Up to date on March twenty second, 2022 by Nikolaos Sismanis

Athanor Capital is a macro-focused hedge fund based in 2017 by Parvinder Thiara.

The agency is rising shortly – greater than doubling its belongings beneath administration in 2019. Athanor Capital at the moment manages round $5.8 billion in discretionary funds in accordance with its most up-to-date type ADV.

Traders following the corporate’s 13F filings over the previous couple of quarters (beginning with the mid-February, 2019 submitting by means of the mid-February, 2022 submitting) would have generated annual whole returns of 15.97%. This compares very favorably to the S&P 500 ETF’s (SPY) annual whole returns of 18.17% over the identical interval.

Observe: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You’ll be able to obtain an Excel spreadsheet of Athanor Capital’s efficiency and present and historic frequent inventory 13F holdings under:

Maintain studying this text to study extra about Athanor Capital.

Desk Of Contents

Athanor Capital’s Strategy To Investing

Athanor Capital’s funding technique is top-down. This implies the agency begins with macro-economic elements to construct its funding theses.

Athanor Capital doesn’t cease at high-level macro evaluation. The agency then ‘dives deeper’, performing relative valuation evaluation between particular person securities. This mix of ‘High-down’ and ‘Backside-up’ investing helps Athanor Capital to seek out compelling investments in compelling macro sectors. The picture under provides a breakdown of the agency’s technique.

Supply: Athanor Capital

The corporate’s funding technique can be succinctly acknowledged in its ADV brochure:

“The Funding Supervisor’s course of normally begins with macroeconomic observations together with market dislocations, capital flows, regulatory modifications, secular shifts and different main macroeconomic occasions. The Funding Supervisor seeks to find out whether or not these occasions have induced relative worth mispricings. As soon as a speculation {that a} macro occasion is inflicting a mispricing has been established, the Funding Supervisor seeks to validate or disprove it. The Funding Supervisor will usually take vital positions if it may possibly perceive each the mispricing and its trigger. The Funding Supervisor may exploit alternatives exterior of this course of and protocol.”

Of word is that Athanor Capital seems to be for ‘builders’ when hiring its funding analysis crew. Over 75% of the corporate’s funding and danger groups actively code. And 70% of the corporate’s employees are both minorities and/or girls because the agency values a wide range of views.

Tradition is ready initially by an organization’s founder. Athanor Capital’s founder is Parvinder Thiara.

About Parvinder Thiara

Parvinder Thiara was born in August of 1985; he’s 37. Thiara is a Harvard graduate and Rhodes Scholar. He labored for DE Shaw for 8 years earlier than establishing Athanor Capital.

A disagreement over trades in late 2015 is what induced Thiara to go away DE Shaw. Based on FT.com, executives at DE Shaw concluded that Thiara was not adhering to the funds danger tips:

“Executives concluded that he had not adhered to the hedge fund’s intraday danger tips and that he had not shared ample particulars of his buying and selling with executives, in accordance with the individuals, although Thiara ended most days with positions that have been inside DE Shaw’s protocols.

The agency confronted Thiara about his buying and selling, and Thiara’s rationalization was not ample for the DE Shaw executives, the individuals stated. The events couldn’t resolve their variations, resulting in his exit. Thiara has not been accused of violating any legal guidelines or laws.”

Thiara probably has a distinct interpretation of occasions. The emphasis on danger controls at Athanor Capital speaks to Thiara’s clear focus and understanding of danger.

The authorized battle and ‘unhealthy blood’ surrounding one other proficient worker at DE Shaw – Daniel Michalow – unexpectedly leaving the corporate exhibits that this isn’t an remoted incident. Commenting on the Michalow state of affairs, Parvender stated:

“This looks as if DE Shaw’s playbook when a proficient former worker leaves and chooses to compete.”

Setting apart Thiara’s previous with DE Shaw, it’s clear that traders are flocking to Athanor Capital primarily based on the agency’s fast asset progress.

Latest Developments Concerning Athanor

Athanor’s portfolio was quite concentrated, comprising of equities primarily within the Data Expertise sector. Nonetheless, following current information relating to the fund’s underperformance in addition to the dying of its founder, Athanor has fully revamped its holdings.

Athanor discovered itself in a really difficult spot within the midst of the Covid-19 pandemic. Its Grasp Fund recorded great losses throughout the March 2020 sell-off in international markets. Particularly, it recorded losses of shut to twenty%, which is quite vital contemplating funds like Athanor have a number of hedges in place. Whereas Athanor recouped a number of the losses, it ended 2020 down 3.6%. Mixed with the current dying of its founder, Athanor introduced that it could be returning its purchasers’ a refund.

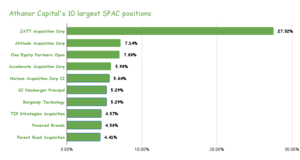

With the remainder of its remaining funds, Athanor has bought nearly solely SPACs. Out of its 20 present holdings, 18 are in reality SPACs.

What Is a Particular Objective Acquisition Firm (SPAC)?

A particular objective acquisition firm (SPAC) is an organization with no enterprise exercise. These authorized entities are created for the only objective of elevating capital by way of an preliminary public providing (IPO) or the intention of shopping for out or merging with an present agency. SPACs are also called “clean test corporations” for that reason. Whereas SPACs have been round for a very long time, their utilization has soared in recent times, primarily resulting from their benefit of getting an organization public a lot quicker than the usual itemizing course of.

Why Would Athanor Purchase SPACs?

Whereas we can not know the precise reasoning behind Athanor’s determination to load up on numerous SPACs, we consider that that is probably as a result of fund selecting to carry cash-like positions with some upside potential. When a SPAC raises capital (normally priced at $10 a share) the funds go into an interest-bearing belief account. They keep this manner till the SPAC’s administration crew identifies a personal firm seeking to go public by means of the merging/fast-track course of.

Many SPACs have recently traded under the $10 worth mark amid investor considerations that curiosity in SPACs (and therefore the chance to be utilized) is declining. Therefore, Athanor’s reasoning might embrace that they’re shopping for the money worth of SPACs for cents on the greenback. As an alternative of holding their money in liquid type, in different phrases, they’re primarily doing so with some upside potential concerned.

Further Assets

See the articles under for evaluation on different main funding companies/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].