FocalFinder/iStock through Getty Photographs

Funding Overview

On the finish of January this 12 months, I shared a word on In search of Alpha masking Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT). This can be a Westlake Village, California-based biotech that markets and sells two dermatological merchandise — ZORYVE® (roflumilast) cream 0.3%, and ZORYVE® (roflumilast) topical foam 0.3%.

Roflumilast is — in keeping with Arcutis’ Q2 2024 quarterly report / 10Q submission:

a extremely potent and selective phosphodiesterase-4 (“PDE4”) inhibitor. PDE4 is a longtime organic goal in dermatology, with a number of PDE4 inhibitors accredited by the FDA for the therapy of dermatological situations.

Zoryve cream was accredited to deal with plaque psoriasis in July 2022, and likewise to deal with psoriasis in kids ages 6-11 in October 2023. The froth product was accredited to deal with seborrheic dermatitis in sufferers aged 9 years and above in December 2023. In July this 12 months, the cream product secured its third main approval, for the therapy of atopic dermatitis (“AD”) in adults and youngsters aged 6 years and above.

Arcutis accomplished its IPO in January 2020, elevating ~$160m through the issuance of 9.375m shares priced at $17 per share. On the time of this word, the corporate’s traded share worth is $8.3, which means shares are down ~50% since IPO.

The scenario was considerably worse on the time of my final word, nevertheless, with inventory valued <$6 per share. My thesis was that sluggish gross sales of Zoryve merchandise had been weighing closely on the corporate valuation — I famous that:

Throughout the primary three quarters of 2023, internet revenues from Zoryve amounted to $2.8m, $4.8m, and $8.1m, whereas Arcutis’ internet losses amounted to $(80.1m), $(71m), and $(44.8m). Collected deficit as of Q3 2023 amounted to $(916m).

Probably readers would agree these figures make for robust studying, however I gave Arcutis inventory a “Purchase” ranking in January, arguing that there have been two methods of trying on the firm’s industrial / monetary predicament. Both the corporate was “operating out of steam” and struggling to compete in profitable, however crowded therapy markets, or that:

we might put Arcutis underperformance with regard to Zoryve revenues all the way down to inexperience out there place, sluggish uptake amongst physicians, and a smaller addressable market within the plaque psoriasis market.

Every of those issues may very well be solved in 2024, as administration good points extra perception into market dynamics – pricing has already emerged as a key differentiator between merchandise – present physicians proceed to prescribe and persuade colleagues to prescribe – and the market alternative converts right into a multi-billion greenback one, due to extra approvals, in AD primarily.

Clearly, the latter thesis proved appropriate, as shares have risen in worth by >40% since my word, however revisiting the thesis almost 8 months on, does it stay legitimate?

On this submit, I’ll reply this query by analyzing the corporate’s current efficiency, and discussing the newest market dynamics, and attempt to present some ideas as to the place I consider the share worth could also be heading subsequent.

Let’s start by taking a look at Q2 2024 earnings, launched on August 14th.

Arcutis — Q2 2024 Earnings Evaluate

In Q2 2024, Arcutis reported revenues of $30.9m — up a formidable 547% year-on-year. Zoryve foam earned $13.6m of revenues, and Zoryve cream $17.3m of revenues. Web losses additionally narrowed considerably, to $(52.3m) for the quarter, and $(87.4m) for the half 12 months, versus a quarterly lack of $(82m) for a similar interval final 12 months, and a half-yearly lack of $(143m).

On the finish of January, Arcutis filed for a $300m combined securities’ shelf, elevating $150m on the finish of February, at $9.5 per share. The corporate’s inventory had been making sturdy good points all through January and February, rising from <$3 per share to ~$12 per share through the interval. It’s maybe buoyed by the froth approval and cream label expansions in December 2023, and optimistic analyst sentiment, triggered by higher than anticipated adoption developments.

Arcutis reported $363m of money as of the tip of Q2 2024, versus $203.8m of long-term debt, which it was in a position to renegotiate phrases on throughout Q2. The corporate’s new Chief Monetary Officer, David Topper, who joined in April from Inmagene Bio, mentioned the modifications as follows through the Q2 earnings name:

The revised deal, which turns into efficient initially of October of this 12 months, offers quite a few crucial enhancements, together with an prolonged maturity to eight/1/29, a lower within the rate of interest of 150 foundation factors, the pliability to repay as much as $100 million within the fourth quarter this 12 months, along with the power to redraw that cash anytime by means of the primary half of 2026, thereby saving us appreciable curiosity expense. We have additionally deferred our 6.95% exit payment on the redrawn $100 million to the August 2029 maturity date and take away restrictions on asset purchases.

All in all, then, it was a stable quarter for Arcutis, with income rising, losses narrowing, new merchandise performing strongly, and debt restructured to make it much less onerous. The corporate was additionally in a position to announce a strategic collaboration and licensing settlement for roflumilast merchandise with Japanese firm Sato Pharmaceutical. Based on a press launch:

Underneath the phrases of the settlement, Arcutis will obtain an upfront fee of $25 million, and probably an extra $40 million if sure regulatory and gross sales milestones are achieved. Arcutis can be eligible to obtain tiered, low double-digit share royalties.

With all that mentioned, since reaching a share worth excessive of $12.5 in April, simply earlier than the combined shelf announcement, Arcutis inventory has retreated in worth to $8.4 per share on the time of writing. This provides the corporate a market cap valuation of $983m, and there are some uncertainties for buyers to think about.

No 2024 Steerage, Ongoing Losses, Rising Competitors

Administration has declined to offer any full-year 2024 steering, and the enterprise stays unprofitable — on the present charge of losses, money may very well be near exhausted by the tip of subsequent 12 months, necessitating one other dilutive fundraising. Addressing profitability on the Q2 earnings name, CFO topper advised analysts:

I am not going to touch upon timing to profitability or breakeven, however what I’ll say, clearly, in case you break SG&A into S on the one hand, and G&A then again, promoting clearly, is at all times going to be fairly intently correlated with income. So the best way you get to interrupt even in this type of enterprise, clearly is thru economies of scale on the G&A gadgets, proper?

Briefly, the extra product gross sales Arcutis makes, the sooner it’s going to transfer to profitability, which is encouraging, though the CFO additionally instructed the trail to profitability is not going to essentially be so linear:

Now, clearly, circumstances can change while you launch merchandise like AD, for instance, or launch a PCP program, you do incur some startup prices and issues like that.

Analysts at Mizuho have beforehand instructed that Zoryve might obtain peak annual revenues of $1.8bn — $3.8bn by 2030, which, if true, makes a robust bull case for an organization whose market cap valuation stays <$1bn.

Even with a comparatively modest worth to gross sales ratio of ~3x, if Arcutis had been to satisfy Mizuho’s expectations, the corporate should be valued at >$6bn, offered it was additionally to realize profitability earlier than the tip of the last decade.

Zoryve shouldn’t be the one topical cream obtainable to sufferers within the indications of psoriasis and atopic dermatitis, nevertheless. Incyte Company’s (INCY) Opzelura, accredited to deal with AD, earned $338m of revenues final 12 months, up 160% year-on-year. Roivant’s (ROIV) Vtama might have earned solely $18.4m of revenues in fiscal Q1 2025, however the firm has submitted a supplementary NDA (“sNDA”) to the FDA requesting approval within the bigger AD indication, which is prone to be accredited.

With competitors intensifying in its core markets, not solely from different topical lotions, but additionally from the likes of Sanofi (SNY) and Regeneron’s (REGN) Dupixent – >$12bn revenues throughout a spread of dermatological indications in 2023 — can Arcutis proceed to develop Zoryve’s market share?

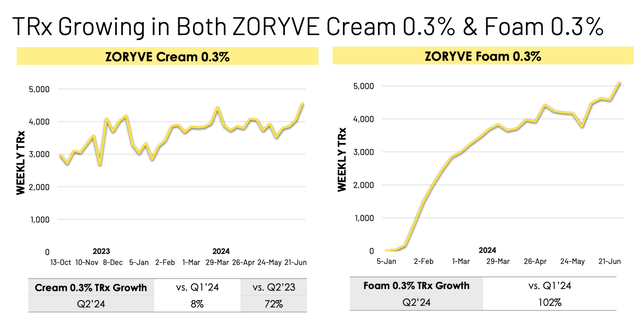

Zoryve TRx development (earnings presentation)

As we are able to see above, prescription development for the extra not too long ago launched foam product has been spectacular, and cream prescriptions additionally proceed to develop, though there may be some indication of development plateauing considerably.

Wanting Forward — New Merchandise & New Approvals Encourage, However Share Value Buoyancy Hangs In Stability

One main purpose for optimism that Arcutis inventory can embark on one other bull run is the approval in AD secured on the finish of July. AD is a double-digit billion greenback market, and concurrent with the approval of Zoryve on this indication, Arcutis introduced the signing of a co-promotion settlement with Kowa Prescribed drugs America — in keeping with a press launch:

Kowa will leverage its major care gross sales drive to market and promote ZORYVE (roflumilast) cream and ZORYVE (roflumilast) foam to major care practitioners and pediatricians for all FDA accredited indications.

Arcutis will keep accountability for the advertising and gross sales of ZORYVE to dermatologists, different dermatology clinicians, and associated specialists. This partnership is anticipated to develop the overall addressable marketplace for ZORYVE, offering entry to a big portion of the 7.4 million sufferers handled exterior of dermatology workplaces.

Arcutis CEO Frank Watanabe advised analysts on the Q2 earnings name, in relation to the Kowa deal, that “we would not anticipate to see significant income contribution from these efforts till 2025.” Nevertheless, with a brand new, extra profitable market now in play, and an skilled accomplice added, there should be optimism across the type of income figures that may be achieved in 2025, even when administration are reluctant to offer any steering.

In the meantime, Arcutis’ pipeline consists of ARQ-255, a “deep-penetrating topical formulation of ivarmacitinib, a potent and extremely selective topical Janus kinase kind 1 (“JAK1”) inhibitor,” indicated for alopecia areata — a Part 1b research is underway — whereas Arcutis 2022 acquisition of Ducentis BioTherapeutics offers the corporate entry to candidate ARQ-234, “a fusion protein that may be a potent and extremely selective checkpoint agonist of the CD200 Receptor (CD200R)”, additionally concentrating on the AD market.

If we take into consideration the efficiency of Incyte’s Opzelura in 2023 – >$300m revenues — my intuition is that Arcutis will consider it might probably match or exceed that determine inside a few years. Due to this fact, including in psoriasis and seborrheic dermatitis, a income determine of ~$500m could also be achievable in 2026, I might speculate.

For now, my suspicion is that Mizuho’s perception that Zoryve is a “blockbuster” (>$1bn revenues each year) promoting product in ready, or perhaps a >$3bn each year promoting product, is way too bold. Nevertheless, a $500m promoting product should be sufficient to continue to grow the corporate valuation, offered prices and bills don’t spiral uncontrolled.

The truth that there might quickly be two different competing lotions throughout the psoriasis and AD markets doesn’t essentially imply Zoryve’s market share shall be impacted. We’re originally of those merchandise’ industrial journeys, not the tip, and having three separate firms pushing the non-steroidal, topical cream agenda may very well be a bonus somewhat than a hindrance.

As such, though Arcutis inventory has been declining since its sensational bull run from ~$3 per share, to $12 per share in early 2023, my feeling is that Q3 and This autumn revenues figures will impress Wall Avenue. Offered we additionally see continued motion in direction of break-even, the corporate’s efforts shall be rewarded with additional share worth good points.

I might set an higher restrict market cap valuation of ~$1.5bn which may very well be achieved by mid-2025, so the expansion story for Arcutis Biotherapeutics, Inc. inventory shouldn’t be explosive, in my opinion, nevertheless it stays tangible and achievable nonetheless.