Marko Geber

Thesis

Asana (NYSE:ASAN) is a technology focused company that caters to the project management space from multiple facets:

Asana helps you manage projects, focus on what’s important, and organize work in one place for seamless collaboration

What is also notable about Asana is that it was co-founded by Dustin Moskovitz, one of the original Meta (Facebook) co-founders. The track record is there in terms of successfully moving a tech company from early stages to market adoption. Mr. Moskovitz has bought shares in the company this year, even as the stock price was collapsing. Year to date he has now purchased over $350 million worth of shares.

While we cannot predict when the slide in tech will be over, or whether Asana will double or triple its share price from the current point, we however, can look at the current equity analytics. The violent move down in price this year has resulted in the stock exhibiting a very high implied volatility. A high implied volatility always results in the option chain associated with the stock to exhibit rich premiums. It works for both calls and puts. It makes both instruments expensive.

The article puts forward a one-year cash covered put strategy that can result in yields exceeding 30% if the ASAN stock trades above $17.5 per share in January 2024. This conservative approach also provides an investor with a -35% discount to current spot prices if ASAN does continue to exhibit weakness even a year from now. In our view, taking advantage of the stock’s implied volatility is a very smart way to take a position without the need to market time the stock, a historically impossible feat to achieve.

Performance

Asana is down over 76% year to date:

Price Return (Seeking Alpha)

The stock represents more than 2x the move in the Nasdaq index on the downside. On a longer-term time-frame the stock is now below its IPO levels:

Price Return (Seeking Alpha)

We can see how the stock provided for a 400% return post the IPO, at the top of the tech bubble. The price has retraced, even below its initial levels.

What is the trade?

We are putting forward a cash covered put writing strategy:

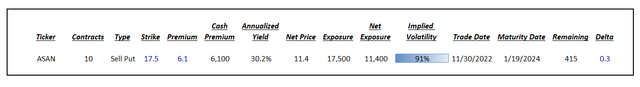

Trade Description (Author)

In the above table we are detailing the mechanics of selling 10 contracts in Asana with a January 2024 maturity date. The premium received for the trade equates to $6.1/share, or $6,100 for our contracts, and represents a 30% annualized yield if the stock price ends up at $17.5 or more per share in January of 2024. Conversely, if the company underperforms and its shares keep sliding, this strategy provides for a discount in the entry point of over 35%.

The possible scenarios for the proposed trade are:

Scenario 1:

- The ASAN stock price is above $17.5 per share in January 2024

- The options expire without being exercised

- The investor makes the entire premium amount, namely $6,100

- The annualized return for the investor is above 30% on an exposure basis (cash needed to be set aside for the trade)

Scenario 2:

- The ASAN stock price is below $17.5 per share in January 2024

- The options are exercised

- The investor ends up buying the shares at $11.4/share, or a discount of over 35% to current spot levels

- The entry point is calculated as strike minus premium (17.5 – 6.1)

- Depending on where ASAN is trading at the time the investor can sell for a profit (if ASAN is trading below $17.5/share but above $11.4/share then the investor will realize a net capital gain)

The proposed trade offers such compelling results because implied volatility is very high. The fact that the co-founder has been buying shares indicates that the company will not go bankrupt, hence the downside is fairly limited from a $17.5/share price point. The risk/reward ratio from a 91% implied volatility priced in the 1-year option chain is extremely compelling.

Conclusion

Co-founded by Dustin Moskovitz, Asana has fallen over 76% since the beginning of the year. This type of return would have been hard to fathom at the peak of the tech bubble, yet investors are not quite certain if this is the bottom. Market timing is a quasi-impossible feat to achieve, yet we are fairly certain that one year from now we will be discussing the magnitude of the rate cuts to come, not increases, and tech stocks will be bid once again. Mr. Moskovitz has exhibited faith in the company’s business model by buying shares worth over $350 million this year, despite the falling price. Any retail investor contemplating purchasing the stock would do well to follow a cash covered put writing strategy that provides for a discount of over 35% to current spot levels. With a very high implied volatility, an at the money sold put option offers yields in excess of 30% if the stock ends up above $17.5 per share in January 2024. Conversely, the same strategy results in a discount of -35% to current spot prices if the shares are ultimately purchased.