Portra/E+ by way of Getty Pictures

Are 55 and older staff propping up the U.S. economic system? The info is quite persuasive that the reply is “sure.”

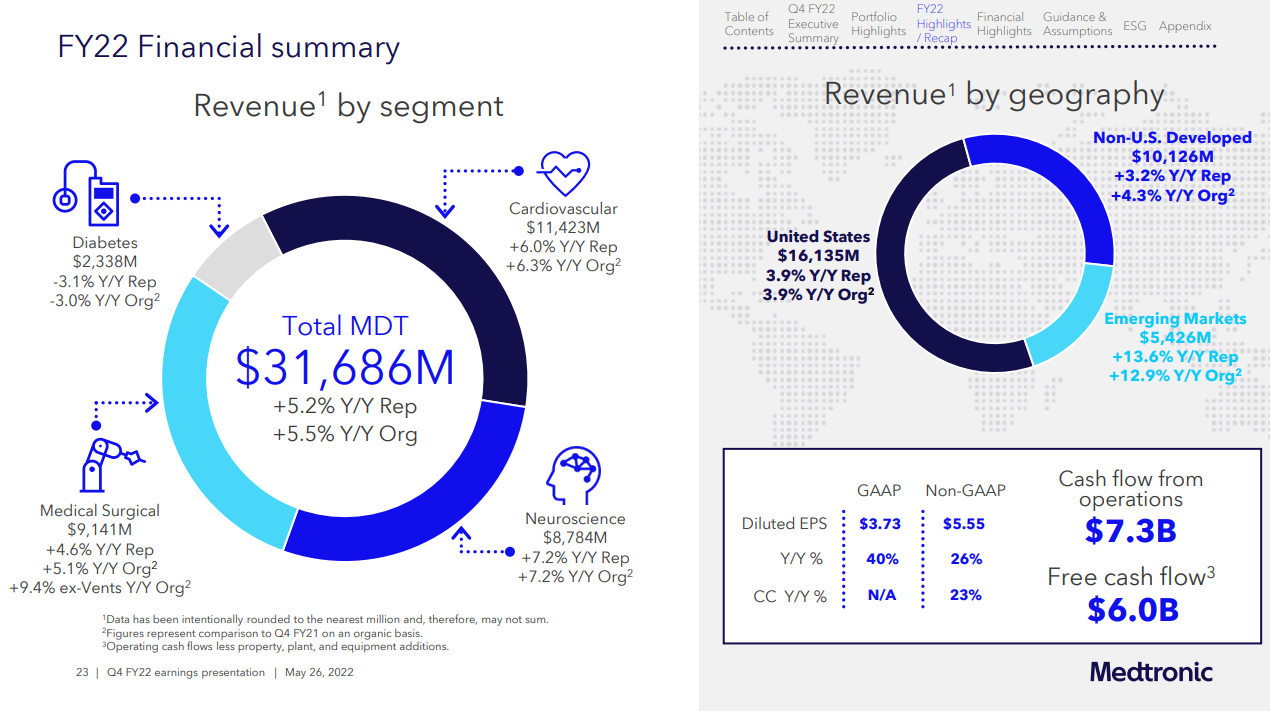

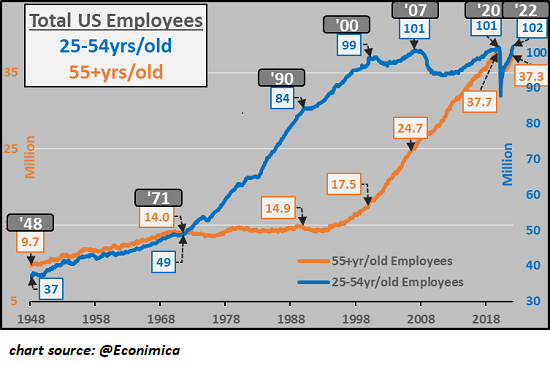

The chart of U.S. employment ages 25 to 54 years of age and 55 and older reveals a startling change.

There at the moment are 20 million extra 55+ employed than there have been in 2000, an equal of your entire workforce of Spain. This unprecedented demographic / employment transition is price a better look.

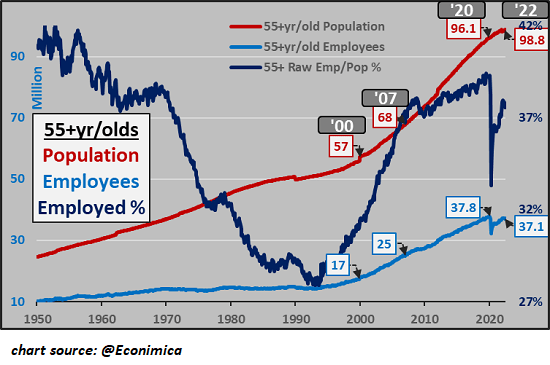

Because the second chart exhibits, a few of this enhance is because of the rising inhabitants of Individuals over 55 years of age – a rise of 42 million. In 2000, 30% of these 55 and older had been employed. At the moment, over 37% are employed – a big enhance within the proportion of 55+ people who find themselves working.

A rise of 20 million workers age 55 and older is so massive that it is tough to understand. A rise equal to a whole nation’s workforce is one approach to make sense of it. One other is to take a look at the rise of America’s complete inhabitants from 2000 to 2022, which is about 48 million individuals (282 million in 2000, 330 million at this time).

The whole U.S. inhabitants elevated by 17%. The 55+ inhabitants elevated by 42 million (from 57 million in 2000 to 99 million at this time), a 74% enhance. Complete employment within the 55+ cohort elevated by 113%.

In 2000, solely 17.6% of the 55 and older populace had a job. Now the proportion is 37.5% A 20% enhance within the proportion of 55+ who’re employed in a 20-year span is unprecedented.

If the proportion of employed 55+ had stayed the identical, there would solely be 17 million 55+ staff at this time. As an alternative, there are over 37 million. This raises a query: why are so many older staff persevering with to work longer than they did in 1990 and 2000?

I doubt there’s one trigger or reply. We will attribute this dramatic shift to various causes: older households that by no means recovered from the monetary injury wrought by the 2008-09 International Monetary Meltdown; older staff (like me) who solely have Social Safety for retirement revenue who cannot get by on simply their SSA test; those that take pleasure in their work and see no cause to cease; individuals who retired and have become bored out of their minds so that they returned to the workforce; mother and father who maintain working to assist their offspring and/or aged mother and father; individuals who maintain working to take care of healthcare protection till they qualify for Medicare; older entrepreneurs who can dial again their workload however who nonetheless love their work, and so forth.

All of those mirror structural modifications within the U.S. economic system: a gradual decline within the buying energy of wages and monetary safety, systemic publicity to the dangers of monetary bubbles bursting, and many others. The underside line is that nest eggs that had been deemed sufficient are not sufficient, and the one approach to fill the hole is to maintain incomes cash.

These modifications are mirrored within the decline within the proportion of employed 55+ individuals from 28% in 1970 to 18% in 1990 and 2000, and the following rise to 37%. In an economic system with an increasing workforce of younger workers and rising productiveness, extra older staff may retire early. That is not the case.

In lots of instances, there isn’t any nest egg because of chapter by way of large medical payments, the heavy burdens of pupil loans, or the prices of serving to youngsters and grandchildren or very aged mother and father. (Many people aged 65-70 are caring for mother and father 90+ years of age and serving to out with energetic 3-year olds. Retirement? You are joking.)

Consequently, bills have risen quite than dropped for the 55+ cohort, requiring an revenue to stabilize family funds. (Have you ever checked out childcare (grandchildren) and aged care (mother and father) prices not too long ago?)

One other necessary structural change is the demand for staff of any age who’re dependable and capable of do the work. People who find themselves accustomed to the constructions of labor by advantage of 40 or 50 years of employment are usually dependable staff and thus valued by employers beset by a shortage of dependable, productive workers. (My first formal paycheck was issued by Dole Pineapple in 1970. That is 52 years of getting accustomed to the calls for of employment. I am fairly effectively damaged in now.)

There are additionally demographic and cultural dynamics in play: the persevering with satisfactions of labor and the lack of function many really feel in retirement, the decline in age discrimination, longer lifespans, and many others.

Regardless of the causes, 37 million staff 55 and older are incomes cash that is flowing into the economic system and offering steady productiveness – 20 million extra 55+ staff than 20 years in the past. These 20 million jobs generate revenue that is not simply funding cruises and RVs. In lots of instances, it is supporting a number of generations on both aspect of the 55+ cohort.

Are 55 and older staff propping up the U.S. economic system? The info is quite persuasive that the reply is “sure.”

(Charts courtesy of CH @Econimica)

Complete US Workers – 25-54 years previous; 55+ years previous 55+ yr olds – Inhabitants, Workers, % Employed

Authentic Submit

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.