Ales_Utovko

The ASML Investment Thesis Remains Robust For The Next Decade

We previously covered ASML Holding (NASDAQ:ASML) in May 2023, discussing the slowdown in its backlog orders, thanks to the natural normalization effect from its pulled-forward growth during the hyper-pandemic period and the peak recessionary fears.

However, with its backlog extending through 2025, we did not expect any material impact on its intermediate performance, with the company still strategically positioned as one of the most important supply chains in the semiconductor chip industry.

For now, our conviction in ASML grows stronger, especially bolstered by its FQ2’23 performance. It recently reported excellent revenues of €6.9B (+2.3% QoQ/ +27.1% YoY) and expanding gross margins of 51.3% (+0.7 points QoQ/ +2.2 YoY) despite the rising inflationary pressure, suggesting its excellent pricing power.

Therefore, while its operating expenses have been accelerating to €1.28B (+6.6% QoQ/ +26.7% YoY), we are not overly concerned for now, since its operating margins have also increased to 32.8% (+0.1 point QoQ/ +2.4 YoY) in the latest quarter.

Combined with the aggressive share repurchases totaling €15.29B since FQ1’20, the ASML management has also substantially retired -27.1M shares to 394M by FQ2’23, naturally boosting its GAAP EPS to €4.93 (inline QoQ/ +39.3% YoY).

Most importantly, despite its wide moat, we believe the company may retain its market-leading edge over its peers, such as Lam Research (LRCX), KLA (KLAC), and Applied Materials (AMAT).

This is because ASML continues to heavily invest in its capabilities with annualized R&D expenses of €3.99B (+5.4% QoQ/ +26.7% YoY) in the latest quarter, building upon its €6B EUV efforts over the past 17 years.

With market analysts estimating a twenty year head start in the high-end semiconductor lithography equipment technology, it is unsurprising that its backlog remains impressive, demonstrating the growing confidence from its global consumers.

In the recent earnings call, ASML reported €38B in backlog (-2.5% QoQ/ +15.1% YoY), with FQ2’23 net bookings of €4.5B (+18.4% QoQ/ -47% YoY).

This may have contributed to its raised FY2023 guidance of +30% in net sales growth YoY, compared to the previous guidance of +25%, implying impressive revenues of €27.51B and EPS of approximately €18.36, partly attributed to an additional revenue recognition of €700M from the fast shipment process.

This cadence alone suggests a tremendous top-line CAGR of +23.51% and bottom line at +31.45% since FY2019, compared to ASML’s pre-pandemic levels of +20.3% and +21.4%, respectively, thanks to the sustained transition to cloud computing and generative AI.

We believe most of the system sales may be attributed to the Logic market for now, with the Memory demand recovery to be slower than expected, since chip inventories remain elevated, as reported by Micron (MU) and Samsung (OTCPK:SSNLF), with fabs preferring to delay system upgrades.

For now, ASML reported €8.41B (+107.1% YoY) of Logic system sales in H1’23, comprising 77.1% (+13.7 points YoY) of its net system sales, compared to FY2021 levels of 70% and FY2019 levels of 73%.

However, market analysts still expect the company to sustain its bottom-line expansion at an accelerated CAGR of +23.3% through FY2027, suggesting that the market demand may remain robust moving forward, despite the ASML management’s more careful commentary in the recent earnings call:

Significant uncertainty remains in the market due to a number of global macro concerns around inflation, rising interest rates, recession, and the geopolitical environment, including export controls. Customers remain cautious due to the uncertainty around the timing, the shape, and the slope of the recovery. Based on our view last quarter, customers were expecting a recovery in the second half of this year, but now seems that this is moving more towards 2024. (Seeking Alpha)

This inventory correction is only temporal.

So, Is ASML Stock A Buy, Sell, or Hold?

ASML 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, the tech and AI rally since the October 2022 bottom have both contributed to ASML’s recovering valuations, at NTM EV/ Revenues of 8.88x and NTM P/E of 31.57x, compared to its 3Y pre-pandemic mean of 6.33x/ 26.79x, respectively.

Based on its NTM P/E and the market analysts’ FY2025 adj EPS projection of €32.25, we are still looking at an excellent long-term price target of $1,018.13, suggesting a tremendous upside potential of +50.5% for patient investors.

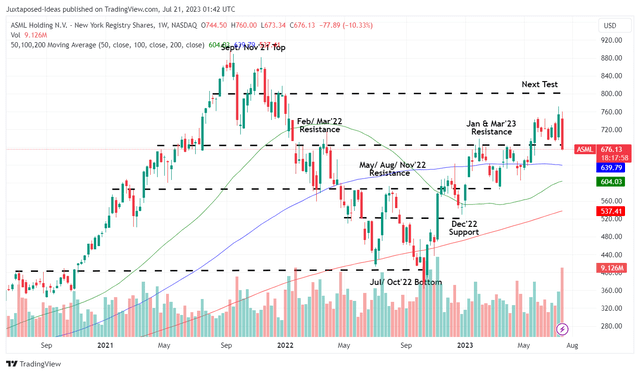

ASML 3Y Stock Price

Trading View

ASML is also well-supported at these levels, with the stock’s sluggish movement after the recent earnings call only attributed to the management’s careful commentary, despite the raised FY2023 guidance. As a result, we believe Mr. Market’s indecisiveness has triggered great opportunities for investors looking to add.

Combined with the annualized dividends of $6.48 in the latest quarter and expanded forward yield of 0.98%, compared to its 4Y average of 0.88%, the ASML stock offers both high growth and decent income, which may be a rare phenomenon in the stock market, in our opinion.

As a result, we continue to rate ASML as a Buy at these levels, especially since its global moat in the most advanced chip making equipment market may remain unchallenged for many years to come.