Real Estate Investment Trust Dzmitry Dzemidovich

Introduction

If you are reading this article, chances are you are looking to derive passive income from your investments. Perhaps you are approaching retirement and a stable, recurring income suits your needs instead of chasing capital growth. Or maybe you are at the beginning of your career and are looking to gradually build up a dividend portfolio to take advantage of the effects of compounding. Or you may be somewhere in between. Regardless, the fact you are reading this right now means you are likely on the lookout for dividend income stocks to add to your portfolio.

Ares Commercial Real Estate Corporation (NYSE:ACRE), a commercial mortgage REIT which I have looked at in the past, is scheduled to announce its Q4 2022 and FY 2022 earnings next week, on 15 February 2023. Ahead of its earnings release, I feel it would be a good time to take a look at the stock to determine whether it is an attractive buy at this point in time.

Background

A relatively young company, Ares Commercial Real Estate Corporation commenced operations just over a decade ago in 2011 before going public shortly after in 2012. As a commercial mortgage REIT, the company’s main source of income is interest income from its loans, more specifically in the commercial real estate sector. Its profit comes from the spread between the interest income earned on these loans and the cost of financing the loans (i.e. its net interest margin). The company’s main focus is on originating and managing these loans, which come in various forms such as senior mortgage loans, subordinated debt, mezzanine loans and preferred equity.

Externally managed by a subsidiary of Ares Management Corporation (NYSE: ARES), an alternative asset manager with approximately $341 billion in assets under management, the company leverages on its manager’s national direct origination platform to source new loans. The company also relies on the expertise of its manager to assess potential investments and risks.

Loan Portfolio

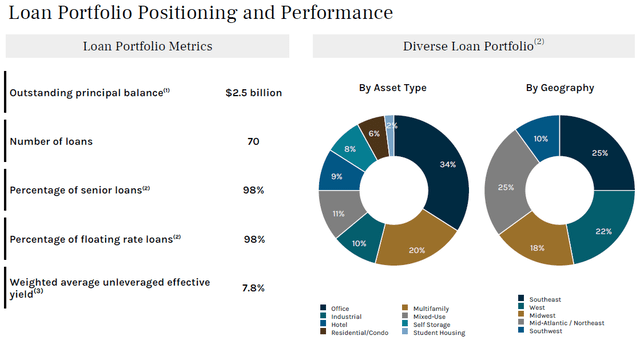

As at the end of Q3 2022, the company had approximately $2.5 billion in loans, a slight increase on the $2.4 billion as at the end of 2021. Owing to how the manager’s offices are spread across the country, the company is able to originate its loans fairly evenly throughout the country, thereby reducing its geographical risk. Additionally, the company spreads out its loans by asset type as well. While office and multifamily loans make up the bulk of the loan portfolio – slightly more than half at 54%, there are other asset types as well to ensure the company is not overly exposed to one particular sector. As a form of comparison, I wrote about another mortgage REIT recently, Arbor Realty Trust (NYSE: ABR). The bulk (93%) of Arbor Realty Trust’s portfolio lies in the multifamily sector, which makes it particularly susceptible to a downturn in the multifamily sector.

ACRE Q3 2022 Earnings Presentation

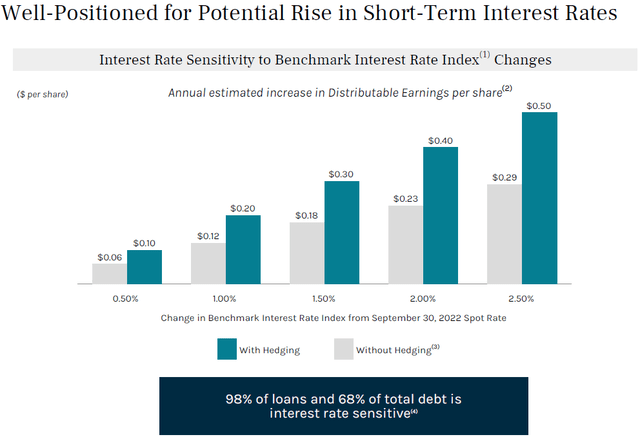

Majority of the company’s loan portfolio (98%) comprises senior mortgage loans, giving the company priority over all other claims on a property in the event of default. This is significant as it gives the company an additional layer of safety. Perhaps a key thing to note is that virtually all of the company’s loan portfolio is made up of floating rate loans. This is especially important given the current macroenvironment and the rising interest rate environment we find ourselves in. Just this month, the Federal Reserve raised interest rates yet again, albeit at a smaller pace than previous increases. Owing to the way its loans are structured, the company actually benefited from this increase. This is reflected in the company’s increasing net interest margin in the past couple of years.

ACRE Q3 2022 Earnings Presentation

Dividends

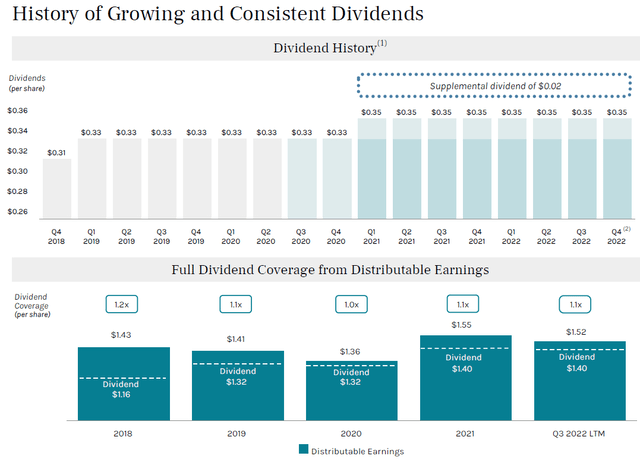

For the past 8 quarters, starting in Q1 2021, the company has declared a quarterly dividend of $0.35/share. To provide some context, the company had previously maintained its quarterly dividend at $0.33/share, for 2019 and 2020. Based on the current share price of approximately $12, this gives the company a dividend yield of 11.67%. By any measure, this is certainly a generous dividend yield.

Of course, one thing to note is that the quarterly dividend of $0.35/share is actually made of up of $0.33/share dividend and a further $0.02/share supplemental dividend. The reason why the company has done so is probably to give it some leeway in the event it decides to return to its $0.33/share dividend. After all, it does not reflect well on a company if it is seen cutting its dividend; this way, the additional $0.02/share can be viewed as a special dividend of sorts. That being said, the company has maintained this supplemental dividend for 2 years now, and it does not seem likely to remove it anytime soon. Furthermore, the company’s distributable earnings on a trailing 12 months basis has covered this additional increase in dividend.

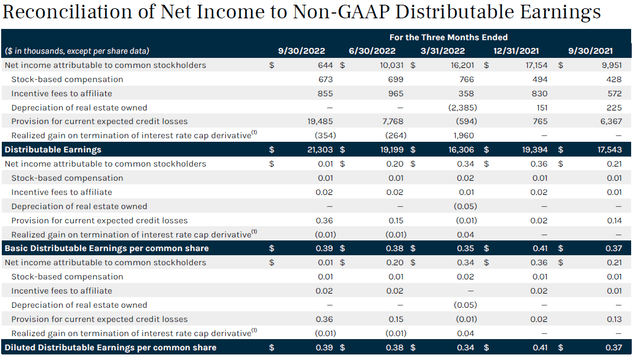

ACRE Q3 2022 Earnings Presentation

Upcoming Earnings

As of Q3 2022, the company has recorded distributable earnings of $1.11/share. With the distributable earnings for 2020 and 2021 being $1.36/share and $1.55/share respectively, the company is on track to comfortably exceed 2020 results, but it would probably take a monster quarter for it to exceed 2021’s performance (the company needs distributable earnings of $0.44/share). Historically, the company has performed well in Q4, recording distributable earnings of $0.41/share in both Q4 2020 and Q4 2021, so it should at least see earnings of at least $1.50/share for 2022. As highlighted above, this ensures that the company will be able to maintain its quarterly dividend of $0.35/share.

ACRE Q3 2022 Earnings Presentation

Undervalued

Based on the Q3 2022 earnings presentation, the company’s book value is at $14.09/share, giving it a price-to-book (P/B) ratio of 0.85. Depending on which website you use – Yahoo Finance, Macrotrends, YCharts, Morningstar or even some other website – you should see a P/B ratio between 0.86 to 0.89. Regardless of the figures used, this indicates at the very least that the company’s shares are undervalued by at least 11%.

While the company’s share price has run up since the start of the year (it was at $10.76/share), together with pretty much the rest of the market, this discount to book value provides a margin of safety for potential investors.

Risks

There are of course, a couple of risks to note, with the main one being interest rates. As previously stated, 98% of the company’s loan portfolio is made up of floating rate loans, allowing it to benefit from rising interest rates. On the flip side, only 68% of its debt is interest rate sensitive, meaning that if interest rates fall, the company will see its net interest margins decline. Of course, given the current environment and with interest rates expected to rise, this should not be an issue for the foreseeable future. Additionally, even in low interest rate environments (i.e. before COVID-19), the company was still performing well, hence there is no reason to believe the management will not be able to adapt to a decline in interest rates.

One other potential risk is the changing macroenvironment. Prior to COVID-19, if you had told me we would have to transition to working from home, I would have said you were lying. And yet, this is the situation we find ourselves in. There has been a decline in demand for office properties as companies transition to remote working, and this is where the company has 34% of its loans in. However, while this is anecdotal, I have observed that companies are embracing a hybrid arrangement (i.e. partial work in office, and partial remote). While this will still result in a decline in demand, it might not be as severe as expected. Additionally, as mentioned above, the company’s loan portfolio has been split among the various asset types, allowing it some form of protection against this decline in demand.

Conclusion

The company is currently trading at a 11% (or more) discount to book value, and also offers a high dividend at the moment. Based on historical performance, I expect the company to announce a good performance for Q4 2022 and at the very least maintain its quarterly dividend of $0.35/share. While the discount to book value offers room for capital growth, I view it as a bonus and not a necessity, as my purpose in purchasing this stock is for its dividend – a stable, recurring source of income. My thesis will remain unchanged even if this discount is not there. That being said, I believe the discount provides an added layer of safety and gives me additional comfort in my decision.