onurdongel/E+ via Getty Images

Synopsis

Armstrong World Industries (NYSE:AWI) is a leading manufacturer of innovative commercial and residential ceiling, wall, and suspension system solutions.

AWI’s historical financials have shown a robust recovery in revenue growth from the impact of COVID-19, but I do notice a slowdown in growth due to weakening housing demand. In addition, margins contracted over the years, driven by increasing SG&A expenses. However, AWI did a good job reducing its debt levels. In its most recent 3Q23, AWI managed to expand its margins through growth initiatives, a better pricing mix, and deflation in energy and freight costs. Looking ahead, the housing demand is showing weakness, but it is expected to recover slowly.

Although the growth outlook is still positive, it is weak. Currently, AWI’s forward P/E is trading in line with its 5-year average, and I argue that it should be lower given the weaker outlook. With that and the negative downside in its share price, I am recommending a hold rating for AWI.

Historical Financial Performance

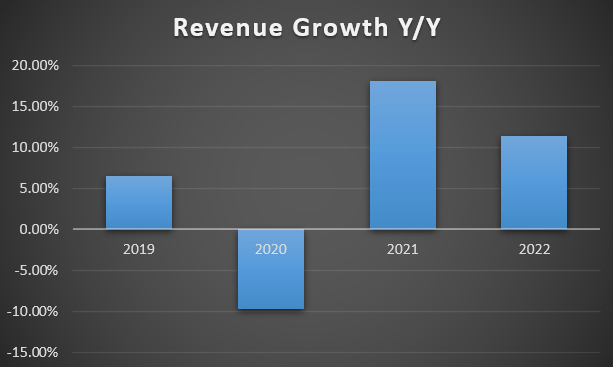

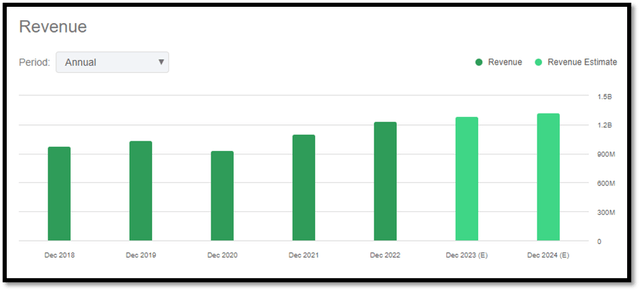

Over the past four years, AWI’s revenue has experienced significant fluctuations. In 2020, it reported a year-over-year decline of -9.75% due to the impact of the COVID pandemic. From 2021 onwards, it has shown a strong recovery, and revenue growth has been at double-digit rates. In 2022, growth slowed down to 11.43% due to high inflation impacting the housing market.Top of Form

Author’s Chart

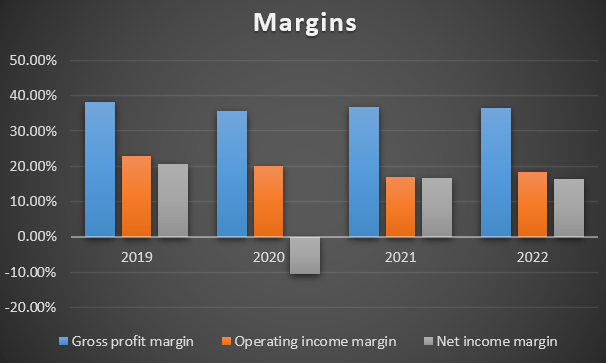

Over the years, AWI’s margins have been gradually contracting. In 2019, gross profit margin [GPM] was 38.06%, and it decreased to 36.42% by 2022. Its operating income margin [OIM] has also contracted from 22.90% to 18.27%. In 2020, I noticed net income was negative due to extraordinary pension expenses. On an adjusted level, net income margin is ~ 18.67%.

Author’s Chart

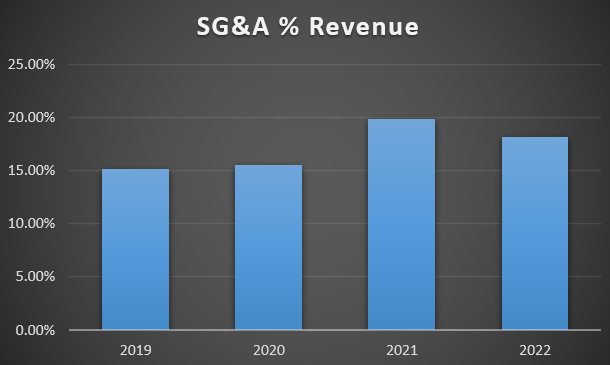

The margin contraction can be attributed to rising SG&A expenses over the years. The rising expenses were mainly driven by rising inflation caused by the central bank’s decision to lower the interest rate in order to combat the recession caused by COVID-19.

Author’s Chart

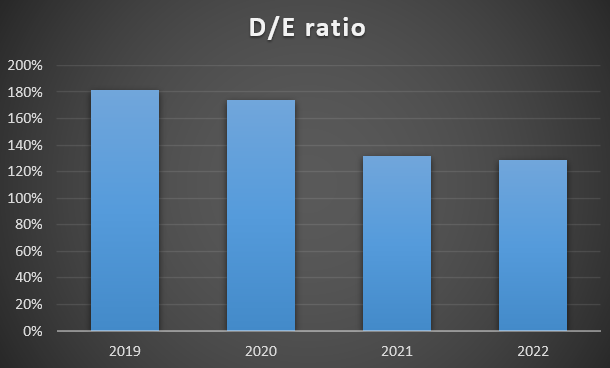

Although margins are contracting slightly, AWI has done a good job managing its debt-to-equity [D/E] ratio over the years. In 2019, its D/E ratio was ~181%, but by 2022, it had decreased to ~128%.

Author’s Chart

Are margins Improving?

In order to analyze and gauge AWI’s margins, I will be taking a look at its most recent 3Q23 earnings results. In 3Q23, its operating income grew 36.7% year-over-year to $100 million, up from the previous period’s $73 million. 3Q23 OIM reported was 28.9%, which expanded 6.3% from 22.6%. 3Q23 NIM was ~20%, up from the previous period of ~17.6%.

The margin expansions were driven by a few factors and initiatives undertaken by management. Firstly, management’s successful growth initiatives, like the Canopy Digital Platform, not only helped to drive sales in its mineral fibre segment but also contributed to margin expansion as the plan for the platform is to be cost-effective. Secondly, there was an 8% growth in average unit volume [AUV] driven by favorable pricing and a positive product mix. As a result, it helped to expand margin as AWI was able to sell its products at higher prices and also sell a greater proportion of higher-margin products.

Thirdly, in its architectural specialties segment, it achieved better operating leverage, which means that AWI efficiently managed its fixed costs while increasing revenue, leading to higher margins. Lastly, management also cited that the benefits from energy and freight deflation also contributed to margin expansion.

Housing Demand Is Weakening

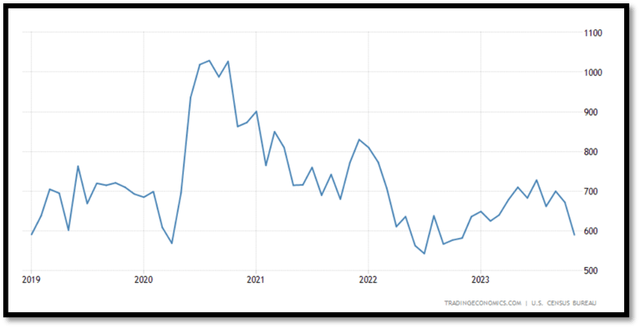

Ever since mid-2020, US home sales have been on a downward trend. As of November 2023, home sales in the US had declined by 12.2% month-over-month to ~590,000 units. This decline is the highest since April 2022, and it is below the market consensus of ~658,000 units. As of November 2023, housing supply is worth ~9.2 months based on the latest sales rate.

Looking ahead, the general market revenue estimate for FY2023 is ~$1.29 billion. This represents a year-over-year growth rate of ~4.87%, which is extremely modest when compared to the previous two years, whereby the growth rates were in double digits. Given the weakness in housing demand, the market estimate is justified.

Trading Economics

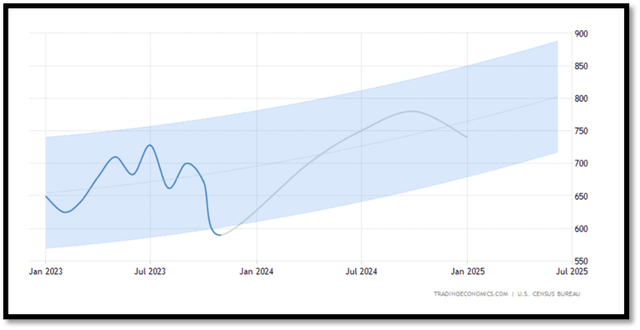

For 2024, the market consensus forecast for home sales is anticipated to reach 670,000 units by the end of the first quarter. For the full year, it is expected to reach ~740,000 units. The general trend is upward sloping, meaning the demand for home sales is expected to strengthen for the full year 2024. Therefore, the anticipated growth in the home sales market will provide AWI with the tailwinds needed to grow in 2024.

Trading Economics

Management’s Guidance for FY2023 Is In Mid-Single Digit

As discussed above, the housing market data is showing signs of weakness, and management’s guidance for FY2023 also echoes the same sentiment. For FY2023, management guided consolidated revenue to be in the range of $1.28 billion to $1.295 billion, which represents a year-over-year growth rate of 4% to 5%. In addition, management’s guidance is in line with market estimates, further supporting the market estimate’s accuracy.

Looking ahead, AWI’s revenue is expected to be growing in the mid to low-single-digits due to the sluggish demand in the housing market driven by high inflation, which resulted in a high mortgage rate and housing prices.

Comparable Valuation Model

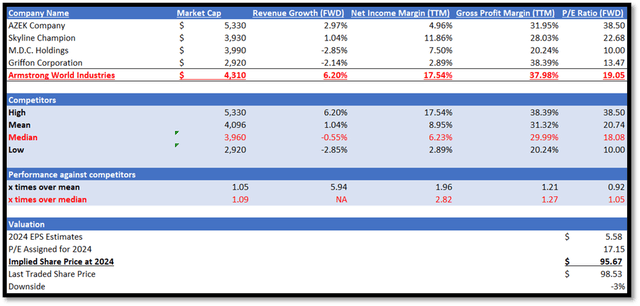

In terms of market size, AWI is 9% larger than its competitor’s median. AWI has a market capitalization of ~$4.31 billion, while its competitors’ median market capitalization is $3.96 billion.

Although AWI is slightly larger than its competitors, its forward revenue growth rate significantly outperforms that of its competitors. AWI has a forward revenue growth rate of 6.2%, while the median is negative 0.55%. In terms of profitability, AWI also significantly outperformed its competitors. AWI has a GPM TTM of 37.98% vs. the median of 29.99%. Moving on, AWI’s NIM TTM is 17.54% vs. the median of 6.23%.

As a result of AWI’s better financial performance, it is currently trading at a higher forward P/E of 19.05x vs. the median of 18.08x. Currently, AWI’s forward P/E is trading in line with its 5-year average forward P/E of 19.19x. However, given the weaker revenue growth outlook for FY2023 and FY2024, where AWI is expected to be growing in the mid to low-single-digits, I argue that it should be trading below its 5-year average.

With this argument, I will be applying a 10% discount to its current forward P/E of 19.05x, and this gives me 17.15x. The market revenue estimates for 2023 and 2024 are $1.29 billion and $1.33 billion, respectively. These estimates are reliable as they are in line with management’s revenue guidance and the sluggish housing market that I have discussed above.

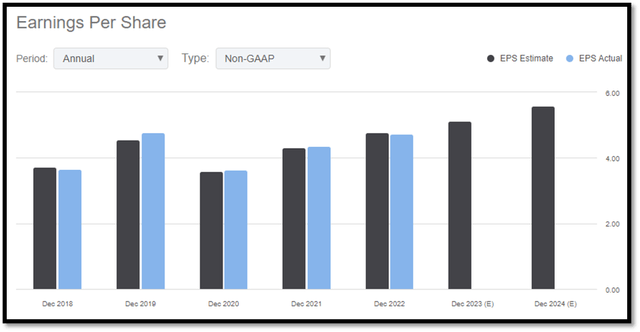

By applying a P/E of 17.15x to AWI’s 2024 market EPS estimate of $5.58, my target price for 2024 is $95.67, which represents a downside of -3%. Given this downside, coupled with a weak revenue growth outlook, I am recommending a hold rating for AWI.

Author’s Valuation Model

Seeking Alpha

Seeking Alpha

Risk

The main upside risk associated with AWI is regarding the direction of inflation. If inflation were to recover better than expected, it might potentially drive the central bank to lower the interest rate. This will result in a lower mortgage rate, which will encourage housing sales and demand. In this scenario, if AWI’s revenue growth were to beat market expectations, we might see an upward revaluation of its forward P/E ratio, which would cause its share price to increase.

Conclusion

In conclusion, AWI’s past financial results have shown a strong recovery, as revenue growth in the last two years was at double-digit rates. However, its revenue growth has also shown signs of deceleration. In addition, AWI’s margins over the last four years have been gradually contracting, driven by increasing SG&A expenses due to rising inflation. In its most recent 3Q23 result, AWI managed to expand all of its margins through a successful growth initiative that aims to drive cost efficiencies, a better price and product mix, and energy and freight deflation.

Looking ahead, the weakness in housing demand is expected to dampen AWI’s revenue growth outlook. As a result, management also acknowledged the weakness and provided revenue guidance in the mid-single-digit range. On a brighter note, the housing market is expected to recover in 2024, but slowly.

When compared to its competitors, AWI outperformed them in terms of both revenue growth outlook and profitability, and hence it trades at a higher forward P/E. However, given AWI’s positive but weak growth outlook caused by the weak housing market, I argue that its current P/E should be trading below its 5-year average. In order to be conservative and to better reflect the current situation, I applied a 10% discount to its P/E. With a target price that is slightly below its last traded price, it is not attractive enough to buy into AWI. Therefore, I am recommending a hold rating for it.