PM Images/DigitalVision via Getty Images

We previously covered ASML Holding N.V. (NASDAQ:ASML) (OTCPK:ASMLF) in July 2023, discussing the sluggish stock movement after the previous FQ2’23 double beat and raised FY2023 outlook.

We had rated the stock as a Buy then, with the stock’s depressed levels offering opportunistic growth/ income investors with the chance to dollar cost average.

In this article, we maintain our optimism about ASML’s prospects, especially since the sustained R&D efforts are likely to enforce its 20Y moat surrounding the chip-making technology.

This is despite the supposed headwinds from Canon Inc. (OTCPK:CAJPY, OTCPK:CAJFF), as a potential competitor to the former’s EUV chip-making technology.

Thanks to the recent correction, we also believe that ASML’s upside potential remains excellent, with the management still iterating their FY2030 profitable growth guidance.

We shall discuss further.

Ignore The Noise Surrounding Canon’s Chipmaking Potential

Canon has supposedly unlocked a new NIL technology, with it producing the most advanced logic semiconductors or the equivalent of a 5-nm-node. It is also important to note that Canon commands 30% of the global volume for lithography equipment, second only to ASML’s 60% monopoly.

Depending on NIL’s eventual success, we may see ASML’s global market share potentially eroded in the long-term, especially based on Canon’s claim that its technology is supposedly -40% cheaper while consuming -90% less power than the former’s EUV technology.

Then again, it remains to be seen when a wider adoption may occur since Canon only expects to achieve a doubled NIL capacity through its new lithography equipment plant in Tokyo by Q1’25.

In addition, based on Pranay Kotasthane, the chairperson of the high tech geopolitics program at the Takshashila Institution, it is believed that ASML’s EUV technology “worked better during the chip printing process.” This naturally demonstrates why the NIL technology has yet to “find wide acceptance despite being available for more than twenty years.”

Furthermore, the NIL technology has yet to achieve the equivalent of 2-nm-node, since it depends on Canon’s ability to “improve the mask technology” in the unknown future.

Lastly, Canon’s NIL technology must be able to exceed ASML’s EUV machine wafer success rate, which is approximately between 70% and 80% for new processors and up to 99% for existing processors, based on Taiwan Semiconductor Manufacturing Company Limited’s (TSM) recent 3-nm experience.

For now, Canon remains the runner up in the chip-making technology race, with ASML still the undisputed winner, thanks to the latter’s intensified R&D efforts at €3.84B over the last twelve months (+27.1% sequentially), compared to the FY2019 levels of €1.96B (+24.8% YoY).

This relationship somehow reminds us of Intel’s (INTC) foundry ambitions against TSM’s obvious lead, with it remaining to be seen when and if INTC may actually achieve TSM’s yields.

As a result, we believe that it is important for ASML investors to adopt a wait and see attitude for now, since we are uncertain about the NIL technology’s eventual success rate.

So, Is ASML Stock A Buy, Sell, or Hold?

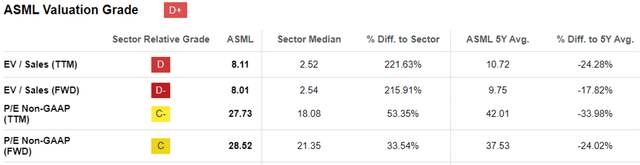

ASML Valuations

S&P Capital IQ

For now, ASML seems to trade at impacted FWD P/E valuation of 28.52x compared to its 5Y means of 37.53x, though still above the sector medians of 21.35x.

Then again, investors must also note that its P/E valuation has merely normalized nearer to its pre-pandemic mean of 26.80x, down from the hyper-pandemic heights of 52.30x.

We believe that the ASML stock still deserves its premium over its peers, attributed to its critical monopoly over leading edge chip-making technology.

This explains why the stock trades at a premium compared to Canon at a FWD P/E of 13.95x, Lam Research (LRCX) at 23.74x, and Applied Materials, Inc. (AMAT) at 17.87x.

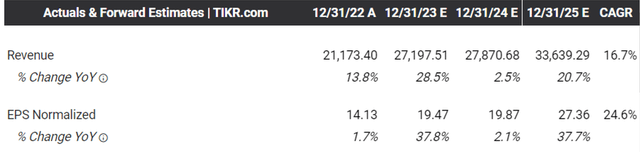

Consensus Forward Estimates In Euros

Tikr Terminal

For now, the consensus forward estimates still suggest that ASML may generate an impressive top and bottom line expansion at a CAGR of +16.7% and +24.6% through FY2025, compared to its historical CAGR of +20.9% and +26.6% between FY2016 and FY2022, respectively.

Much of these tailwinds are naturally attributed to the company’s excellent backlog of over €35B by the latest quarter (-7.8% QoQ/ -7.8% YoY), implying that it is fully booked through Q1’25.

In addition, the ASML management still projects a bullish top-line CAGR of +14.2% through FY2030 at €60B, with the base case still offering an excellent CAGR of +12% at €52B.

Based on the management’s FY2023 sales/ margin guidance, it appears that the consensus EPS estimates of €19.47 (the equivalent of $20.58 based on the exchange rate at the time of writing) is not overly ambitious indeed.

Combined with its FWD P/E of 28.52x, we believe that the ASML stock is also trading near its fair value of $586.94. Based on the consensus FY2025 EPS estimates of $28.93, there appears to be an excellent upside potential of +40.3% to our long-term price target of $825.08 from current levels.

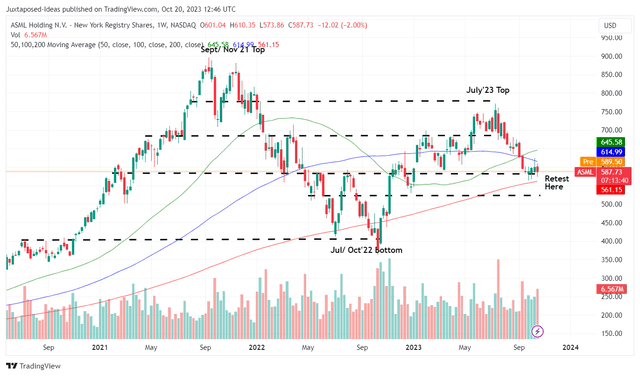

ASML 3Y Stock Price

Trading View

Based on ASML’s movement over the past few weeks, we believe that the current support levels may hold, especially aided by the promising commentary by Dr. C. C. Wei, the CEO of TSM, in the latest earnings call:

As I said, we do observe some early signs of demand stabilization in PC and smartphone end markets. Those two segments are the biggest segment for TSMC’s business. We want to say that 2024 will be a very healthy growth. But right now, did we see the bottom very close. (Seeking Alpha)

With the semiconductor cycle already bottoming, we may see market sentiments surrounding most chip stocks, including ASML, recover from this bottom moving forward.

As a result of the highly attractive risk/ reward ratio at current levels, we continue to rate the ASML stock as a Buy here. Take advantage of this dip.