SafakOguz/iStock via Getty Images

Here at the Lab, after having commented on BHP and Rio Tinto Q2 results, we decided to deep-dive into Anglo American (OTCQX:NGLOY) (OTCQX:AAUKF). Aside from a brief analysis of the half-year report, today we would like to focus on the company’s product portfolio supported by a Balanced Approach To Earnings Diversification and a favorable exposure towards the Platinum Group Metals with many megatrend growths (energy transition, semiconductor, and electric vehicles). Our internal team also has a positive view of the new Quellaveco high-quality copper mining facility that we believe is not well appreciated by Wall Street. Year-to-date, Anglo-American stock price lost almost 33.23%, including the 2022 dividend payment; the performance is minus 31.54%. However, we should say that Anglo-American is already at ex-dividend (interim 2023) with an expected paid date in early October 2023.

Seeking Alpha

Anglo American Upside

Starting with the positive update, here are our main forward-thinking highlights:

- We see value in the Anglo-American structure with a particular emphasis on copper. Here at the Lab, in line with the company’s projection, Quellaveco ramping up will reach a copper production of approximately 600 kta per year (Fig 1). Many sectors require copper, and the company has a world-class facility with a first-year production capacity already close to 350 kta. According to our estimates, post Quellaveco ramp, this segment is worth approximately $21 billion with a $35k/t annual capacity. In number, this is about 72% of Anglo’s current market cap;

- Including Anglo Platinum and Kumba, the two listed subsidiaries in which the company has 78.56% and 69.71%, we also add in our valuations of $6.75 and $5 billion. Therefore, Anglo-American reached an enterprise value of $32.75 billion. The bottom line is that the copper business explains much of the company’s current valuation; however, many other businesses are very cash-generative. For instance, even if the market is not appreciating the coal sector, following TECK and BHP, Anglo’s coking coal business is the third largest in the world. India might be a supportive and growing emerging market on steel and might have significant positive implications for coking coal demand in the short-term medium horizon;

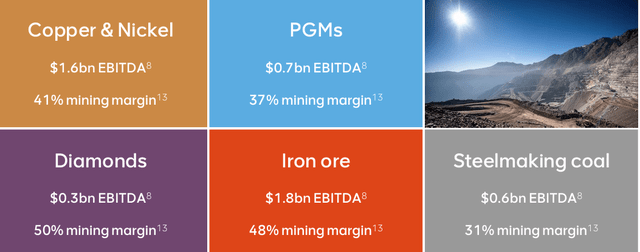

- Besides copper and steelmaking coal, Anglo has a diversified portfolio with Nickel, PGM, and iron ore mining facilities around the Globe (Fig 2). In H1, the company delivered an EBITDA of $5.1 billion, signing a minus 41% vs. last year, given the weaker product prices. Compared to its peers, this unique portfolio will likely supply the world’s future needs, and we prefer to have more diversification earnings MIX than BHP and Rio Tinto. The two companies have 3/4 of their EBITDA MIX related to iron ore. In addition, both BHP and Rio Tinto moved on with critical acquisitions to support growth (at expensive multiple), while Anglo-American does not need to invest for growth inorganically;

- On a positive note, Anglo’s net debt is $8.8 billion, with a net debt/EBITDA of 0.9x.

Anglo American Copper new plan

Source: Anglo American H1 results presentation – Fig 1

Anglo American H1 EBITDA

Fig 2

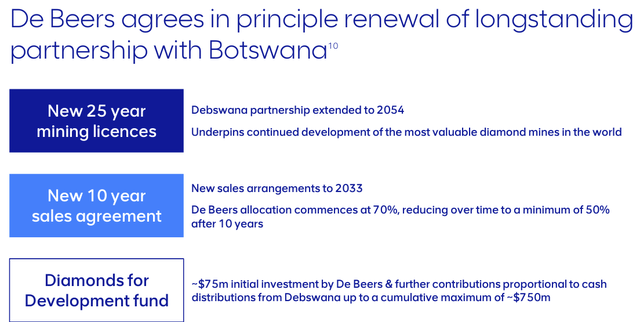

Current Downside

In our estimates, Anglo’s diamond subsidiary is valued at around 11% of its Net Present Value. The company and the Botswana government (GoB) signed a deal in early July. Looking at the details, the GoB will increase its stake by 2% over the next ten years, arriving at a control of 50%. The transaction extends the Debswana mining licenses by 25 years to 2054. This key milestone indicates that Debswana mines have long resource lives. However, in our view, the GoB’s desire to sell more diamonds at a price level that might negatively impact the longer-term diamond business, especially in a recession scenario. Here at the Lab, we anticipate an EBITDA decline of approximately $130 million, which is minor on the company’s total EBITDA contribution. The Anglo division (De Beers) will also contribute to a total CAPEX of $75 million annually in the next ten years. This will help Botswana to diversify from diamonds, which currently account for a third of its GDP.

To mitigate Anglo risk, we should recall that in 2022, the Diamonds division achieved the lowest ROCE among the company’s commodities (11% vs. 30% at the group level). Diamonds have always been seen as a luxury consumable but, on a financial aspect, are instead a “commodity.” Moreover, De Beers is advancing with lab-grown diamonds with the Lightbox products offering.

Anglo American – De Beers development

Conclusion and Valuation

Without considering Anglo’s NPV basis and the undervaluation of the company’s copper business, we believe that Wall Street is penalizing a mining group that can benefit from “CAPEX underinvestment and secular growth trends.” Therefore, today, we reiterated our buy rating on Anglo.

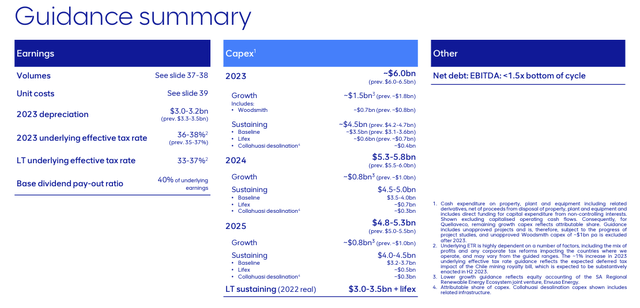

Anglo American Outlook

Considering the unchanged CAPEX plan (a reduction of $0.3 billion was recorded in H1) and the commodities price changes, we still believe that Anglo is discounted. Looking at the EV/EBITDA peers, Rio Tinto, BHP, and Glencore are currently trading at 4.68x, 6.14x, and 3.92x, respectively. Anglo-American trades at 4.15x. Regarding the dividend, in our estimates, the company offers a dividend yield in line with Rio Tinto at 6% and much higher than BHP (3%). Given the lower CAPEX requirements, our FCF yield in 2024 is at 8.8%. Lowering our EV/EBITDA from 5x vs. previous estimates of 4.5x and including the diamond’s recent performance, we derived a valuation of £32 per share (from £35 per share). Key risks to our rating include lower commodity prices, which impact the company’s cash flow, and stronger currency development focusing on ZAR/$, AUD$, and the Chilean peso. In addition, we should include geopolitical risk and regulatory changes. Quellaveco copper ramp-up also has a CAPEX of >$5 billion, and costs increase given inflation and delays.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.