IngaNielsen/iStock through Getty Photos

Popular culture fan or not, the quantum mechanics principle of Schrodinger’s Cat has develop into commonplace due to “The Large Bang Idea” for a shortcut for the potential for two states of existence without delay.

Like the cat within the experiment, the U.S. financial system could have this duality. It might be in a recession proper now, or in no way till we really observe one.

From an fairness perspective, the broader market (SP500) (NYSEARCA:SPY), development (QQQ) (IWF) and small-caps (IWM) are all in bear territory.

And the Treasury market (TBT) (TLT) (SHY) is pricing in a Fed overshoot with the current tumble in yields and breakeven expectations.

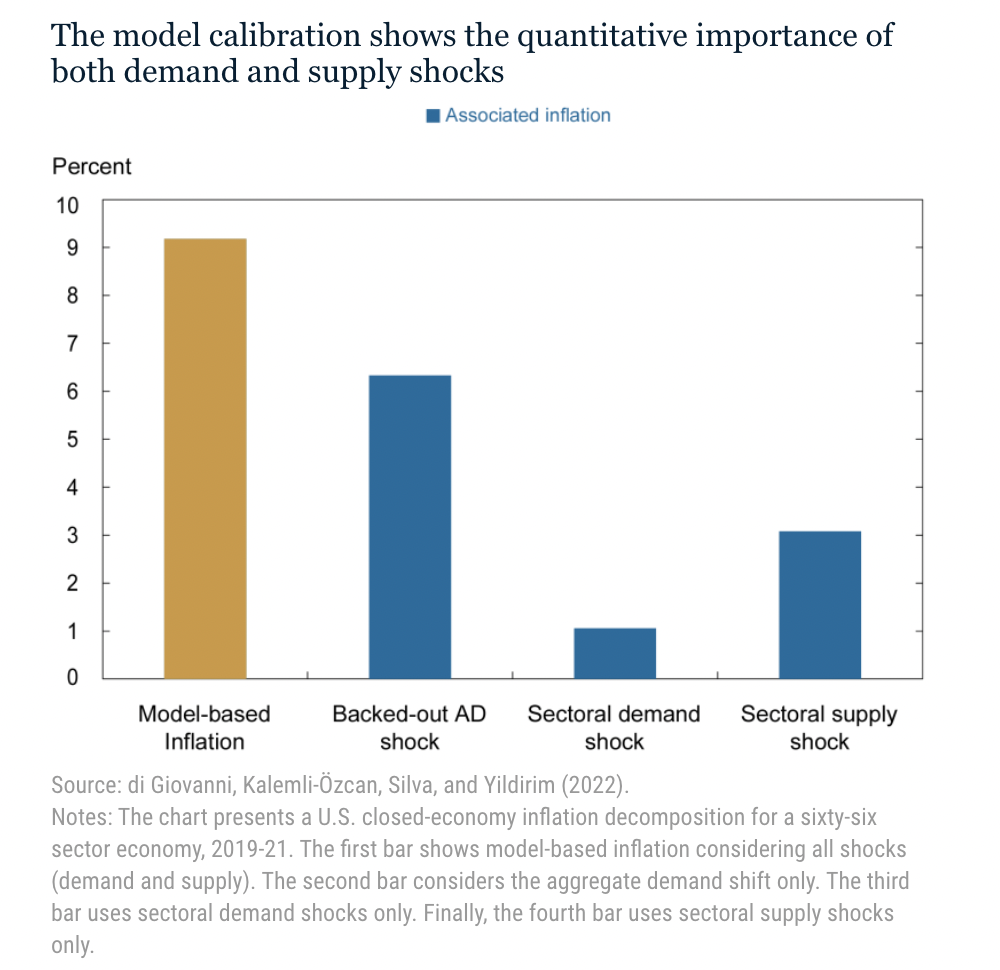

The Atlanta Fed’s GDPNow forecast has Q2 GDP at -2.1% following Friday’s manufacturing knowledge.

“After this morning’s Manufacturing ISM Report On Enterprise from the Institute for Provide Administration and the development report from the US Census Bureau, the nowcasts of second-quarter actual private consumption expenditures development and actual gross non-public home funding development decreased from 1.7 % and -13.2 %, respectively, to 0.8 % and -15.2 %, respectively,” the most recent report stated.

Two consecutive quarters of contraction is the standard definition of a recession. However it’s the NBER’s definition of declining financial exercise that’s the arbiter.

“The NBER’s definition emphasizes {that a} recession includes a big decline in financial exercise that’s unfold throughout the financial system and lasts quite a lot of months,” it says. “In our interpretation of this definition, we deal with the three standards – depth, diffusion, and length – as considerably interchangeable.”

“That’s, whereas every criterion must be met individually to a point, excessive situations revealed by one criterion could partially offset weaker indications from one other,” it added.

“For instance, within the case of the February 2020 peak in financial exercise, the committee concluded that the following drop in exercise had been so nice and so extensively subtle all through the financial system that, even when it proved to be fairly temporary, the downturn ought to be categorized as a recession.”

“The NBER’s definition of recessions is intentionally obscure,” Pantheon Macro Chief Economist Ian Shepherdson stated. However “they normally require a decline in payrolls to validate the message from different knowledge.”

“Payrolls rose by a mean of about 440K per 30 days throughout the primary half of the yr, a tempo extra in step with a raging increase than recession, although a lot of the rise presumably displays continued post-Covid catch-up hiring.”

Getting again to shares, Jim Paulsen, strategist on the Leuthold Group, famous that the New York Fed’s recession mannequin, which makes use of the 10-year/3-month Treasury yield curve to foretell a recession in 12 months is simply at 4.1%.

“Whereas most fashions counsel the chance of recession within the subsequent twelve months is minimal, fears of a recession are terribly excessive,” Paulson wrote. “Subsequently, many imagine bottom-up Wall Avenue analysts will quickly be pressured to considerably decrease most firms’ earnings estimates”

“Nonetheless, if historical past is any information, till the NY Fed’s recession mannequin rises to at the very least 20%, maybe EPS fundamentals will proceed to be a nice shock?”

See how in actual phrases, inventory are Civil Conflict efficiency.

![Manchester United superstar Cristiano Ronaldo hilariously recreates Antony’s special spin [WATCH] Manchester United superstar Cristiano Ronaldo hilariously recreates Antony’s special spin [WATCH]](https://staticc.sportskeeda.com/editor/2022/11/b94b7-16672846828916-1920.jpg)