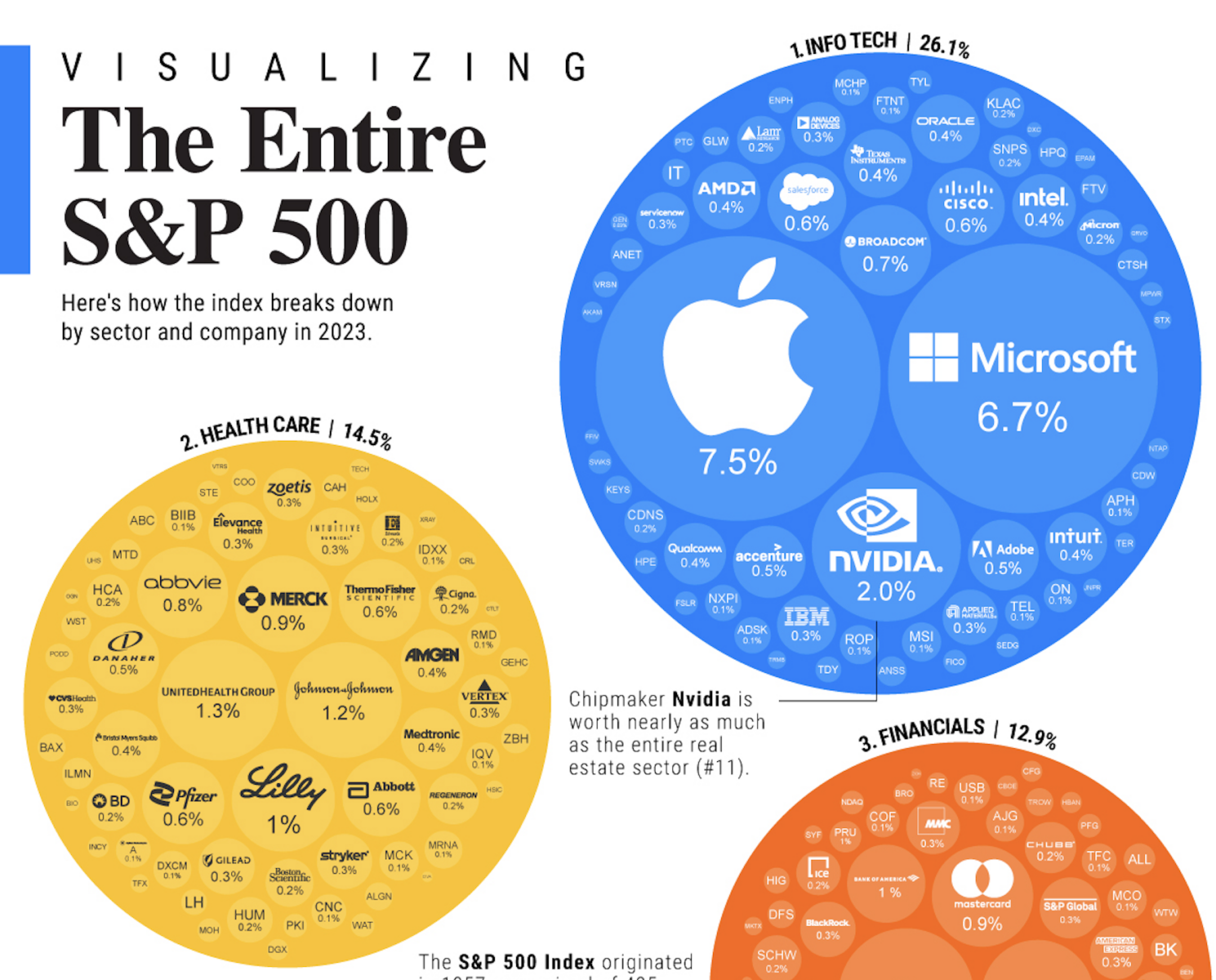

After a not-so-impressive start to the fiscal year, Apple Inc. (NASDAQ: AAPL) impressed the market this week by reporting stronger-than-expected earnings results. More iPhones were sold in the second quarter than widely expected, with record sales in emerging markets, underscoring the strength of the company’s signature product.

Apple’s stock made strong grains soon after the earnings announcement on Thursday evening, after starting the session sharply lower. Currently, the shares are hovering close to the record highs of early 2023. It is worth noting that the value has more than tippled in the past five years.

A Safe Bet

The consistent growth, reflecting the stock’s ability to bounce back quickly from temporary dips, underscores the efficiency of Apple’s unique business model. That justifies the bullish outlook on the stock and the strong investor interest. It has a good track record of creating shareholder value, a trend that should continue in the years to come.

That said, the business is not immune to the macroeconomic challenges and muted consumer sentiment. In the near term, areas like mobile gaming and digital advertising would remain under pressure from the current headwinds.

In the second quarter, Apple’s profit beat estimates after falling short of expectations in the previous quarter, which was the first miss in more than five years. At $1.52 per share, earnings remained unchanged from last year, while revenues dropped 3% to $94.8 billion. The topline performance was better than the consensus estimates — iPhone sales rose 1.5% and exceeded the forecast, rebounding from the slowdown experienced in the previous quarter when sales declined.

iPhone Power

What makes the recovery significant is that the broad smartphone market witnessed a double-digit fall in sales during that period. Last month, Apple opened its first flagship store in India, which according to experts could become a bigger market for the tech firm than China, where sales dropped 3%. Meanwhile, sales of Mac and iPad declined and missed estimates in Q2, in line with the management’s expectations. The Wearables, Home, and Accessories business was down 1%.

Apple’s CEO Tim Cook said on the latest call with analysts, “During the March quarter, we continue to face foreign-exchange headwinds, which had an impact of more than 500 basis points, as well as ongoing challenges related to the macroeconomic environment. Revenue was down 3% year-over-year as a result, while on a constant-currency basis, we grew in total and in the vast majority of the markets we track. Despite these challenges, we continue to manage for the long-term and to push the limits of what’s possible always-on behalf of the customers who depend on our products”

Services Shines

The highlight of the quarter was yet another strong performance by the rapidly-growing Services segment, with revenues rising 5% and hitting an all-time high of $20.91 billion. Encouraged by the healthy cash position – operating cash flow came in at $28.6 billion in Q2 – the management announced an additional program to repurchase up to $90 billion of the company’s shares. Around $23 billion was returned to shareholders during the quarter.

AAPL has been trading above its 52-week average for quite some time. The stock has gained steadily since the beginning of the year, growing an impressive 39% during that period. It closed Friday’s session up 5%, extending the post-earnings momentum.