koto_feja

Intro

Annovis Bio (NYSE:ANVS) is set to report the results of its Phase 3 trial in early-stage Parkinson’s disease (PD) in the coming weeks. The company’s lead asset, buntanetap (formerly known as posiphen), is a translational inhibitor of alpha synucelein (associated with PD), amyloid precursor protein (Alzheimer’s), TDP-43 (ALS), and other proteins associated with neurodegenerative disease (further discussion of mechanism in our initiation report). While Annovis also has an ongoing Phase 3 trial in Alzheimer’s disease (AD) that is expected to report data in the 2Q24, this report aims to analyze and provide insight regarding the prospects of the Phase 3 PD trial.

Uniquely, there are a number of patients from the Phase 3 PD trial that have shared their experiences online. These anecdotes come with a number of caveats, chiefly that their extrapolation to the whole study is inherently limited. Still, we believe there are insights that can be drawn from the anecdotes. We also discuss Parkinson’s rating scales and historical disease progression data.

Thesis

We believe the anecdotal data, while limited to a sample of just 21 patients, suggests that buntanetap has some degree of underlying activity in PD. A minority of roughly 24-38% (depending on interpretation) of anecdotal patients appear to report experiencing clear, clinically meaningful improvements from baseline on various PD symptoms. These reports include subjective improvements (e.g. energy, balance, cognition), objective/measurable improvements (e.g. timed typing test, arm swing), and background dopaminergic medication reductions. To us, the fact that there are any patients at all reporting clear and noticeable improvements is encouraging, even if it is in a minority portion of a small sample of anecdotes.

Additionally, for a number of reasons we have discussed in our initiation report and on Twitter, we believe the doses selected by Annovis for the Phase 3 trials (10 and 20 mg) are lower than optimal. As a result, we think it is likely that the 20 mg cohort significantly outperforms the 10 mg cohort, and even that most of the “responders” in the trial will turn out to be from the 20 mg cohort. Given that only 33% of patients in the trial are in the 20 mg cohort (trial is split 1:1:1 between placebo, 10 mg, and 20 mg), we view the fact that 24-38% of patients in this small sample of anecdotes appear to be experiencing symptom improvement as supportive of buntanetap’s probability of delivering a positive result, specifically in the 20 mg cohort.

Concerns

At the same time, Annovis is facing a number of risks, both related and unrelated to the upcoming data, which make it a precarious investment:

Annovis is very low on cash. It has filed a mixed shelf registration and will likely look to raise at least some cash following the Phase 3 PD results (doesn’t seem they will make it to AD results in the 2Q24). The market is aware of this fact, and going into a data readout with no cash provides a serious overhang.

The trial’s primary endpoint, UPDRS Part II, is not optimal for early-stage PD patients, and thus may not be sensitive enough to reliably detect improvement in Annovis’s patient population, even if patients report subjective improvement. We believe UPDRS Total score and other secondary endpoints are more likely to be positive.

Annovis has a track record of struggling to display and communicate data in a clear, easily-digestible manner (see our second article), which could cause issues if topline results are not black and white (the most likely scenario, in our eyes).

The anecdotal data, taken into account with Annovis’s preclinical, mechanistic, and clinical-stage data, leads us to believe the probability of a (mostly) successful topline Phase 3 PD readout, especially in the 20 mg cohort, is considerably higher than the company’s current ~$110 million market cap suggests. While inherently risky, we believe Annovis represents one of the few promising disease-modifying approaches to PD and/or AD, and given the readthrough that a positive PD result would have for the upcoming AD data, we see Annovis as a potential 5-10x return opportunity over the next 6-12 months if our thesis plays out.

Data Delay

Annovis’s January 24th press release announced that the Phase 3 PD readout would be delayed from the end-of-January timetable that had previously been expected. The company stated that the delay was due to ongoing data cleaning and processing efforts, which meant the company had not yet been able to unblind the data to perform its statistical analysis.

The delay does not affect our thesis and is understandable given that the last patient visit was on December 5th. Still, Annovis’s stock reacted quite negatively, primarily because 1) no updated timeline was given, 2) the market is extremely skeptical especially of neuro-focused biotechs that postpone data (because of BioVie, Anavex, etc.), 3) the company is low on cash, and 4) the press release was written in unnecessarily complicated and roundabout verbiage.

We don’t see the delay as indicative of any underlying issue. Instead we think CEO Maria Maccecchini and the company simply underestimated how long data verification and processing for a large (523 patient) international study would take. Investors in the space (including ourselves) have been conditioned to assume the worst from small neuro biotechs, especially when data is delayed. In this case, however, we think the company was overzealous in providing a very specific timeline in the first place, and that the company will report its results in the next few weeks.

Patient Anecdotes

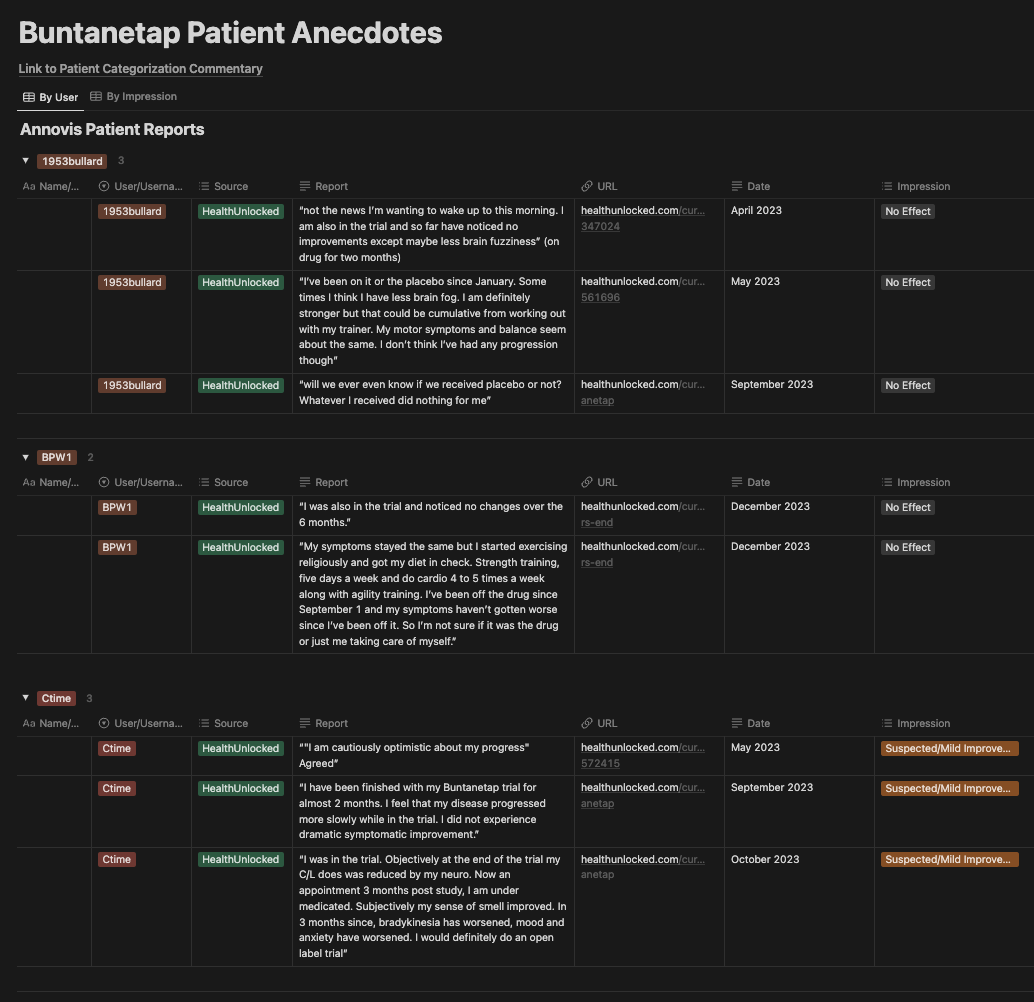

Some Annovis investors, specifically those that monitor StockTwits, may have seen a few screenshots of patient anecdotes from the Phase 3 PD trail floating around. We created a Buntanetap Patient Anecdotes master table in Notion to track all of these anecdotes. While all of these patients appear to be genuine based on their profile activity, obviously, this data is subject to a number of caveats (e.g. patient authenticity, interpretation of ambiguous anecdotes). Most importantly, we stress that using a small sample size to prognosticate on a large study is inherently limited.

(Note: We do not believe in interacting with patients on patient-focused forums and find it distasteful that some Annovis investors have recently started commenting or asking for patients’ experiences).

Notion Patient Anecdotes Table

In total, we found 23 PD patients that participated in the Phase 3 buntanetap trial. Most of the anecdotes were collected from a patient forum called HealthUnlocked, with a few others coming from Reddit. Of the 23 patients, 21 gave some form of an opinion on their treatment with buntanetap and disease progression during the trial.

We assigned patients to the following categories:

Definitive Improvement: patients with the express opinion that they received buntanetap (not placebo) and that it significantly improved their condition. We include these patients as responders in our analysis.

Suspected/Mild Improvement: patients with either a perceived or measured improvement in at least one aspect of their disease. We include these patients as responders in our analysis, though they are less obvious than Definitive Improvement.

Possible Stabilization/No Effect: patients that claim or have reason to believe their disease may have stabilized during the trial. These patients are not counted as responders in our analysis.

No Effect: patients that felt nothing or worsened.

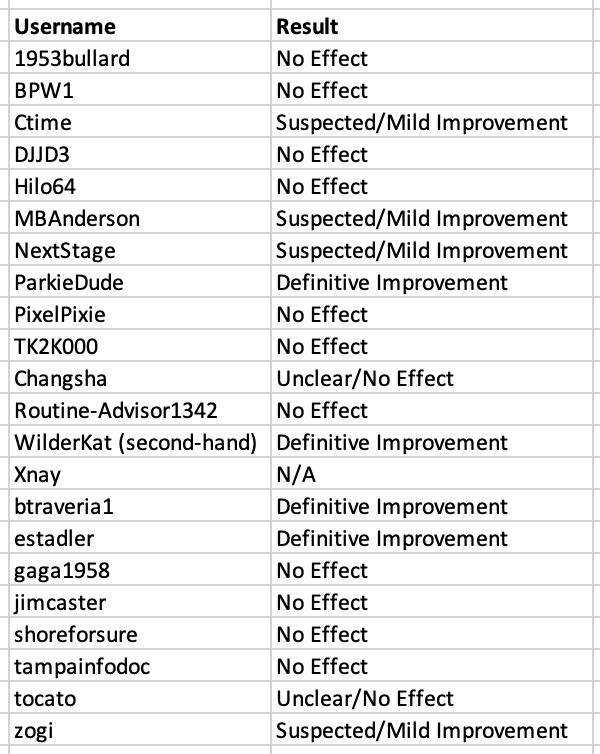

While there is a fair bit of subjectivity in some of the anecdotes, our categorizations of the anecdotes are:

Impression | # | % |

Definitive Improvement | 4 | 19% |

Suspected/Mild Improvement | 4 | 19% |

Unclear/No Effect | 2 | 10% |

No Effect | 11 | 52% |

Total | 21 |

We attempted to err on the side of conservatism if a patient’s anecdote(s) were ambiguous or changed throughout the duration of the trial. We encourage investors to look through the anecdotes and assign categories for themselves.

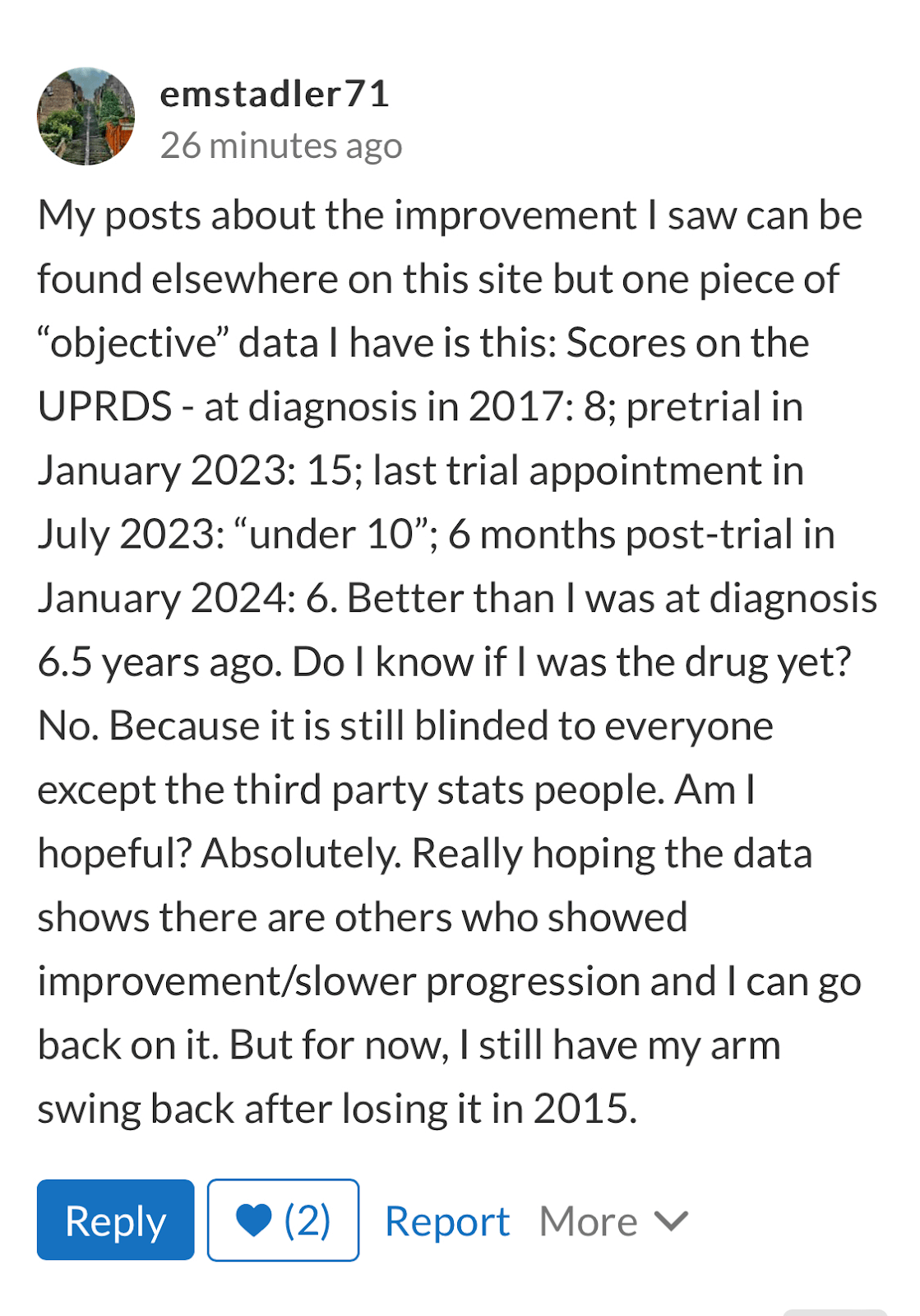

Definitive Improvement

We think that the 4 Definitive Improvement patients (19% of patients) were the easiest to categorize. These reports include a clear improvement in movement (arm swing, handwriting, walking, tremor), strength, energy, and/or cognition. One patient (ParkieDude) describes regaining an intense sense of smell (an early hallmark of PD) and being able to read and understand a complicated novel for the first time in five years. We note that one of these patients (emStaler71) did claim to lose 45 pounds during the trial, suggesting some of her benefits might have come from lifestyle changes. Another of the Definitive Improvements (WilderKat) was a second-hand account, which may be dubious to some, but the user’s profile suggests the account is genuine.

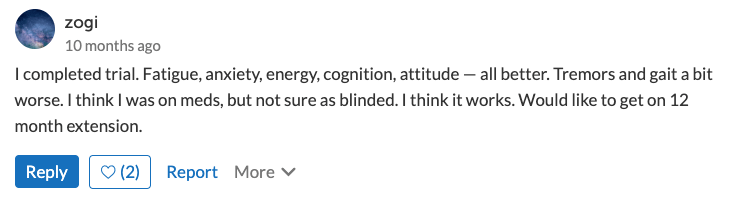

Suspected/Mild Improvement

The 4 Suspected/Mild Improvement patients (19% of patients) report noticeable improvements, though narrower or with more caveats than the Definitive Improvement patients. At least two of these patients are actually trending more towards Definitive Improvement status. NextStage described that their right hand, which was asymmetrically affected, improved to the typing speed of their left hand, as measured by a timed typing test. Another patient, Zogi (shown below), had a host of symptoms clearly improve, while a couple of others got worse.

HealthUnlocked

Possible Stabilization/No Effect

The 2 patients categorized as Possible Stabilization/No Effect (10% of patients) are difficult to categorize. This kind of acts as an “Unclear” category. One of the patients, Tocato, stated that he felt absolutely nothing for the first four months, and then in a subsequent comment said that three of the four symptoms he evaluated improved during the last two months of treatment. The other patient, Changsha, stated that he believed his disease stabilized while in the trial and then noticeably progressed after stopping. We treat these patients as non-responders for the purposes of our analysis below.

No Effect

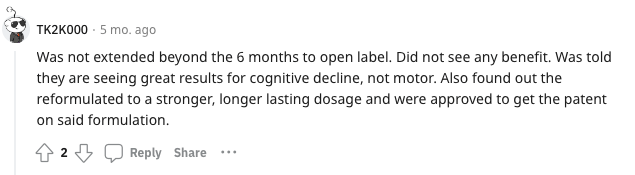

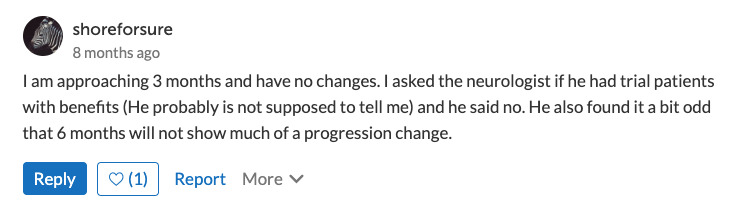

The 11 No Effect patients (52% of patients) were pretty straightforward for the most part. Most patients just stated flatly that they noticed no benefit and didn’t really feel anything at all. There were a couple, however, that were a bit less clear. One user, Routine-Advisor1342, a wife reporting on behalf of her husband, felt that her husband seemed better in the summer (when he was on the drug), but that it was also probably related to him being on summer vacation as a teacher. There were also two No Effect patients which shared contradictory insights from their healthcare practitioners:

Reddit HealthUnlocked

Discussion of Categorizations

For easier viewing, here is a list of how we categorized each patient (in the same order as the Notion table):

Microsoft Excel

(XNay is listed as N/A because they report having felt a significant benefit in the Phase 2a trial, but do not comment on their experience in the Phase 3 trial. They have only two comments on their HealthUnlocked profile).

We provide further in-depth commentary on the categorizations of a few potentially debatable patients here (Categorization Commentary), for those that are interested. The interpretations for some of these anecdotes can vary and it is difficult to predict what self-reported improvements will translate to numerical improvement on the trial’s actual endpoints. We are interested to hear other opinions.

Discussion and “The 20mg Hypothesis”

If our categorizations are correct, about 38% of patients (4 Definitive Improvement + 4 Mild/Suspected Improvement patients) in the anecdotal data set experienced a pretty-clear-to-obvious improvement on at least one Parkinson’s symptom and/or reported an objective measurement of improvement (i.e. typing speed, practitioner assessment, lowering dose of underlying drug). Said another way, 8 patients (38%) noticeably improved. We believe these 8 patients are likely to record an improvement from baseline on the Unified Parkinson’s Disease Rating Scale (UPDRS).

Recall that Annovis’s Phase 3 PD study is randomized 1:1:1 between placebo, 10 mg, and 20 mg of buntanetap. So, if this sample of 21 patients were perfectly representative of the whole study and buntanetap worked in every patient, we would see 14 patients (67%) reporting an improvement (the 10 and 20 mg patients) and 7 patients (33%) reporting no change or disease worsening (placebo patients). While only 38% of patients reported a noticeable improvement, there are a couple key reasons we interpret this data as a positive signal for buntanetap’s underlying efficacy.

Any Improvement is Encouraging

If buntantetap had no underlying impact on Parkinson’s or its symptoms, we would expect to see very few (or 0) patients reporting an obvious, noticeable, or measurable improvement. While placebo effects are possible in early-stage Parkinson’s, it is not common for patients to report a significant absolute improvement from baseline. Furthermore, the reports from these patients, especially the Definitive Improvement patients, include a level of improvement that appears to be outside the realm of placebo effects. Reporting clearly noticeable functional improvements in a disease characterized by continuous degeneration is both unexpected and encouraging, even if it is only in a minority of patients.

The 20 mg Hypothesis

As we have mentioned before in our initiation report and on Twitter/X, we believe the doses selected for Annovis’s Phase 3 trial of PD (and likely AD as well) are lower than optimal. As a result, we expect buntanetap to report considerably greater activity in the 20 mg cohort vs. the 10 mg cohort. If this hypothesis is correct, it is possible that most or all of the 8 patients (38%) reporting a noticeable benefit are from the 20 mg cohort. Since we would only expect 7 of the 21 anecdotal patients (33%) to be from the 20 mg cohort if the sample was perfectly representative of the whole study, extrapolating the data would suggests that a potentially high proportion of 20 mg cohort experienced clear improvement that may translate to UPDRS and other measures of clinical improvement.

Conservative Scenario

While we believe we were objective in categorizing patient anecdotes, it is possible that some of the Suspected/Mild Improvement patients’ positive comments did not translate to a significant improvement from baseline on UPDRS (discussed in our Categorization Commentary). However, even in a more conservative scenario where only 5 or 6 of these patients showed an improved score from baseline, that is still 24-29% of this 21-patient sample. Assuming that all of these clear responder patients are coming from the 20 mg cohort, a 24-29% improvement rate in the whole study data would still translate to a large majority (73-86%) of 20 mg patients. Even if the number was far lower, say just 15% of patients showed a significant improvement from baseline, that would be 45% of the 20 mg cohort and could still be enough to reach statistical significance primary and/or secondary endpoints, depending on the placebo group’s decline.

While the assumptions used to make these predictions are subject to a fair amount of guesswork, we think this model of considering the anecdotal patient data is useful in trying to gain an idea of buntanetap’s underlying efficacy, and highlights the potential of buntanetap to report positive results, at least on some endpoints, in the 20 mg cohort.

UPDRS and Other Endpoints: Will Anecdotes Translate?

There has been some discussion about the fact that Annovis recently changed their corporate presentation to list UPDRS Part II as the primary endpoint for the Phase 3, versus UPDRS Part II + III previously. Though it still appears as UPDRS Part II + III on ClinicalTrials.gov, according to those that have corresponded with Dr. Maccecchini, Annovis was told by the FDA after the interim analysis that it would prefer UPDRS Part II to be the primary endpoint. This is a suggestion rather than a mandate, and the company will still present both Part II and III, among other endpoints like UPDRS Total Score, WAIS Coding, biomarkers, etc. We believe the UPDRS Total score (or UPDRS Part II + III) is a more sensitive measure in Annovis’s early-stage PD patient population, and will be valued by the market as a historically validated primary endpoint in PD.

The full UPDRS test, including the 13 items included in Part II, is given here. Part II is designed to assess patients’ activities of daily living (e.g. speech, walking, handwriting). Patients are essentially asked to rate themselves on each item, and the practitioner determines a score between 0 (no disease) and 4 (severe disease). The maximum UPDRS Total score is 199, with higher scores indicating worse disease. The UPDRS Part II is a total of 52 points.

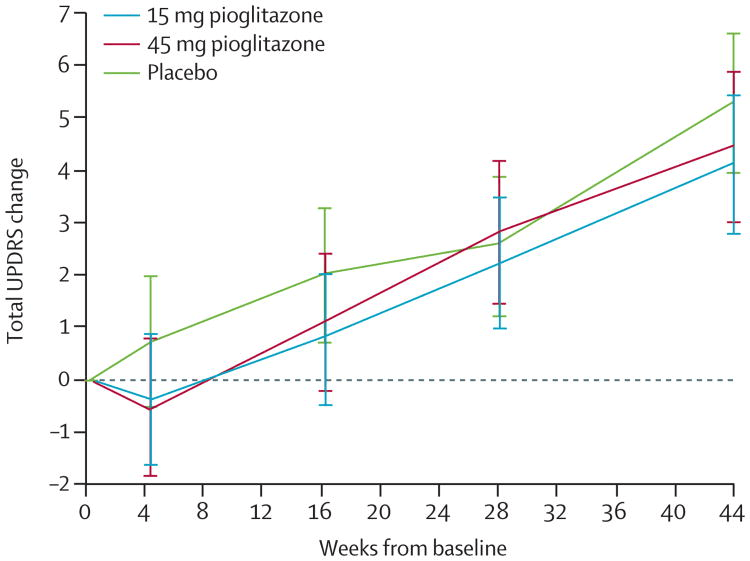

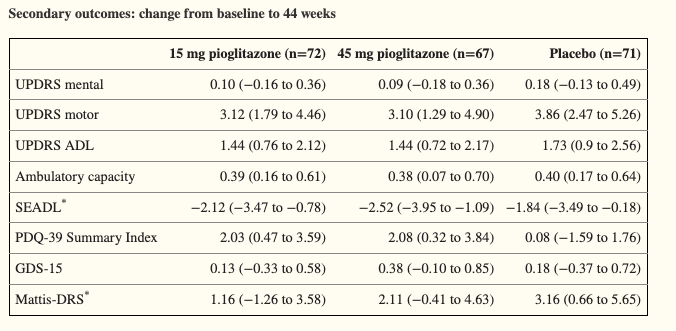

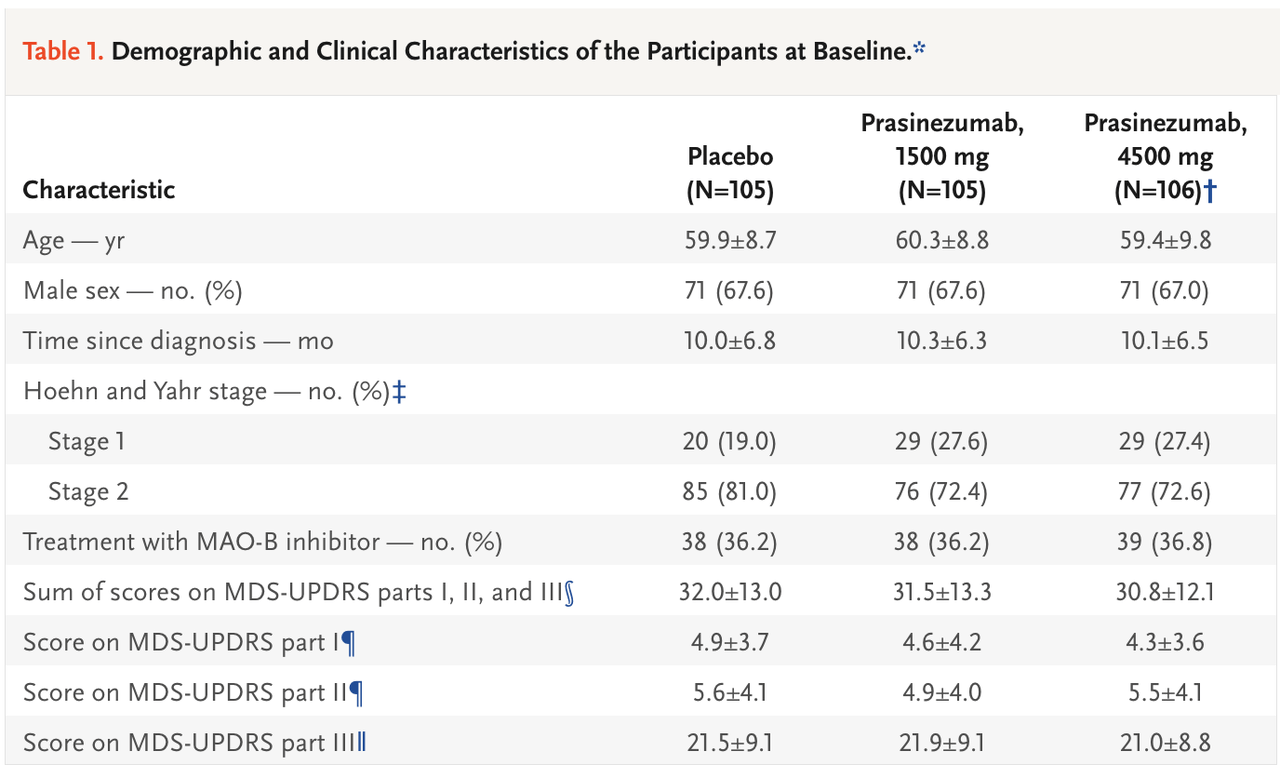

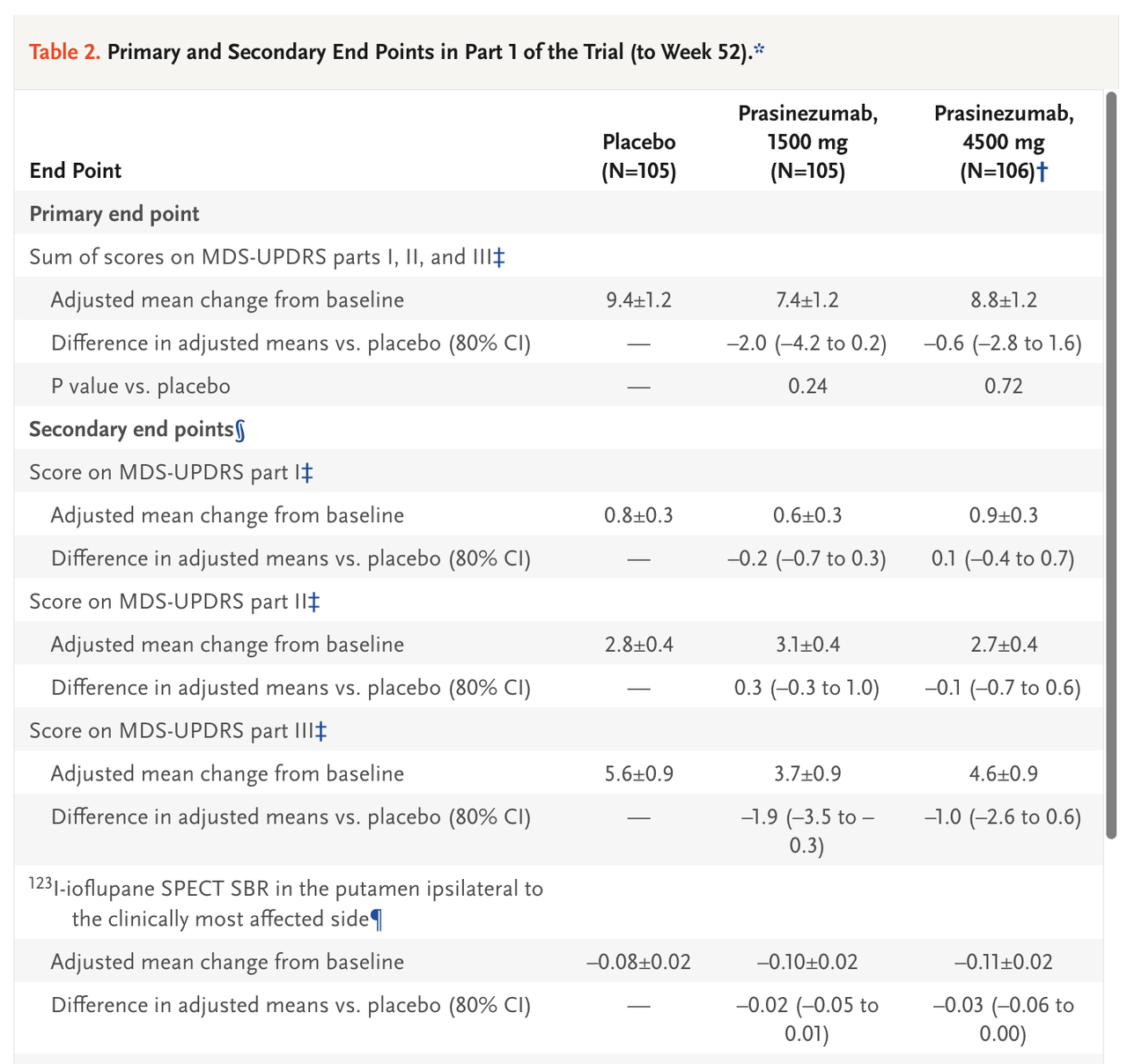

Expected Decline and Examples

For an idea of what Annovis’s Phase 3 patient population could look like, a study of pioglitazone in early-stage PD patients (average 0.8 years since diagnosis) showed a baseline UPDRS Total score of around 22 points and a baseline UPDRS Part II score of about 5.5 points, which reflect mild, early-stage disease (Simuni, 2015). During this 44-week trial, both placebo and treatment patients worsened by 4-5 points on Total UPDRS and about 1.5 points on UPDRS Part II (labeled as “UPDRS ADL” in table below). The declines were roughly linear, meaning patients declined around 2-2.5 points and .75 points on Total and Part II, respectively, at six months (the duration of Annovis’s PD trial).

Simuni, et al., 2015 Simuni, et al., 2015

These results line up roughly with the expected disease progression of early PD patients. The expected annual decline for PD patients on UPDRS Total score is ~5 points per year, with some studies reporting higher numbers (Holden, et al., 2017). The expected decline for early PD patients on UPDRS Part II is about 1-2 points per year.

Holden, et al., 2017

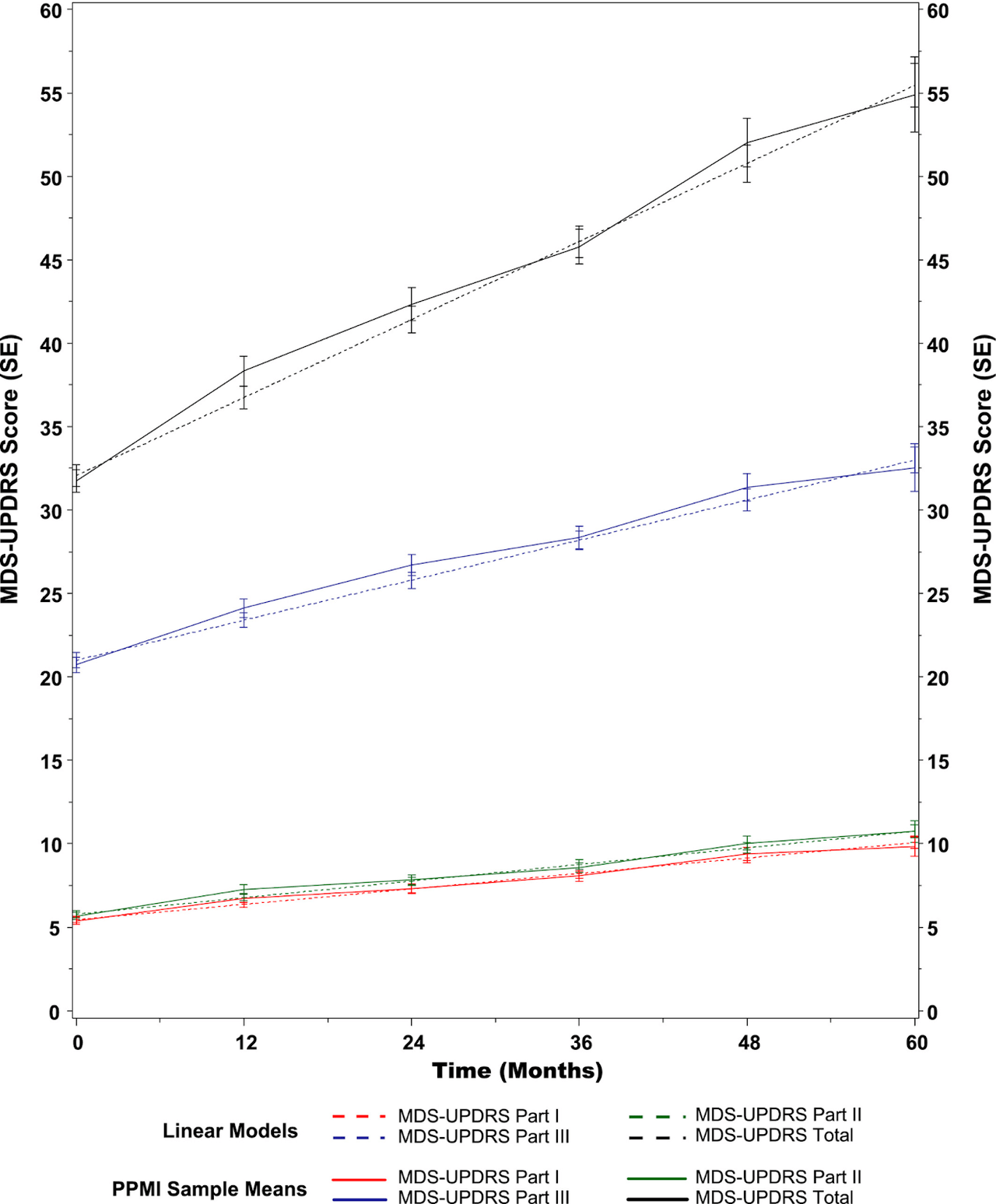

For another example, a recent study of prasinezumab (Roche/Prothena) in early-stage Parkinson’s patients reported a baseline UPDRS Total score of ~31 points and a baseline UPDRS Part II score of ~5 points. Over the course of the 52-week study, patients (in both the placebo and prasinezumab groups) worsened by ~8 points on UPDRS Total and ~3 points on UPDRS Part II. We can predict that patients declined by ~4 points and ~1.5 points on UPDRS Total and Part II, respectively, at six months.

Pagano, et al., 2022 Pagano, et al., 2022

Based on respective inclusion criteria of the respective studies, we expect Annovis’s Phase 3 trial to have similar or slightly later-stage baseline UPDRS scores to the pioglitazone and prasinezumab studies. We predict a baseline UPDRS Total of 35-40 points and a UPDRS Part II of 7-8 points, and believe the expected decline over Annovis’s 6-month study to be about 3-4 points on UPDRS Total and about 1 point on UPDRS Part II.

Detecting Improvement on UPDRS

Our primary concern is whether the UPDRS scale, specifically UPDRS Part II, is sufficiently sensitive to detect an improvement in early-stage patients that have a low baseline UPDRS score to begin with. For example, if the average UPDRS Part II score in the Phase 3 is around 5 points at baseline, patients are likely scoring as a 1 (on a scale of 0 to 4, with 4 representing severe symptoms) on 5 of the 13 items. This means a patient will have to improve to a score of 0 on certain items, which represents “normal” functioning, in order to record an improvement from baseline on UPDRS Part II. While we expect this to happen for some patients, especially those with Definitive Improvement anecdotes (who we believe are predominantly in the 20 mg cohort), it is mechanically a high bar to clear in early PD patients.

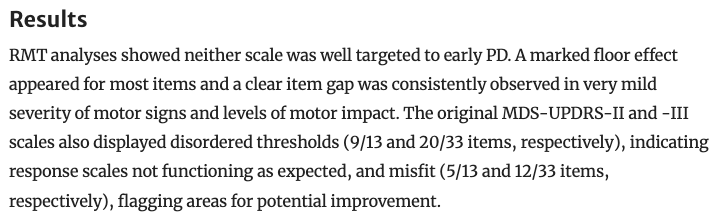

For example, this study found that UPDRS Part II and III were not well targeted to detect progression specifically in early-stage PD patients.

Regnault, et al., 2019

For some more context on UPDRS from a patient standpoint, here is one comment from emstadler71, a Definitive Improvement patient, regarding her UPDRS score:

HealthUnlocked

We note that emstadler71 is perhaps the most enthusiastic positive responders from the buntanetap trial. Contrarily, here is a comment from Ctime, a Suspected/Mild Improvement patient:

HealthUnlocked

Nonetheless, we are encouraged by the fact that previous studies in early PD patients have reliably reported untreated/placebo patients worsening 5+ points on UPDRS Total and 1-2 points on UPDRS Part II annually. Though the UPDRS Part II, Part III, or Total may not be the optimal primary or key secondary endpoints for Annovis’s Phase 3 trial, assuming Annovis’s placebo group declines roughly in line with this historical precedent, improvements of 2-3 points on UPDRS Total and ~1 point on UPDRS Part II for buntanetap-treated patients would likely be enough to reach statistical significance.

Based on the limited sample of patient anecdotes and our analysis, we believe these types of improvements are achievable in buntanetap’s 20 mg dose, and thus believe statistical significance is a possibility for all UPDRS endpoints, though more likely for the UPDRS Total score due to its greater detection specificity in an earlier stage of PD.

Other Endpoints

Aside from UPDRS, the Phase 3 PD trial includes PGIC, CGIS, the WAIS Digit Symbol Coding Test, and plasma biomarker assays. Given the early stage of disease, and a potential bias towards reports of cognitive/mental energy improvement in the anecdotal data, we think the WAIS Coding test, which is a highly sensitive measure of cognitive function and processing speed, is likely to show a statistically significant improvement for the 20 mg group vs. placebo if the extrapolation of the patient anecdotes is even roughly accurate.

We are also curious to see the biomarker data. Annovis recently shared data from the Phase 2a about reductions in TDP-43, as measured in plasma by the Quanterix Simoa assay. We would be curious to see this type of biomarker data for alpha synuclein, amyloid beta, neurofilament lights, and other proteins.

Market Perception

With a short study, in an early disease population, with a range of primary and secondary endpoints, it is hard to determine: What will the market consider a successful outcome in this trial?

Obviously, statistical significance across most or all endpoints in the 20 mg group vs. placebo would catapult Annovis to top-tier relevance in the neurodegenerative space. But what about if the results are mixed? What if UPDRS Part II misses statistical significance but UPDRS Total score is strongly statistical significance? We are not sure how that would be perceived, but our intuition is that achieving statistical significance on UPDRS Total (or UPDRS Part II + III) would almost certainly result in a net positive reaction, regardless of results on other endpoints.

We also believe that the market’s reception of the data could be significantly influenced by how clearly it is presented. While ideally the data would be so good that it doesn’t matter how it is presented, the more likely scenario is that there is some nuance to the data, which leaves it up to Annovis’s management to create a clear, concise, sufficiently transparent presentation of the data. Unfortunately, Annovis does not have a good track record of executing clear, coherent data presentations or press releases.

The short duration of the Phase 3 trial will also factor into the reception. If the results are positive, it will be easy for some to claim that buntanetap is just a symptomatic treatment, not disease-modifying, or that the results were not all that impressive because their durability is unknown. On the flip side, one thing that is on Annovis’s side is the large sample size of the trial. There is unlikely to be an unexpected placebo response, and it is likely that if buntanetap has underlying efficacy in Parkinson’s, it will show up in the results.

Other Risks

Communication/Public Relations

It is our opinion that Annovis does not have a good system in place to ensure consistently clear communication with investors and the public. The presentation of the Phase 2a results and the “interim” analysis in May 2023 are the largest examples of this (covered in our previous piece). It is also evident to some degree in most press releases—they are often confusing and generally don’t mirror the tone or structure of most biotech companies’ PRs. We do not think anything nefarious is at play, but do believe the company’s (in)ability to communicate clearly could rear its ugly head in the upcoming PD and AD data releases, especially if the results are nuanced, which is likely. For example, we would hope that the company does not continue to use Microsoft Excel’s graphing tool for its data presentation. They have added a number of employees since the Phase 2a data was released, though this November 2023 resorted to an Excel graph as a means of data presentation.

Results and Primary Endpoint

Though we attempted to speculate about the Phase 3 results based on anecdotal data, the actual data could turn out completely different. 21 patients is a very small sample size to try to to base any large predictions on. There may also be confusion in the market regarding which endpoint should be considered the primary endpoint, given the FDA appears to favor UPDRS Part II, though UPDRS Part II + III and UPDRS Total have been more common historically.

Skepticism of Micro Caps

While micro caps are inherently high-risk, the market has taken an especially skeptical stance toward micro cap neurology companies. The space has proven so difficult to find any success that the market seems to assume the worst in any given scenario. There is also the spectre of fraud or shady practices looming in the micro cap biotech space thanks to the likes of BioVie, Seelos Therapeutics, and others. Annovis’s public communications have also not helped their perception.

Potential Response Bias

It is difficult to determine what kind of response/selection bias might be present in the patients that reported their experiences in the Phase 3 trial on HealthUnlocked or Reddit. It is our intuition that the selection bias would be towards patients that had a positive experience in Annovis’s Phase 3 trial and are eager to share their experience, though it could also be the other way around. Many patients that reported their anecdotes on HealthUnlocked have been active on the site for long before they were in the Annovis trial.

Cash Position

The company had around $9 million of cash at the end of the 3Q23 and raised about $7 million in late October 2023. The company burned about $10 million in the 3Q23, and even though their burn has been reduced by the completion of the PD trial, they will need to raise capital in the next couple months. The company is likely hoping to raise following the announcement of positive results in PD. Going into a data readout with no cash can be tricky, especially if the results are mixed. If results are negative or at least perceived as partly negative, Annovis’s stock will likely drop considerably. The company will (at some point) need to raise at least $50-100 million in order to fund the longer-duration, disease-modification trials in PD and AD that it has planned.

Conclusion

Annovis’s Phase 3 PD data represents a pivotal moment for the company. The anecdotal data, though too small a sample to be significantly de-risking, appears to align with our earlier analyses of buntanetap’s potentially best-in-class mechanism targeting the upstream drivers of neurodegenerative protein aggregation. In our opinion, given the totality of evidence, buntanetap’s 20 mg cohort has a better-than-not chance of delivering a positive topline result in PD in the coming weeks. We believe the probability of a net positive readout is currently being significantly undervalued by the market, especially considering the fact that positive PD results would portend well for Alzheimer’s data due in the 2Q24. While there are significant headwinds—the suboptimal primary endpoint, cash constraints, potential communication issues, inherent skepticism towards micro-cap neurology companies—Annovis has the potential to take a leap forward in an essentially untapped and untreatable multi-billion dollar neurodegeneration market.