Ilari Nackel/iStock Editorial via Getty Images

Introduction

Terry Smith has ditched his stake in Finnish elevator and escalator company KONE (OTCPK:KNYJF, OTCPK:KNYJY), months after it warned of a sales slowdown. According to Fundsmith’s factsheet, KONE was the only holding Smith Jettisoned. Since Smith first bought the company in April 2011, KONE’s shares have risen 88%. However, over the past year, it has slumped 27%, as the company has been hit by supply chain difficulties and rising costs. Furthermore, in July, KONE warned that revenue and profits for the fiscal year would come in lower than expected due to hampered sales in China because of the zero-Covid policy.

In this article, I would like to reverse engineer Terry Smith’s choice to assess whether KONE is a good investment at the moment or not.

Terry Smith’s investing philosophy

Terry Smith is among the most admired investors of the past decade with his Fundsmith with an annualized return since inception of 15.5%. His strategy is quite famous: buy high-quality companies, don’t overpay, do nothing. Fundsmith’s owner manual clarifies that high-quality companies have some intangible assets that provide them with a unique moat:

The kinds of intangible assets we seek are brand names, dominant market share, patents, distribution networks, installed bases and client relationships. Some combination of such intangibles defines a company’s franchise.

Among the key aspects, Terry Smith looks for in a business is the high return on operating capital employed. In cash, Mr. Smith always underlines. The fund’s owner manual explains this strategy well:

we are not just looking for a high rate of return. We are seeking a sustainably high rate of return. An important contributor to this is repeat business, usually from consumers. A company that sells many small items each day is better able to earn more consistent returns over the years than a company whose business is cyclical, like a steel manufacturer, or “lumpy”, like a property developer. […] We only invest in companies that earn a high return on their capital on an unleveraged basis. The companies may well have leverage, but they don’t require borrowed money to function.

After reading these words, we could ask ourselves why Terry Smith bought a big stake in a company that is within the industrial machinery industry, one of the most cyclical ones. Was it a mistake from the beginning? Fundsmith’s owner manual explains why a company like KONE that doesn’t have repeat business can be chosen as part of the fund’s highly concentrated portfolio (bold is mine):

[Our] approach rules out most businesses that do not sell direct to consumers or which make goods which are not consumed at short and regular intervals. Capital goods companies sell to businesses; business buyers are able to defer purchases of such products when the business cycle turns down. Moreover, business buyers employ staff whose sole raison d’être is to drive down the cost of purchase and lengthen their payment terms. Even when a company sells to consumers, it is unlikely to fit our criteria if its products have a life which can be extended. When consumers hit hard times, they can defer replacing their cars, houses and appliances, but not food and toiletries. However, not all companies which sell capital goods or which sell to businesses are outside our investible universe. A business service company may have a source of consistent repeat business, and some capital goods companies earn much of their revenue, and sometimes more than all their profits, from the provision of servicing and spare parts to their installed base of equipment. These can satisfy our criteria.

I think these words are self-explanatory: recurrent revenue is key and if a capital goods company is able to have a meaningful portion of its revenue coming in repeatedly then Terry Smith will consider it.

KONE

KONE is a company that provides elevators, escalators, and automatic building doors, as well as solutions for maintenance and modernization. The company fits into the capital goods category and is also exposed to the housing market.

These aspects could rule out KONE as an investment because they expose the company to cyclical swings. However, elevators are not exactly to be compared with capital goods such as cars. In fact, while consumers may defer purchasing a new vehicle, it is a need of the current urbanization megatrend to have buildings with elevators and escalators. That is a purchase that can’t be postponed, as it is strictly linked to the construction process of a building.

The company states for this reason that it sees its business as shaped by three major megatrends – urbanization, sustainability, and technology – which should make the business predictable in terms of future growth.

KONE has three main business lines: equipment, maintenance, and modernization. In maintenance, it ensures the safety and availability of the equipment in operation, and in modernization, it offers solutions for aging equipment ranging from the replacement of components to full replacements.

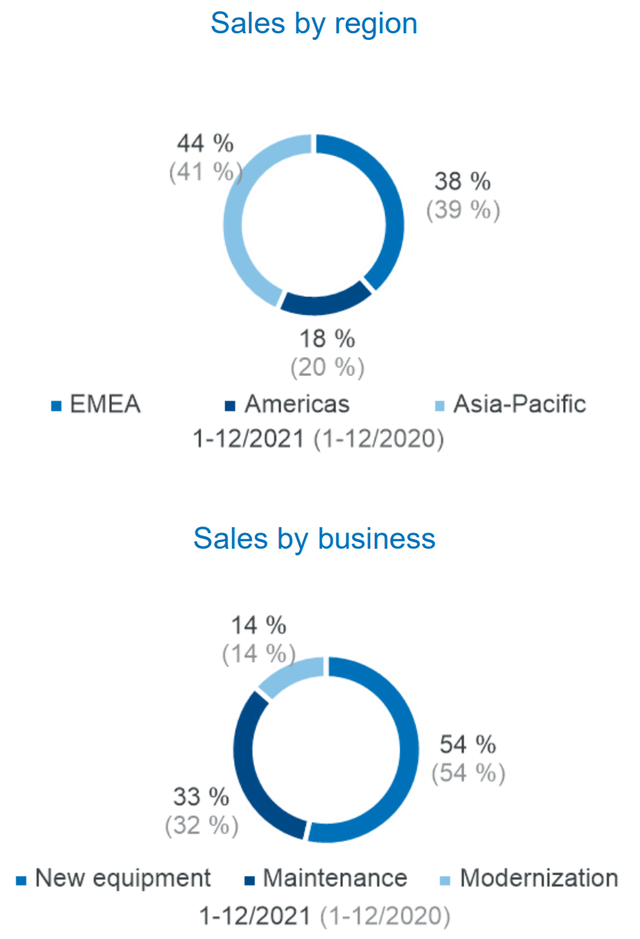

As we can see below, the company operates in three main regions: EMEA, which accounts for 44% of 2021 total sales; Asia-Pacific, which has a 38% weight on total sales; Americas. While 54% of total revenues came from new equipment, maintenance and modernization make up the remaining 46%. While modernization is still somehow a cyclical business, maintenance is not. Here we see why Terry Smith found the company interesting, as it has a third of its revenues from recurrent sources.

KONE 2021 Annual Report

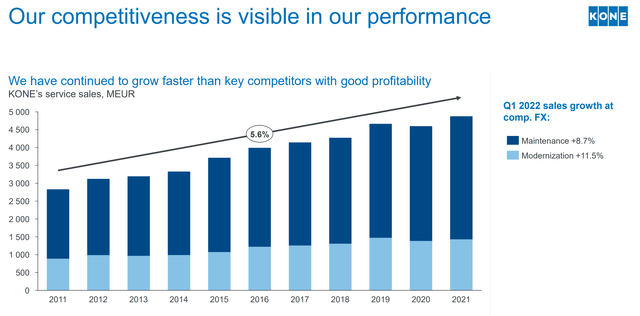

Now, the key growth drivers of the new equipment business are urbanization and changing demographics. But every new installed elevator or escalator leads to the real cash cow of the company: the maintenance business, which is very stable due to high requirements for safety and reliability. KONE has focused on being competitive in service sales, and it states that it has grown at a faster pace than its competitors, as we can see below.

KONE 2022 IR Presentation

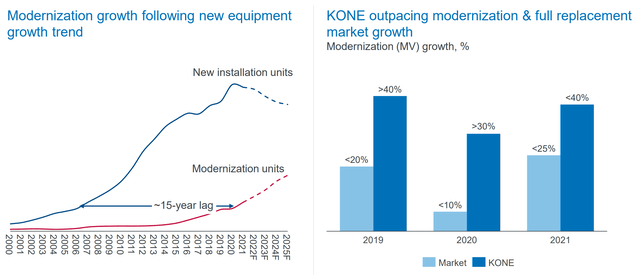

Now, if we consider that KONE has an existing maintenance base of close to 1.5 million units around the world, we can forecast that in the upcoming years, service sales will continue to go up. In addition, KONE knows that every installed unit can become an opportunity for future modernization, a business that is picking up speed and that kicks off with a 15-year lag from the first installations. In this business, KONE is outpacing the market, as we can see below.

KONE IR 2022 Presentation

China exposure

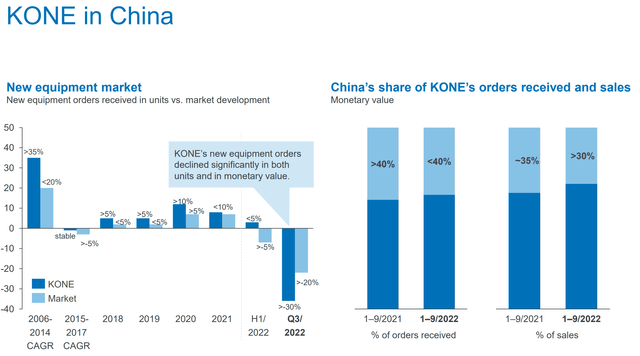

Now, it is no secret that a big part of KONE’s success in the first two decades of the century comes from its leadership in China. The company was quick to grasp the opportunity China was offering thanks to its strong urbanization process. As we can see from the left chart below, KONE grew by more than 35% from 2006 to 2014. Then, after two years of no growth, it resumed growing, though at a slower pace, with rates that outperformed the market and that stayed between 5-10% per year. This was true until this year. China’s percentage of total orders and total sales YTD has shrunk compared to last year.

KONE Q3 Results Presentation

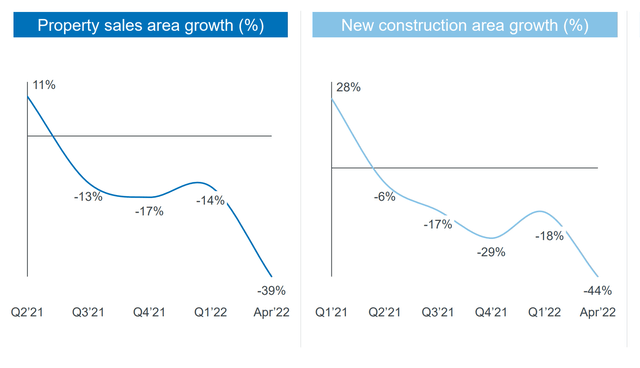

The reason is well-known: the housing market in China is in turmoil, and it is facing big liquidity problems. This is outlined by two graphs that KONE shared that show a sharp decline in property sales and new construction growth rates.

KONE IR 2022 Presentation

I can cross-check these data with the ones that CNH Industrial (CNHI), which has a construction machinery manufacturing unit, recently reported a 9% decrease in Light and Heavy equipment demand for Asia Pacific, particularly in China. More details can be found by looking at KONE in China Presentation.

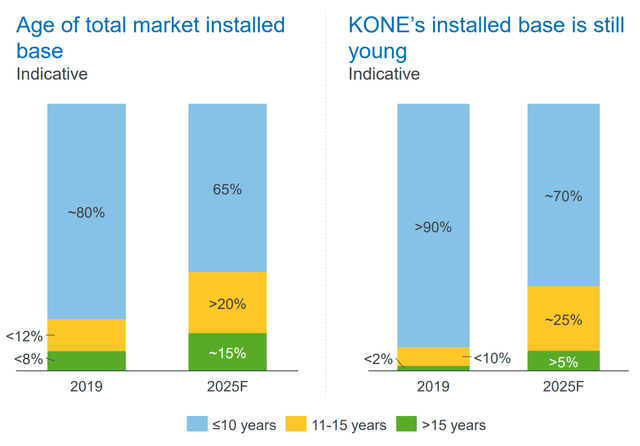

However, I would like to point out for the sake of this article that, even though KONE is seeing its orders in China plummet, the company still has a young installed base of elevators and escalators in China, as the graph shows.

KONE IR 2022 Presentation

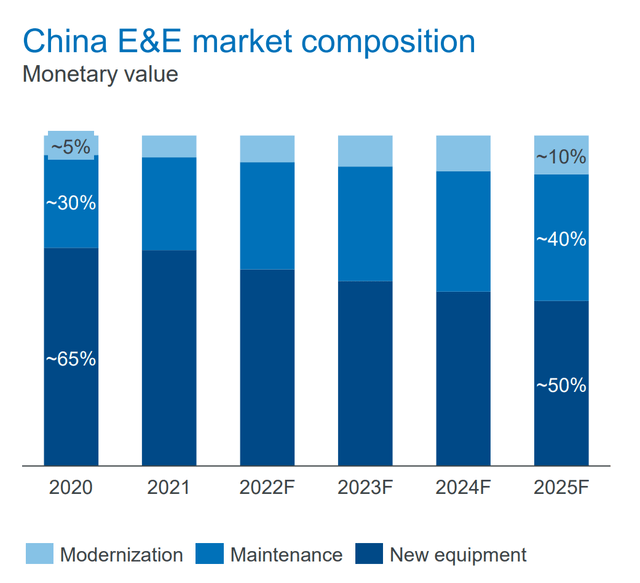

This means that as the installed units age, KONE can reasonably expect its maintenance revenue to go up. As we see below, this is the ongoing trend with China, where more and more of the monetary value of the country comes from maintenance, with equipment sales expected to account only for 50% of total revenues by 2025.

KONE IR 2022 Presentation

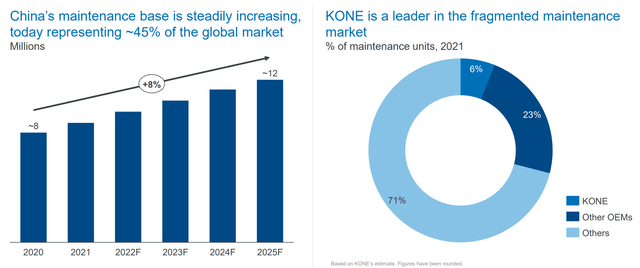

This is something Terry Smith may like a lot because it means that the company will have a greater portion of its revenues coming from recurrent sources. Clearly, China’s maintenance base is increasing and KONE can leverage its expertise and know-how to gain market share in maintenance by offering its services for other companies’ elevators and escalators.

KONE IR 2022 Presentation

So, we are before a double-sided picture: on one hand, KONE is highly exposed to a country that is seeing liquidity constraints in its housing market; on the other, KONE has performed so well in China in the past 15 years that we can now expect its installed-unit base to deliver high results from its services.

I think Terry Smith pondered carefully the situation and decided that it was time to lock in some gains before holding onto a company whose main source of revenues is so reliant on China with the uncertainty this carries along.

Financials

Let’s look quickly at KONE’s Q3 2022 Report. During the earnings call, Henrik Ehrnrooth, KONE’s President and CEO, had no way around it:

the biggest things during Q3 that impacted our performance overall was, number one, the weakening of the Chinese new equipment market.

What is driving our performance? It’s clearly the outlook in services and our strong order book.

China at the moment is the weak point for KONE, which is a strange situation since this region has been up until now a real gold mine. But I think that Terry Smith saw this geographical exposure as somewhat concerning given the current geopolitical tension.

In any case, I think that if we look at what happened to KONE’s profitability, orders and sales, we see that the company has been found unprepared for some of the recent economic trends, such as raw material price increases and supply chain constraints.

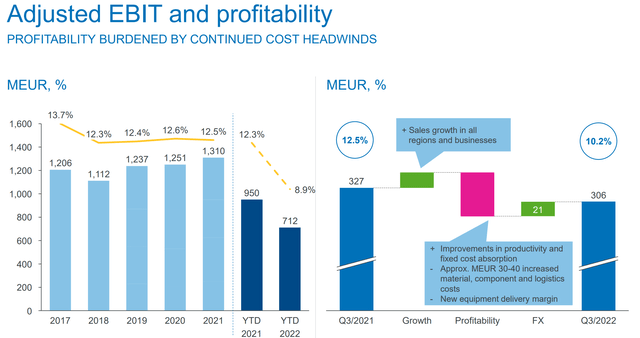

As we can see from the slide below, KONE’s profitability, which has usually been above 12%, plummeted to 8.9% YTD. The bridge graph on the right shows that production costs were high and had a big impact on lower marginality. We also see that KONE is relying on favorable FX to offset some of its inflationary costs.

KONE Q3 Results Presentation

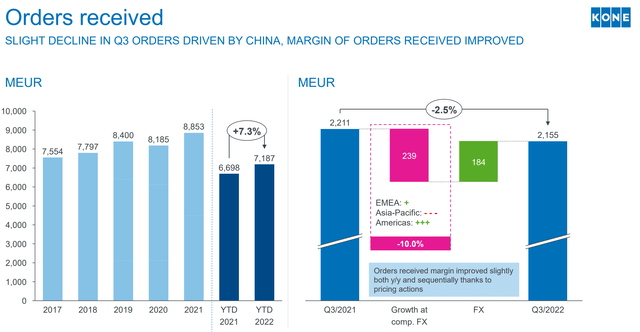

The same thing is true for orders and sales, as we can see below. FX plays a big role in offsetting other negative impacts. I don’t really think this is good for the company as it is clear that inflationary pressure caught it off-guard, making it one of the last big industrial companies to face margin compression at this point of the fiscal year.

KONE Q3 Results Presentation

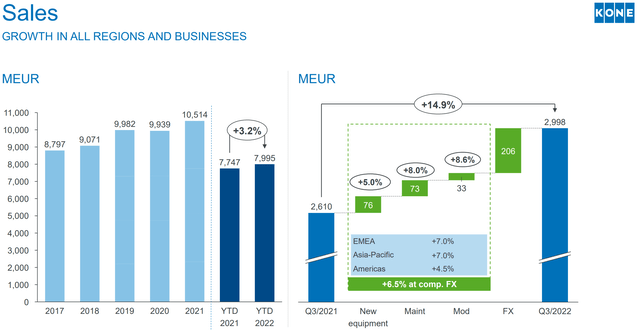

Sales are growing, except in China, but FX once again plays a role that throws some shadows on the real performance of the company.

KONE Q3 Results Presentation

Valuation

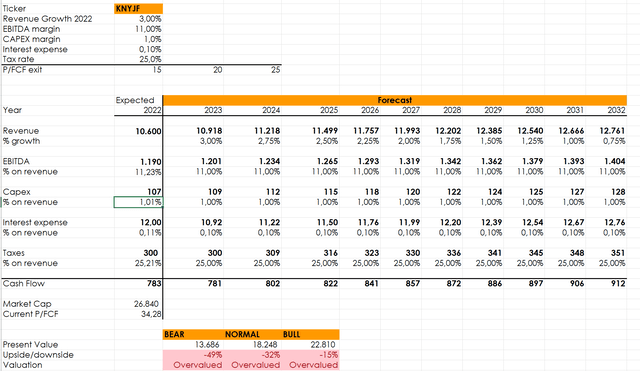

Temporary headwinds may be an opportunity to buy a quality company at a depressed valuation. Though KONE has traded down this year, if I plug in my discounted cash flow model some numbers taken from the company’s guidance for this fiscal year, I still reach the result that the company is overvalued.

Author, with estimates based on SA data and KONE’s reports

Now, since KONE is part of an oligopoly with high barriers of entry and few competitors, I am willing to give KONE a premium. But in order to see the stock undervalued, we would need to use very high price/free cash flow multiples.

If we look at the stock PE, we are still before an expensive company that trades in the low 30s. As much as I may like the company, thinking it is stable and reliable, with a big portion of its revenues being recurrent, I think this multiple is too high.

Here is what I think Terry Smith saw, too. He had made a nice profit, and he saw that KONE was going towards some headwinds due to China. He also saw that there are other opportunities in the market. In particular, he replaced his stake in KONE with Otis (OTIS). I plan on writing another article to dig deeper into this choice and share my research on this competitor of KONE.

As for me, though interested in the company, I rate it as a hold since it still trades at a high valuation compared to its earnings and its free cash flow.