LumiNola/E+ via Getty Images

Investment thesis

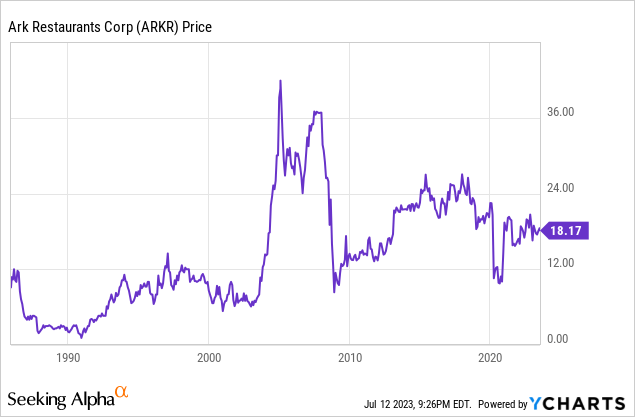

Even though Ark Restaurants (NASDAQ:ARKR) has grown slightly in recent years and its balance sheet remains very robust, the share price fails to recover as it remains 34% below recent highs of $27.59 in December 2017. In recent years, the restaurant industry has not gone through a good time overall, and neither has Ark Restaurants. First of all, the coronavirus pandemic (and mandatory restrictions derived from it) caused a significant impact on operations in 2020, and despite having recovered all revenues by 2022, the company is now facing a significant margin contraction as a result of increased operating costs and wages.

Over the past quarter, profit margins have continued to decline despite recent menu price raises, and a lower influx of customers with moderate purchasing power suggests the company is losing the ability to continue raising prices as they are apparently reaching a limit. Also, a potential recession as a consequence of recent interest rate hikes now poses a new concern as things could worsen even further. For this reason, investors are expecting some pain in the short and medium term, which is currently reflected (at least partially) in the share price.

But despite this, I consider that the company is prepared to endure the current inflationary context and even a potential recession as the balance sheet is very robust thanks to a very manageable long-term debt and very high cash and equivalents, so, in my opinion, the short term pain (and recessionary risks) represent a good opportunity for those long-term dividend growth investors interested in high dividend yield on costs as the dividend yield currently stands at 4.13% (and would reach 5.50% should the management fully reinstate the dividend in the future).

A brief overview of the company

Ark Restaurants is an operator of both owned and leased restaurants. The company was founded in 1983 and its market cap currently stands at $67 million as it operates 17 restaurants and bars, 16 fast food concepts, and catering operations through its subsidiaries. Insiders own a whopping 41.42% of the total number of shares outstanding, which means the management is a direct beneficiary of good share price performance.

Ark Restaurants logo (Arkrestaurants.com)

The company currently employs almost 2,000 workers, and wage inflation, as well as increased raw material and operating costs, have caused a significant decline in profit margins despite a significant increase in menu prices. But despite this, the management has recently increased the dividend to $0.1875 per quarter, which leaves us with a dividend yield on cost of 4.13%. Also, the company has almost completely deleveraged the balance sheet, which means the company is prepared to perform a new acquisition soon. Still, it’s very important to note that investments in micro-cap companies are generally subject to significant risks as they usually are not very diversified (in terms of products and markets), as is the case with Ark Restaurants.

Currently, shares are trading at $18.27, which represents a 33.78% decline from recent highs of $27.59 on December 29, 2017. This fall in the share price reflects growing pessimism among investors (mainly due to margin contraction and fears of a potential recession) despite a successful deleveraging process and increased net sales boosted by not only increased menu prices to offset inflationary pressures, but also a series of acquisitions that the company performed in recent years.

Recent acquisitions

In recent years, the company has managed to grow gradually but steadily (except for fiscal 2020 and 2021 due to coronavirus-related restrictions) through a series of acquisitions that I will summarize below.

- The Rustic Inn in Dania Beach, Florida (2014).

- Shuckers in Jensen Beach, Florida (2016).

- Two Original Oyster Houses, one in Gulf Shores, Alabama, and the other in Spanish Fort, Alabama (2017).

- JB’s on the Beach in Deerfield Beach, Florida (2019).

- Blue Moon Fish Company in Lauderdale-by-the-Sea, Florida(2021).

These acquisitions have generally been financed through debt, but the company has already managed to pay off a significant part of it, so more acquisitions could be expected in the foreseeable future, especially considering the balance sheet holds significant cash and equivalents.

Acquisitions and increased menu prices boosted revenues in recent years

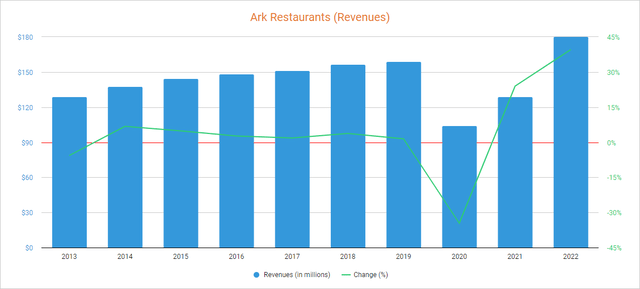

Ark Restaurants has achieved slow but steady growth rates in recent years boosted by acquisitions, and although revenues declined by 34.60% year over year during fiscal 2020 due to coronavirus-related mandatory restrictions, they recovered in the two following years as they increased by 23.95% in fiscal 2021 and by a further 39.56% in fiscal 2022 as these restrictions were lifted and the price of menus was raised to offset inflationary pressures.

Ark Restaurants revenues (Seeking Alpha)

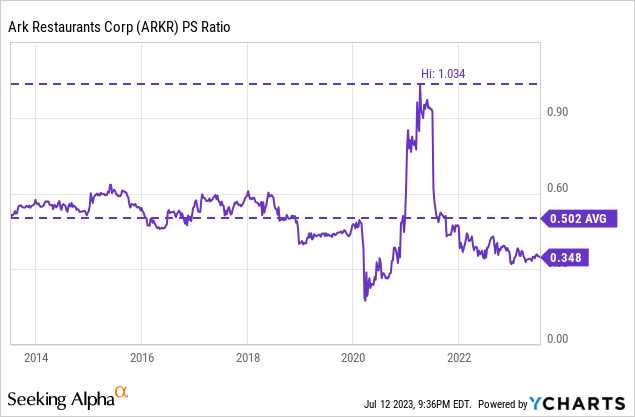

Furthermore, revenues kept increasing during the first and second quarters of fiscal 2023 as they increased by 7.64% and 5.39%, respectively, compared to the same quarters of fiscal 2022. But despite these increases, investors remain on the sidelines as inflationary pressures are negatively impacting profit margins, which has caused a sharp drop in the P/S ratio to 0.348. This means that the company currently generates $2.87 in revenues for each dollar held in shares by investors, annually.

This ratio is 30.68% lower than the average of the past 10 years and represents a 66.34% decline from decade highs of 1.034. In this sense, investors are placing less value on the company’s sales despite lower debt levels as its capacity to convert these revenues into actual cash is being seriously affected by the increase in operating costs. In addition, customers in the lower income range are beginning to visit the company’s restaurants less frequently due to their weakening purchasing power derived from high inflation rates, and a potential recession as a result of recent interest rate hikes to tackle the inflation problem could further aggravate the problem in the short and medium term.

Margin contraction is intensifying

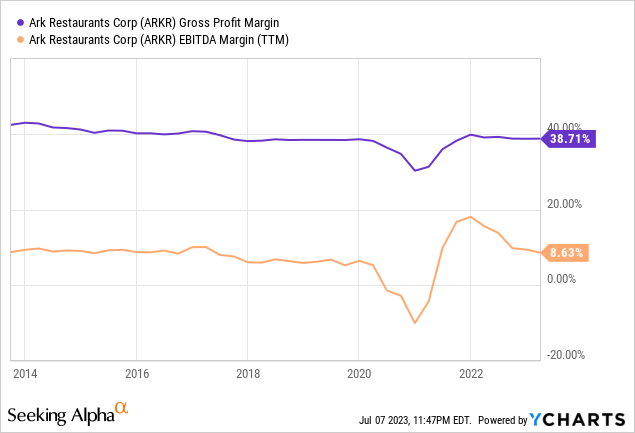

Overall, the company has achieved positive and very stable profit and EBITDA margins over the years, but increased commodity prices, operating costs, and wages due to labor shortages and inflationary pressures are currently having a significant impact on the company’s profit margins despite recent menu price raises.

Despite finding a trailing twelve months’ gross profit margin of 38.1% and a trailing twelve months’ EBITDA margin of 8.63%, both gross profit and EBITDA margins declined to 35.30% and 3.57%, respectively, during the second quarter of fiscal 2023 due to the mentioned headwinds, and this represents a significant concern for investors as the management has already begun to notice a decrease in diners among the population with lower purchasing power as the increase in the price of the menus is taking place at a time when purchasing power of families is being eroded by high inflation rates while growing concerns of a potential recession are leading to more responsible spending of families’ economic resources.

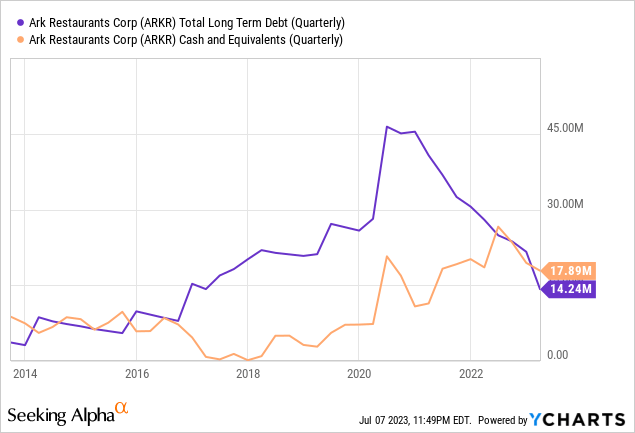

Fortunately, the management has made a significant effort in recent years to reduce the balance sheet’s long-term debt, which has drastically reduced interest expenses and provided some margin to face current and potential headwinds. For this reason, I strongly believe the company is prepared to endure current headwinds and even a potential recession.

The deleveraging process is almost completed

The company has contracted some debt over the years in order to perform acquisitions, and the debt pile increased even further in 2020 due to the coronavirus pandemic crisis to $45 million. Nevertheless, a dividend cut in 2020 and strong cash from operations in 2022 have allowed the company to pay down a large part of it to $14 million, which will generate annual interest rate savings of over $1 million in the coming years.

In addition, this debt level does not pose a significant risk to the future of the company as it currently holds $17.89 million in cash and equivalents, so the debt should continue to decline in the foreseeable future. This should make it possible for the current dividend to be sustainable in the long term, although it is important to note that there are significant risks in the short and medium term due to the current complex macroeconomic context.

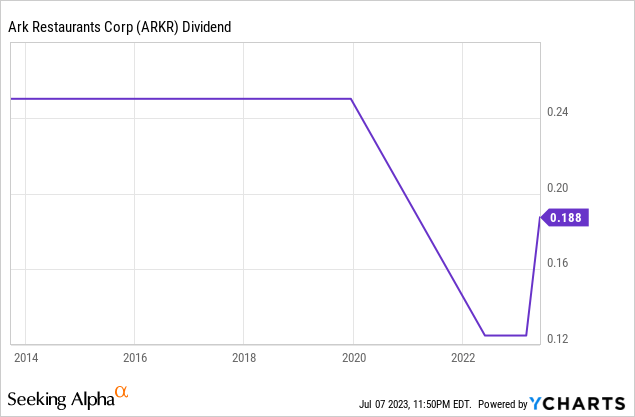

A high dividend yield on cost accompanied by short-term risks

The company used to pay a quarterly dividend of $0.25 per share, but the dividend was canceled during the second quarter of fiscal 2020 due to the disruptions derived from the coronavirus pandemic. Nevertheless, the company reinstated a $0.125 quarterly dividend in June 2022 and increased it to $0.1875 during the second quarter of fiscal 2023.

Considering the current annual dividend of $0.75 per share and the current share price of $18.17, the dividend yield currently stands at 4.13%, which is quite generous considering it’s still 25% below what the company used to pay before the coronavirus pandemic. Should the management fully reinstate the quarterly dividend to $0.25 again, the dividend yield on cost would stand at 5.50%, which would be very high considering the historically low cash payout ratios.

In the following table, I have calculated the company’s ability to cover the dividend (and interest expenses) over the years by calculating what percentage of cash from operations it has allocated to both expenses. In this way, one can see the dividend’s sustainability through actual operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $11.9 | $11.3 | $7.6 | $10.4 | $9.6 | $10.6 | -$4.5 | $9.3 | $20.3 |

| Dividends paid (in millions) | $3.3 | $4.2 | $3.4 | $2.6 | $3.4 | $3.5 | $1.8 | $0 | $0.9 |

| Interest expenses (in millions) | $0.2 | $0.2 | $0.4 | $0.8 | $1.2 | $1.4 | $1.4 | $1.2 | $1.2 |

| Cash payout ratio | 29% | 39% | 50% | 33% | 48% | 46% | – | 13% | 10% |

As one can see in the table above, the cash payout ratio has remained at very conservative levels over the years thanks to a modest dividend and very manageable debt (except in 2020 as a consequence of negative cash from operations). As for the current fiscal year, cash from operations was negative at -$0.9 million during the first quarter (compared to $3.9 during the same quarter of fiscal 2022) and $3.0 million during the second quarter (compared to $1.1 million during the same quarter of fiscal 2022). Therefore, the company continues to be profitable, although with certain difficulties due to the current margin contraction.

Personally, I consider the company’s operations to be sustainable at this point, but I believe the current dividend is at risk as margin contraction could continue to intensify due to high recessionary risks from current interest rate hikes. But despite this, the current headwinds seem to be of a temporary nature as they are directly linked to the current macroeconomic landscape, so it is a matter of time before a dividend of $0.25 (and thus a dividend yield on cost of ~5.50%) can be paid with a cash payout ratio below (or close to) 50%, as was the case in the years prior to the coronavirus crisis and the subsequent inflationary crisis. For this reason, I consider Ark Restaurants a good investment idea for long-term dividend investors with enough patience (and some risk tolerance).

Risks worth mentioning

Overall, I consider that the risks associated with Ark Restaurants, despite being a micro-cap company, are not too high thanks to the robustness of its balance sheet (high cash and equivalents and low debt). But still, there are certain risks that I would like to highlight.

- If inflationary pressures continue to be part of the current macroeconomic landscape, profit margins could remain depressed as production costs could keep increasing. In addition, said scenario would be accompanied by further menu price increases, which would continue to negatively affect demand from social sectors with more precarious purchasing powers.

- A potential recession as a consequence of the recent interest rate hikes could have a very significant impact on the company’s operations as they would likely have a direct impact on consumer demand and the company’s pricing power.

- If profit and EBITDA margins remain contracted for more quarters, the management could decide to cut the dividend again, so the current high dividend yield should be seen as a temporarily risky dividend, not an immediate guarantee.

- I also believe that it is important to monitor share dilution as the number of shares outstanding has increased by 11% in the last 10 years. This means that each share now represents a smaller slice of the company, something that could continue to happen in the coming years if we consider that this increase has been continuous over the years.

Conclusion

Despite the myriad of headwinds the company has had to face since the outbreak of the coronavirus pandemic in 2020, the balance sheet remains robust and cash from operations, although weak, remains slightly positive. Currently, there is a main headwind that the company has to face, which is related to inflationary pressures. It seems that the price of the menus cannot continue to increase at the same pace as before since recent raises are beginning to be noticed in the frequency of diners, so the stabilization of profit margins depends primarily on how inflation behaves in the coming quarters. But in addition to this, we have the risk of recession as a result of recent interest rate hikes, which would have a direct impact on the company’s revenues due to weakening demand.

Despite these headwinds and a potential recession, it is important to consider that sales have increased over the years (despite current headwinds) thanks to acquisitions and that debt is at very manageable levels thanks to the deleveraging that has taken place since 2021, so the company appears to be in good shape to weather a prolonged period of margin squeeze and even a potential recession. That is why I believe that the recent share price decline represents a good opportunity for long-term dividend investors interested in high dividend yields on costs.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

.jpg?h=c673cd1c&itok=78jxuSzO)