Sezeryadigar

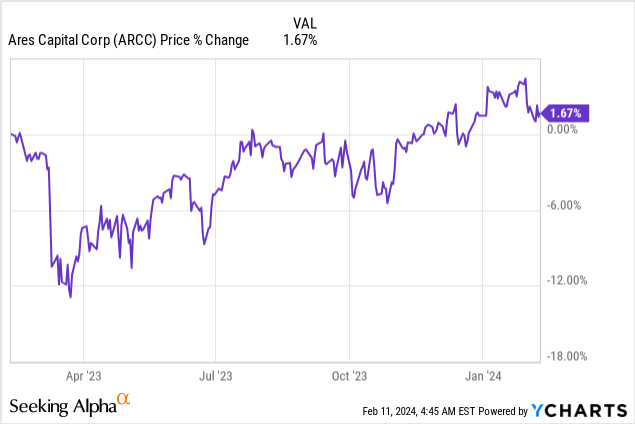

Ares Capital (NASDAQ:ARCC)’s shares gained more than 1% after the BDC reported better than expected results for the December quarter. Ares Capital’s portfolio is performing well, net investment income is growing by the double-digits, and the BDC has seen an expansion in its debt yields due to higher interest rates in the U.S. economy. Ares Capital is currently trading at 1.04X P/NAV ratio, which is slightly above the longer-term average price-to-NAV ratio. Ares Capital is a top high-yield stock and acts as a 10%-yielding piggy bank with very impressive portfolio performance and indications of growing loan demand making shares attractive from an income and yield perspective!

Previous coverage

I recommended Ares Capital back in October — A Magnificent 10% Yield To Buy And Hold Forever — because I believed the BDC’s strong past annual returns, recession-resistant net investment income and upside revaluation potential to $20 made shares a buy. Following Ares Capital’s Q4’23 earnings, which indicated stable loan quality and growing debt yields, I reaffirm my buy rating for shares of the BDC.

A top BDC income play with a stable, well-supported 10% yield

Business development companies lend money to middle market companies and, in return, receive a fixed or floating-rate fee for their loans. Ares Capital is one of the longest-serving BDCs in the market, being established in 2004, and the investment firm is the largest BDC in the sector with a market cap of $11.7B.

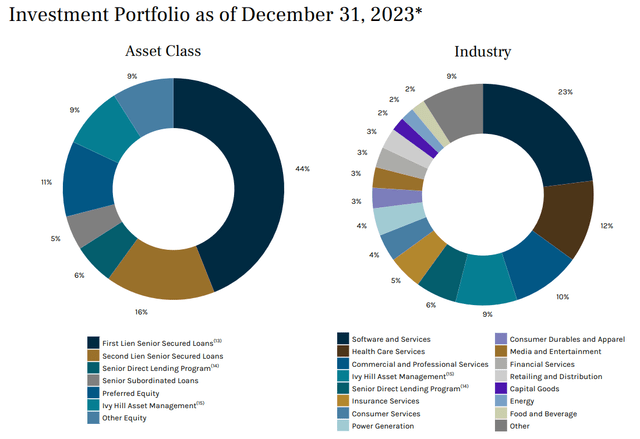

Ares Capital runs a senior loan-focused investment strategy, meaning first and second liens are core investment instruments for the BDC to generate recurring interest income. The senior secured loan percentage as of the end of FY 2023 was 71%. A breakdown of Ares Capital’s portfolio exposure shows that the Software and Services industry is the largest sector to receive investment capital from the BDC (representing a share of 23%).

Ares Capital

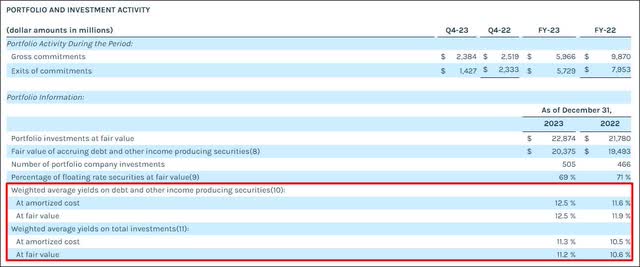

One major takeaway of Ares Capital’s Q4’23 report was that the investment firm is seeing a significant uptick in net commitments, which is an indication of growing loan demand. Loan growth in Ares Capital’s portfolio slowed last year as the Federal Reserve made investments more expensive, but the firm’s net investment commitments point in the right direction: they increased by a factor of three, Q/Q, to $957M.

Q4’22 | Q1’23 | Q2’23 | Q3’23 | Q4’23 | |

Gross Commitments | $2,519 | $766 | $1,218 | $1,598 | $2,384 |

Exits of Commitments | ($2,333) | ($1,884) | ($1,138) | ($1,280) | ($1,427) |

Net Commitments | $186 | ($1,118) | $80 | $318 | $957 |

(Source: Author)

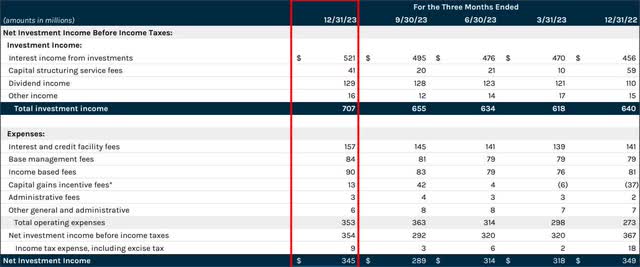

Ares Capital is growing its net investment income as well, in part due to higher average debt yields in the investment portfolio. Ares Capital’s interest income increased 5.3% quarter over quarter to $521M in Q4’23 while its total investment income gained 7.9% Q/Q to $707M. The growth trends in all major key income metrics — interest income, total investment income and net investment income — points upward.

Ares Capital

Ares Capital’s dividend supports the current quarterly dividend of $0.48 per-share as well: the BDC’s dividend coverage was 119% in FY 2023 and 117% in FY 2022, so Ares Capital saw a slight 2 PP expansion in the dividend coverage ratio. For investors, this means that the dividend has become slightly better covered by NII.

Ares Capital’s debt yields expanded in FY 2023 due to the BDC’s focus on loans that pay a variable rate (which is something that affects 69% of all loans): the BDC’s weighted average yield increased from 10.6% in FY 2022 to 11.2% in FY 2023. Going forward, there is a good chance that the yields will contract as the Federal Reserve said it will pivot in terms of interest rates this year. However, despite an expected drop in interest rates, Ares Capital earns more than enough net investment income to support its 10% yield.

Ares Capital

Taking a look at Ares Capital’s loan quality trend

Loan quality obviously is a huge concern for BDCs that are dealing with handing out loans, and the quality of the loan portfolio determines how safe the dividend is for investors is at the end of the day. In Q4’23, Ares Capital had $136M of a total of $22.8B of investments on non-accrual, implying a percentage of 0.6%, based off of fair value. The loan quality trend is profoundly positive as Ares Capital’s non-accrual percentage declined by 0.5 PP over the course of the last four quarters and the loan quality profile did not get worse in Q4’23.

Portfolio, Non-Accrual Trend | Q4’22 | Q1’23 | Q2’23 | Q3’23 | Q4’23 |

Portfolio Value, fair value | $21,780 | $21,148 | $21,496 | $21,929 | $22,874 |

Non-Accrual Amount (cost, $M) | $372 | $496 | $444 | $266 | $295 |

In Percent | 1.7% | 2.3% | 2.1% | 1.2% | 1.3% |

Non-Accrual Amount (FV, $M) | $241 | $277 | $239 | $136 | $136 |

In Percent | 1.1% | 1.3% | 1.1% | 0.6% | 0.6% |

(Source: Author)

Raising my fair value estimate for Ares Capital’s shares

In my last work on the business development company I said that I see a fair value P/NAV ratio of 1.10X for Ares Capital at which point I would consider taking profits. Since Ares Capital grew its net investment income in Q4’23 and added $0.25 per-share to its net asset value (+1.3% Q/Q, NAV: $19.24 per-share), I am updating my fair value estimate to $21.17, implying 5.5% upside revaluation potential.

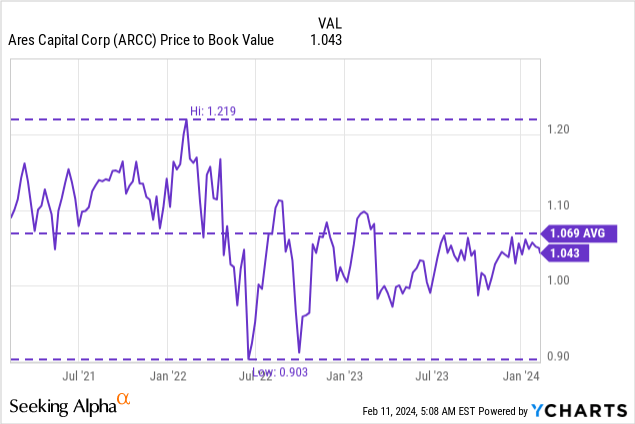

Shares of Ares Capital have a 3-year average P/NAV ratios of 1.07X and are currently slightly below this valuation level at 1.04X, implying a 2.4% discount. I would add aggressively at 0.9X P/NAV ($17.32) and start my sale process once shares hit my fair value estimate of $21.17.

Risks with Ares Capital

Ares Capital’s dividend coverage, non-accrual percentage and NII growth looked all quite good in the fourth-quarter and in FY 2023. But that does not mean dividend investors can just lean back and enjoy the quarterly dividend check. Things worth monitoring include the coverage ratio, the non-accrual percentage, the BDC’s NAV (incremental additions/declines to net asset value), and yields on debt investments.

Final thoughts

I treat Ares Capital as my own personal piggy bank… but one that pays me a very decent 10% yield every year. I believe my investment here is well protected given Ares Capital’s high NII/Dividend ratio (dividend coverage) and good dividend safety margin.

The BDC also delivered better than expected results and the outlook for FY 2024, I would say, is generally positive. The U.S. economy is on a roll and inflation is falling, both of which support business spending, investing and consumption… all metrics that favor additional demand for investment capital at the investment portfolio level. Investment commitments are rising and the BDC’s loan quality looks good as well. As a result, shares of Ares Capital get a solid buy rating from me after Q4’23 earnings!