Eoneren/E+ through Getty Photographs

AST SpaceMobile, Inc. (NASDAQ:ASTS) is on observe to disrupt the telecommunications trade due to its objective of delivering direct-to-cell (“DTC”) providers to smartphone customers who’re out of terrestrial mobile protection. With the corporate on observe to launch its first 5 Block 1 BlueBird satellites subsequent month, it’s properly positioned to understand its first revenues by This fall this 12 months. Given the importance of this milestone, I count on AST to proceed its bullish worth motion on a profitable launch.

In the meantime, the corporate’s superior know-how, in comparison with its direct rivals SpaceX (SPACE) and Lynk (SLAM), in addition to its relationships with greater than 40 MNOs with person bases of greater than 2.8 billion customers might see its revenues develop exponentially over the approaching years. For my part, these elements set AST as much as entice a substantial portion of the adults residing within the “efficient protection hole” who’re estimated to succeed in 532 million by 2035. In mild of this, I’m score AST as a powerful purchase with a worth goal of $144 by 2030, implying 1018% upside from present ranges.

Enterprise Overview

AST is a vertically built-in space-based mobile broadband community supplier with greater than 3350 patents and patent pending claims. The corporate intends to function a constellation of LEO satellites that may present connectivity on to cellphones at broadband speeds.

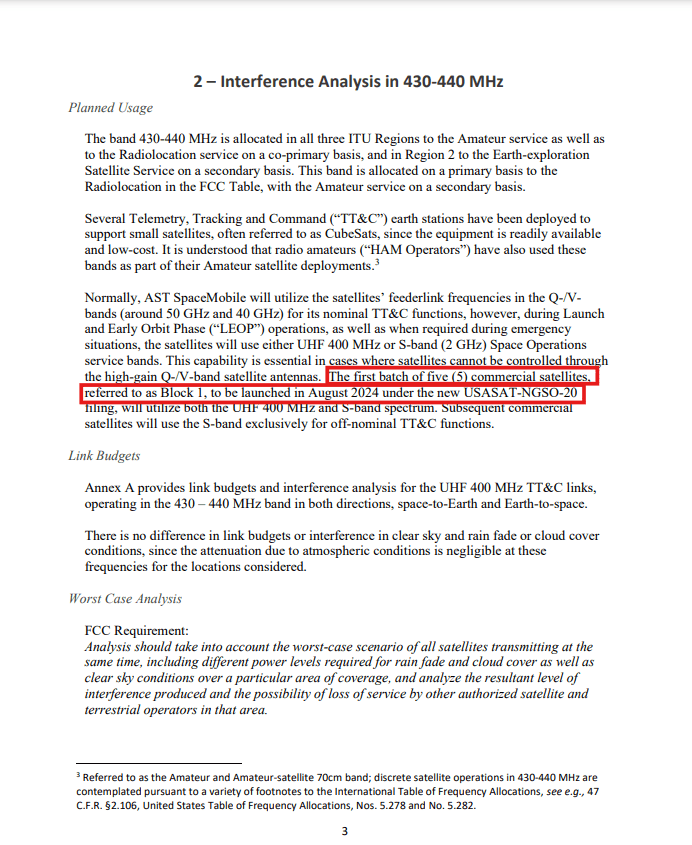

The primary 5 BlueBird satellites of the corporate’s constellation, representing Block 1 and are absolutely funded, are anticipated to launch in August, per a complement filed with the FCC on July 18th. Provided that administration beforehand shared that they count on to spend round three months to check and calibrate these satellites in orbit, it could possibly be protected to count on the corporate to start out producing revenues in This fall this 12 months, together with $20 million in income commitments from AT&T (T).

FCC Worldwide Communications Submitting System

Presently, the corporate is within the technique of constructing and creating the subsequent era of the BlueBird satellite tv for pc which is designed to enhance throughput by 10 instances. The subsequent era of the BlueBird satellite tv for pc can be launched as a part of Block 2 which is able to embrace 20 satellites and its launch is estimated to be in late This fall 2024 or in Q1 2025

With the 5 Block 1 satellites and 20 Block 2 satellites, AST will have the ability to present restricted and non-continuous service because it wants 45-60 satellites for steady providers within the US, and 90 satellites to be absolutely operational. With that in thoughts, the corporate said in its newest 10-Q submitting that along with its money stability of $212.4 million, it has to lift between $350-$400 million to fund the prices related to designing, assembling, and launching the 20 Block 2 BB satellites.

On that be aware, AST’s enterprise mannequin seems to be following the sample of excessive CapEx and low working prices. The launch and deployment of a giant constellation of LEO satellites requires vital upfront investments, as proven by the capital AST used and intends to make use of for the upcoming launches of BB1 and BB2 satellites.

As soon as these satellites are efficiently deployed in LEO, AST is more likely to incur comparatively low working prices related to monitoring the satellites and sustaining them in orbit. That mentioned, LEO satellites are estimated to have a lifespan of seven to 10 years, which implies that the corporate could must launch new satellites to switch the outdated ones by round 2031.

On the identical time, it must be famous that AST doesn’t have bodily infrastructure because it leverages the mobile community infrastructure of its associate MNOs on the bottom. This helps the corporate scale back its want for in depth bodily upkeep in comparison with conventional telecom corporations.

AST’s enterprise mannequin additionally permits it to incur minimal gross sales and advertising and marketing prices because it doesn’t provide its service on to shoppers, however its service is obtainable by its companions to their subscribers. Accordingly, the corporate depends on its companions’ subscriber progress to extend its addressable market.

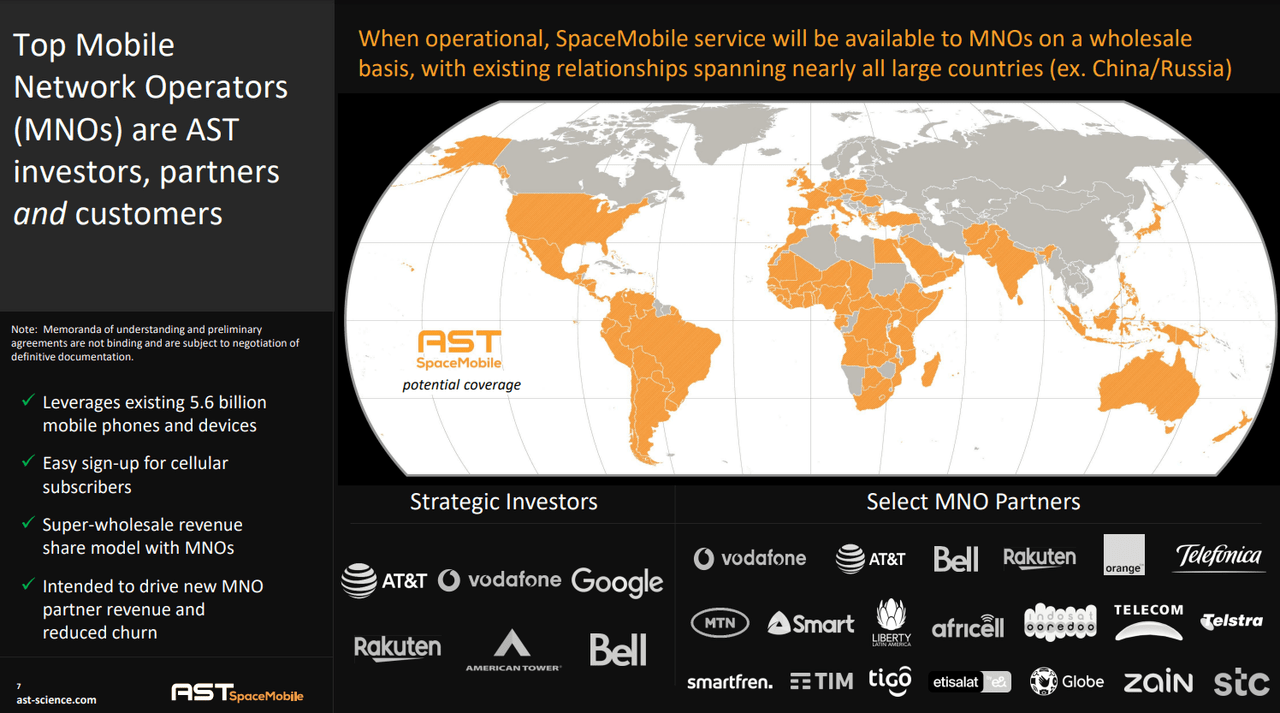

With that in thoughts, the corporate estimates that its partnerships with world MNOs present it with entry to greater than 2.8 billion subscribers. These companions embrace AT&T, Rakuten (OTCPK:RKUNY), Vodafone (VOD), and Verizon (VZ), which has just lately partnered with the corporate in late Could. This massive addressable market is particularly promising for AST contemplating that it could be working a 50-50 income share mannequin primarily based on its take care of AT&T, as talked about within the Q1 earnings name.

April Investor Presentation

Benefits of Satellite tv for pc Based mostly Networks

Whereas some could be skeptical of the corporate’s enterprise path, I imagine its tech could possibly be a sport changer for the hundreds of thousands residing within the protection hole and on the sting of protection. Per GSMA estimates, round 240 million adults can be residing outdoors the vary of a 3G, 4G, or 5G community in 2025.

On the identical time, one other group that lives inside vary of a 3G, 4G, or 5G sign however experiences patchy service at dwelling or in transit for work or journey is estimated to succeed in 280 million adults in 2025. These teams residing within the “efficient protection hole” would be the major progress drivers for satellite tv for pc primarily based networks, much like AST’s providing.

I imagine that’s the case since integrating satellite tv for pc and terrestrial cellular networks on these teams’ cellphones might assist fill in service gaps and maximize geographic and inhabitants community protection. Thus, satellite tv for pc networks might assist bridge the digital divide and produce alternatives and financial advantages to distant communities.

Moreover, industrial and authorities providers will even drive progress on this rising market. Communication providers for public security and nationwide security could possibly be pure use circumstances for DTC providers. The truth is, satellite tv for pc networks generally is a lifeline throughout pure disasters or emergencies when terrestrial networks are down, permitting individuals to name for assist and keep in contact with family members throughout these tough instances.

Aggressive Panorama

Wanting on the aggressive panorama within the DTC house, AST faces direct competitors from Lynk International, which is about to go public by a SPAC merger with Slam Corp. (SLAM) later this 12 months, and SpaceX’s Starlink division. That mentioned, AST’s know-how seems to be extra superior than its rivals within the discipline of DTC connectivity.

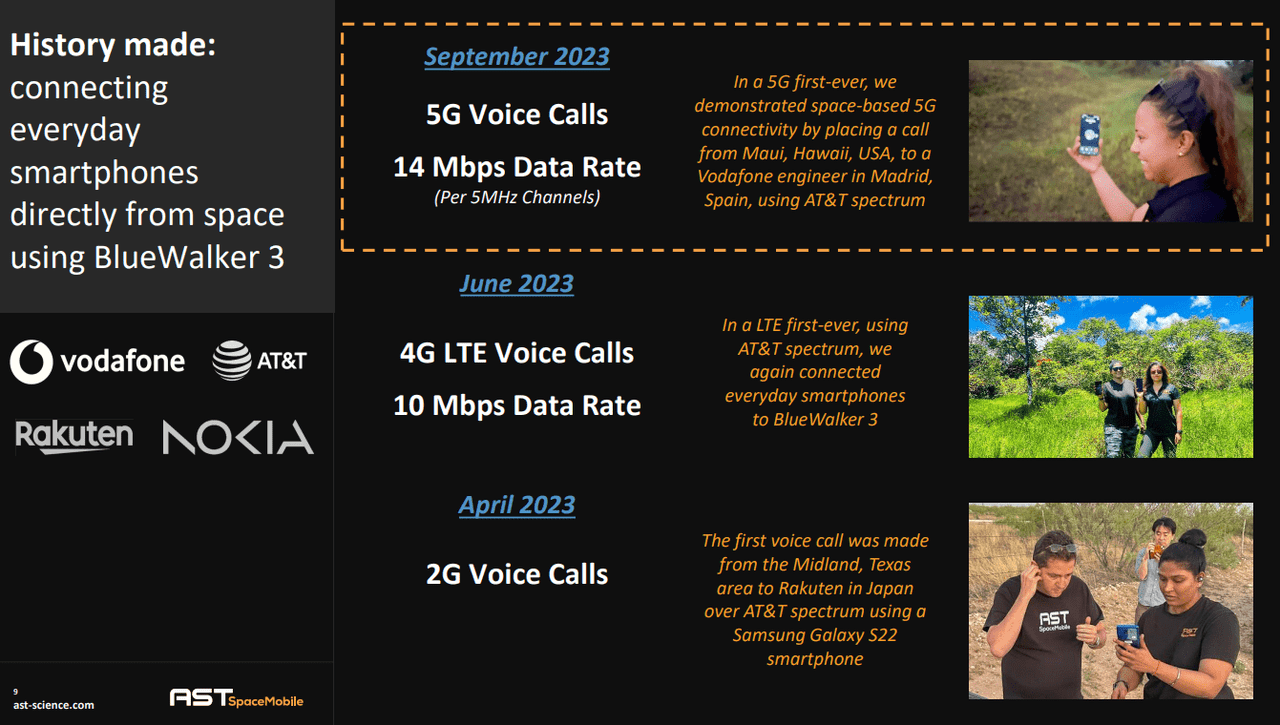

Over the course of final 12 months, AST achieved a number of milestones highlighting its satellites’ capabilities. That mentioned, probably the most spectacular feat the corporate achieved was making the primary ever 5G voice name and attaining a 14 Mbps knowledge price in September 2023.

April Investor Presentation

As compared, Starlink efficiently despatched and acquired its first textual content message to and from unmodified cell telephones on the bottom to its satellites in house utilizing T-Cellular (TMUS) community spectrum final January. Whereas SpaceX didn’t share particulars relating to speeds, latency, or different limitations, the corporate shared a photograph on X displaying that one of many despatched messages was misplaced throughout transmissions. This exhibits that Starlink is way behind AST when it comes to its satellites’ capabilities provided that it plans to increase its service to assist voice and knowledge in 2025, one thing AST has already achieved efficiently.

Furthermore, Elon Musk beforehand shared that the mobile Starlink system is designed to produce about 7 Mbps per cell which is simply good for textual content messages. In the meantime, AST already achieved a knowledge price double of that at 14 Mbps, as talked about earlier, and its deliberate operational satellites are designed to assist capability of as much as 40 Mhz which might allow knowledge transmission speeds of as much as 120 Mbps.

As for Lynk, the corporate has constructed 11 satellites and plans to make use of the proceeds from its SPAC merger to increase manufacturing to 12 satellites monthly, per its investor presentation. With that in thoughts, Lynk’s CEO Charles Miller, has beforehand shared that the corporate’s plan is to construct 200 satellites monthly and attain 5000 satellites inside 2 years.

For my part, these plans are extraordinarily optimistic contemplating the monetary state of the corporate. Per Lynk’s investor presentation, the price of producing a satellite tv for pc is $300 thousand and the launch value is round $650 thousand. In the meantime, the merger deal has a minimal money settlement of $110 million. On that be aware, Slam’s newest 10-Q submitting exhibits that it has simply lower than $100 million held in belief. That mentioned, Lynk has a dedication from Antara Capital to take a position $25 million to assist offset redemptions.

In parallel with its SPAC deal, Lynk is trying to elevate $40 million in a Collection B funding spherical. This could convey its whole money raised to $150 million by all of those capital raises, that are anticipated to assist produce extra satellites, safe launches, and assist satellite tv for pc designs and operations. For my part, these figures don’t align with the corporate’s plan to supply 5000 satellites inside two years since the price of producing 5000 satellites, with out taking launch prices into consideration, could be $1.5 billion, whereas that determine would balloon to $4.8 billion when contemplating launch prices.

Deliberate Satellites | 5000 |

Price Excl. Launch | $1,500,000,000 |

Price Incl. Launch | $4,750,000,000 |

In the meantime, the $150 million Lynk has entry to are solely sufficient to supply 500 satellites, with out contemplating launch prices and working prices, or 158 satellites when taking launch prices into consideration.

Money | $150,000,000 |

Launch Price/Sat | $650,000 |

Sat BOM Price | $300,000 |

Complete Price/Sat | $950,000 |

Attainable Sats Excl. Launch | 500 |

Attainable Sats Incl. Launch | 158 |

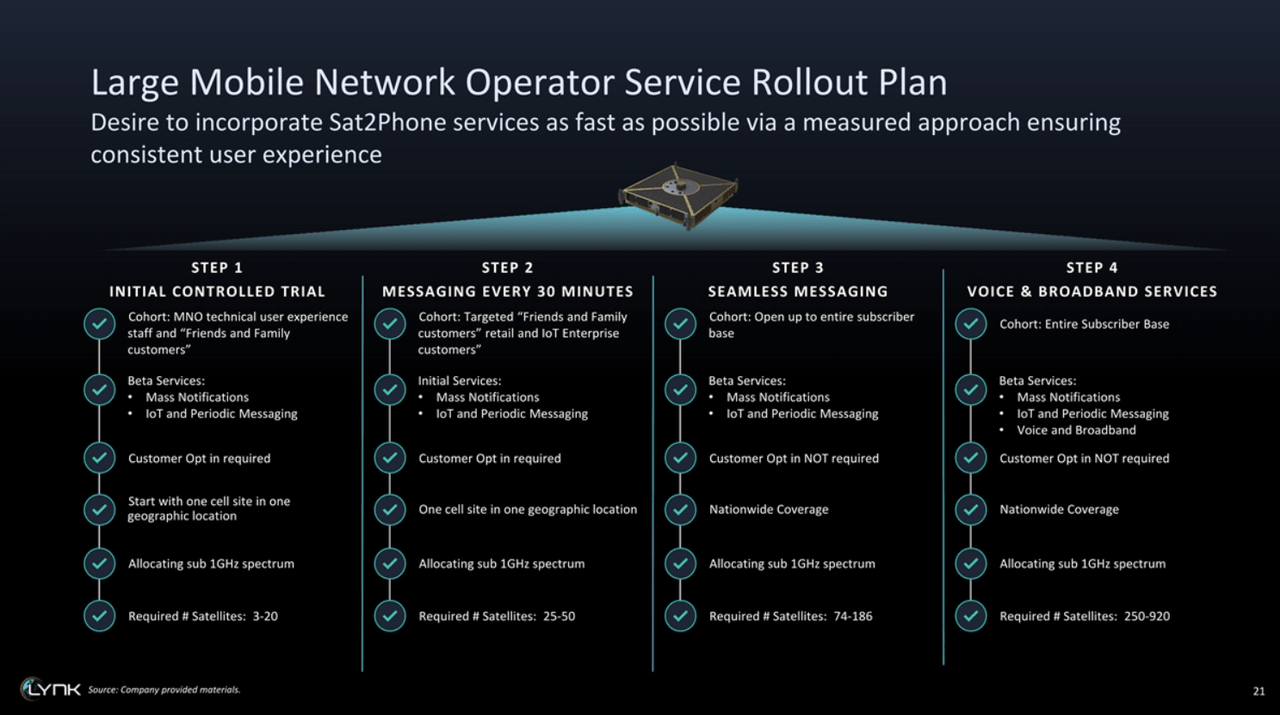

Transferring to know-how, Lynk seems to be far behind AST, as per its investor presentation, it requires 25-50 satellites to assist messaging each half-hour, 74-186 satellites to assist seamless messaging, and 250-920 satellites to assist voice and broadband providers.

Lynk’s Investor Presentation

As compared, AST’s preliminary 5 Block 1 satellites and 20 Block 2 satellites can provide all of these providers, albeit restricted, within the US, and requires 90 satellites solely to cowl the entire world, per its president Scott Wisniewski.

Income Projections

Whereas AST’s companions have 2.8 billion subscribers, the corporate can’t entry this potential buyer base till its service is accessible globally, which might solely be potential when it has 90 satellites launched. With the corporate launching its first 5 Block 1 satellites subsequent month, and plans to launch 20 Block 2 satellites in late This fall 2024 or Q1 2025, it will have 25 satellites able to offering restricted service within the US.

AST has an current capability to supply two satellites monthly and a possible capability of six satellites monthly. Assuming the corporate is ready to produce 4 satellites monthly in 2025, it could possibly attain greater than the 90 satellites required for full deployment in 2026. This timeline is in keeping with the corporate’s plan to supply its service in Japan by Rakuten in 2026.

12 months | Satellites |

2024 | 5 |

2025 | 73 |

2026 | 121 |

Provided that AST is partnered with AT&T and Verizon within the US, it could possibly provide its service to each corporations’ person bases of 114.5 million and 114.8 million, respectively, which means that its potential person base within the US in 2025 is round 229.3 million. Please be aware that Verizon’s customers determine could be discovered contained in the Monetary & Working Data file.

In the meantime, unconfirmed studies counsel that AT&T expects between 30-40% of its US customers to subscribe to AST’s service which is reported to be round $2 monthly. In mild of this, I’ll be projecting AST’s revenues primarily based on the next assumptions.

Assumptions | |

Month-to-month Subscription | $2 |

ASTS’ Share of Subscription | 50% |

ASTS’ Month-to-month Rev/Consumer | $1 |

ASTS’ Annual Rev/Consumer | $12 |

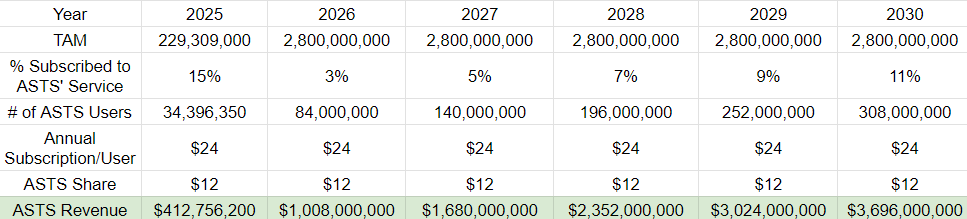

For 2025, I’m forecasting AST’s revenues assuming 15% of AT&T and Verizon’s customers subscribe to the corporate’s service, which is a conservative strategy for my part primarily based on the unconfirmed studies from AT&T. Accordingly, my income estimate for 2025 is $412.8 million.

For 2026 and past, as soon as AST is ready to provide its service globally, I’m assuming its share of its companions’ customers to be 3% in 2026, 5% in 2027, 7% in 2028, 9% in 2029, and 11% in 2030. The rationale why I count on customers of AST’s service to extend is that with extra satellites launched and higher protection, its service might entice extra customers within the “efficient protection hole”, which GSMA estimated to succeed in 532 million adults by 2035.

In mild of those assumptions, my income projections for AST till 2030 are as follows.

Personal Calculations

Please be aware that my projections don’t consider any potential progress within the person bases of AST’s companions.

Valuation

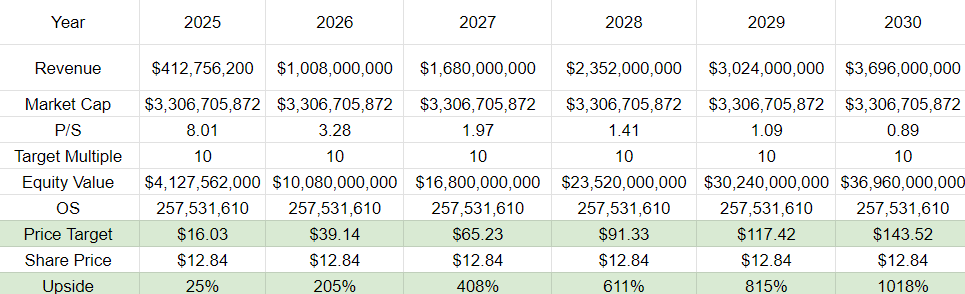

So as to attain a worth goal for AST, I’ll be evaluating its valuation to SpaceX since Lynk’s SPAC merger is but to be closed. As is, each SpaceX and Lynk are the one direct rivals to AST. With that in thoughts, SpaceX is estimated to be valued at $210 billion primarily based on its newest tender provide in late June. On the identical time, SpaceX is forecasted to generate $13.3 billion in revenues this 12 months, together with $6.85 billion from its Starlink division.

Whereas these knowledge suggest that SpaceX’s P/S ratio is 15.79, my goal P/S ratio for AST is 10 since SpaceX derives its worth from each its launch division and Starlink division, which is AST’s direct competitor.

SpaceX Valuation | $210,000,000,000 |

SpaceX Proj. Rev | $13,302,000,000 |

SpaceX P/S | 15.79 |

Based mostly on this, my worth targets for AST till 2030, primarily based on my income estimates, are as follows.

Personal Calculations

Dangers

Though I’m bullish on AST, there are a number of dangers to contemplate. The primary threat to my thesis is the monetary viability of the corporate. The prices of constructing, launching, and sustaining LEO satellites are excessive as the corporate nonetheless anticipates elevating $350-$400 million to launch the 20 Block 2 satellites. Due to this fact, the corporate may resort to dilution to lift future capital to launch its whole constellation, which is essential for offering its service globally.

That mentioned, the corporate is backed by a number of large MNOs who can present it with strategic investments, much like the investments it acquired from AT&T, Verizon, and Vodafone. The corporate’s companions might additionally fund the event and launch of future satellites, given the service’s potential to draw extra customers to those MNOs.

The second threat to my thesis is market adoption of AST’s know-how. Demand for DTC connectivity, particularly 5G connectivity, in underserved areas remains to be evolving. As such, it stays to be seen whether or not customers will undertake this know-how or be prepared to pay for such service.

One other threat to my thesis is potential regulatory hurdles as satellite tv for pc communications and spectrum allocations are topic to heavy laws. These laws exist to guard the radio frequency spectrum, which is a finite useful resource, forestall interference between customers on the spectrum to make sure easy operations, and coordinate spectrum use between international locations to keep away from battle. As such, these laws might impression AST’s operations in some areas.

Conclusion

In abstract, I’m bullish on AST resulting from its progress potential by its first mover benefit within the DTC house and technological benefit over its direct rivals, SpaceX and Lynk. The corporate is on observe to launch 5 Block 1 satellites subsequent month and intends to launch 20 Block 2 satellites in This fall 2024 or in Q1 2025. By these preliminary satellites, the corporate can provide restricted service to the 229.3 million AT&T and Verizon customers within the US. With that in thoughts, unconfirmed studies from AT&T counsel that 30-40% of the telco large’s customers could be prepared to subscribe to AST’s service, which is reported to value $2 month-to-month.

In the meantime, AST could possibly be on observe to start out providing its service globally in 2026, offering it with entry to its companions’ person bases of greater than 2.8 billion. Contemplating that adults residing within the “efficient protection hole” are estimated to succeed in 532 million by 2035, these relationships might enable AST to draw a considerable portion of this inhabitants. In mild of those elements, I’m score AST as a powerful purchase with a worth goal of $144 by 2030, representing 1018% upside from present ranges.

Editor’s Notice: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.