Kwangmoozaa/iStock via Getty Images

Investment Thesis

The allure of high dividend yields often draws in investors, but the outcome may ultimately disappoint. Despite the appealing 9.5% dividend yield of Ardagh Metal Packaging (NYSE:AMBP), our cash flow analysis reveals possible sustainability concerns over the long term. While we anticipate that the quarterly 10-cent payout will continue because:

- AMBP has enough resources to support the dividend, and

- the upstreamed dividend is crucial for funding the parent company Ardagh Group’s operations, the risk/reward ultimately skews to downside for investors.

To justify the current dividend payout, investors must have faith in AMBP’s ability to outpace the industry while not diluting margins.

Business Overview

In early 2021, Ardagh Group spun off its metal packaging business, Ardagh Metal Packaging, via a merger with a SPAC, valuing the company at $8.5 billion. AMBP is a partially-owned subsidiary of Ardagh Group, and is one of the world’s largest beverage can suppliers. With operations spanning across nine countries and 24 production facilities, AMBP employs more than 6,300 people and reported sales of approximately $4.7 billion and EBITDA of $625 million in FY2022.

In a consolidated market with rational competition, AMBP focuses on maintaining a plant utilization rate above 90% rather than competing on price, similar to other packaging companies. Packaging companies hold a unique position with their CPG customers, as packaging is necessary for transporting goods, yet only a small part of the final product’s cost, giving packaging companies pricing power. The regional focus of the industry further limits competition, particularly from imports, as transporting empty cans is not cost-effective.

For companies like AMBP, volume growth is the primary driver, dependent on consumer preference (e.g. drinking beer out of a glass bottle vs. an aluminum can) and new product innovation (e.g. carbonated water). Inflation has hindered volume growth over the past two years, but the packaging industry remains stable and performs well during market downturns. The beverage can market is expected to grow at an average of 5.3% annually from 2023 to 2023.

Dividend Analysis

At the time of its IPO in 2021, AMBP did not distribute dividends. However, the company started paying a quarterly dividend of 10 cents from Q1-2022, in our view to align itself with its dividend-paying competitors such as BALL and CCK. As of now, AMBP has paid out four dividends and has declared its Q1-2023 dividend.

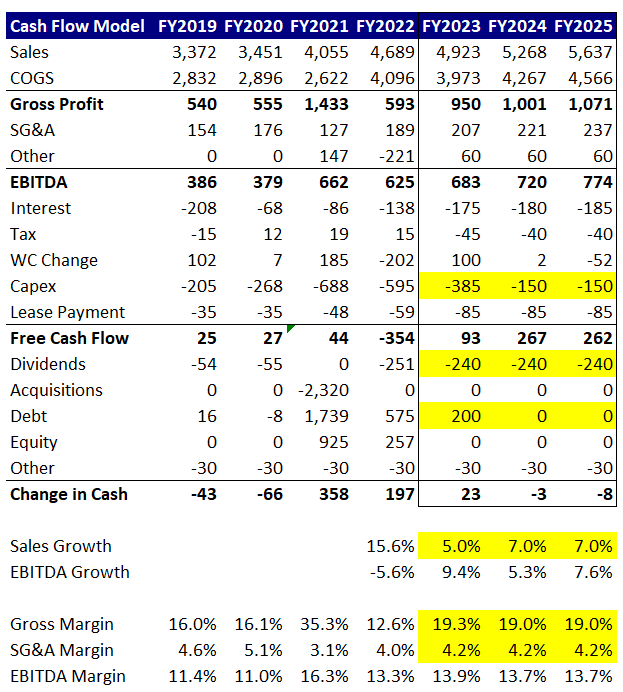

The cash flow model presented below indicates that AMBP incurred significant investment-related expenses during FY2021 and FY2022, with capital expenditures considerably higher than in the previous two years. Consequently, we believe initiating a dividend in FY2022 was not prudent. Moreover, in FY2022, AMBP not only had to assume additional debt but also had to issue a $250 million preferred stock to its parent company, Ardagh Group, to finance the dividend payout of $250 million.

During the earnings call, the management provided a walkthrough of other cash flow items for FY2023, including an EBITDA guidance of a 10% YoY increase. These items included an interest expense of $175 million, a cash tax of $45 million, a working capital benefit of $100 million, growth and maintenance capex of $385 million, and a lease payment of $85 million. Based on these figures, a positive free cash flow is projected, but it still falls short of the $240 million dividend payout. However, given that AMBP has a total liquidity of $970 million ($555 million cash on hand and $415 million revolver capacity), we believe that the FY2023 dividend can and will be funded through either the cash on hand or by tapping into the revolver.

Taking a longer-term perspective on FY2024 and FY2025, the sustainability of the dividend relies on AMBP’s ability to increase volume and utilize the expanded capacity it invested in between FY2021 and FY2023. According to our calculations, to support the $240 million dividend, the top line needs to grow by a minimum of 7%, along with a margin expansion, and a reduction in growth capex. This growth rate is higher than the industry expected growth as mentioned above. Therefore, the existing business alone is not sufficient to support the dividend, putting the probability of it continuing beyond FY2023 into jeopardy

Over the past decade, beverage can volume has grown at a mid- to high-single-digit, driven by the secular trend of glass-to-can switching and new product innovation such as seltzer water. The outlook for beverage cans is positive from an ESG perspective, as they are infinitely recyclable in theory, and their manufacturing process is less energy-intensive than that of glass. Although we believe that the required 7% growth is reasonably achievable, there are some short-term factors that could potentially hinder this trend. Firstly, inflation has impacted volume growth in FY2022, and while goods inflation is expected to decline, we believe it could remain structurally higher going forward. Additionally, although the packaging industry has historically been defensive during a recession due to its stable end-markets, volume growth may still hit a ceiling during an economic downturn. Considering that AMBP’s current dividend level necessitates a top-line growth of at least 7%, we believe that the dividend is at risk, regardless of the management team’s confidence in its sustainability.

Author

Majority Shareholder is Heavily Dependent on Dividend

It is important to note that Ardagh Group owns approximately 80% of AMBP, and most of the dividend is funneled back to the parent company. Ardagh Group has a highly leveraged balance sheet with a net leverage ratio of 6.2x and is currently in an investment phase, with a planned capex of $650 million for FY2023. Including a $300 million interest expense and a $50 million working capital draw, Ardagh Group is projected to have a cash outlay of $1.0 billion. The source of this cash outlay is expected to be $850 million in EBITDA (guidance) and roughly $200 million in dividends from AMBP. This is a crucial reason why we believe that the dividend for AMBP will remain in place for the foreseeable future, as Ardagh Group views the dividend as a source of funding. However, this could potentially change once the investment intensity decreases in a few years or if the parent company de-levers its balance sheet.

Given the handcuffs that AMBP is constrained by to support this dividend, investors are exposed to a dividend policy that is catered to one shareholder and not fairly compensated for this risk.

Risks

Apart from the volume risk mentioned earlier, any deterioration in the credit market could increase AMBP’s cost of capital in the next refinancing. All of AMBP’s bonds are trading well below par, indicating that the cost of capital has already risen. Fortunately, AMBP’s upcoming maturity is a relatively modest $415 million asset-based loan facility, so the higher cost of capital has not directly impacted AMBP. However, if this elevated interest rate environment persists, AMBP may have to decrease its debt level to lower its cost of capital, which could entail reducing the dividend and utilizing the funds to strengthen the balance sheet.

Upside

It seems unlikely that AMBP can sustain, let alone increase, its current dividend in the long term. We believe that if the majority shareholder, Ardagh Group, decreases its leverage in the next two years, the dividend could be set to a more optimal level. Ultimately this would allow AMBP to reinvest as appropriate and return more value to shareholders. Although the stock may initially receive a negative response, the risk of holding AMBP after the dividend cut would be significantly less and have further upside, particularly when AMBP is no longer functioning as a funding vehicle for the parent company.

Conclusion

In our view, AMBP initiated the dividend prematurely and should have waited until the investment phase was completed and volume growth was more apparent. Although, our analysis indicates that AMBP can maintain the dividend due to its strong liquidity position, the additional risk introduces excessive risk that we do not expect investors to be compensated for. Furthermore, the overly constraining dividend is expected to remain in place since the parent company, Ardagh Group, requires the funds to finance its own operations. Our assessment is that the dividend for AMBP will continue for at least FY2023 and potentially even FY2024, but there are significant risks regarding its long-term sustainability. We recommend investors steer clear of AMBP until they either have a path to grow out of their currently burdensome dividend commitments or reduce the dividend payout.