2023 is the year of artificial intelligence tech.

This technology is a major market disruptor.

On March 22, Elon Musk wrote an open letter to AI companies — asking them to hit pause on all projects that weren’t GPT-4.

It just has so many use cases that we haven’t fully explored yet.

AI tech is reaching virtually every industry, from software development and automation, to engineering, marketing, administrative support, health care, video gaming and so many more.

So let’s talk about it: The good and the bad of AI.

(And find out how you can get my #1 recommended stock pick in artificial intelligence!)

In Today’s Video:

Amber Lancaster and I are covering:

- Market News: The March jobs report shows a slowdown in new hires, but will it be enough for the Federal Reserve to slow down on rate hikes? [0:30]

- Tech News: From deepfakes to actor replacements, this year’s theme in tech innovation is definitely artificial intelligence technology. Here’s how GPT-4 actually works. [3:20]

- Investing Opportunity: I wrote about my #1 stock pick for artificial intelligence in my Strategic Fortunes newsletter. Click here to see how you can get the stock ticker (and the full write up)! [15:20]

- World of Crypto: Are Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) good buys? [16:10]

- Mega Trend: With the surge of electric vehicle sales, automotive powertrain suppliers are experiencing massive growth! [20:40]

Start watching below!

(Or read the transcript here.)

Listen On the Go!

Tune in to Monday’s episode of The Banyan Edge Podcast to catch Charles Sizemore and I chatting about the pros and cons of a U.S. digital dollar.

And if you have more questions about what’s happening in the market, crypto investing, artificial intelligence or electric vehicles, let us know!

Send us an email at [email protected].

See you soon,

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Ian King mentioned in today’s video that he thought the Federal Reserve may soon be done raising rates.

We’ll see. Whether the Fed stands pat here or still has one last 0.25% hike left in it, I agree that a “pivot” is coming sooner rather than later. We’re already seeing estimates for GDP growth revising lower.

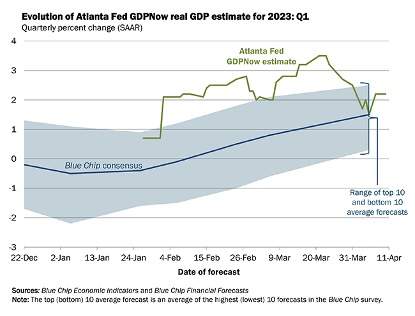

The Federal Reserve Bank of Atlanta runs a GDP forecasting model, GDPNow. It aims to get a snapshot of GDP growth before the official numbers are released.

This model pulls together 13 subcomponents that make up the GDP, and updates them in as close to real time as they can get.

As recently as March 20, the Fed’s GDPNow forecasted at 3.5% economic growth rate in the first quarter. But as the banking scare wore on, expectations started dropping fast — at one point dipping below 2%.

The latest figures estimate GDP coming in at 2.2%:

Hey, growth is growth. And after the scare we had in March, 2.2% growth doesn’t look so bad.

But that’s still a drop of almost 40% in a matter of days. And expectations may just continue to drop.

If you’ve been keeping up with The Banyan Edge, I’ve maintained my position that the banking crisis would take a bite out of growth.

This doesn’t mean that more banks have to fail. Simply by getting more conservative and raising lending standards, the banks will starve many small, mom and pop’s businesses of the capital they need to grow.

But this isn’t the sort of thing that shows up immediately. It may be another full quarter or two before we really see the evidence of this in the data.

This puts the Fed in an uncomfortable place, as inflation is still stubbornly high. Fed Chairman Jerome Powell will likely have to have to accept either a little more inflation than he wants, or a little more economic cooling than he wants … or maybe both!

The March CPI inflation numbers come out this Wednesday, April 12. The consensus estimate by economists is that prices rose at a 5.2% clip in March. If that number holds, it will be a major improvement over the 6% rate we saw in February.

If inflation comes in much lower than 5.2%, that could be a sign that the economy is cooling too quickly. It implies that we might be sliding our way into recession now.

And if inflation comes in much hotter than 5.2%, it means the Fed might be forced to squeeze out another couple of rate hikes.

Neither of those outcomes would make for a happy Mr. Market. So, pop some popcorn and get comfortable. We might be in for a good show!

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge