akinbostanci/iStock through Getty Pictures

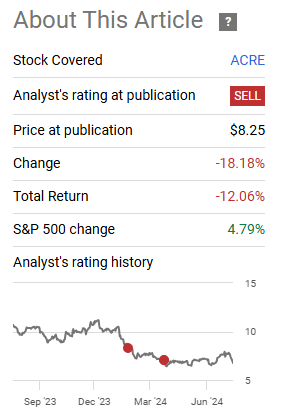

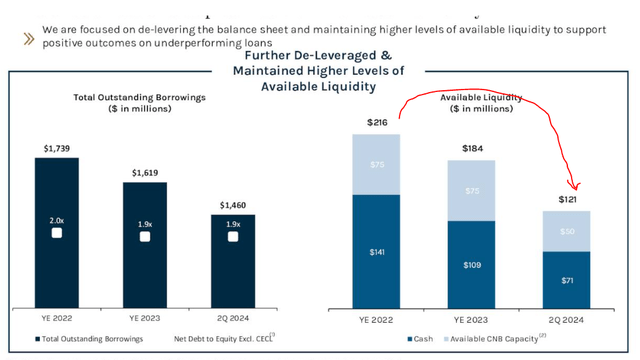

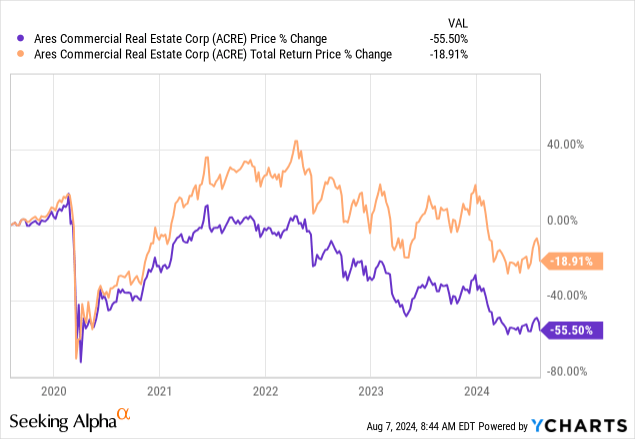

We first wrote about Ares Business Actual Property Company (NYSE:ACRE) in February 2024. The concept then was that the poor distribution protection would end in a reduce, sooner moderately than later. The precise distribution reduce got here inside two weeks, and the inventory has responded in sort. Complete returns have been unfavorable, even accounting for the distributions.

Looking for Alpha

In our subsequent protection, we made the moderately uncommon name {that a} second distribution reduce could be coming inside a yr. It has been three months since that article and the inventory is flat. The current outcomes did present a possibility to see whether or not every little thing is on schedule or not, and we dived proper in.

Q2-2024

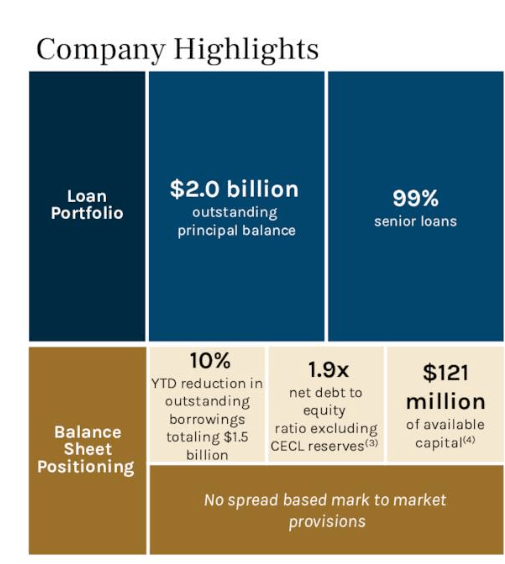

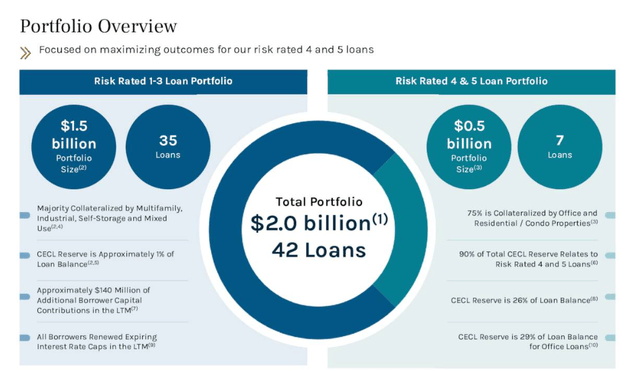

The corporate’s slide work began off by highlighting the important thing causes you need to make investments right here. That features their debt discount yr thus far and the truth that they had been working solely a 1.9X debt to fairness leverage ratio.

ACRE Q2-2024 Presentation

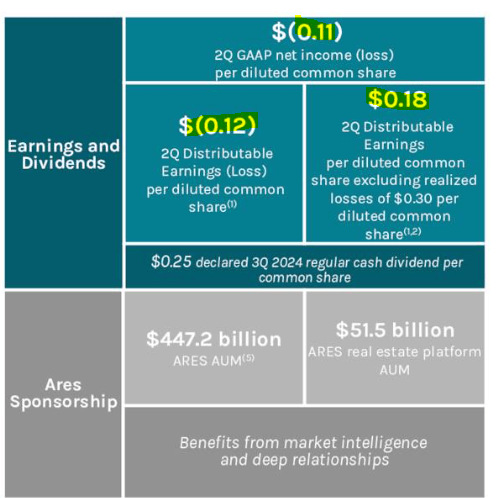

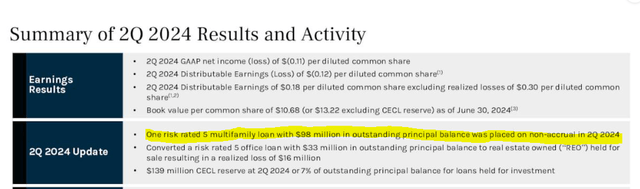

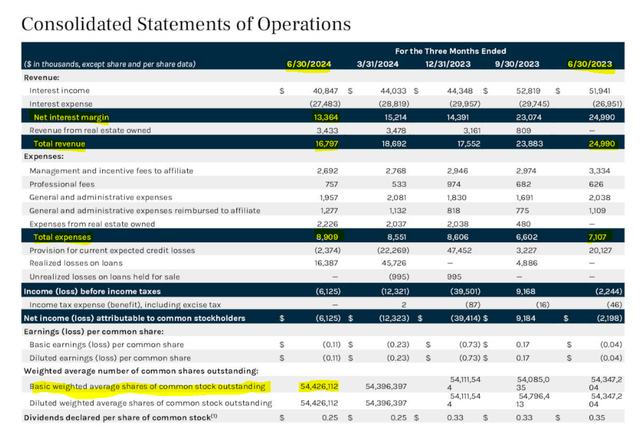

Sadly, the opposite half of that very same first slide confirmed what an unmitigated catastrophe the earnings assertion was in Q2-2024. GAAP (sure, listen earnings chasers) was unfavorable 11 cents. Their distributable earnings metric was additionally at unfavorable 12 cents. One last metric thrown in there was the distributable earnings excluding losses, which got here to 18 cents.

ACRE Q2-2024 Presentation

In case you had been alarmed by the truth that none of them got here near the 25 cents of declared distribution, we’d counsel you’re too late. At this level you ought to be in panic mode, not simply anxious. So what went fallacious this quarter? Properly, for starters, one other massive mortgage went on non-accrual and this was within the multifamily enviornment. Additionally they took a shower on a stage 5 workplace mortgage, which was offered at a giant loss.

ACRE Q2-2024 Presentation

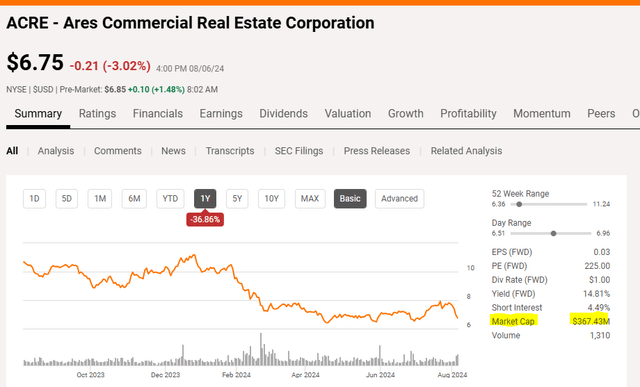

However let’s get again to that multifamily mortgage. After all, the bullhorn may go that this was only one mortgage. It was already a threat stage 5. So what is the fear? The fear as all the time is that ACRE has not proven the power to make many good loans. The variety of these that preserve falling into non-accruals is pretty extraordinarily. Let’s not overlook that $98 million is not precisely chump change for ACRE. Their whole market capitalization is $367.43 million.

Looking for Alpha

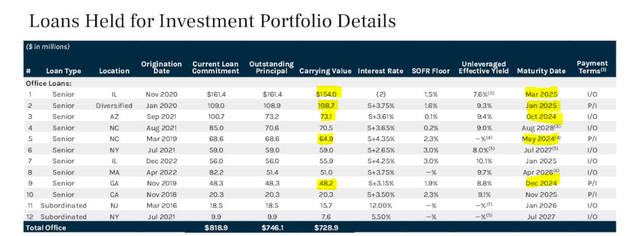

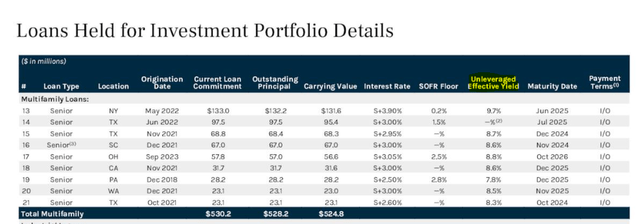

Let’s additionally not overlook that they’ve threat 4 and 5 rated loans that exceed their market capitalization, by so much.

ACRE Q2-2024 Presentation

These are a number of the salient options you want to concentrate on earlier than you go diving into that “I get a 15% yield” mentality.

Outlook

They didn’t reduce the distribution, regardless of all their very own metrics displaying that they had been nowhere shut to creating it work. As these losses work their approach into the books, ACRE must scale back debt additional to stop its leverage from creeping up. The aspect impact of that’s that its liquidity retains dropping.

ACRE Q2-2024 Presentation

It’ll drop even additional if ACRE insists on paying that outlandish uncovered dividend. The workplace portfolio itself is about 2X the market cap and nicely in extra of even the tangible fairness. A whole lot of these are arising for renewal quickly, and we anticipate extra losses right here.

ACRE Q2-2024 Presentation

As this quarter confirmed, even multifamily is cracking, and the mortgage that dropped into non-accrual was its second largest in that area. A reminder right here that ACRE just isn’t getting these unleveraged yields as a result of it’s lending to AAA stage initiatives.

ACRE Q2-2024 Presentation

There may be more likely to be considerably extra ache. After all, traders may try to latch on the Fed fee cuts. If these occur within the context of a average or extreme recession, you’re unlikely to get any assist from them. Additionally, do word that there’s a large lag between cuts and an influence to ACRE. We’d assume 12-18 months or so. However let’s simply have a look at the distribution potential right here, assuming that we do not see additional harm.

The consolidated statements of operations reveals how internet curiosity margin has been collapsing during the last 4 quarters. Now we have dropped from circa $25 million to $16.8 million. Simply that internet curiosity earnings minus the bills will get us near $8.0 million quarterly run fee.

ACRE Q2-2024 Presentation

A few of that’s depreciation on actual property owned, however that could be a very reasonable value on these properties that it has been compelled to takeover. $8.0 million divided by 54.4 million shares will get us to below 15 cents a share. That’s your absolute best-case scenario for a distribution in 1-2 quarters.

Verdict

ACRE held the road of the distribution. The rationale doubtless was that they wished to keep away from a panic. However a sustainable run-rate within the best-case scenario is round 15 cents in our opinion. In the event that they wish to construct a buffer to deal with their points, 10 cents 1 / 4 distribution makes extra sense. After all, that might kill the inventory. It doubtless reprices to a 15% yield on that 40 cents pretty shortly. That’s the place it’ll get to earlier than it attracts within the new investing champs salivating at a 15% yield and “low cost to e-book worth”. ACRE now will get the utmost score on our proprietary Kenny Loggins, dividend hazard, scale.

Writer’s Scale

There’s a cause ACRE has been a nasty choose even amongst mortgage REITs during the last 5 years.

We downgrade this to a Sturdy Promote and search for a minimum of a 40% distribution reduce inside 2 quarters.