Andrei Akushevich/iStock via Getty Images

Summary

Armstrong World Industries, Inc. (NYSE:AWI) is a global leader in designing and manufacturing innovative ceiling, wall, and suspension system solutions. With a legacy spanning over a century, AWI offers a diverse product portfolio, including mineral fiber, fiberglass, metal, and wood solutions, catering to commercial, educational, healthcare, retail, and residential spaces. Renowned for its commitment to sustainability and design aesthetics, AWI combines functionality with visual appeal, serving a vast global customer base through its extensive manufacturing and sales network.

With the current elevated levels of inflation and economic uncertainty surrounding its future trajectory, the housing market is under pressure, which in turn is affecting AWI’s performance. Despite posting strong results in the third quarter, AWI is grappling with challenging market conditions. While the current weakened market state is anticipated to remain consistent, prospects for a swift recovery appear dim. To navigate these challenges, AWI has been proactively investing in growth initiatives. However, given the unpredictable market environment closely tied to inflationary trends, the outcomes of AWI’s strategic efforts remain uncertain at this juncture. While AWI’s performance metrics surpass those of its peers, my target price aligns closely with its current trading price. This indicates that the market has already factored in AWI’s strengths and advantages in my view. Given this assessment, I recommend a hold rating for AWI.

Financials

Over the past five years, AWI’s sales trajectory has seen notable fluctuations, particularly around the COVID-19 period. Between 2017 and 2019, AWI maintained a steady performance, registering low single-digit growth. However, the onset of the COVID-19 pandemic in 2020 significantly impacted its revenue, resulting in a decline of 9.75%. In the post-pandemic phase, AWI experienced a resurgence, reporting an impressive 18% growth in 2021 and 11% in 2022. This rebound can be attributed to the lower interest rates during that period, which spurred a surge in home sales. Yet, it’s evident that AWI’s growth is tapering off, influenced by the current inflationary environment. Rising inflation often leads to higher interest rates, which, in turn, can dampen the housing market. Indeed, since the beginning of 2022, there’s been a noticeable downtrend in home sales, presenting challenges for AWI’s revenue stream. This declining trend in the housing market is likely to create headwinds for AWI’s future revenue growth.

Valuation

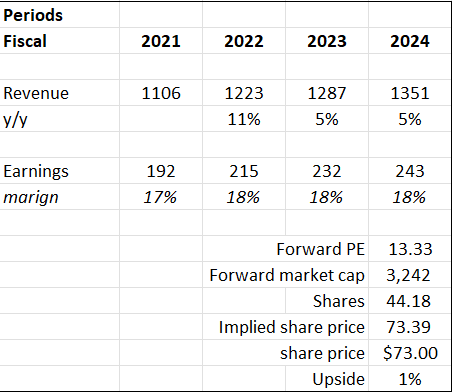

Based on my view of the business, I anticipate mid-single-digit growth in AWI revenue for both FY23 and FY24. This projection for FY23 is anchored in the management’s guidance, as detailed in their Earnings Call Presentation slide. The management has forecasted a revenue range of $1.280 to $1.295 billion for FY23. Utilizing the midpoint of this guidance, my growth expectation is 5%, which I also project for FY24. Several factors shape this moderated growth perspective. Notably, while AWI’s third quarter 2023 financials were commendable, the management’s indication of a 5% growth for FY23 implies potential challenges in sustaining such momentum. This interpretation is further substantiated by the consistent performance metrics from both the Mineral Fiber and Architectural Specialties segments, suggesting a possible plateau in growth.

Diving deeper into market dynamics, AWI’s adeptness at managing order fluctuations and delays is evident. However, these market volatilities underscore the inherent challenges and unpredictability in the industry AWI operates within. On the operational front, AWI’s commitment to ensuring timely deliveries and upholding low claim rates is noteworthy. Yet, the task of maintaining this operational efficiency in a fluctuating market environment is a tall order, presenting more challenges than opportunities for AWI. Strategically, AWI’s recent endeavors, including the acquisition of BOK Modern and the venture into the metal category, hold promise. However, the long-term growth implications of these strategic moves, especially against the backdrop of a volatile market, remain uncertain given the fact that their performance was only included for the first time this quarter.

Based on author’s own math

Peers overview:

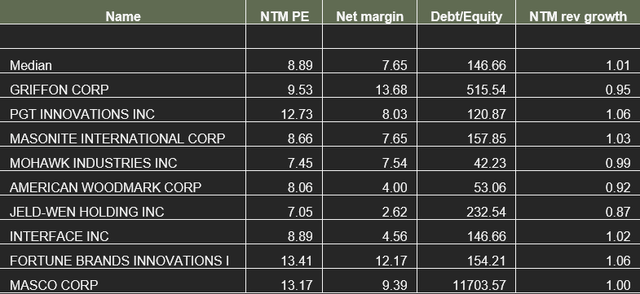

FactSet

Currently, AWI is trading at a forward P/E of 13.33x. In my assessment, this valuation is justified, especially when considering that it stands above the peer median of 8.89x. This premium can be attributed to AWI’s superior net margin of 17.46%, which is notably double that of its peers, pegged at a median of 8.89%. Furthermore, AWI’s financial health is underscored by its lower debt-to-equity ratio of 115, compared to the peer average of 146. From a growth perspective, AWI also outpaces its peers, with a projected revenue growth rate of 5%, as opposed to the peer average of 1%.

However, it’s crucial to note that even at a forward P/E of 13.33x, my target price for AWI stands at $73.39. This aligns closely with its current trading price, suggesting that the market has already factored in these positives. Given the absence of a margin of safety, despite AWI’s evident strengths compared to its peers, I would recommend a ‘hold’ rating. The rationale behind this is the limited potential for capital appreciation at its current trading price.

Comments

In the third quarter of 2023, AWI reported commendable results despite the challenges posed by weak market conditions impacting both their Mineral Fiber and Architectural Specialties segments. The resilience in AWI’s performance can be attributed to the stabilization of market activity, preventing further declines. During this period, AWI saw a 7% rise in net sales, a remarkable feat given the prevailing market challenges. Additionally, the company’s adjusted EBITDA surged by 19%. The Mineral Fiber segment of AWI stood out with a 7% growth in sales and an 18% boost in adjusted EBITDA. This robust sales performance was primarily driven by sales volumes that exceeded expectations. Contrary to forecasts of a weaker economic environment in the latter half of 2023, the market conditions during the third quarter mirrored those of the first half of the year.

In the Architectural Specialties segment, AWI Industries reported record-setting sales and adjusted EBITDA of nearly $100 million and $20 million, respectively. The segment’s adjusted EBITDA margins expanded by 3.7% compared to the previous year, surpassing the company’s minimum target of 20%.

Overall, the company’s total adjusted EBITDA of $125 million marked the highest quarterly result in the history of the business, with the adjusted EBITDA margin expanding by 3.8%. Both the Mineral Fiber and Architectural Specialties segments reported record-setting quarterly sales and earnings with robust margin expansion. These results demonstrate the resilience of AWI Industries’ business model, with a strong market position, a diverse set of end markets, and effective growth initiatives providing strength and stability to their sales and earnings.

The Architectural Specialties segment of AWI Industries showcased a commendable performance in the third quarter of 2023. The company took pride in the team’s efforts, especially in the Architectural Specialties plants, for their exceptional operational performance during the quarter. This was evident in terms of timely deliveries and low claims rates, which are crucial metrics in the industry.

A significant highlight for the Architectural Specialties segment was the addition of BOK Modern, which was included in the company’s results for the first time this quarter. This acquisition has not only added more capabilities to AWI but has also opened new avenues for sales in novel spaces. This strategic move is expected to further strengthen the company’s position in the market and cater to a broader customer base.

In terms of market activity within the Architectural Specialties segment, there was a continuation of positive quoting activity. However, it was observed to be slightly less positive compared to the first half of the year. The company also experienced some fluctuations in order activity, with certain new orders facing delays. Despite these challenges, it’s important to note that while there were delays in project awards, the company did not experience any project cancellations. This is a testament to the company’s strong market presence and customer trust.

A specific area of strength within the Architectural Specialties segment was transportation, with a particular emphasis on airports and large municipal projects, such as convention centers. These projects, given their scale and complexity, often have shifting schedules, and the company is continually monitoring them to ensure timely deliveries and maintain its reputation in the market.

Furthermore, the company highlighted an internal investment that was brought online during the quarter to expand its capacity and capabilities within the Architectural Specialties Metal category. Metal has been a growth area for AWI over the years, and the company has been active in acquisitions with unique metal design and production capabilities. One such acquisition was Steel Ceilings in Johnstown, Ohio, back in 2018, which primarily produces the company’s metalwork product line today. Due to the growth in metal and the centralized location of Johnstown, the company invested approximately $15 million over the last two years to expand the capability and capacity of this location. These investments are expected to significantly advance the company’s finishing capability, triple the production capacity of the site, and reduce lead times.

Risk & conclusion

An upside risk to the hold rating for AWI is the potential boost in the housing market due to lower inflation. When inflation rates are lower, borrowing costs, including mortgage rates, often decrease. This makes home loans more affordable for consumers, leading to an uptick in home building and construction activities. As a result, there would be an increased demand for building materials, including wall and ceiling products. AWI, being a prominent player in the wall and ceiling industry, stands to benefit significantly from this surge in demand. An increase in home building would directly translate to higher sales for AWI’s wall and ceiling products, potentially boosting its revenue and profitability. This scenario could lead to a rise in AWI’s stock price, suggesting that its current valuation might be low.

Despite AWI’s positive third-quarter results, the company is grappling with challenging market conditions, exacerbated by the prevailing inflationary environment. While management’s growth projections for the upcoming years are promising, they are notably more conservative than the robust growth seen in 2022. This indicates that the market AWI operates in is facing downward pressure, making it difficult to maintain previous growth rates. Furthermore, consistent metrics across its key segments hint at a potential levelling in growth. AWI is also navigating market challenges, including order fluctuations and delays, which make operational efficiency a daunting task. While AWI’s recent strategic investments are encouraging, the long-term benefits in an unpredictable market are yet to be seen. AWI’s valuation, which surpasses that of its competitors, underscores its commendable performance and sound financial health. However, the alignment of the target price with its current trading value suggests that the market has already priced in AWI’s strengths. Taking all these factors into account and the limited room for stock price appreciation, I recommend a hold rating for AWI.