jetcityimage

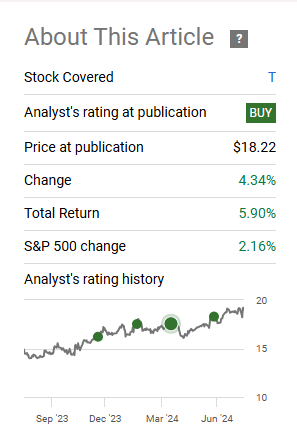

In our earlier replace on AT&T (NYSE:T), we maintained a Purchase and prompt that truthful worth was modestly increased.

We expect that no matter cyclicality we get, the present valuation does supply buyers a very good buffer. As soon as we hit that focus on, a dividend hike is extraordinarily probably. We proceed to charge AT&T Inc. shares a Purchase and keep a $21 truthful worth goal.

Supply: Looking for Alpha

The inventory has continued to trek increased and the identical image beneath reveals that we’ve been optimistic on this for fairly a while.

Looking for Alpha

We go over the Q2-2024 outcomes now and let you know why we’re shifting to a maintain ranking.

Q2-2024

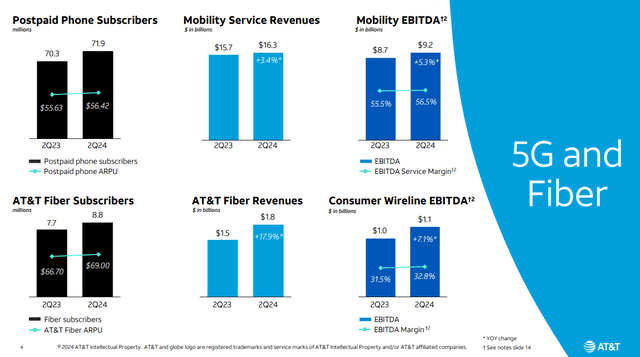

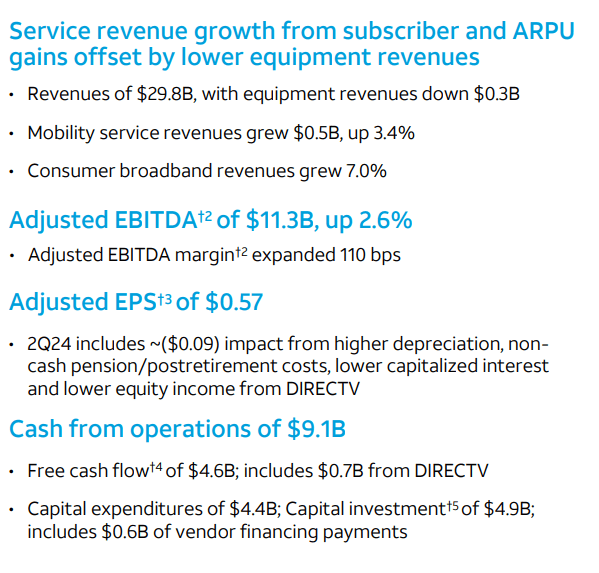

AT&T delivered a surprisingly good quarter and buyers had been pleasantly stunned after the marginally weaker numbers that got here from its competitor Verizon Communications Inc. (VZ). It seemed like AT&T was consuming Verizon’s lunch as its personal postpaid telephone subscribers grew 12 months over 12 months to 71.9 million. Mobility service revenues moved up at a barely quicker tempo and strong value management noticed EBITDA rise at a 5.3% clip.

AT&T Q2-2024 Presentation

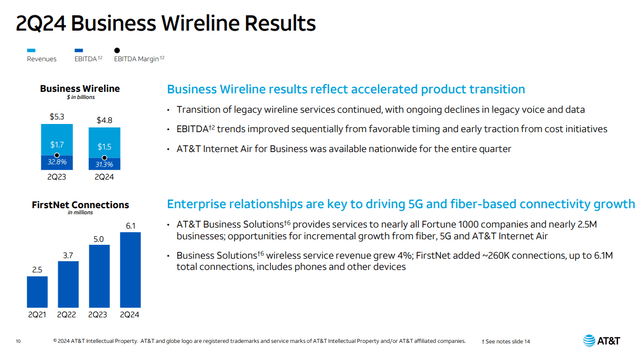

AT&T added some heft behind these numbers with Fiber subscriber and revenues shifting up well as properly. There was some weak spot as anticipated on the enterprise wireline facet. That enterprise continues to drop, and we proceed to see reverse economies of scales. The EBITDA margin was simply 31.3% this quarter and sure heads beneath 30% within the subsequent 2-4 quarters.

AT&T Q2-2024 Presentation

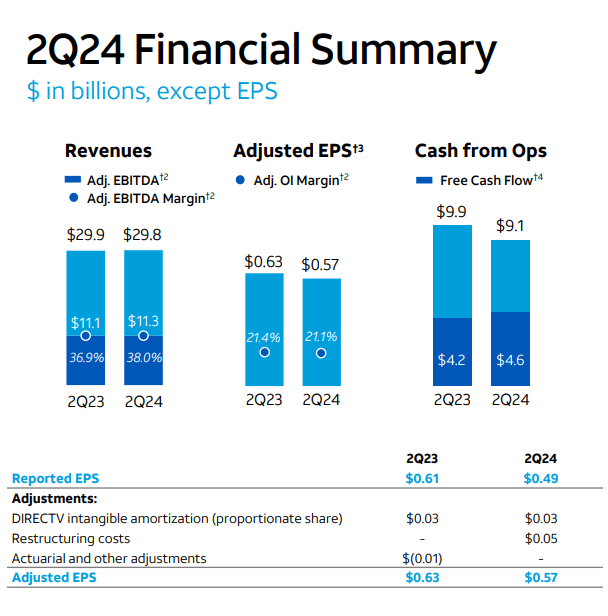

The 2 forces offset one another within the general monetary numbers as adjusted EBITDA was nearly precisely the identical 12 months over 12 months. There have been some variations within the adjusted EPS and money from operations however the free money stream metric was spectacular sufficient to ignore the opposite two.

AT&T Q2-2024 Presentation

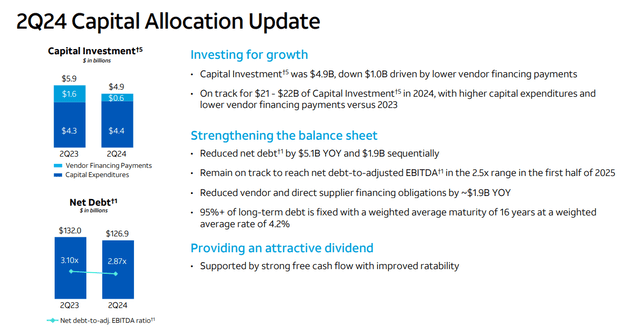

AT&T has been holding the road on its capex and that self-discipline continues to point out right here. The fear was that this is able to both drift increased or trigger some potential buyer loss over time. Neither has occurred thus far.

AT&T Q2-2024 Presentation

The progress in the direction of the online debt to EBITDA goal continues and that is very disciplined conduct by the corporate. We are going to add right here that this ratio is healthier at present than all of the three telecoms we cowl in Canada. The debt maturity profile can be the most effective within the enterprise and prone to be a supply of power even in a extreme downturn.

AT&T Q2-2024 Presentation

Outlook

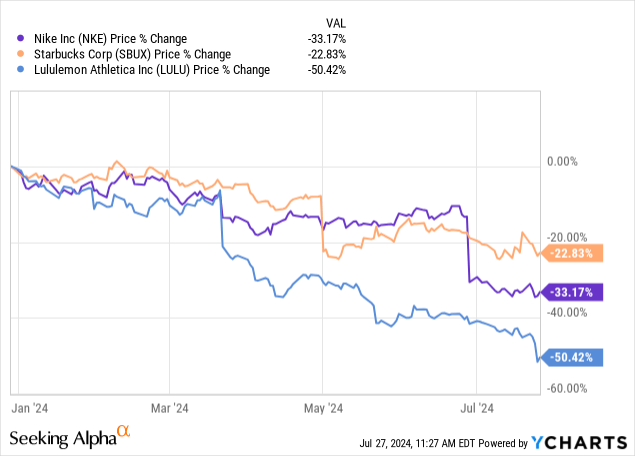

We’re seeing growing dangers exhibiting up within the financial system. We’ve had an inverted yield curve for fairly a while and the un-inversion is the place the “enjoyable” actually begins for the inventory market.

Half-Time Dealer on X

A few of that is now being mirrored in actions of some shopper discretionary shares.

AT&T has acquired the deleveraging half nearly accomplished and their sub 2.5X EBITDA ratio seems to be to be set for 2025. In fact if EBITDA falls, then debt to EBITDA will rise, whilst complete debt is decreased. We expect the telecom area is pretty aggressive and we are going to probably see some value wars in a recession and the chances of a transfer decrease has elevated in our view.

Verdict

There may be not a lot you could find improper with how AT&T has navigated the present financial cycle up up to now. However there’s undoubtedly some stress on the patron, and it’s starting to point out throughout a number of metrics. When you take a look at corporations like AT&T, their capital expenditure wants are usually pretty constant and that doesn’t materially transfer throughout a recession. So a contracting high line, alongside contracting margins, can play havoc with the free money stream projections. The nice half is that AT&T just isn’t costly to start with, so any pullback is probably going going to be modest. The full return can even be buffered by a hefty dividend yield that may maintain buyers . We beforehand anticipated a dividend hike in 2025, however at this level, we expect it will not occur if the recession materializes on schedule. For an investor counting on the dividend, we expect that is about as protected because it will get for now. From a complete return standpoint, which is the one metric that we care about, this has moved to a relative impartial level. Right here, the draw back dangers are about even at present with upside potential.

We’re shifting this to a Maintain ranking.

We had been holding the shares for a while with none hooked up lined calls. On these positions, we used the rally to promote the January 17, 2025 $20 strike lined requires 76 cents per share. That added a pleasant “yield” on high of the big dividend and creates some buffer within the interim. Whereas which will appear small, including such buffers periodically is what has allowed to us to outperform our benchmarks. On this specific case, we anticipate the vary of value motion to even be modest ($16-$22). In that context, an additional 76 cents per share provides loads.

Most popular Shares

Alongside the widespread shares, AT&T additionally has most popular shares listed. These are,

1) AT&T Inc. 5% DEP RP PFD A (NYSE:NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:NYSE:T.PR.C).

In our earlier protection, we had famous that the worth has improved, and the 2 courses weren’t obscenely valued anymore. Since our earlier replace, the costs are flat. Since most most popular shares we cowl (and we cowl and commerce loads of these), are up over this timeframe, we’d regulate the relative attractiveness of this up a bit. They aren’t precisely within the purchase zone, so they may proceed to be simply on our watch record for now. We are going to notice although that their dividend yield at present is similar to that of the widespread shares. For buyers simply on the lookout for a pleasant yield from AT&T, these may very well make extra sense than the widespread shares on the present level.

Please notice that this isn’t monetary recommendation. It could appear to be it, sound prefer it, however surprisingly, it’s not. Traders are anticipated to do their very own due diligence and seek the advice of knowledgeable who is aware of their goals and constraints.