Nikita Burdenkov

Ardagh Metal Packaging (NYSE:AMBP) was one of Mare Evidence Lab’s 2022 top-pick that was not in line with our stock price expectations. Today, we are taking the time to review our investment thesis and to provide further insight into the company’s future development. In our initiation of coverage, we were overweight AMBP for macro and micro reasons. In detail, we positively view 1) the ban on single-use plastic, 2) the Ardagh packaging replacement solution for our day-to-day life, 3) a “doing good while doing well” ESG player, 4) a tasty dividend payment with a yield of almost 8%, and 5) an interesting entry point based on EV/EBITDA multiple as well as an FCF yield.

All related to our points 1-2-3), the ban on single-use plastics is a worldwide effort to decrease the amount of plastic waste that ends up in our lands and oceans. Single-use plastics are items like plastic bags, straws, water bottles, and utensils that are designed to be used once and then discarded. As we all know, these items are a major contributor to plastic pollution and can take hundreds of years to decompose. Many countries have implemented restrictions or bans on single-use plastics to reduce their environmental impact. The goal is to encourage people to switch to more sustainable alternatives and Ardagh’s packaging replacement solution is a clear example of this thesis. In addition, some countries (especially in Europe) have implemented fees or taxes on single-use plastics to discourage their use and encourage people to make more environmentally friendly choices.

For the above reason, the global can industry has been growing steadily over the years, driven by the increasing demand for packaged food and beverages. For the future, we estimated a CAGR of 3% over the next five years. In specific, the food cans market is expected to experience significant growth, especially in emerging economies due to the increasing urbanization, rising disposable income, and growing population. In addition, the beverage cans segment is also forecasted to increase due to higher demand for alcoholic beverages (such as beers) and energy drinks.

Q4 results

Yesterday, the company released its quarterly update and was penalized by Wall Street with a minus 5.7%. Why? EBITDA missed expectations by 11%, in numbers, sell-side analysts were forecasting an average EBITDA of $175 million, and more importantly to report, Ardagh Metal Packaging volume shipments grew by only 1% on a yearly basis, while its closest competitor Crown Holdings volume was up by 3%. Going into detail and looking at the divisional highlights, America’s Q4 EBITDA reached $114 million and was below guidance. This was mainly due to higher input costs and even if it was not enough, the company recorded a favorable volume/mix evaluation. On a quarterly basis, the EBITDA margin improved by 3 basis points. The same negative results were achieved in Europe, where EBITDA was again a miss ($45 million versus a consensus average of $49 million), and the margin declined by more than 17% due to negative FX evolution. Looking at the aggregate level, the specialty cans division is now contributing to 48% of the company’s total yearly shipments, up by 3% compared to 2021. Aside from the higher input costs in Europe which recorded a minus 160 basis points in the margin, the EBITDA miss was primarily driven by Brazilian volume weaker performance with a decline of 8% on a yearly basis. Going to the forecast numbers:

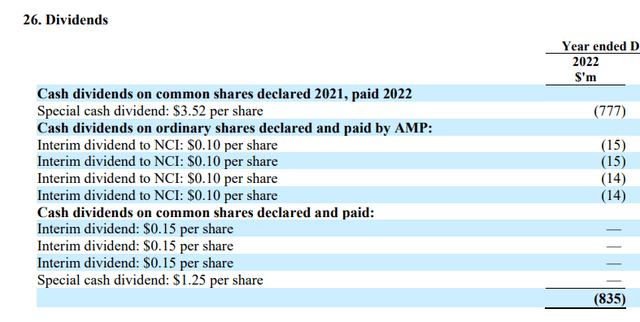

- The company announced its quarterly dividend per share payment set at $0.10, so we are now forecasting a total payment consideration of $60 million per quarter, totaling $240 million per year. Even considering the NCI dividend payment, the total dividend payment is considerably down vs the previous year which was impacted by a special dividend distribution (Fig 1);

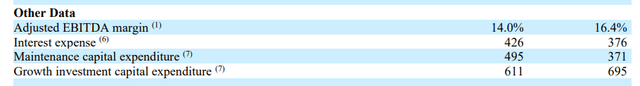

Financially speaking AMBP is well placed for 2023 with lower CAPEX requirements. We are estimating a capital commitment at <$300 million from the $495 million deployed in 2022 (Fig 2);

Despite the special dividend payment, the company has an ample liquidity buffer at $970 million (including cash equivalents of $555 million and an ABL facility for $415 million);

AMBP leverage reached 4.9x EBITDA; however, there is no debt maturity before 2027. We are forecasting $430 million in interest expenses for 2023 accounts.

Ardagh dividend payment

(Fig 1)

Ardagh Financials in a Snap

(Fig 2)

Conclusion

After having participated at the Credit Suisse Global Industrials Conference, our internal team came away with an increasingly high conviction idea in the AMBP operating model. While we acknowledge recent challenges, we are more confident in the company’s long-term growth earnings potential. Our investment thesis remains intact and the incremental industrial capacity which will be completed by the 2023 year-end will be a positive catalyst. In addition, during the Q&A call, the CEO reported that clients’ inventories are at a low level and this might support volume growth in 2023 H1. Indeed, clients’ inventory is now normalizing and this year should lead to normal ordering patterns. On the supply chain, ocean freight rates are now down from recent highs and Ardagh Metal Packaging might potentially benefit from this development.

Valuation and risks

The 2023 outlook was below expectations, but we believe they are now more realistic projections. Last time, 2022 EBITDA was further cut to a range between $640 and $650 million, now we are forecasting a $670 million with mid-single-digit growth in volumes. Thanks to a solid order backlog that provides visibility to at least 2024, we decided to reduce AMBP valuation from $10 to $8 per share, but we still maintain an outperforming rating (the company is trading at $5.08 per share). Our price is still derived based on an EV/EBITDA of 10x with an FCF yield of 9%.

Ardagh Metal Packaging’s key risks include excess supply/demand imbalance, CAPEX growth execution, stronger $ evolution, higher input costs, and specialty demand curve. Here at the Lab, we also commented on Ardagh’s half-year and Q3 results.