Up to date on March 4th, 2022, by Nikolaos Sismanis

Appaloosa Administration was based in 1993 by David Tepper and Jack Walton. The agency used to function as a junk bond funding firm within the Nineties however developed by means of the 2000s to turn into a extra diversified hedge fund.

It has been one of the crucial profitable hedge funds by specializing in public fairness and glued revenue markets all over the world, delivering jaw-dropping returns to its institutional traders throughout occasions of misery.

As of its final 13F submitting, the fund had ~$3.8 billion in managed securities below administration, a 15.7% decline from its earlier quarter amid decrease capital allocation in its public-equity holdings, presumably as a consequence of shedding some shoppers.

Buyers following the corporate’s 13F filings during the last 3 years (from mid-February 2019 by means of mid-February 2022) would have generated annualized complete returns of 11.97%. For comparability, the S&P 500 ETF (SPY) generated annualized complete returns of 18.17% over the identical time interval.

Be aware: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

Click on the hyperlink under to obtain an Excel spreadsheet with metrics that matter of Appaloosa Administration’s present 13F fairness holdings:

Preserve studying this text to study extra about Appaloosa Administration.

Desk Of Contents

David Tepper

Little will be stated about Appaloosa Administration with out mentioning its legendary supervisor David Tepper. Mr. Tepper has been considered one of Wall Avenue’s highest-paid hedge fund managers of the previous decade, delivering market-beating returns throughout recessionary occasions.

His web value is at the moment round $15.8 billion. His fortune was made by means of Appaloosa, having the vast majority of his belongings connected to the fund. Mr. Tepper has created most of his and Appaloosa’s worth by navigating the fund’s allocations throughout occasions of misery.

In 2001, for instance, when the market was struggling huge losses amid the dot com bubble, Mr. Tepper generated a 61% return by specializing in distressed bonds. In the course of the Nice Recession, he embraced the “purchase when there’s blood within the streets” mentality by buying distressed monetary shares.

Whereas all people else was dumping their shares, Tepper was scooping up shares, together with his well-known play of shopping for Financial institution of America (BAC) shares for $3 every, in addition to AIG’s debt.

His daring bets paid off massively. From 2009 to 2010, the fund’s belongings below administration grew from $5 billion to $12 billion. Round $4 billion of those features had been added to Mr. Tepper’s web value, making him the very best earner of the recession and forming the vast majority of his wealth.

Final 12 months, Mr. Tepper introduced his retirement to pursue proudly owning the Carolina Panthers soccer group, which he purchased in 2018 for a document $2.3 billion. A portion of Appaloosa’s belongings left the fund, which can clarify its present decreased AUM of $4.8 billion.

Appaloosa Administration’s New Buys & Sells

Throughout its newest 13F submitting, Appaloosa Administration executed the next notable portfolio changes:

Noteworthy New Buys:

- Normal Motors Co (GM)

- Dicks Sporting Items, Inc (DKS)

- Hole (The) (GPS)

- Foot Locker Inc. (FL)

Noteworthy New Sells:

- HCA Healthcare Inc (HCA)

- Alibaba Group Holding Ltd ADR (BABA)

- Cvent Holding Corp (CVT)

- Beachbody Firm Inc (The) (BODY)

Appaloosa Administration’s Present Main Investments

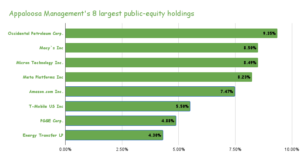

Appaloosa Administration’s long-term technique has targeted on concentrated funding positions with multi-bagger potential. This funding philosophy appears to be the case effectively after Mr. Tapper’s departure, because the fund’s practically ~$3.8 billion-worth public fairness portfolio consists of solely 30 shares, with the highest 5 accounting for round 42.0% of its complete holdings.

Supply: 13F Filings, Creator

The fund’s 10 largest investments are the next:

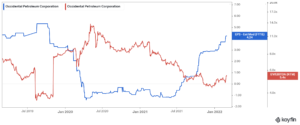

Occidental Petroleum Company (OXY)

On August eighth, 2019, Occidental acquired Anadarko. Occidental pursued this acquisition due to the promising asset base of Anadarko within the Permian, which has enhanced the already sturdy presence of Occidental within the space, and the $3.5 billion annual synergies it expects to realize. Nevertheless, this can be a big acquisition, because the $38 billion worth of the deal is sort of equal to the present market cap of Occidental. Occidental secured $10 billion in funding from Berkshire Hathaway (BRK.A) in trade for most popular shares, which obtain an 8% annual dividend.

In late February, Occidental reported monetary outcomes for the fourth quarter of fiscal 2021. The common realized costs of oil and gasoline grew 10% and seven%, respectively, over the prior quarter whereas the chemical section posted document earnings due to vast margins amid sturdy pent-up demand. Consequently, Occidental grew its adjusted earnings per share by 70%, from $0.87 to $1.48. As a consequence of its excessive debt load, Occidental is among the best beneficiaries in its sector from the 7-year excessive costs of oil and pure gasoline. It decreased its web debt by $6.7 billion in 2021, to $47.6 billion. As well as, it just lately introduced that it’ll retire no less than one other $2.5 billion of debt in 2022.

It’s value noting that the inventory trades comparatively cheaply from a ahead EV/EBITDA perspective. The corporate can also be anticipated to realize near-record EPS this 12 months amid elevated commodity worth ranges.

Occidental is Appaloosa’s largest holding. The fund held its place regular over the last quarter.

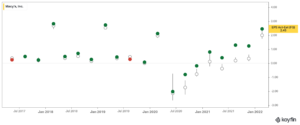

Macy’s, Inc. (M)

Macy’s climbed to the corporate’s prime ten holdings after the fund elevated its place within the inventory by 93% final 12 months.

Macy’s reported its fourth-quarter earnings outcomes on February twenty second. Revenues totaled $8.67 billion in the course of the quarter, which beat consensus estimates by $220 million. Macy’s revenues had been up by 27.9% versus the earlier 12 months’s quarter, which had seen a big pandemic affect.

The income enhance will be defined by the easing coronavirus pandemic within the US. This resulted in a serious margin enchancment in comparison with the earlier 12 months’s quarter. Macy’s generated earnings-per-share of $2.45 in the course of the interval

The corporate has overwhelmed estimates persistently over the previous few quarters as illustrated under, which is relatively promising with regard to its future prospects contemplating that its funding case nonetheless holds notable dangers.

The inventory accounts for 8.5% of Appalossa’s portfolio.

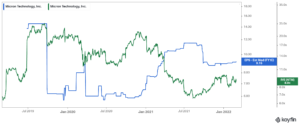

Micron Know-how (MU)

Regardless of Appaloosa trimming its Micron Know-how stake by 51% final 12 months, the corporate is at the moment the fund’s third-largest holding, accounting for round 8.5% of its public fairness investments. The inventory has skilled a spectacular rally over the previous 5 years, because the demand for its semiconductors has been explosive.

Whereas the inventory is taken into account speculative, its sturdy profitability during the last a number of years has confirmed bears and short-sellers incorrect. Many had predicted that the corporate’s prime & backside traces would undergo as a result of pandemic.

Nevertheless, Micron posted a strong FY2021 web revenue of $5.86 billion. The corporate is anticipated to supply EPS of $9.15 subsequent 12 months. This means a ahead P/E within the single digits which certainly suggests a comparatively honest a number of for a semiconductor firm.

Nonetheless, the trade stays wildly cyclical, which may translate to unstable future efficiency for MU’s shareholders.

Appaloosa held its Micron place regular in the course of the quarter.

Meta Platforms, Inc. (FB)

Appaloosa decreased its Meta Platforms stake by round 3%, although the inventory remains to be the portfolio’s second-largest holding. Meta shares account for round 8.2% of the fund’s holdings. With sturdy progress, a wholesome stability sheet, and one of the best platform for advertisers to make the most of, Meta stays a sexy decide at an affordable valuation.

Meta is an amazing money cow, however with an issue. With sturdy financials, a wholesome stability sheet, and one of the best social media platform for advertisers, Meta has been dominating the social media trade. The corporate reported an all-time excessive backside line of $19.37 billion in FY2021, amid nice person progress, however now decelerating to the one digits.

For these causes, it could not be a whole shock if Meta paid a dividend in some unspecified time in the future sooner or later.

Then again, the inventory has failed to draw the next a number of, because the steep scrutiny it has confronted over the previous few years have had an affect on the valuation. The inventory is just buying and selling at round 16.3 occasions its underlying earnings, regardless of its fast progress.

With its ARPU (common income per person) nonetheless very sturdy, Meta’s financials are greater than prone to proceed increasing quickly. Meta’s funding case at the moment doesn’t solely embrace the potential for a major upside but in addition comes with a terrific margin of security.

If such a valuation enlargement by no means seems, and Meta continues to commerce at a ahead P/E of round 16.3, at an EPS progress charge of 10%-20% within the medium time period (which the present person and APRU progress trajectory may simply maintain), traders ought to obtain equally passable returns with a continuing valuation a number of.

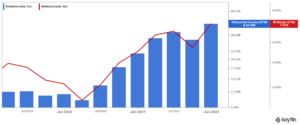

Amazon.com Inc. (AMZN)

Amazon is Appaloosa’s fifth-largest holding, comprising 7.5% of its complete portfolio. The fund held its place regular over the last quarter.

Amazon delivered one other strong quarter just lately, with This autumn AWS web gross sales up 40% YoY to $17.78 billion, topping the $17.23 billion consensus estimate. Revenues grew to $137.4 billion, a 9.4% enhance YoY, contributing to all-time excessive LTM (final twelve months) gross sales of $469.8 billion.

As a consequence of scaling its operations, the corporate’s web revenue margins reached 7.1% in the course of the previous twelve months, turning Amazon into an more and more worthwhile firm. The inventory is at the moment buying and selling at a P/E of 60.3 primarily based on this 12 months’s projected web revenue, however contemplating its EPS progress, the corporate will seemingly develop into its valuation.

The inventory has had a spot in Appaloosa’s portfolio since Q1-2019.

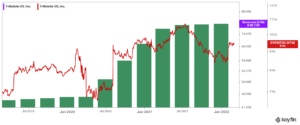

T-Cell US, Inc. (TMUS)

T-Cell has had a spot in Appaloosa’s portfolio since 2017. With T-Cell buying Dash final 12 months, the corporate ought to have the ability to actively compete with AT&T (T) and Verizon (VZ). On account of the synergies to be unlocked, the corporate ought to bear a progress section over the subsequent few quarters. Revenues rose by 2.2% to $20.79 billion in the latest quarter, with service revenues rising 6% to $15 billion.

Administration raised its merger synergy forecasts following the continued integration progress. Round 50% of Dash’s buyer visitors is now carried on the T-Cell community, whereas roughly 20% of Dash clients have been moved over.

It already achieved synergies of $3.8 billion for FY2021. As a consequence of elevated investor expectations, the inventory’s valuation a number of has expanded, at the moment at a ahead EV/EBITDA a number of of 8.7.

The inventory at the moment occupies round 5.5% of Appaloosa’s portfolio. It’s now the fund’s sixth-largest holding.

PG&E Company (PCG)

PG&E Company engages within the sale and supply of electrical energy and pure gasoline to customers in northern and central California. The corporate owns and runs round 18,000 circuit miles of interconnected transmission traces, 33 electrical transmission substations, and about 108,000 circuit miles of distribution traces amongst different infrastructure belongings.

The corporate’s shares stay comparatively depressed following PG&E being held answerable for wildfires in recent times that destroyed a whole bunch of hundreds of acres in California. The corporate’s web debt place has turn into more and more riskier. That stated shares commerce very near their guide worth. Therefore the inventory could have upside contemplating that profitability has considerably improved. This can be the explanation Appaloosa has allotted capital on this speculative inventory.

PG&E Company is Appaloosa’s seventh-largest holding, accounting for round 4.9% of its holdings.

PG&E Company is Appaloosa’s seventh-largest holding, accounting for round 4.9% of its holdings.

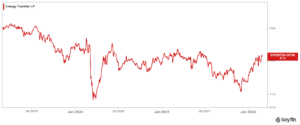

Power Switch LP (ET)

Power Switch operates one of many largest and most diversified portfolios of power belongings in america. Operations embrace pure gasoline transportation and storage together with crude oil, pure gasoline liquids, and refined product transportation and storage totaling 83,000 miles of pipelines. Power Switch, a $32.0 billion market capitalization firm, additionally owns the Lake Charles LNG Firm and stakes in Sunoco LP (SUN) and USA Compression Companions (USAC). On December seventh, 2021 Power Switch accomplished the acquisition of Allow Midstream Companions (ENBL) in a $7 billion stock-for-stock deal.

In mid-February, Power Switch reported monetary outcomes for the fourth quarter of fiscal 2021. The corporate posted all-time excessive NGL transportation and fractionation volumes for the second quarter in a row and likewise benefited from larger commodity costs and the acquisition of Allow. Consequently, distributable money stream grew 18% over the prior 12 months’s quarter, from $1.36 billion to $1.60 billion.

Within the full 12 months, Power Switch decreased its long-term debt by $6.3 billion and thus maintained an honest leverage ratio of three.07. It additionally supplied steerage for adjusted EBITDA of $11.8-$12.2 billion in 2022 (vs. $13.0 billion in 2021) and raised the distribution by 15%. The lower in annual EBITDA is anticipated as a result of abnormally excessive, non-recurring earnings reported within the first quarter of 2021 on account of winter storm Uri. Furthermore, administration acknowledged that it has a aim of restoring the annual distribution to $1.22 in some unspecified time in the future sooner or later.

Whereas models of Power Switch have considerably recovered currently, the inventory stays moderately valued at a ahead EV/EBITDA of 8.1 contemplating the continued favorable power market setting and its general qualities.

Power Switch is Appaloosa’s eighth-largest holding, accounting for round 4.3% of its public fairness portfolio.

Last Ideas

Appaloosa Administration has had a affluent previous, with a number of achievements below Mr. Tepper’s management. The agency has spoiled its traders with jaw-dropping returns throughout antagonistic financial occasions. Mr. Tepper’s departure marks a brand new period for the fund.

The agency’s public holdings have underperformed the market over the previous three years, but it surely nonetheless could also be early to guage. The agency might be well-positioned to shine going ahead contemplating administration’s prolonged expertise.

Further Sources

See the articles under for evaluation on different main funding companies/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].