With very fascinating efficiency outcomes.

It should’ve been previous midnight. I don’t keep in mind the place (possibly Medium?), however I realized one may use Google Finance’s API inside an internet spreadsheet to question inventory value information. 🤯 So, half-heartedly, I question some information and begin enjoying round. My go-to was the S&P500 (ticker: INDEXSP:.INX; known as SPX) and an equal ETF (ticker SPY).

Quick ahead a number of minutes, I’m wanting on the graph beneath.

Exploration

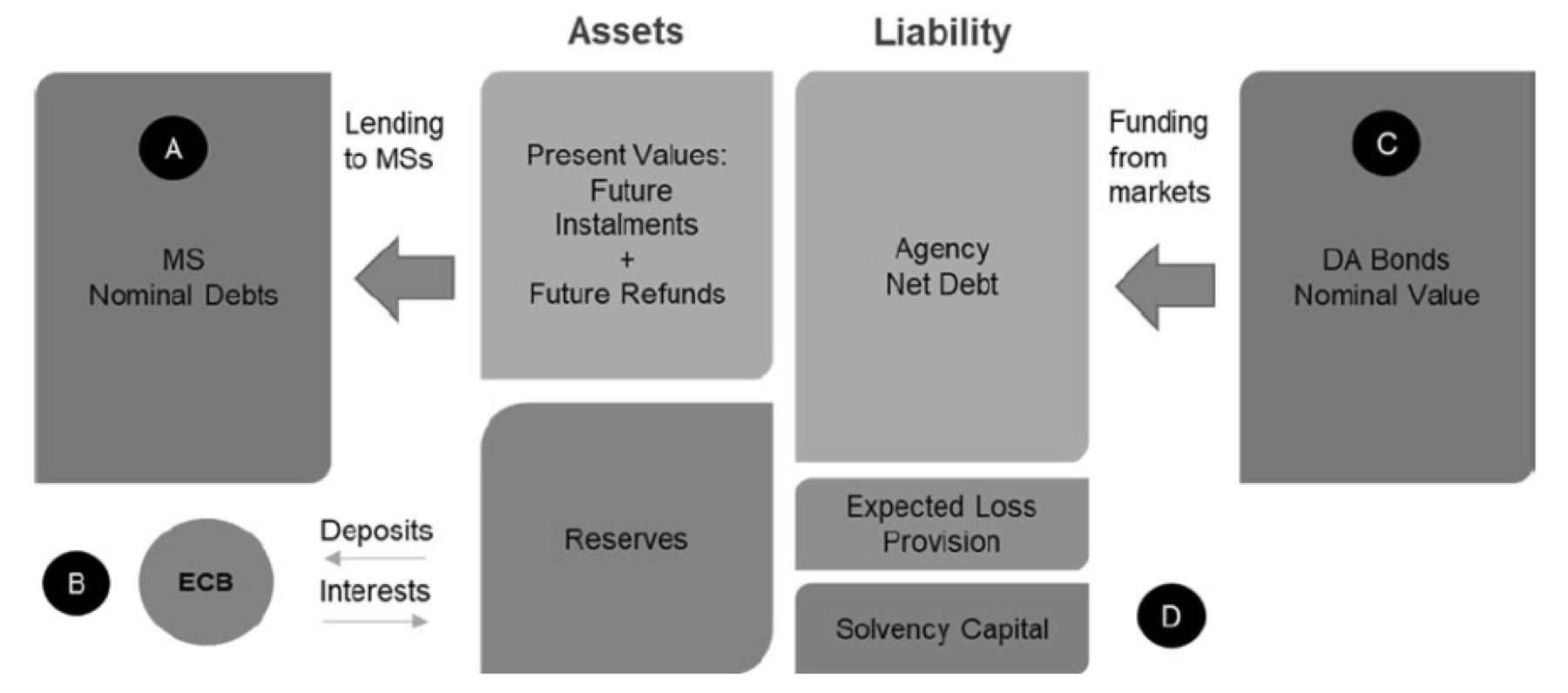

Three items stick out to me within the graph above: first, there appears to be cyclicality, then I see reversion conduct, and lastly, there appears to be an exponential progress/decay issue at play (a long-term development, if you’ll). Furthermore, it appears there are occasions when the worth of the index and the worth of the ETF differ in direction of and away from one another — there appears to be an arbitrary, slow-moving, center level.

From this, I bounce to the conclusion this may very well be a worthwhile discovering.

Quick ahead somewhat extra, I discovered that in sure components of the 12 months — 4 occasions EVERY YEAR actually, since 2013 — the worth of the connection comes off shortly, it normally takes +/- 5 days to finish, then the rest of the interval the worth of the connection slowly creeps upward, solely till it comes off once more.

For extra context, I take the S&P500 away from an element of the ETF, so when the worth of the funding drops, it implies the S&P500 weakens relative to the ETF. Or you might state it within the reverse, the ETF strengthens relative to the S&P500 throughout that interval.

Moreover, it doesn’t matter which leg is doing the work, as a result of the funding is predictable. Now, figuring out which leg is prone to do the work could be an much more worthwhile technique, however we’ll go away that on the desk for now.

Preliminary Analysis

In a scenario like this, the place we observe a sample with all our information, I’m at all times skeptical of evaluating outcomes. It’s the basic, “You can not use the identical information level for rigor, if it was used for inspiration.” Doing so is akin to tasting a beverage first earlier than hypothesizing whether or not or not you’re going to get pleasure from it— you simply can not try this.

In fact, I’m going to interrupt that rule, as a result of this text wouldn’t be as fascinating. It could be invaluable to test much more ETFs (than SPY) to see if this can be a phenomena that happens in additional locations than one. Should you try this work, please give your insights within the feedback beneath.

The technique right here is to be lengthy the funding the massive majority of the 12 months, besides once we suppose the connection will drop, then we might flip our place to quick. Keep in mind, I discussed this happens 4 occasions yearly and just for a +/- 5 days, so the technique will likely be quick for 20–30 days per 12 months and lengthy the remainder of the 12 months. The efficiency of this technique is proven within the graph beneath.

Stats: Win%=57.4; WghtWin%=64.2; AvgAnnPL=77.4; AvgAnnVaR=3.9; MaxDraw=26.2; AnnPL/MaxDraw=3.1; AnnPL/VaR=23.9; AnnPL/$Inv=0.015

It appears the technique performs higher, in a shorter window, throughout the giant drops within the funding. I feel that is why we see the weighted win p.c larger than the (unweighted) win p.c. It could be good to dimension positions in accordance with the chance of upper positive factors.

Once more, the wager of this technique is, for a lot of the 12 months, the S&P500 will strengthen relative to the ETF, and on occasion, we flip the logic of the wager.

Why does this conduct exist? What forces drive the continued divergence and fast reversion at completely different occasions of the 12 months (and the very same occasions from 12 months to 12 months)?

Assessment

Let’s take a step again, now that we perceive the technique somewhat higher, and critically take into consideration what these outcomes inform us.

The annualized PL / max day by day drawdown in addition to annualized PL/worth in danger each look nice. However, the most important situation I’ve with the efficiency stats is the annual PL/cash invested. 0.015 is horrible. That worth means I’ll make 1.5% of no matter I make investments, in a mean 12 months. Common Annual PL says we’ll make $77, however I’ve to speculate, on common, $5,133. So, if I wish to make any sort of cash on this technique, in a full 12 months — assuming I wish to make $10K — then I have to allocate $667K for the entire 12 months.

I don’t even suppose it’s price pursuing the evaluation additional. Do you?

Last Ideas

On this article we mentioned a extremely fascinating arbitrage between the S&P500 and one in every of its ETF’s: SPY. The technique we employed appeared promisingly predictive. Once we evaluated the selections the technique would have informed us to make by historical past, we realized the efficiency appeared wonderful. Put into context, after reviewing abstract statistics, we realized it might take a considerable amount of capital to make any affordable amount of money for somebody like me.

The query I’m left with is, “Wouldn’t it be definitely worth the funding?”

Go away your ideas within the feedback beneath. I might love for somebody to disagree with me.

***Please be suggested, I’ve not made any suggestions for buying and selling or investments. This text is for the reader — to not be taken as funding recommendation. Contact a monetary advisor for such inquiries. I’m not a monetary advisor.

If you’re all in favour of shares and buying and selling evaluation, I extremely suggest Webull. Webull supplies an incredible quantity of sources for analytics inside their app and/or web site.