zhongguo

It has been almost a year since the last time we covered Atlantica Sustainable Infrastructure (NASDAQ:AY), which we already thought was attractively priced, although we warned that we did not expect the company to deliver much growth in cash available for distribution (CAFD) or dividend increases. Surprisingly, their “Strategic Review” is still ongoing, but we now have full year 2023 results and FY2024 guidance to update our take on the company.

While interest rates have increased more than we expected, we think the market has overreacted, and shares are now strikingly undervalued. The earnings call was relatively brief, but we did not find anything to make us worried. We were actually reassured that management was firm and explicit in saying they are not considering issuing equity to finance projects at this time. That would have been a huge disappointment otherwise. There was an interesting exchange in this regard during the Q&A of the earnings call, between an analyst and CFO Francisco Martinez-Davis.

Mark Jarvi

Okay. And then again, if you try to get it to $300 million, though, you think all those tools or those different options would get you there as it stands today? Like there’s no need for equity to get to $300 million of equity deployments this year?

Francisco Martinez-Davis

At this particular stage, we are not going to play with equity, Mark.

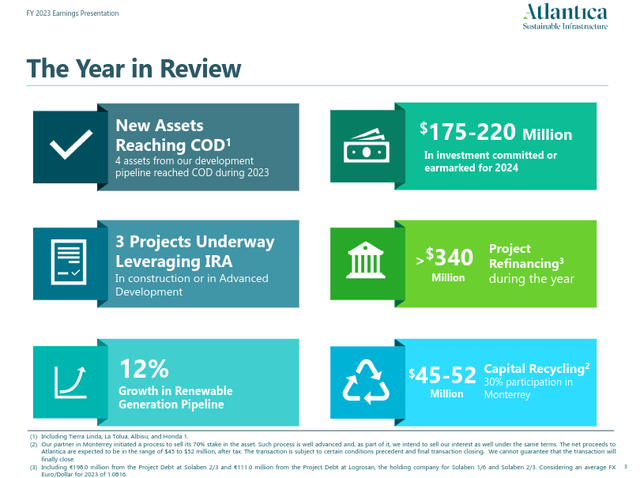

Something that should help in 2024 is that the company’s partner in the Monterrey asset is planning to sell their 70% stake, giving the company the opportunity to divest its 30% interest. This should result in net proceeds after taxes in the range of $45 to $52 million, which will help finance the projects currently under construction.

Company Overview

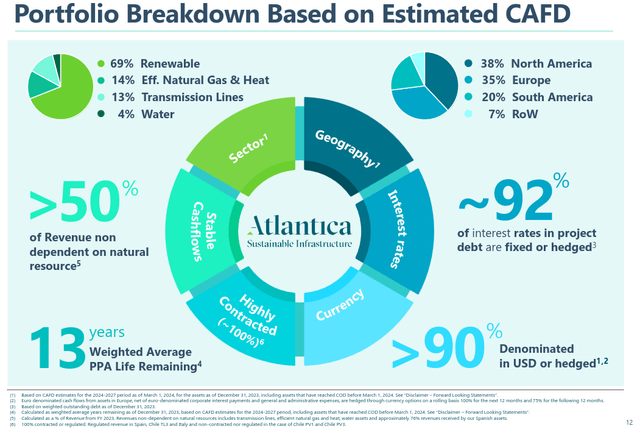

As a reminder, Atlantica Sustainable Infrastructure is mostly a renewable energy producer, and it sometimes buys completed projects, but it also has development capabilities. It also has small exposure to transmission lines in Chile and Perú, efficient natural gas and heat, and a water utility in Algeria. Its renewable energy portfolio is dominated by solar power, followed by wind, one geothermal project, and a mini-hydro (4 MW) project in Perú.

We appreciate the technology and geographic diversification, and we particularly like the transmission lines assets. Still, we find companies with significant hydro exposure more attractive, as these are almost perpetual assets which can store energy for when it is needed the most. They work great when paired with other technologies like solar and wind, to be able to guarantee 24/7 clean energy to customers. Peers with significant hydro exposure include Brookfield Renewable (BEP)(BEPC) and Innergex (OTCPK:INGXF). Atlantica’s strategy to overcome this issue appears to be coupling solar power plants with batteries.

Atlantica Sustainable Infrastructure Investor Presentation

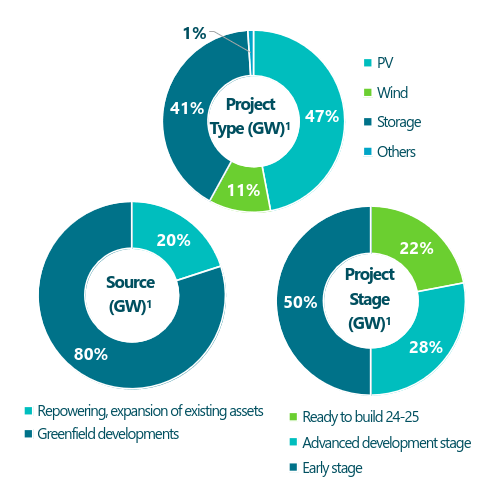

We think the company is not getting much credit for its development pipeline, even though a large part is already in the advanced stage. Compared to last year, the renewable energy pipeline has expanded by ~12% to 2.2 GW, and the storage development pipeline has expanded 5% to 6 GWh.

Most of these projects are in North America, and 80% are greenfield developments, with 20% being re-powering or expansion of existing assets. The company is clearly very focused on solar (PV) and battery storage, with wind projects representing only 11%. Almost a quarter of the development pipeline is ready to be built this year or next.

Atlantica Sustainable Infrastructure Investor Presentation

Q4 and FY23 Results

Cash available for distribution, their most important metric, was within guidance at $235 million, or $2.03 per share. This was about 2.1% lower compared to the $2.07 CAFD per share the company reported the previous year. We don’t think this is too bad considering a few headwinds the company experienced in 2023, including an unscheduled outage at its Kaxu solar plant, volatile energy prices in Spain, and higher financing costs.

The company reported it has continued advancing with the construction of several projects, including a 150 MW solar project in California that will be paired with battery storage, and for which the company has already signed a power purchase agreement (PPA). The company is also planning on expansions to its transmission lines assets where revenues are based on availability and indexed to inflation.

Fiscal year 2024 should benefit from four development assets that were commissioned during 2023 and the sale of the company’s 30% participation in the Monterrey asset. Despite their strategic review still ongoing, the company continues to invest, with roughly $200 million already committed for 2024.

Atlantica Sustainable Infrastructure Investor Presentation

Strategic Review

One thing that soured sentiment towards the company was that its sponsor Algonquin Power & Utilities (AQN) had some financial issues, and has now concluded that they want to sell their interest in Atlantica Sustainable, in what could be a sale of their stake, or of the entire company. Without the support from Algonquin Power, the company has had to rely on its own resources to develop and finance projects. It is difficult to know exactly what will happen, as Atlantica’s own strategic review remains ongoing, and management declined to discuss the topic during the earnings call.

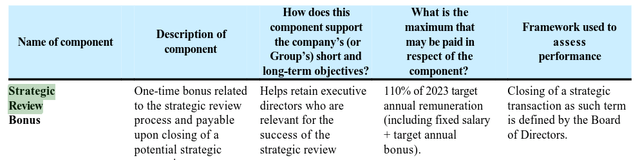

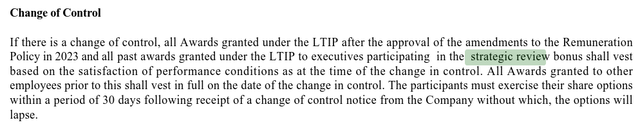

Reading the annual report, we found it interesting that ten members of management and the CEO have a “strategic review bonus”, which would become payable upon closing of a strategic transaction. We view this as a hint that the company is probably trying to sell itself completely, as it would be unfair for other shareholders if a “strategic transaction” was simply helping Algonquin Power sell its stake. In any case, we think that completing this “strategic review” will remove uncertainty that is currently affecting the share price.

On February 21, 2023, Atlantica announced the initiation of a process to explore and evaluate potential strategic alternatives that may be available to Atlantica to maximize shareholder value. In connection with this process, the purpose of the strategic review bonus is to retain talent for certain positions in the organization which are relevant for the success of this process. The strategic review bonus applies to ten executives and the CEO. The value of the bonus is defined as 75% of the target annual remuneration for 2023 (including fixed salary + target annual bonus for 2023) (110% in the case of the CEO) and will become payable upon closing of a potential strategic transaction, as such term is defined by the Board of Directors. In the case of the CEO, the strategic review bonus was approved at the Shareholders Annual General Meeting held in April 2023.

Atlantica Sustainable Infrastructure Annual Report

Company executives have an additional incentive to complete the strategic review, and to get a high share price in the case of a sale of the entire company, as it appears a change in control would make their stock options vest immediately.

Atlantica Sustainable Infrastructure Annual Report

Stock Buybacks

CEO Santiago Seage answered an analyst question on whether the hurdle rates for projects the company is developing are higher than what shares are currently yielding, and whether the company would consider buybacks. We learned that the strategic review is preventing the company from repurchasing shares, but it sounded like something they would consider in the future otherwise.

Both in projects we have developed and are building in M&A., our hurdle rates obviously are higher. At this point in time, we are able to deploy capital with those higher hurdle rates because of the fact that we are under a strategic review, stock repurchase at this point in time is not an option we can consider. Obviously, in the future, it would be an option if the strategic review was not there.

Dividends

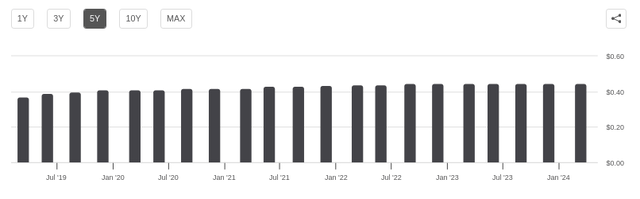

While it was a relief to many investors that the Board approved an unchanged dividend of $0.445 per share, we continue to believe investors should not expect significant increases any time soon.

The company is already paying most of its CAFD as dividends, and depending on what happens with interest rates and the strategic review, there is some risk it might even get reduced to fund future developments. The recently announced dividend is expected to be paid on March 22, 2024, to shareholders of record as of March 12, 2024.

Seeking Alpha

Balance Sheet

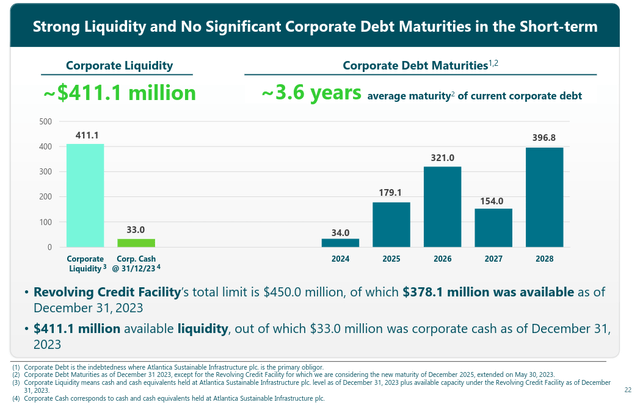

The company ended the year with net project debt of $3.9 billion, and net corporate debt was $1,051.7 million. The company still has time to wait for interest rates to be reduced, as it does not have meaningful maturities until 2025. Leverage remains at a reasonable level with a net corporate debt /CAFD (pre-corporate debt service) ratio of 3.8x.

If interest rates remain at the current elevated levels by the time the company has to refinance its 2025/2026 corporate debt, we believe it might have to reduce the dividend to be able to afford the higher interest payments. For example, the debt maturing in 2026 was issued at a very low interest rate, which would likely see a very significant increase if refinanced today.

On March 20, 2020, we entered into a senior secured note purchase agreement with a group of institutional investors as purchasers providing for the 2020 Green Private Placement. The transaction closed on April 1, 2020, and we issued notes for a total principal amount of €290 million ($320 million), maturing on June 20, 2026. Interest accrues at a rate per annum equal to 1.96%. – AY Form 20-F

Atlantica Sustainable Infrastructure Investor Presentation

Outlook

In the short term the company expects to be able to finances its projects under construction using the retained portion of the CAFD generated throughout the year, their cash position, and additional draw-downs on their corporate borrowing facilities. It can also easily add non-recourse debt at the project level, as these are fully contracted assets.

The company guided for FY24 adjusted EBITDA in the range of $800 million to $850 million, and cash available for distribution in the range of $220 million to $270 million. Even at the low end of the range, CAFD should cover the current dividend, but would complicate the financing of the development projects. The company expects to be able to narrow the range in the upcoming quarters once it has better visibility on certain items, including the confirmation of the closure of the Monterrey equity interest.

Valuation

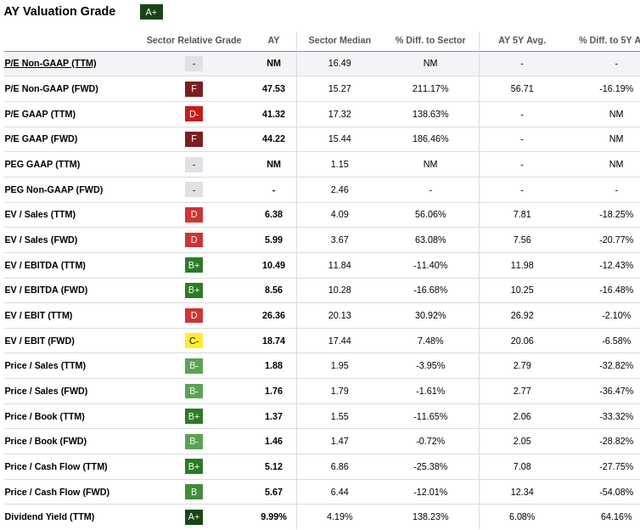

Given that Atlantica currently trades with a market cap of $2.07 billion, even if they only deliver CAFD at the low end of their 2024 guidance, the CAFD yield would be 10.6%. Given that it is paying most of its CAFD as dividends, and leaving little for reinvestment, we do not expect significant growth. Still, with a dividend yield above 9%, modest CAFD growth could result in double digit returns for investors.

We therefore agree with SA Quant’s “A+” valuation grade. We would note in particular that forward EV/EBITDA is roughly 16% below the company’s own 5-year average, as well as 16% below the sector average.

Seeking Alpha

Based on our estimates for future CAFD, we calculate a net present value of ~$26.3. With shares currently trading around $17.8, we believe they are roughly one third undervalued, or trading at ~67% of their intrinsic value.

Alternatively, we get a share price close to the current one if we use a 15% discount rate. Either way, we believe this points to severe undervaluation.

| CAFD | Discounted @ 10% | |

| FY 24E | 2.04 | 1.85 |

| FY 25E | 2.02 | 1.67 |

| FY 26E | 2.00 | 1.50 |

| FY 27E | 1.98 | 1.35 |

| FY 28E | 2.08 | 1.29 |

| FY 29E | 2.18 | 1.23 |

| FY 30E | 2.29 | 1.18 |

| FY 31E | 2.41 | 1.12 |

| FY 32E | 2.53 | 1.07 |

| FY 33E | 2.65 | 1.02 |

| FY 34E | 2.79 | 0.98 |

| Terminal Value @ 3% terminal growth | 37.89 | 12.07 |

| NPV | $26.34 |

Risks

Operating projects for renewable energy producers tend to be relatively low risk, mostly energy production variability due to the weather. While development projects add most of the risk. Inflation, higher construction and equipment costs have derailed some projects at some of its peers causing impairment charges, but Atlantica appears to have fared better in this respect, given that solar panels and battery prices have been coming down.

PV dynamics, I think, are good for somebody purchasing like us. In the case of batteries, battery prices have been coming down as well, significantly during 2023 globally, everywhere. So again, good dynamics for us.

The main risks we see with an investment in Atlantica Sustainable Infrastructure are refinancing risks if interest rates remain elevated or further increase, and a disappointing result from the “strategic review”.

On the positive side, the company continues commissioning projects that should contribute to CAFD, and the company might find the right sponsor or be acquired at a nice premium by a larger company like Brookfield Renewable.

Conclusion

The company is becoming too cheap to ignore, with a CAFD yield of over 10%, while it continues developing and commissioning projects. Based on CAFD guidance for 2024 the dividend should be fully covered, although the company might decide to reduce it if financing development projects gets complicated. The company continues investing significant amounts, especially in solar power and storage projects in North America. It is also investing in the transmission lines it owns in South America, where it will be receiving capacity payments with inflation indexation and payments denominated in U.S. dollars. At the current valuation we see shares as strikingly cheap, even if there are risks to consider. While the company might decide to reduce the dividend if refinancing debt becomes too expensive or difficult, we still believe shares are extremely attractive trading with a CAFD yield of over 10%. As such, we are upgrading our rating to “Strong Buy”.