Michael Vi

As the market continues to inch upward with investors taking on more risk, gains are not being spread evenly across tech stocks. Buoyed both by strong fundamental performance in the wake of a recession as well as an upward valuation reset, some small/mid-cap tech stocks are enjoying some of their strongest gains in years.

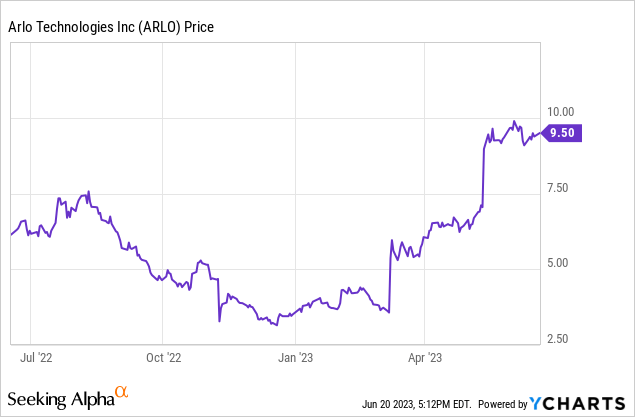

Arlo (NYSE:ARLO), the maker of cloud-driven security cameras, is one standout here. The stock is up nearly 3x year to date, with gains picking up steam after the company’s most recent Q1 earnings print. Long considered a speculative small-cap play (it’s hard to convince the markets to love a hardware play), Arlo is finally earning the respect it deserves.

In spite of the recent upside here, I remain bullish on Arlo and I am holding onto the stock in my portfolio.

The most important recent driver that investors should be aware of is that Arlo has completely revamped its pricing strategy. It slashed prices on its hardware products in order to stimulate new household additions, while simultaneously increasing the monthly subscription prices on its services (which, as a reminder, broadly enable users to store security footage in the cloud). It was a perfect time to slide in price increases on services, as the “headline” subscription services like Netflix (NFLX) also push through price increases and crack down on password sharing – in other words, the current inflationary environment for services has made consumers more amenable to Arlo’s changes. We’ll discuss recent results in the next section, but the broad outcome of this pricing play has been widely successful at both driving a pickup in hardware demand as well as dramatically boosting services ARR.

As a reminder for investors who are newer to this stock, here is my full long-term bull case for Arlo:

- Best-in-class category leader. Arlo has been highly reviewed by major tech publications like CNET and PCMag and is considered one of the top home smart cameras. In addition to this, Arlo is one of the most prominent security companies to promote DIY installation, vs. other cameras that required expensive technicians for installation.

- Huge TAM. Arlo estimates the market for home security to currently stand at $53 billion, and it also expects this opportunity to grow to $78 billion by 2025. With less than ~$500 million in annual revenue, Arlo has plenty of room to expand and innovate in this space. Given as well that there is no clear leader in the home security camera market, Arlo has a chance to take the crown.

- Partnerships with some of the largest retailers in the country. Arlo products are sold through resellers like Best Buy (BBY), Costco (COST), Amazon (AMZN), and others. Arlo’s visibility to consumers is unmatched, and the company is well-positioned for retail sales growth ahead of the holiday season.

- Building a subscription base. Arlo is moving away from being a pure hardware products company. Paid subscriber accounts, now above 2 million customers, are growing at nearly a 2x y/y clip. Arlo also notes that ~65% of new hardware customers sign up for Arlo Secure within six months.

- Profitability. Unlike many small-caps of its size, Arlo has hit pro forma operating profitability, or hovered very close to it, for several quarters in a row.

The bottom line here: with Arlo demonstrating more momentum than it has since the start of the pandemic, hold onto the stock and keep riding recent gains higher.

Q1 download

Let’s now go through Arlo’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Arlo Q1 results (Arlo Q1 earnings release)

Arlo’s revenue in Q1 declined -11% y/y to $111.1 million, which came in better than Wall Street’s expectations of $105.0 million (-16% y/y). This was all driven by a -29% y/y decline in hardware, driven both by a decline in average selling prices (the company’s own pricing decision) as well as softer consumer demand from a year-over-year standpoint.

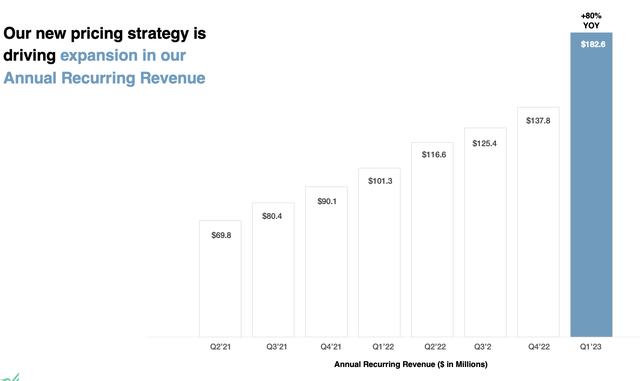

The big story here, however, was on services – which grew 47% y/y to $44.0 million in revenue and represented a record 40% of overall revenue. Arlo’s ARR (annual recurring revenue), meanwhile, skyrocketed to $182.6 million (+80% y/y), adding $45 million of ARR sequentially since the price hikes kicked in.

Arlo ARR trends (Arlo Q1 earnings release)

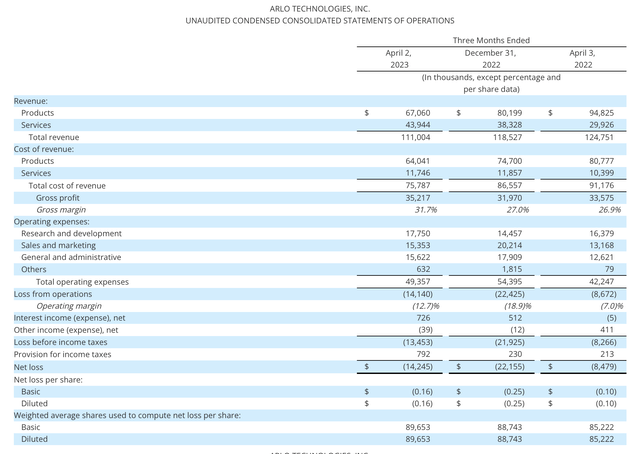

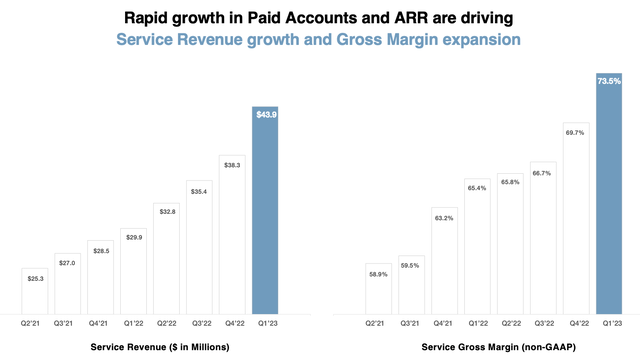

Favorable pricing for services is also helping Arlo boost its services pro forma gross margin to a record 73.5%, as shown in the chart below – which puts Arlo’s margin roughly at parity vis-a-vis other software peers.

Arlo services maturation (Arlo Q1 earnings release)

The company notes that higher subscription fees have had a minimal impact on churn, while hardware price cuts have helped to drive volume and lower channel inventory. Per CEO Matthew McRae’s remarks on the Q1 earnings call:

Looking at Q1 in more detail, revenue came in at $111 million which was above the high end of our guidance and we saw strong demand throughout the quarter thereby driving our inventory lower. Arlo added 182,000 paid accounts and cross the 2 million paid accounts subscriber milestone in Q1. Earlier this year, we adjusted the pricing on our hardware and subscriptions to optimize our ability to drive shareholder value. Lowering hardware prices to sell more units while increasing subscription pricing to accelerate service revenue. The price increases have had an immaterial impact on churn to date and we have seen an upward mix shift across our subscription plans […]

The observed price elasticity and successful upselling is a testament to the value proposition Arlo services bring to our users as well as to the lifetime value of each subscriber.

Arlo remains on track to continue our strong pace of subscriber additions and achieve $200 million of service revenue in 2023 at close to 75% non-GAAP gross margin and growing nearly 50% year-over-year. The performance of our service business not only delivered non-GAAP profitability, it drove $9 million of free cash flow in Q1.”

It’s worth noting as well that in spite of hardware price cuts, Arlo’s total company gross margin still improved 470bps sequentially and 480bps y/y, indicating that the company’s pricing strategy yielded a favorable outcome.

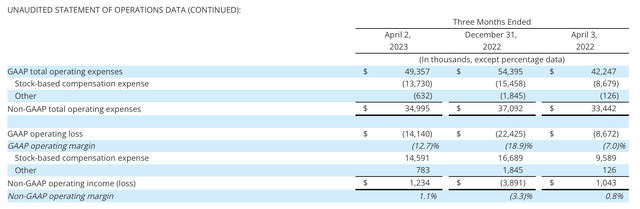

The more favorable mix toward services and higher services gross margin also helped push pro forma operating margins to 1.1%, a 440bps sequential improvement and a 30bps y/y jump.

Arlo operating income (Arlo Q1 earnings release)

Key takeaways

Though it took several years for Arlo to prove its mettle, the company is finally showing its stripes as a bona fide services play. The fact that churn remained low (1.2%) amid a fee increase is proof that Arlo’s subscription bundle is a core part of its value proposition to customers. Stay long here as the company begins to lean in on its profitability story and continues growing its ARR.