Rising mortgage charges are prompting some lenders to downsize to adapt to altering market circumstances. However the market shift can be anticipated to drive mergers and acquisitions.

In a shifting actual property market, the steering and experience that Inman imparts are by no means extra worthwhile. Whether or not at our occasions, or with our each day information protection and how-to journalism, we’re right here that will help you construct your small business, undertake the correct instruments — and make cash. Be a part of us in individual in Las Vegas at Join, and make the most of your Choose subscription for all the knowledge you have to make the correct selections. When the waters get uneven, belief Inman that will help you navigate.

New Jersey-based AnnieMac Residence Mortgage has expanded its presence within the mid-Atlantic area by buying OVM Monetary Inc., a purchase-focused mortgage originator with over 220 workers and places of work throughout Virginia and in North Carolina, Texas and Florida.

The phrases of the deal weren’t introduced.

AnnieMac is a “doing enterprise as” or commerce identify of Mount Laurel-based American Neighborhood Mortgage Acceptance Firm LLC which additionally operates as Lofi Direct. In line with the Nationwide Multistate Licensing System, the corporate is licensed in 48 states — in every single place however Iowa and North Dakota — and sponsors 517 mortgage mortgage originators who work out of 96 department places.

Ryan Kube

“In a rising price atmosphere, development, scale and tradition are extra vital than ever,” AnnieMac President Ryan Kube mentioned in an announcement. “OVM brings that to AnnieMac in spades.”

Headquartered in Virginia Seaside OVM Monetary — previously Previous Virginia Mortgage Inc.— was based in 2001 and is licensed in 14 states.

OVM’s 4 homeowners — Matt Beckwith, Aaron Legum, George Temple Jr. and Ben Temple — will tackle lively management roles at AnnieMac, the businesses mentioned, as will OVM Monetary CEO Adam Newman and Vice President of Gross sales Brian Hill.

Matt Beckwith

“We’re excited to companion with AnnieMac to proceed offering distinctive service to our prospects and referral companions,” Beckwith mentioned in an announcement. “AnnieMac supplies development alternatives to our workers, and we share the joy for what our two organizations can do collectively.”

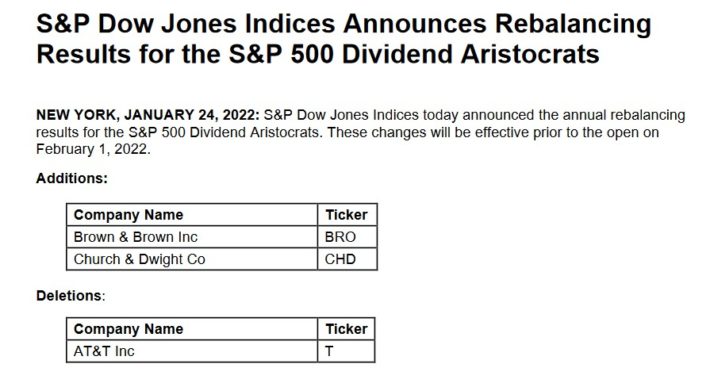

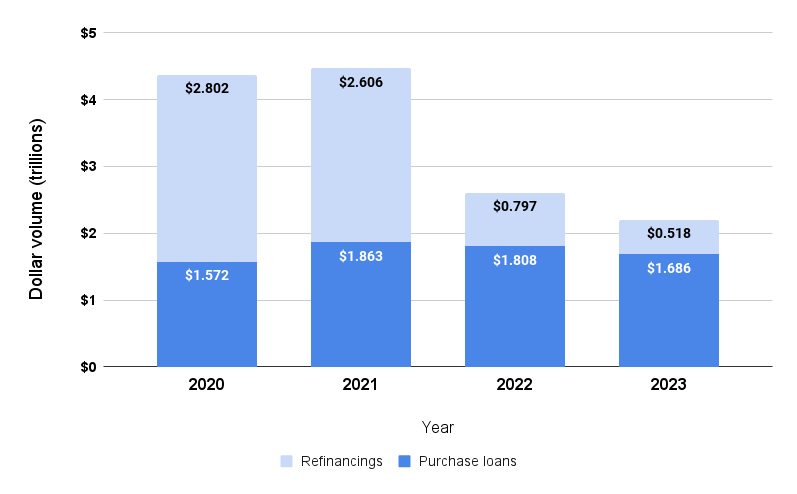

Mortgage refinancings anticipated to drop by 69% this 12 months

Supply: Fannie Mae June 2022 Housing Forecast.

Rising mortgage charges have put the brakes on the worthwhile refinancing increase of 2020-21 when the Federal Reserve’s efforts to maintain rates of interest low through the pandemic helped lenders refinance greater than $5.4 trillion in mortgages.

With mortgage charges almost doubling within the final 12 months solely 2 % of excellent mortgages have an incentive to refinance, Fannie Mae economists mentioned in a June forecast that predicted refinancing quantity will drop by 69 % this 12 months to $797 billion and by one other 35 % in 2023 to $518 billion.

Thanks partially to rising dwelling costs, buy mortgage quantity is projected to say no by a extra modest 3 % this 12 months to $1.808 trillion and by one other 6.7 % in 2023 to $1.686 trillion. Which means lenders can count on to do most of their enterprise making loans to homebuyers somewhat than refinancing present owners.

Many mortgage lenders have downsized to adapt to altering market circumstances, and First Warranty Mortgage Corp. — a Texas-based nationwide mortgage lender that makes a speciality of riskier “non-QM” loans — filed for Chapter 11 chapter safety on June 30.

However the market shift can be anticipated to drive mergers and acquisitions, akin to Redfin’s $135 million deal to accumulate San Francisco-based Bay Fairness Residence Loans in January and actual property expertise platform HomeLight’s settlement to accumulate money supply supplier Settle for.inc, introduced in June.

There has additionally been a transfer to consolidate amongst firms that present companies to mortgage lenders, most notably Intercontinental Change Inc.’s plan to accumulate mortgage software program, knowledge and analytics supplier Black Knight for $13.1 billion.

Whereas that deal is predicted to face scrutiny by antitrust regulators, borrower conversion platform Mortgage Coach and automatic retention software program Gross sales Boomerang introduced final month that the businesses had merged underneath the management of a brand new CEO, SparkPost veteran Richard Harris

Get Inman’s Further Credit score Publication delivered proper to your inbox. A weekly roundup of all the largest information on the earth of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E-mail Matt Carter