shapecharge

About a month ago, I detailed why I was losing faith in technology giant Apple Inc. (NASDAQ:AAPL). A number of data points were suggesting that future sales were not doing as well as expected, partly due to a lack of new product releases this fall. While my premise turned out to be correct regarding the company, shares have not acted the way I would have normally expected. Today, I’d like to discuss why that is, and why my stance on the stock has changed.

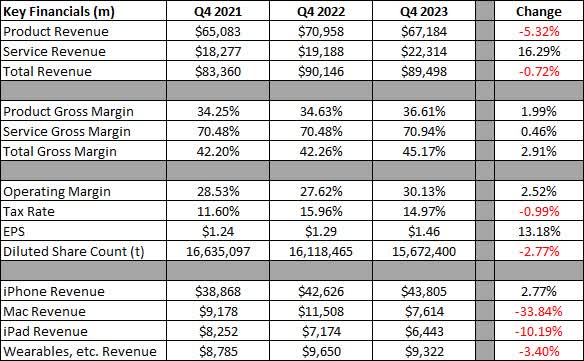

A couple of weeks ago, we received fiscal fourth quarter results from Apple (AAPL) for its September-ending quarter. The top line number of $89.5 billion was just ahead of analyst estimates, but the street average had come down by more than $1.1 billion since the August report. The iPhone was the only product segment to show year-over-year growth, and it, along the iPad and Services, beat their individual respective estimates. On the flip side, Wearables came in just below and the Mac line fell a bit short. Key results compared to the past two fiscal Q4 periods can be seen in the graphic below. The change column represents the year-over-year change from Q4 2022 to Q4 2023, while changes for margins and tax rates are the actual percentage difference between the two periods.

Q4 Key Results (Apple Earnings Releases)

Apple reported solid gains when looking at margins. Product margins were up rather nicely, perhaps due to an effective price raise for this year’s slate of iPhones. The high margin Services segment also showed some improvement, and it is becoming a larger portion of Apple’s total over time, helping the company’s wide gross margin figure. Management was also able to keep operating expense growth very limited, helping drive operating margins over 30% for the quarter. With a lower tax rate and help from the buyback, earnings per share growth came in at more than 13%, with the reported number beating the street by 7 cents. Management’s ability to control its cost structure means that the bottom line can still impress a bit even if the top line does not.

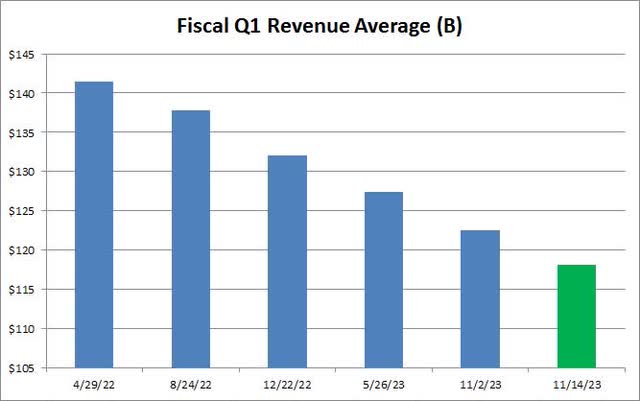

In my previous article on Apple, my biggest worry was a lack of revenue growth. For the first time in several years, the company had just reported four quarters of year-over-year revenue declines. As the chart below shows, Street analysts had cut their average Q1 revenue estimate by more than $18 billion in the roughly 18-month period going into the Q4 report. I still thought there were a number of headwinds coming Apple’s way, including competition from Huawei and no iPad refresh this year, along with the company’s headset not coming until calendar 2024.

It turned out that my stance on Apple the business was correct, because on the conference call, management said revenues in the December 2023 (fiscal Q1 2024) period would be similar to the year ago quarter. The street was looking for about 4.6% growth in the holiday period, and the current average estimate below in green now represents just 0.8% growth over last year’s period. Some analysts tried to defend the company by pointing to the calendar shift last year adding an extra week to that year’s sales period, but this was a known item that I’ve discussed for many months and should have already been factored into estimates.

Fiscal Q1 Revenue Average (Seeking Alpha)

Initially, Apple shares tumbled when guidance was given, falling below $170 in that after-hours session. However, shares have more than recovered since, and are now just a stone’s throw from their all-time high. Why is this? Well, it all has to do with the U.S. economy. The October jobs report was not great, and monthly wage growth was less than expected. Since then, gasoline prices have come down even more, and we had a couple of decent bond auctions. On Tuesday, consumer inflation data was a bit cooler than expected.

As a result, we’ve seen bond yields come down considerably in recent weeks. On October 22nd, the 10-Year yield (US10Y) was just below 5%, but it closed on Tuesday at 4.44%. With every new data point that suggests the Federal Reserve might be done hiking rates, the market rallies nicely, as we saw again on Tuesday. I will still note that Apple is up 5.70% since reporting earnings, yet that number has actually trailed the Invesco QQQ ETF (QQQ) that tracks the NASDAQ 100, which itself is up 6.02% over this time.

As of Tuesday’s close, Apple shares are trading at more than 28.5 times their expected earnings per share for this fiscal year ending next September. That’s more expensive than when I previously covered the name, but the market seems willing to pay that amount because rates are quite a bit lower. Also, even though revenue growth seems to be stagnant right now, the above mentioned margin progress has earnings per share growth looking to be more impressive than previously thought. Continued strong net income drives substantial cash flow here, and that benefits shareholders through dividends and a huge share repurchase plan.

With the overall market dynamic changing in recent weeks, I am thus upgrading Apple shares back to a hold today. I cannot say that I would buy Apple Inc. shares right now, given the tepid revenue growth situation and high valuation, combined with a 10% rally from the post-earnings low in just a couple of weeks. However, the market seems much less worried about U.S. inflation currently, and if the Fed is truly done with raising rates, large-cap tech is likely to head higher moving forward. In the end, while my view of Apple’s business was correct, the stock shook off the bad news with the overall market rallying.