Tom Werner

I reiterated my ‘Purchase’ ranking for Apple (NASDAQ:AAPL) in my earlier article revealed in Might 2024, highlighting its sturdy development in service enterprise. Since my final report, the inventory value has surged by greater than 19%, considerably outperforming the S&P 500 index (SP500). Apple is ready to report its Q3 outcome on August 1st. I anticipate sturdy development in its service enterprise however weak iPhone income development for FY24. Because the inventory value is overvalued, as per my calculation, I downgrade to a ‘Promote’ ranking with truthful worth of $180 per share.

Flat iPhone Progress Anticipated

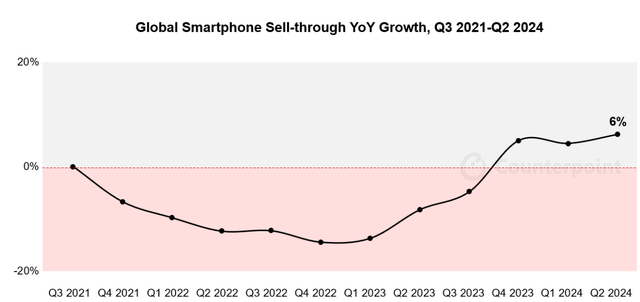

In line with the newest Counterpoint report launched on July 15th, international smartphone sell-through grew 6% year-over-year for the third consecutive quarter, as illustrated within the chart beneath.

Counterpoint Report (As of July fifteenth 2024)

Nevertheless, Apple’s international iPhone gross sales are anticipated to stay flat within the Counterpoint report, with sturdy development in Europe and LATAM, being offset by weak gross sales in China. As mentioned in my earlier article, Apple is dealing with sturdy competitors from Huawei in China. In April 2024, as reported by the media, Huawei launched its Pura 70 collection of smartphones, persevering with to create development challenges for Apple in China. Larger China accounted for greater than 18% of whole income in FY23; due to this fact, China stays a vital marketplace for Apple.

I count on Apple’s smartphone enterprise in China will proceed to lose market share to native gamers, resembling Huawei and Xiaomi, and the important thing causes are as follows:

- With the growing geopolitical tensions between the U.S. and China, the iPhone is unlikely to be favored within the home market in China because of the patriotism amongst Chinese language native customers.

- The high-net-worth people in China favor the iPhone model; nevertheless, the penetration of wealth Chinese language is near the tip, in my view. Within the close to future, iPhone’s development in China will primarily be pushed by alternative cycles.

- The rise of Huawei and its in-house developed chips might probably create vital development challenges for Apple in China.

Robust Service Progress Forward

Providers accounted for over 26% of whole income prior to now quarter, rising 14% year-over-year. As mentioned in my earlier coverages, I anticipate companies will turn out to be the brand new development driver for Apple within the close to future. Apple possesses vital benefits within the service market, together with:

- The large variety of gadgets in its put in base permits Apple to additional develop its subscription, App shops, fee and different companies. Solely Apple has the potential to leverage its gadgets to increase its service enterprise.

- Apple has been integrating AI into its apps and ecosystem of {hardware} and repair. On June 10th, OpenAI and Apple introduced partnership to combine ChatGPT into Apple experiences, together with iOS, iPadOS and mac OS techniques. I anticipate Apple will combine extra AI functionalities into its working techniques and {hardware} sooner or later, driving extra subscriptions income development.

Total, I estimate Apple’s service enterprise will proceed to develop at mid-teens, contributing 4%-5% to the topline development.

Outlook and Valuation

FY24 could be a transitional 12 months for Apple, because the iPhone 16 lineup is because of launch in September 2024. Based mostly on the efficiency of the primary two quarters, I estimate Apple will ship 3% income development in FY24, with companies including 4% to topline development and gadgets dragging down whole development by 1%.

From FY25 onwards, I forecast Apple’s normalized income development to be 9%, assuming:

- As mentioned, I anticipate Apple’s service enterprise will develop by 15% yearly, contributing 4%-5% to the general topline development. The important thing development drivers are the growing system put in base, extra forms of companies offered by iPhone ecosystems and ARPU development.

- For different {hardware} enterprise, I assume Apple will ship 7% natural income development, aligned with its historic development common.

I anticipate 20bps working margin enlargement yearly, major pushed by:

- 10bps enlargement from gross income, pushed by growing service enterprise with higher margin profile.

- 10bps working leverage from SG&A

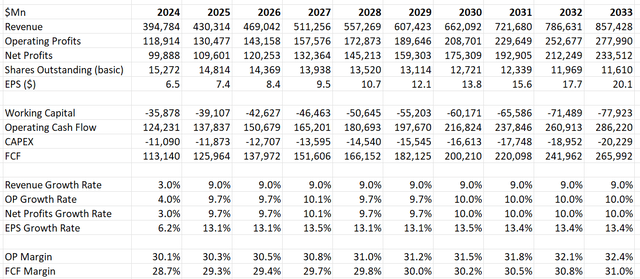

The DCF abstract will be discovered as follows:

Apple DCF – Writer’s Calculations

The WACC is calculated to be 12.5% assuming:

- Threat free price: 4.2% (US 10Y treasury yield)

- Beta: 1.19 (SA)

- Tax price: 16%

- Fairness threat premium 7%; value of debt 7%.

- Fairness steadiness $3.34 trillion; debt steadiness $111 billion

The truthful worth of Apple’s inventory is calculated to be $180 per share after discounting all the longer term FCF.

Key Dangers

As reported by the media, the European Union fined Apple €1.84 billion for breaking its competitors legal guidelines for stopping Spotify (SPOT) from advising app customers cheaper methods to subscribe exterior of Apple’s app retailer. It’s evident that Apple App Retailer is charging a 15-20% reduce from any fee inside the retailer. I consider the same complaints will come up sooner or later, as this charge reduce share is sort of materials for app builders.

On July 24th, Spain’s competitors authority, the CNMC, introduced the investigation into Apple’s App Retailer. It’s too early to foretell the result of the investigation; nevertheless, these investigations might power Apple to alter its insurance policies for its App retailer fee.

As I give Apple a ‘Promote’ ranking, I’m contemplating the next upside dangers:

- Apple plans to allocate $110 billion in the direction of shares repurchase, growing the quantity of capital returned to shareholder. The large shares repurchase might probably enhance Apple’s inventory value within the near-term.

- Apple might presumably ship higher-than-expected service income development, which might please the market. I’ve to acknowledge that Apple is sort of sturdy in cloud, video, fee options, streaming and different companies.

Finish Word

Whereas I anticipate iPhone income development to be beneath strain within the close to time period attributable to weak China gross sales, Apple’s companies would proceed to develop at mid-teens, contributing development for Apple. Nevertheless, the inventory value is overvalued as per my calculations, I downgrade to a ‘Promote’ ranking with truthful worth of $180 per share.