s dividend and continuing to grow in the fiber and the 5G space.

AT&T Still Needs A Management Shakeup

Let’s face it. A big reason AT&T is in the mess that it’s in is because of the company’s botched merger with Time Warner. Of course, it was not a merger of equals, as AT&T acquired the company for a massive sum. AT&T’s management used a heavy-handed approach at times, stifling Time Warner’s creative potential and leading to poorer quality in its content (arguably). AT&T’s management was primarily focused on its agenda and did not listen to the top managers at WarnerMedia. The results speak for themselves, and five years later, AT&T sold its WarnerMedia interests for approximately half of what the company paid initially.

How’s That For An Investment?

AT&T needs a management shake-up. Everything has become so stale and stiff at AT&T that the company needs new leadership. John Stankey has spent his entire 37-year career at AT&T. Now, that’s a good thing, but it is also a bad thing. How can we expect AT&T to reform its corporate culture with a lifelong AT&T executive as CEO? A change is required for AT&T to become more efficient, growth-oriented, and increasingly profitable. Therefore, more changes are needed at the organization’s top to improve its bottom line eventually. Nevertheless, now that the media spinoff is complete, AT&T can focus on its core operations, and its stock is exceptionally cheap now.

Wait, How Cheap Is AT&T Now?

AT&T trades at a P/S ratio of 0.9 here, and its P/E ratio is just above a rock bottom of 6.0 now. Moreover, AT&T provides a 7% dividend, potentially making its stock as cheap as it gets. This year’s EPS should be in the $2.40-$2.60 range. While consensus estimates are for $2.43, my estimate is $2.50.

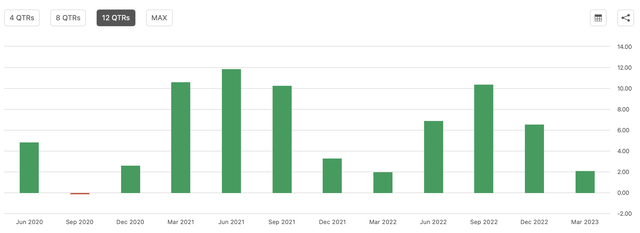

EPS Estimates – Likely to Expand More

EPS Estimates (seekingalpha.com)

Don’t mind the significant drop in EPS, as it’s not adjusted for the WarnerMedia spinoff. However, EPS will likely show a slight decline from last year. 2022 EPS came in at $2.57, and this year should come in at about $2.50. We can attribute this phenomenon to a tighter monetary environment and an economic slowdown, transitory factors that should fade. Also, if we look at EPS surprises, AT&T has beaten consensus estimates in its last ten quarters.

EPS Surprises – Trend Likely to Continue

EPS Surprises (seekingalpha.com)

In its last four quarters, AT&T has beat the consensus estimates by an average of 6.5%. If we apply a similar beat rate to 2023 full-year estimates, we arrive at $2.59 in EPS. Also, if we use the same 6.5% beat rate to next year’s consensus figure, we arrive at an EPS of $2.65. If AT&T delivers $2.65 in EPS next year, its stock is trading at only around 5.7 forward earnings. This valuation is remarkably cheap, and AT&T’s stock should move higher on modest earnings growth and multiple expansion in the coming years.

Here’s where AT&T’s stock could be in several years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $122.5 | $124.8 | $128 | $131 | $134 | $137.5 | $140.5 |

| Revenue growth | 1.5% | 1.9% | 2.56% | 2.45% | 2.33% | 2.46% | 2.22% |

| EPS | $2.50 | $2.65 | $2.78 | $2.92 | $3.04 | $3.19 | $3.32 |

| EPS growth | N/A | 6% | 5% | 5% | 4% | 5% | 4% |

| Forward P/E | 5.66 | 7 | 8 | 10 | 11 | 12 | 11 |

| Stock price | $15 | $19.50 | $23.36 | $30.40 | $35.09 | $39.84 | $45 |

Source: The Financial Prophet

The Bottom Line – AT&T Is Dirt Cheap

AT&T is exceptionally cheap here, and its stock should benefit from mild EPS growth and multiple expansion in the coming years. While keeping my projections modest, we still see that AT&T’s stock could triple in the coming years. Therefore, AT&T is a strong buy with limited downside risk and substantial upside potential as we advance. Also, there’s the 7% dividend to consider, which should continue growing if the company meets my projections in the coming years.