Justin Sullivan

Overview

Apple (NASDAQ:AAPL) needs no introduction. Currently the undisputed king of the market, Apple has had a hectic start to September, driven mostly by news of the Chinese ban on government officials’ use of the iPhone. This was the latest development in a wider effort by China to promote the use of domestic technology and comes just over a year after a similar announcement about foreign-branded PCs. This announcement came shortly after news broke of a new Huawei phone touting a domestically-produced 5 or 7nm chip.

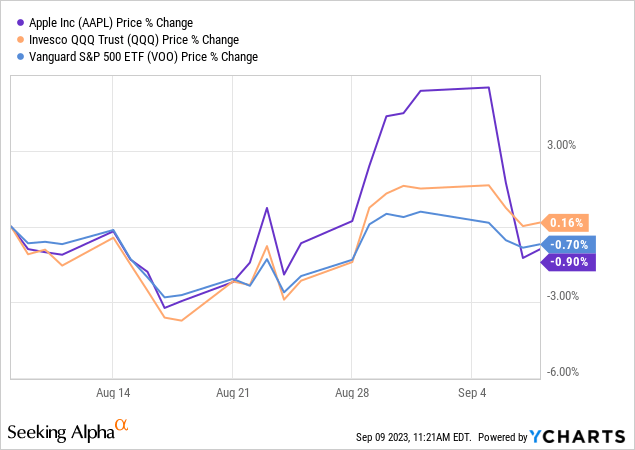

These two announcements caused quite a bit of FUD (Fear, Uncertainty, and Doubt) throughout the shortened trading week last week. Not only is the Chinese Communist Party taking a public stance against the iPhone, but Huawei and SMIC (China’s leading fab) are charging forward with innovations in chip design and manufacturing. Apple finished September 8th down over a 30-day period and is underperforming both the S&P and Nasdaq over that period:

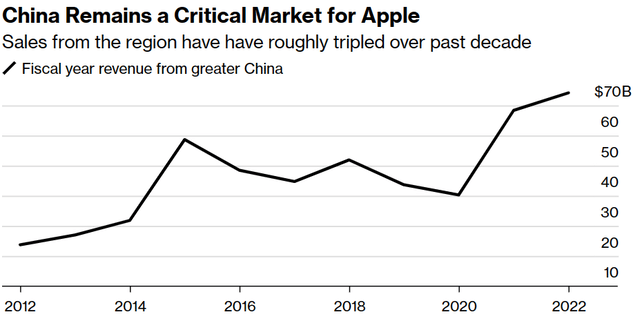

This selloff comes after a surprisingly strong 2023 and recognizes the importance of China for Apple’s ongoing growth:

Company Reports, Bloomberg

A reversal of this trend could materially impact Apple’s valuation, so let’s take a look at Huawei’s Mate 60 Pro’s competitive position against the iPhone.

Huawei vs Apple

China’s leading chip foundry, Semiconductor Manufacturing International Corporation (“SMIC”) has ASML Twinscan NXT:2000i deep ultraviolet (DUV) lithography machines, which are capable of fabbing both 5 and 7nm chips. While this is a huge step forward for China’s chip industry, it’s still far behind TSMC in terms of economic viability at these nodes. Meanwhile, additional export controls on lithography equipment will make this gap harder to bridge in the future. Not to mention Apple is reportedly moving to the 3nm node for the iPhone 15, while TSMC is beginning to research the N2 and N1.4 node production process. Huawei’s Mate 60 Pro phone is a strong step forward in achieving self-sufficiency but it’s still years behind the leading edge.

On top of that, Chinese progress is being actively hindered by U.S. sanctions, making it nearly unthinkable that they will catch up to TSMC and Apple anytime soon. Regardless, the Mate 60 line has stirred excitement in China and some buyers are motivated by a nationalistic desire to own Chinese-produced tech. While this may help reverse Huawei’s shrinking market share, it will not be a silver bullet. The hardware is an improvement but still lags behind Apple, so buyers looking for quality and performance will still be drawn to the iPhone.

The data backs this up. Apple has been eating Huawei’s lunch post-pandemic with material increases in market share. It’s clear that the Mate 60 phone line is a strategic attempt to reverse this trend. It’s priced in line with the iPhone 14 in the Chinese market, but this does not mean they are equal. The Mate 60 uses a 5nm chip at best (as reported by government-run Global Times, meanwhile a TechInsights analysis states this is a 7nm chip), while the iPhone 14 features a 4nm chip. The iPhone 14 is both cheaper and better than the Mate 60 and is soon to be replaced by the iPhone 15 (to be announced at the Apple event on September 12th). The iPhone 15 is expected to tout a 3nm chip, extending Apple’s lead on Huawei, making it unlikely that the Mate 60 line will sustainably reverse the troubling market share trend for Huawei. Not to mention, iPhone chips enjoy better unit economics since they are produced with EUV lithography technology versus SMIC’s DUV manufacturing. While DUV technology is impressive, EUV technology offers respectable throughput on leading-edge chips that aren’t possible with DUV manufacturing.

Meanwhile, China is years behind and fighting an uphill battle against a slew of sanctions. In his book Chip Wars, Chris Miller states:

Across the entire semiconductor supply chain, aggregating the impact of chip design, intellectual property, tools, fabrication, and other steps, Chinese firms have a 6 percent market share, compared to America’s 39 percent, South Korea’s 16 percent, or Taiwan’s 12 percent, according to Georgetown researchers.

China is starting the race from behind and is running against the weight of American sanctions. This does not mean China will simply roll over and cede defeat, but it illustrates the tall task facing Beijing. As the CCP continues pushing its chip industry forward, the iPhone will continue to offer market-leading processing power and innovation in China and should continue growing in the region. Despite ongoing efforts to make Huawei competitive, it’s still clear that Apple products are dominant. Apple offers higher quality products around the same price point as Huawei phones, and this lead is expected to continue expanding because of U.S. sanctions.

Trouble in Paradise

Despite the bull case above, it’s not all rosy for Apple. Earlier this year, Tim Cook said that Apple and China have a symbiotic relationship, but these developments are in stark contrast to that sentiment. After the pandemic highlighted just how interconnected and fragile the semiconductor supply chain is, geopolitical rivals have intensified rhetoric and nations globally are stepping up subsidies for domestic chip manufacturing capabilities.

From some angles, Apple’s situation is somewhat grim. Sales have now decreased for the third consecutive quarter. Meanwhile, China comprised 19% of 2022 sales and touts much stronger growth than the larger Americas and European markets. With China actively taking steps against Apple, a key growth vector is at risk while the top line has been shrinking quarterly.

In 2023, China overtook the North American region as the largest iPhone market. Mainland China accounted for 24% of Q2 iPhone shipments versus 21% for the United States according to TechInsights (as reported by the Wall Street Journal). This isn’t entirely a bad thing for Apple, though. Despite the recent political actions, Apple enjoyed a 65% market share in Q2 in China for phones above the $600 price point according to the same WSJ report. Huawei had only 18%. In the first half of 2020, this was roughly a 50/50 split.

Huawei’s Mate 60 line is likely the first in a series of attempts to reverse this trend. Bloomberg reported in August that Huawei is building a shadow network of fabs to sidestep US sanctions. Export controls on ASML EUV machines have made SMIC reliant on a costly and inefficient DUV multi-patterning manufacturing process, so any EUV capacity would be hugely beneficial. The goal of a shadow network would most likely be to build up EUV manufacturing capacity. If these shadow fabs are successful in sidestepping sanctions, China could continue catching up to the leading edge.

Undeserved FUD

At the time of writing, Apple is down over 6% in the past week. This is undeserved FUD and offers a compelling short term or long term entry point. While the Chinese drama is a notable headwind, there are numerous catalysts for strong price performance.

Wonderlust

Apple’s annual September conference, most notable for the annual release of a new iPhone version, is on September 12th, 2023. This event has been dubbed ‘Wonderlust’ and is expected to feature a new USB-C enabled iPhone 15, with base models featuring the A16 chip from last year’s iPhone 14 Pro models. The 15 Pro models will likely feature the new A17 chip and a titanium frame. New Watch models, a new USB-C enabled Airpods case, and iOS 17 are expected to be announced.

There will likely be 4 iPhone 15 offerings: iPhone 15 (6.1″ display), iPhone 15 (6.7″ display), iPhone 15 Pro (6.1″ display), and the iPhone 15 Pro Max (6.7″ display). The Pro and Pro Max versions should feature the new A17 chip, which offers 10-15% more processing power and 35% less power consumption. The A17 would be the first Apple chip built on TSMC’s 3nm node. Meaningful camera upgrades are also rumored. All this is likely coupled with a price increase in the Pro models, while standard models should be priced the same as standard 14 models.

The iPhone 15 may provide just the catalyst that Apple needs to start growing sales again after three negative quarters. Further, despite trouble in China Apple is enjoying strong growth in India, which has a larger population than China.

Apple AI

Apple is also rumored to be working on a Chatbot dubbed ‘Ajax’. Based on parameter size, this could be expected to fall between GPT 3.5 and 4 in terms of performance (better than 3.5, worse than 4). This would lead to a greatly enhanced Siri, which could be seen as soon as iOS18. Meanwhile, Apple Insider claims that Ajax is just the tip of the iceberg for AI applications within the Apple ecosystem. Apple is also developing its models with privacy in mind, which may help ease regulatory pressures over the long run, although it’s a short-term drag on the amount of data Apple can use for training.

While Apple has been characteristically secretive about AI applications within its ecosystem, we can safely assume that Apple is working on AI and it will be incorporated into Apple products over time.

Still a Buy

Despite the FUD stirred up by China and Huawei’s recent announcements, there are plentiful reasons to continue liking Apple. The market is punishing Apple too much which has created a solid entry point for both short term and long term buyers. Apple is the king of the market and is well-positioned to retain that title for a while. A strong ecosystem, plentiful market opportunities, and a promising pipeline of new products are just three reasons to be long Apple.