alvarez

Abstract

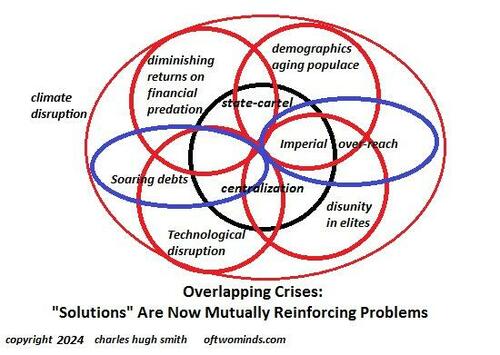

ATS Company (NYSE:ATS) out of Canada is a play on automation development within the manufacturing sector with publicity to electrical car battery outsourcing. Whereas the cycle is correct now placing a dent in near-term development (with Goldman lately placing a promote on the inventory), the long-term story stays a superb one: labor shortages and insourcing developments will create elevated demand so as to add North American-based manufacturing capability and enhance efficiencies.

Additionally a plus, ATS sells and companies producers in lots of defensive industries: healthcare, client merchandise/packaging, in addition to sectors like vitality and electrical automobiles.

The inventory has been killed up to now 12 months, down 40% from its peak, as some massive EV contracts have rolled off.

Under is a chart from Bloomberg.

Bloomberg

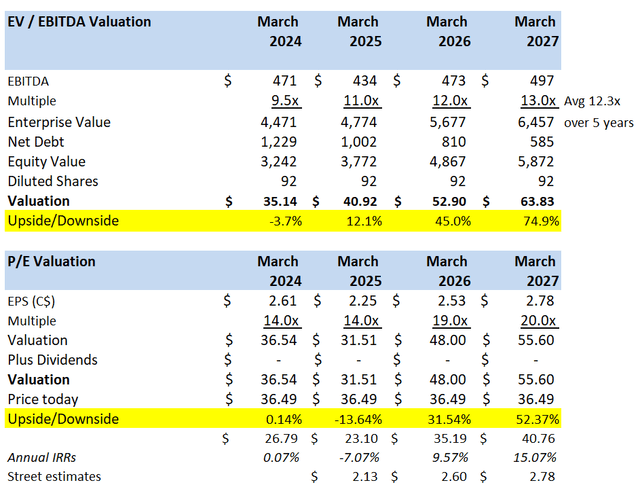

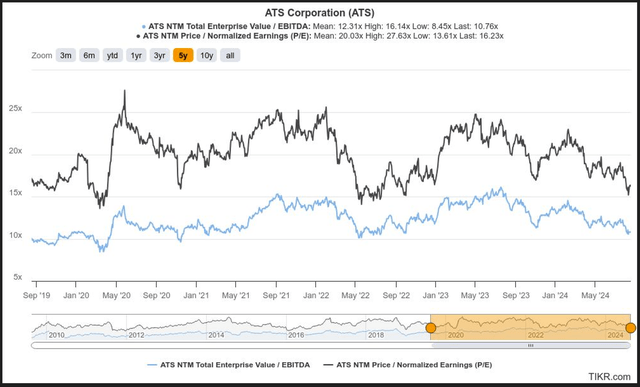

A inventory within the automation trade, particularly one with a Danaher kind enterprise system, gained’t come low cost. Rockwell Automation (ROK) trades at 25.8x ahead earnings and at 19x EBITDA. It’s also off its highs, however not as a lot as ATS. We might level out that ATS has grown income about 3x as quick as ROK up to now 5 years, with EPS development that’s 40% higher per 12 months. ATS at $36.50 now trades at 16x subsequent 12 months’s earnings (12 months ending March 2025) and 10.6x fiscal 12 months 2025 EBITDA.

It’s value stating that final 12 months, ATS was a 22x P/E a number of inventory.

The bottom a number of that ATS has traded traditionally was just below 14x throughout the pandemic. That means a 14% draw back within the inventory.

On the upside, ATS, we consider, is value 12-13x EBITDA, which implies over 50% upside in a few years. On common over the previous 5 years, ATS has traded at 12.3x ahead EBITDA, so we really feel that the upside case is sort of conservative.

Latest Earnings

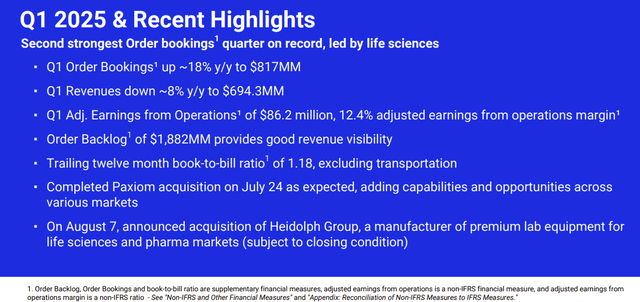

ATS reported a slight EPS miss within the June quarter. Revenues fell 8% as a whole lot of EV battery enterprise rolled off in comparison with final 12 months. Natural income development was -12.7% in Q2. On the plus aspect, quarterly bookings had been up 18% together with some GLP-1 enterprise as mentioned on the decision.

EBITDA fell 10% in comparison with a 12 months in the past however beat estimates by 1%.

EPS was $0.52, a 2c miss and down from $0.69 a 12 months in the past.

The corporate is slicing prices of their Transportation section as EV gross sales sluggish and prospects reduce on electrical car purchases.

The stability sheet appears tremendous too, with debt to EBITDA at 2.7x as of the top of June.

The corporate has 2 acquisitions lined up for Q3 (Paxiom closed in July and a deal to purchase Heidolph Group was introduced). These guys have a wonderful M&A monitor file, so we’re optimistic, however monetary information is scarce to date. On the decision, administration merely mentioned it was accretive on a gross margin foundation and an asset they bought out of chapter.

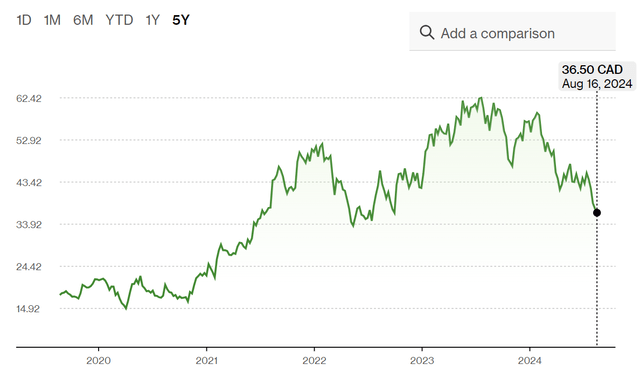

Under is income in Q2 by section.

ATS Investor Relations

Excluding Transportation, income grew 3%.

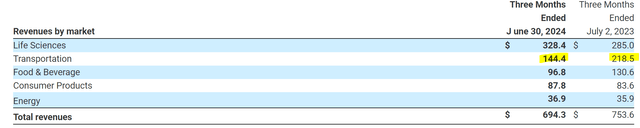

Within the quarter, backlog stays depressed in Transportation after all, however is doing fairly properly throughout each different vertical.

ATS Investor Relations

Backlog development ex-Transportation was 23% in Q2 in comparison with a 12 months in the past.

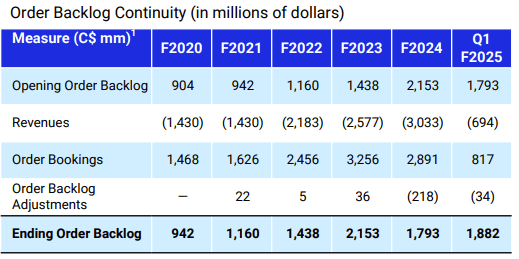

Right here is backlog over the previous few years.

ATS Investor Relations

Word that backlog is lastly ticking up once more after peaking in March 2023. E-book to invoice is 1.18x and bodes properly for development going ahead.

Right here is their most up-to-date slide discussing order bookings:

ATS Investor Relations

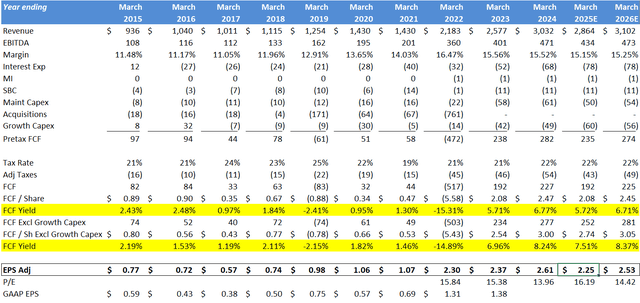

Avenue estimate are $2.13 in EPS for 2025 (FY Ending March) and $2.60 the next 12 months. Administration mentioned some margin strain because the Transportation enterprise winds down, and that might be a close to time period points. Mixed with the 2c miss to estimates, we predict $2.25 in EPS, give or take for the March 2025 FY.

Right here is our abstract free money circulate and earnings mannequin.

Firm financials, Creator spreadsheet

A By means of the Cycle Compounder

Per the above, whereas close to time period outcomes have been uneven with some massive EV contracts rolling off in 2023 and 2024, that’s principally behind the corporate. Since 2015, ATS has clearly been a terrific Compounder, with EPS up virtually 3x (utilizing FY 2025 estimates, which appears like a trough 12 months).

We credit score the comparatively new and younger CEO for a lot of its latest success. Andrew Hider took cost in 2017 (after a protracted stint at Danaher) and has applied many cultural modifications which have improved margins, market share, and EPS. We now have mentioned the success of the Danaher Enterprise System (DBS) up to now because it has created important worth throughout a spread of area of interest producers like Parker-Hannifin (PH), DHR and Flowserve (FLS) to call a couple of.

Whereas the corporate has had a whole lot of long-term development, there was a whole lot of financial noise alongside the way in which. Most lately, funding in automation know-how presumably peaked in 2022. It naturally lagged in 2020 throughout the pandemic, a lot of its development was pushed by deferred orders and deliveries. Certainly, natural development reached as excessive as 20% in 2021 (in sure quarters), earlier than slowing to five.5% within the June 2022 quarter. The latest earnings report confirmed natural income falling 12.7% (the June 2024 quarter), however as mentioned, new order bookings are these days robust, with complete backlog up 5% sequentially.

We all know the story with robust comps. ATS has been within the penalty field for a number of quarters now because the world normalizes, however the firm appears poised to develop once more. We additionally view their EV enterprise as probably a “free possibility” ought to demand decide up within the house.

In the long run, we love the secular development towards spending on elevated manufacturing capability and efficiencies in ATS’s core markets (US and Europe). There are all the time producers seeking to enhance margins, and re-sourcing developments can solely assist this development.

We view ATS as a strong Compounder, noting the next:

– Income has grown organically by 7% over the previous 5 years;

– EPS has compounded by 12% yearly since 2016, up over 3-fold;

– EPS has compounded by 22% yearly since Eric Hider took over;

– The stability sheet is strong at 2.7x on a debt/EBITDA foundation, intending to maintain leverage beneath 3.0x;

– A terrific CEO who hails from Danaher; and

– A powerful acquisition monitor file.

Dangers embrace a recession, which may sluggish spending amongst many producers. Europe actually faces weak development right now and whereas ATS has a strong acquisition monitor file, they might make a mistake on this regard. Additionally, the corporate collects income in quite a lot of currencies and so there’s F/X danger right here.

Valuation Ideas

Whereas ATS may sit within the penalty field for a couple of extra quarters, we consider in a 12 months, at its common 19x P/E a number of, ATS is a $48 inventory (in Canadian phrases, from $36.50 in C$ right now). That’s an upside of 11% and a good base case.

With smaller names, we regularly do extra diligence than extra established firms, given the elevated dangers with a small cap. With ATS, we spent a little bit time talking with the CFO on a spread of subjects. We additionally gathered intel from different trade insiders.

One buysider believes that IMA (Industria Macchine Automatiche) based mostly out of Italy, may be an purchaser of ATS. IMA is owned by a personal fairness consortium together with BC Companions, BDT, and MSD Companions. This group bought IMA in January 2021 for 14x 2020 EBITDA and 12x ahead EBITDA estimates.

At 12x ahead EBITDA, ATS has 45% upside.

Listed here are some valuation eventualities.

Firm Financials, Estimates, Creator Spreadsheet

Here’s a chart illustrating ATS’s common ahead multiples on each an EV/EBITDA foundation and a P/E foundation. The inventory is near pandemic lows.

TIKR.com

Whereas ATS experiences in Canadian {dollars}, the inventory is actively traded on the NYSE in US {dollars} too. We personal the USD model.

Purchase.