juliannafunk

International debt has soared to a file $307 trillion, rising by a staggering $100 trillion over the previous decade, and now represents 340% of world GDP. This is the reason there isn’t a simple escape from the upcoming recession. The salve to convey economies again after a drop in asset costs and contraction in development has at all times been for governments to ramp up deficit spending and for central banks to print an enormous quantity of latest cash to flood the banking system with credit score whereas on the identical time bringing down borrowing prices considerably. Nonetheless, the worldwide financial system is already debt disabled and can also be coming off one of many worst concurrent battles with inflation ever suffered. For instance, the US and Europe had official inflation close to 10% and precise inflation close to 20%. Due to this fact, borrowing and printing much more cash to fight a recession this time round could not trigger rates of interest to fall for very lengthy, if in any respect. There’s a vital danger they are going to soar on the lengthy finish of the yield curve as a substitute.

Some market gurus declare that public debt and deficits don’t matter. However they’re improper. Onerous debt and deficits are a tax on future consumption and result in larger charges of inflation and decrease charges of development. However after all, the US will at all times have the ability to discover patrons for its debt—even when it should purchase all of it itself, however the query is at what rate of interest? The US has the world’s reserve foreign money and essentially the most liquid bond market–though each situations are actually being challenged. Nonetheless, having the world’s reserve foreign money didn’t cease the benchmark Treasury Be aware from hovering to fifteen% in 1980. Inflation and credit score dangers could cause US charges to skyrocket. It has occurred earlier than, and it’ll occur once more.

- The US can be spending $1 trillion on curiosity funds on the Nationwide debt in 2025. In 2007, the overall deficit was simply $160 billion

- 1/5th of all income spent on curiosity

- Complete US debt/GDP is now 123%. It was 60% of GDP pre-GFC.

- Nationwide Debt is 725% of income. Including 40% of all yearly income to the debt this fiscal yr alone

Artificially-low rates of interest result in huge debt accumulation and asset bubble formation.

Residence costs are actually 47% larger than in early 2020, with the median sale value 5 instances the median family earnings. Residence Costs proceed to leap; they elevated by 6.3% y/y in April.

CNBC experiences that half of all renter households – greater than 22 million – spent greater than 30% of their earnings on housing, which is taken into account “price burdened” by Harvard Joint Facilities for Housing Research. Twelve million of these households spend greater than half their earnings on hire. For owners, 20 million are thought-about cost-burdened by their month-to-month funds. All of these cost-burdened ranges signify data. Upkeep, taxes, and insurance coverage prices are additionally surging, with insurance coverage up by over 20% from 2022-2023 alone.

The huge bubble in inventory costs is abundantly clear. The Worth-to-sales ratio of the S&P 500 is shut to three. This ratio was 1.5 simply previous to the GFC in 2008, and the median determine is 1.5. The whole market cap of equities as a share of GDP is 192%. This ratio was simply 106% previous to the GFC.

The personal credit score bubble is daunting as nicely.

- Personal credit score loans to companies that can’t get a mortgage from a financial institution or concern company debt- totaled $100 billion pre-GFC within the US. That quantity is now $1.7 trillion, up 1,600%

- Company Debt is now $13.7T, which is a 100% improve since 2007 and a file 49% of GDP.

- CLOs, that are securitized swimming pools of leveraged loans, had been $300 billion in 2008 however are actually $1.4 trillion at the moment—a 366% improve!

Therefore, we now have three huge bubbles: credit score, housing, and equities – a triumvirate of bubbles all at data and present concurrently.

The financial system is now broadly weakening, and but the one factor that appears to matter to Wall Avenue, no less than up till a number of days in the past, is that NVDA is including the valuation of an MCD to its market cap every day. Or that NVDA is value greater than all the market cap of German equities. NVDA is up 140% this yr whereas the broader market, as represented by the Russell 2000, is definitely down barely on the yr, and the equal weight S&P 500 is up simply 4%.

That is the narrowest bull market in historical past. All such slim rallies have ended badly, such because the Nifty fifty and the Nasdaq bubble eras. Nonetheless, this AI-led bull has introduced the market to the most costly stage ever on so many metrics. For extra proof, the fairness danger premium is now in adverse territory. Which means that the earnings yield of shares is lower than the risk-free return from proudly owning treasuries. This can be a very uncommon phenomenon. Merely proudly owning a basket of shares that mirrors the S&P 500 now gives buyers extra danger and fewer return than proudly owning bonds.

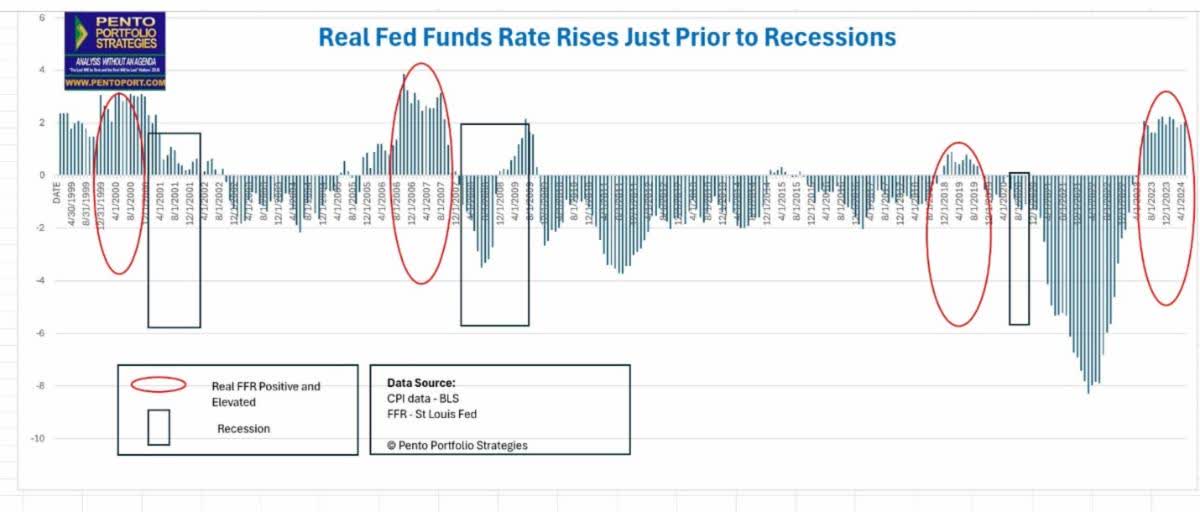

That’s the reason it’s crucial to carry a good portion of your portfolio in Treasury bonds (within the right period) whereas additionally proudly owning the suitable shares with the suitable beta profile, given at the moment’s unstable backdrop. The Fed desires to begin chopping charges as quickly as doable however can’t achieve this shortly or considerably, on condition that inflation stays sticky and nicely above its goal. This implies the extent of the true FFR will stay close to 2% for a fair longer time, which can ship the financial system right into a recession, simply because it at all times has finished so prior to now.

By the best way, the identical dynamic applies to the yield curve inversion, which has now been upside-down for the longest period in historical past. PPS stays lengthy the market whereas vigilant for the early warning recession indicators that may set off our plan to attempt to defend and revenue from the subsequent bear market. Having a mannequin and a plan is important now greater than ever.

Unique Put up

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.