Marvin Samuel Tolentino Pineda

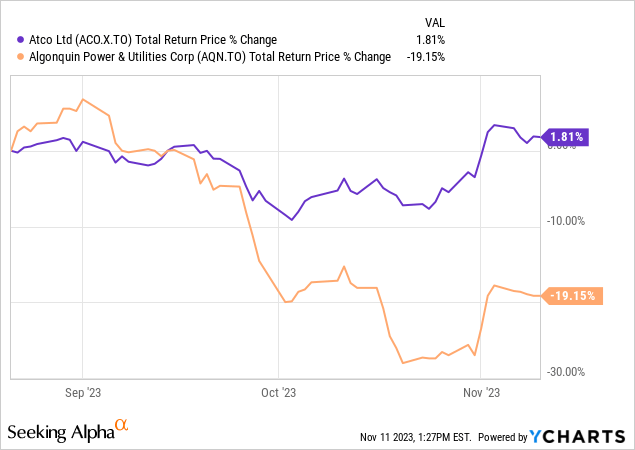

On our last coverage of ATCO Ltd. (TSX:ACO.X:CA), (TSX:ACO.Y:CA) we made the case that there was a quality investment here that was likely to give you good risk-adjusted returns. That was even more true when weighed against another utility Algonquin Power & Utilities Corp. (AQN:CA)(AQN). We felt there were compelling reasons to favor ATCO and gave you three reasons the winner was clear.

Since then ATCO managed a minuscule gain, but Algonquin was taken to the cleaners.

We examine just the Q3-2023 numbers for ATCO today and tell you where we stand.

Q3-2023

ATCO reported a strong third quarter with normalized earnings per share coming in at $0.71, miles ahead of estimates of $0.61. Surprisingly, its primary moneymaker, Canadian Utilities (CU:CA) was a bit weaker than expected. The beat came from the performance in Structures & Logistics division and also from Neltume Ports. It is no surprise that Structures & Logistics is benefitting from housing and rental space activity. Revenue generation was also strong at Neltume Ports but there was an additional lift via a weaker Canadian dollar. With the bulk of the year’s results in, we can predict with a fair amount of certainty that earnings should be at about $3.65. We now go over three reasons the stock is still a strong buy in our view.

Valuation Compelling

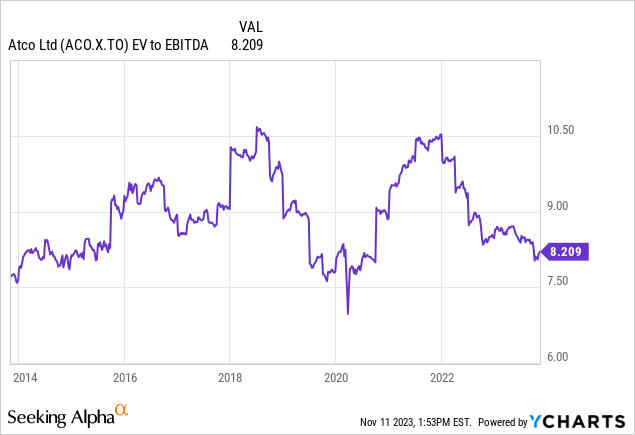

The stock is trading at about 10X earnings with a solid 5.3% dividend yield. That is quite compelling relative to its history. EV to EBITDA, which strips out some of the earnings noise also looks cheap relative to its decade long history shown below.

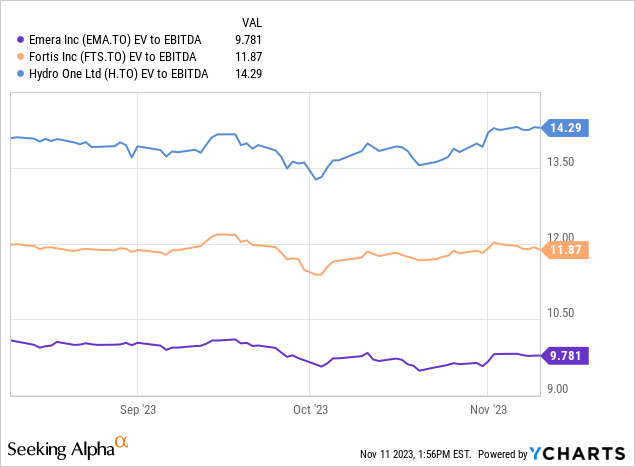

8.2X also is really cheap in the utilities sector. On the Canadian side, Fortis Inc. (FTS)(FTS:CA), Emera Inc. (OTCPK:EMRAF)[EMA] and Hydro One Ltd. (H:CA), are good comparatives and they all ring in incredibly expensive here.

Even the cheapest of the 3, Emera, is now trading 1.6 multiples wide on EV to EBITDA and 5 multiples wide on P/E ratios. We will add here that Emera carries far more debt and is on ratings watch from all three credit agencies. Valuation on this front is about as compelling as it gets.

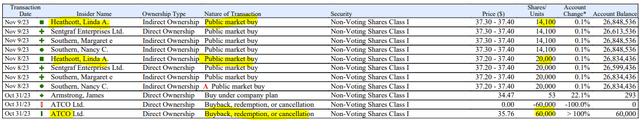

Insider Interest

We have seen a few transactions here, near the lows and that is always an added vote of confidence. We will note here that there are just three distinct transactions and the rest are duplicates.

Insider Ink Report

The third one shown is the buyback, a very tiny one from ATCO. We would have loved to see ATCO get a bit more aggressive here, but their management style always involves moving slowly and in incremental small steps. They dashed hopes on the conference call for those that would have liked more buybacks.

Mark Jarvi

Okay. And then you updated the normal course issuer bid parameters, but it doesn’t seem like you’ve acted on it. Share price is weaker. Like what would tip you to kind of be more active on the buyback right now? Is it that you’re holding back cash because you’re seeing more opportunities around private market new investments? Or just sort of what’s sort of informing the decision not to use the NCIB at this time?

Katie Patrick

Yes. No, we updated, we increased. We did use up to our maximum that we had approved. It’s a small amount. We’re not — we haven’t — we’re not talking about a massive NCIB program. We increased it to 2%. So I think we — as we said in the past, we continue to — how we would utilize that at times, we will see a disconnect between what we think is the true value of our assets and the market pricing. And we’ll look to opportunistically buy back shares in those circumstances. So won’t set a specific price to say when that happens or how, but we certainly monitor all the time.

Nonetheless, they retain the ability to deploy their free cash flow in this area.

Sum Of The Parts

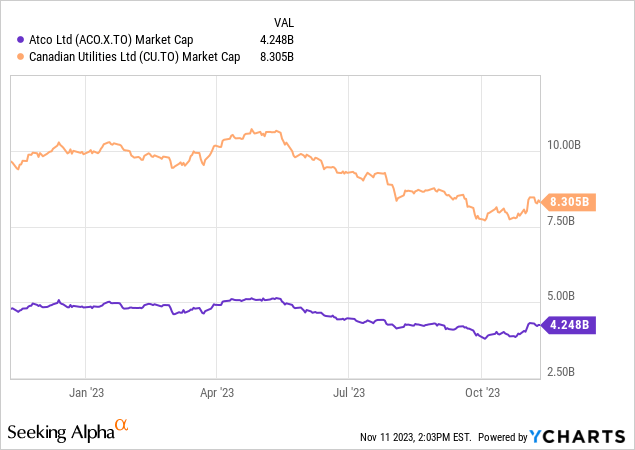

The primary case for ATCO is always about Canadian Utilities. That is the primary holding and if you don’t like that, then well, you shouldn’t buy ATCO. It is interesting here that you are basically getting all the other parts of ATCO for free. ATCO owns 52% of Canadian Utilities so the current market cap basically counts just that stake.

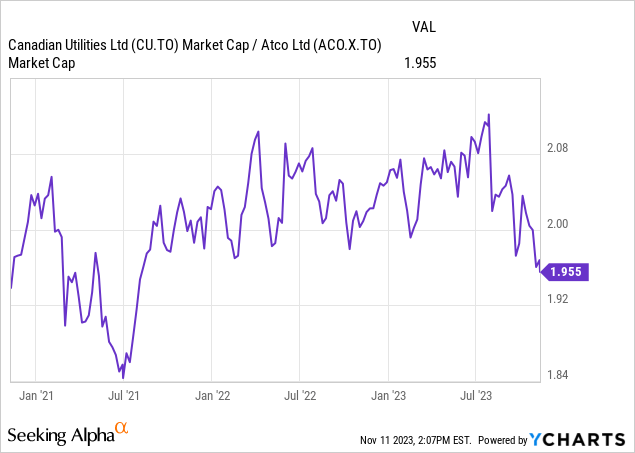

ATCO has about $4.75 of corporate level debt, but we estimate the Structure and Logistics and Neltume Ports to be worth about $14 a share. So net-net, you are getting an amazing deal versus buying Canadian utilities directly. One way to visualize this is to take a ratio of the market capitalizations of the two. At 1.955 ATCO rings in relatively cheaper than it has over the last two years.

It did get quite cheap on a relative basis in July 2021, but we would argue that the current valuation is on par with that. Our logic is that the two non-CU divisions will produce almost 50% more EBITDA in 2024 than they did in 2021.

Verdict

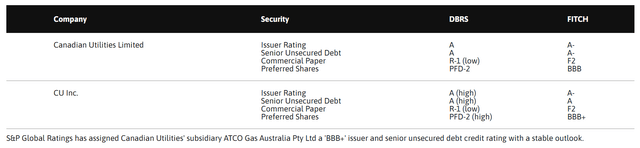

In the utilities sector, we have generally exercised caution. High debt levels have met some challenging fundamentals. Rising risk free rates will likely be a longer term pressure and you want to only buy select cases where valuation is in your favor. Canadian Utilities though, looks like an outright buy, based on Alberta’s growth and the company’s excellent credit metrics.

Canadian Utilities

ATCO is an excellent play on that with compelling side businesses that enhance total return prospects. We would look for 10 year total annualized returns close to 9% a year with low volatility from these levels.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.