Printed on March twenty third, 2022 by Josh Arnold

Mergers and acquisitions happen fairly incessantly within the capital markets, however by way of scale, media protection, and significance for dividend buyers, the approaching transaction between AT&T (T) and Discovery (DISCA) is without doubt one of the largest in current reminiscence.

AT&T is undoing a number of the merger exercise it accomplished up to now decade and attempting to refocus its enterprise. Previous to the merger, AT&T was a Dividend Aristocrat because of its 30+ years of rising dividends.

The Dividend Aristocrats are a gaggle of 66 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

You’ll be able to obtain a whole record of all 66 Dividend Aristocrats (plus necessary monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

In the meantime, Discovery shareholders wish to know the outlook for the inventory, significantly its future progress prospects and whether or not it should pay a dividend post-merger.

Discovery will instantly develop its content material library fairly considerably, and the monetary phrases appear truthful to each.

On this article, we’ll check out the transaction itself, what the spin-off of WarnerMedia means to Discovery’s outlook, and whether or not or not we’d see the corporate pay a dividend sooner or later.

Transaction Overview

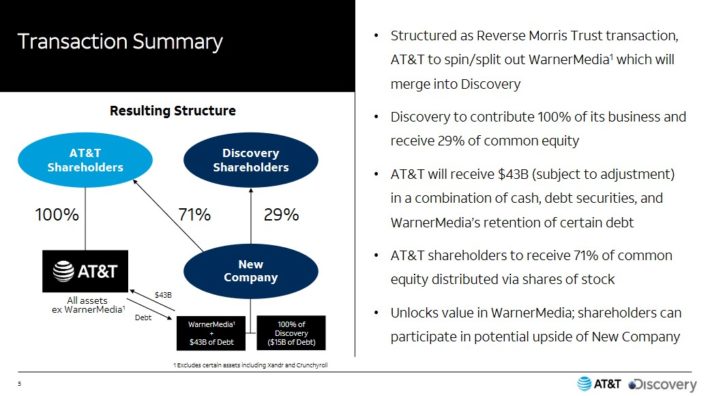

Let’s start with the phrases of the deal, and as we will see beneath, the businesses have elected to make use of a Reverse Morris Belief transaction. Primarily, such a transaction permits AT&T to create a tax-free spinoff of WarnerMedia by instantly merging it into Discovery.

Supply: Investor presentation, slide 5

WarnerMedia can be spun off into a brand new firm, which is able to then merge with the present Discovery enterprise with the latter’s shareholders proudly owning 29% of the brand new firm, and AT&T shareholders taking the remaining 71%.

Consequently, AT&T will obtain $43 billion of money and equivalents as a part of the deal, which quantities to compensation for shareholders for the WarnerMedia enterprise.

Associated: To see an in depth evaluation of the merger from the angle of AT&T, click on right here.

The purpose of this transaction is to take the content material and media portion of AT&T’s present enterprise that doesn’t essentially match strategically with the rest of the enterprise, and permit AT&T to refocus its enterprise on telecom and broadband, whereas Discovery significantly expands its content material library.

We see the transfer as favorable for each firms, and we expect Discovery’s progress prospects could possibly be improved following completion of the transaction, which is presently slated for April 2022.

What Discovery Will Look Like Publish-Merger

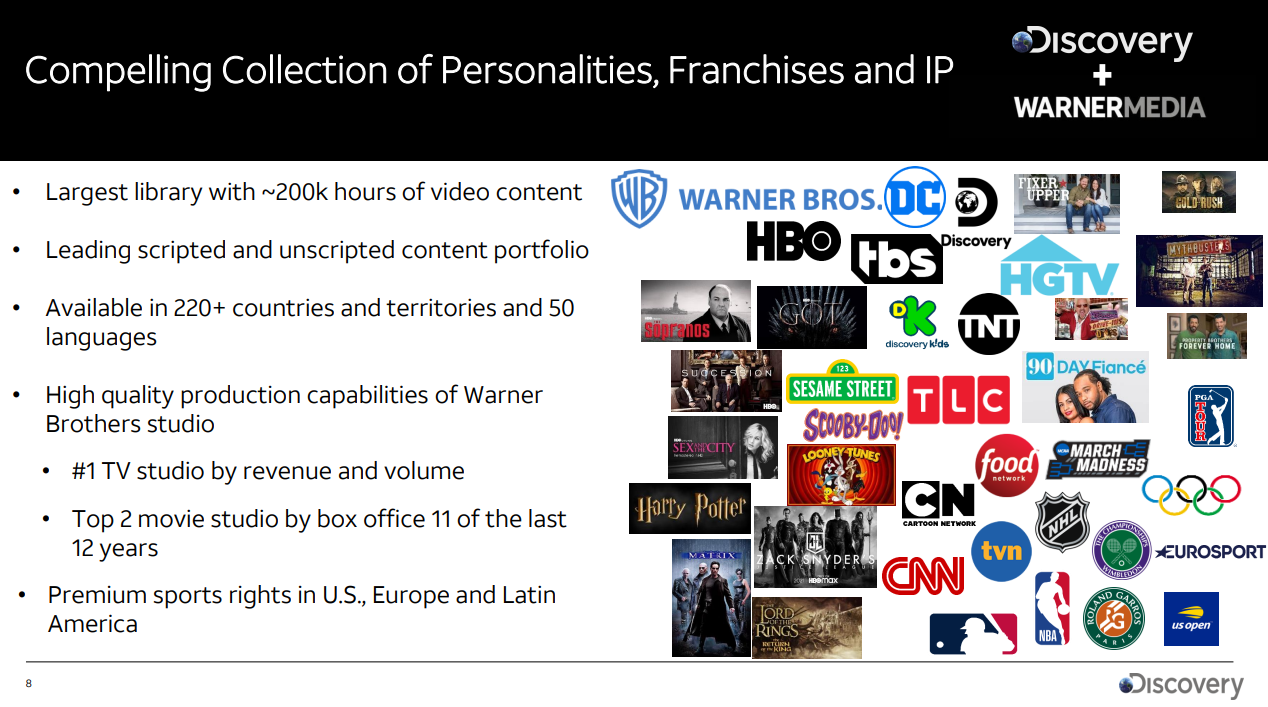

By consummating this transaction, Discovery’s content material library will transfer from what’s extraordinarily reliant upon actuality and documentary-style content material to including profitable franchises like Warner’s film enterprise, HBO, TBS, Harry Potter, Lord of the Rings, and rather more.

Supply: Investor presentation, slide 8

Discovery will instantly transfer into the highest spot by way of TV income and quantity, and turn into an enormous participant in scripted content material, the place it has little or no at present. Motion pictures are one other manner Discovery stands to profit from the merger, as Warner’s film studio owns profitable franchises, but in addition creates new content material frequently.

Lastly, Discovery is choosing up a large dwell sports activities portfolio, and we expect the addition of those strains of enterprise may see Discovery with extra secure income and earnings, and stronger, extra diversified progress potential than the legacy Discovery portfolio.

Progress Prospects

Discovery is presently set to develop earnings at about 5% per 12 months, on common, previous to the merger with WarnerMedia. That features its present Discovery+ streaming service, which has confirmed fairly standard, and its different content material and licensing offers.

Nevertheless, its income is about to soar as soon as the merger is full, transferring from about $12 billion yearly at present, to greater than $40 billion as soon as WarnerMedia is a part of the corporate.

Supply: Investor presentation, slide 11

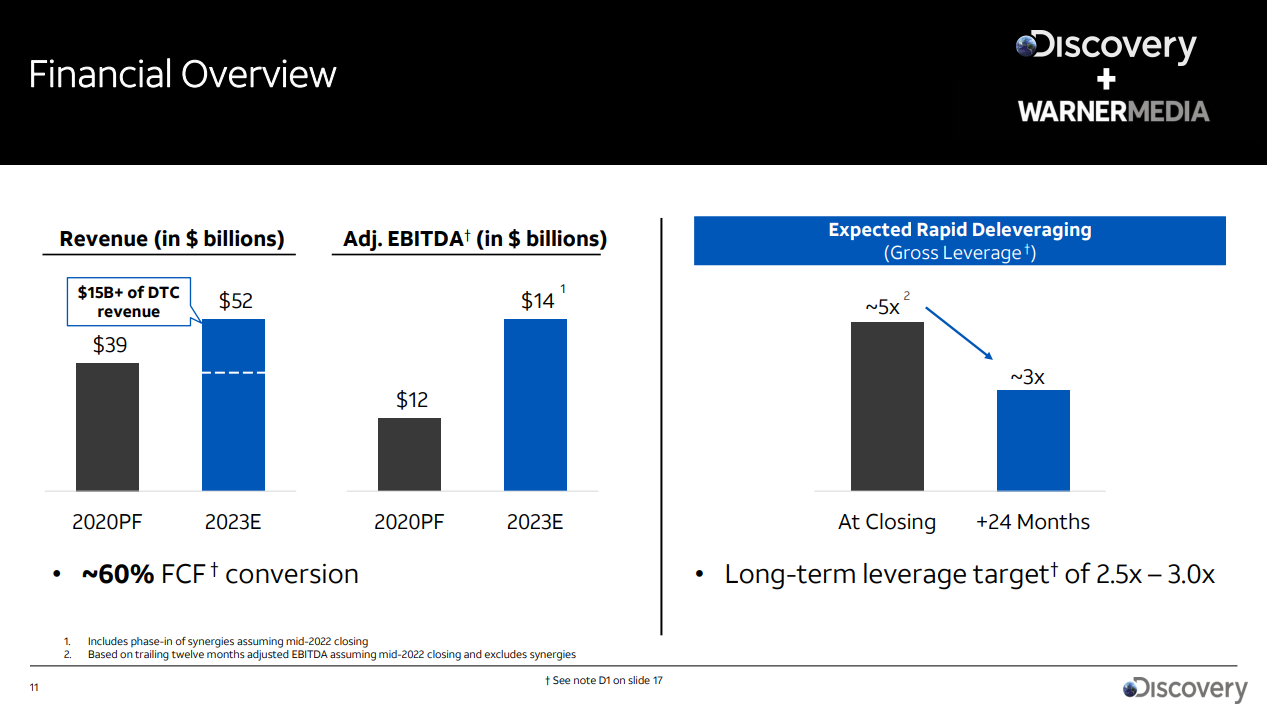

We are able to see that pro-forma income for the Discovery/WarnerMedia enterprise would have been about $39 billion in 2020, and that administration believes it may be $52 billion by the top of subsequent 12 months. That displays the large content material library that Discovery is gaining, and it means whole income may ~4X within the subsequent 18 months or so.

That’s spectacular progress, and it implies that the mixed entities would see one thing like low double-digit annual progress in income on a pro-forma foundation from 2020 to 2023.

Adjusted EBITDA is slated to develop at a slower price, with projections of the mix rising from an estimated $12 billion in 2020 to $14 billion in 2023, however we nonetheless see Discovery’s post-merger earnings progress alternative as significant.

That is significantly true as a result of Discovery ought to be capable to considerably deleverage post-transaction. The corporate is about to have a leverage ratio of about 5X at closing, however expects to see it at 3X or much less two years after. That won’t solely present the corporate with extra monetary flexibility, however will even cut back the burden of curiosity expense on the corporate’s earnings.

Mixed, we see Discovery’s earnings progress profile as enhanced following this era of deleveraging, which is able to then enable additional content material growth funding in Discovery and WarnerMedia.

Along with that, Discovery and WarnerMedia need to save at the least $3 billion yearly in presently redundant prices, which is able to accrue important advantages over time to the corporate’s margin profile.

These advantages gained’t seemingly be seen till at the least 2023, however we see this as one other important tailwind for not solely earnings progress, however free money stream technology that can be utilized for content material funding or additional deleveraging.

Dividend Prospects & Valuation

Discovery doesn’t presently pay a dividend, however we imagine that might change following the merger. Discovery presently produces greater than $4 per share yearly in free money stream, which it makes use of to spend money on new content material, servicing debt, and shopping for again its personal inventory to scale back the float.

Whereas the corporate might not elect to instantly pay a dividend following the merger, we imagine that when the deleveraging course of is accomplished, which shouldn’t take greater than two years, the corporate can be very well-positioned to start returning money to shareholders through dividends. Given the hesitancy to pay a dividend up thus far, we imagine Discovery would begin with a small dividend, however its free money stream technology post-merger can be greater than adequate to help a dividend of lower than $2 per share.

As well as, the valuation of Discovery could be very engaging, because the inventory goes for simply 9 occasions this 12 months’s earnings estimates. Not solely does that make the inventory engaging from a capital appreciation standpoint, however as a result of the valuation is so low, if a dividend is initiated, the yield needs to be engaging as effectively.

Ultimate Ideas

Whereas the transaction that may see Discovery take over WarnerMedia’s enterprise is considerably uncommon and complex, we just like the deal from Discovery’s perspective. The WarnerMedia enterprise provides Discovery a really robust present portfolio of profitable properties, and offers Discovery and instantaneous management place in dwell sports activities and scripted content material, the place Discovery doesn’t actually compete at present.

It is going to roughly quadruple the present measurement of the income base for Discovery, and will present strong value synergies that may assist with earnings progress within the coming years. Lastly, the deleveraging that administration has dedicated to will enhance the corporate’s flexibility, and afford it the power to start paying a dividend within the years to come back.

Given all of those components, together with the engaging valuation, we like Discovery as a purchase heading into the merger.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].