Farewell, July, it’s been a pleasure. Sentiment would possibly lastly be turning on Wall Road after the inventory market recorded its greatest month since November 2020, buoyed by the tech giants better-than-expected quarterly outcomes and the prospect of the Fed easing on future fee hikes.

The foremost indexes are nonetheless down for the yr, however we’re clearly within the midst of a rally.

The place this rally will go is anybody’s guess. For now, Wall Road’s analysts are busy deciding on the shares they see as greatest positioned for features going by means of the remainder of 2H22. These ‘High Picks’ are an attention-grabbing bunch, Purchase-rated shares with robust upside projected for all.

Does that make them the best shares for a confused time? We will check out the most recent particulars, drawn from the TipRanks database, and examine in with latest analyst commentary, to seek out out. Every of those three shares has been given a ‘High Choose’ designation in latest weeks.

TechnipFMC Plc (FTI)

First on our record is TechnipFMC, a expertise supplier within the vitality sector, serving each conventional producers and new vitality clients. TechnipFMC delivers a variety of totally built-in tasks, merchandise, and providers, starting from on-shore hydrocarbon exploration and extraction to off-shore rigs and platforms to petroleum refining. The corporate operates a fleet of 18 technically superior oceangoing industrial vessels, has an energetic presence in 41 international locations, and noticed $6.4 billion in income in 2021.

A have a look at TechnipFMC’s revenues over the previous two years exhibits a pointy drop from 4Q20 to 1Q21 – however that’s an artifact of the corporate’s spinning off its petrochemical and liquified pure fuel companies right into a separate firm. Because the spin-off, revenues have been steady between $1.53 and $1.68 billion. Till this previous Q2.

For 2Q22, the corporate introduced a high line of $1.72 billion, a sequential leap of 10% from 1Q22 and a extra modest achieve of three% year-over-year. The rise in income was pushed by stable features in each predominant facets of the enterprise, together with a 9.7% sequential achieve in Subsea income and 13% sequential achieve within the Floor Applied sciences phase.

Stable efficiency allowed the corporate to make enhancements to capital construction, together with a $530 million discount in complete debt, which now stands at $1.5 billion. The corporate claimed $684.9 million in money and liquid belongings on the finish of the quarter. Along with enhancing the steadiness sheet, the corporate additionally introduced a $400 million share repurchase authorization, which interprets to some 15% to the full excellent shares. The authorization marks the start of a capital-return coverage to shareholders.

In protection for Piper Sandler, analyst Ian Macpherson factors to growing momentum in Subsea as a ahead driver for FTI shares, writing, “After reserving $1.9B in Q1, we’ve assumed avg $1.6B avg inbound for Q2- This autumn, and wouldn’t be shocked to see our FY estimate of $6.7B eclipsed. The quantity of labor that FTI is no-bidding this yr is unprecedented previously decade. This in itself is a robust indicator of pricing energy lastly normalizing again to sustainable ranges. That cyclical tailwind, when layered in with the embedded margin levers related to FTI’s relentless enterprise mannequin innovation over the previous 5 and previous 1-2 years suggests cheap upside to the just lately outlined Subsea margin roadmap…”

Believing that this firm will outperform going ahead and bookings and enterprise will enhance, Macpherson retains it as a ‘High Choose,’ and charges the shares as Obese (a Purchase). His value goal, at $14.65 in US foreign money, suggests a one-year upside of 81% within the coming yr. (To look at Macpherson’s observe report, click on right here.)

This participant within the vitality trade supporting solid has 4 latest analyst evaluations on report, and they’re unanimous that this can be a inventory to Purchase, backing up the Sturdy Purchase consensus score. The shares are buying and selling for $8.09 and their $11.91 common value goal implies a 47% one-year achieve. (See TechnipFMC’s inventory forecast at TipRanks.)

Legend Biotech Company (LEGN)

Subsequent up on our record is Legend Biotech. This clinical-stage biopharmaceutical firm is engaged on superior cell therapies for the remedy of hematological and stable tumor cancers. It is a generally trod path for biopharma corporations; Legend is ready aside by the superior nature of its pipeline program, which at the moment options a number of Part 2 and Part 3 medical trials. The corporate’s hematologic malignancy program is its most superior, with no fewer than 6 late-stage trials underway.

On its medical program, Legend made a number of necessary bulletins in simply this previous June. The primary of those bulletins involved a brand new program, LB1908, for which the FDA has simply cleared the investigational new drug utility (IND), thus clearing the best way for a Part 1 medical trial of LB1908 within the US. The drug candidate is a CAR-T remedy designed to assault relapsed or refractory gastric, esophageal, and pancreatic stable tumor cancers. A Part 1 trial of this drug candidate is already ongoing in China.

Within the second announcement, Legend launched new information from its ongoing, large-scale CARTITUDE medical trial program of ciltacabtagene autoleucel. It is a new remedy for the damaging blood most cancers a number of myeloma, which has no efficient remedies and excessive unmet medical wants. The brand new information exhibits ‘deep and sturdy’ therapeutic responses amongst sufferers in a number of of the CARTITUDE trials, with an general response fee of 98% after two years.

Essentially the most thrilling growth, nevertheless, was the FDA’s February approval of Carvykti, considered one of Legend’s new remedies for a number of myeloma. The FDA transfer was adopted in Might by approval from the European Fee to start advertising actions. Carvykti is a BCMA-directed, genetically modified autologous T-cell immunotherapy, additionally known as cilta-cel. Legend has an unique international licensing settlement with Janssen for the commercialization of Carvykti.

Along with these medical updates, Legend reported necessary monetary leads to the primary quarter. These included revenues of $40.8 million, derived from growth milestones in licensed analysis packages. Legend additionally has $796 million in money and money equivalents out there, in comparison with Q1 R&D and G&A bills of $94 million, giving the corporate a money runway into 2024.

All of that was sufficient for BMO analyst Kostas Biliouris to make Legend considered one of his High Picks within the biotech sector, and to set an Outperform (Purchase) score on the shares. His value goal, of $77, implies a one-year upside of 63%.

Backing his stance, Biliouris factors out a number of strengths of this firm: “1) Carvykti commercialization in A number of Myeloma (MM) as a best-inclass late-line CAR T remedy anticipated to confer a major income stream, offering draw back safety; (2) Steady growth of Carvykti addressable inhabitants by means of approvals in earlier traces and ex-US areas will gasoline further development, driving long-term worth; (3) Upcoming information readouts from earlier-line therapies can drive short-term upside; and (4) Diversified pipeline affords optionality and alternative for additional upside.” (To look at Biliouris’ observe report, click on right here.)

As soon as once more, we’re a inventory with a unanimous Sturdy Purchase consensus score; Legend has obtained 4 optimistic analyst evaluations just lately. LEGN shares have a median value goal of $72, indicating a 52% upside from the present buying and selling value of $47.24. (See Legend’s inventory forecast at TipRanks.)

AvePoint (AVPT)

The final inventory we’ll have a look at right here is AvePoint, one of many software program trade’s main gamers. The corporate affords a cloud-based SaaS platform offering options for information migration, administration, and safety at the side of Microsoft 365. The New Jersey-based firm was based in 2001 and has tailored because the computing surroundings has modified through the years, increasing its vary of software program merchandise and options.

some numbers, AvePoint boasts that it has managed over 125 petabytes of knowledge, and that its most up-to-date quarter, 1Q22, confirmed 45% SaaS income development and 30% annual recurring income (ARR) development, to a complete of $167.4 million.

The corporate’s enhance in SaaS income introduced that phase’s complete to $26.6 million in Q1, out of a complete of $50.3 million on the high line. Whereas revenues have been on the best way up, earnings got here in adverse, with a 6-cent diluted EPS loss, though this in contrast favorably to the year-ago quarter, when the EPS loss got here in at 14 cents. AvePoint has a sound money holdings, with $260 million in money and short-term investments out there.

5-star analyst Nehal Chokshi, of Northland Capital Markets, chosen this inventory as a High Choose after a deep dive into the corporate’s efficiency. He’s impressed by AvePoint’s ahead potential, writing, “We view our new long run income CAGR of 25% as very conservative given our initiation work highlighting a extremely differentiated functionality relative to main co-opetive participant MSFT and that our work that verifies AVPT is addressing the total $6.5B TAM recognized…. Different key parameters in our DCF embody a 30% non-GAAP OM, which is 500 bp above the low finish of administration’s 25%+ steering however is per the 30%+ terminal OM we assume with different prime quality SaaS names beneath protection…”

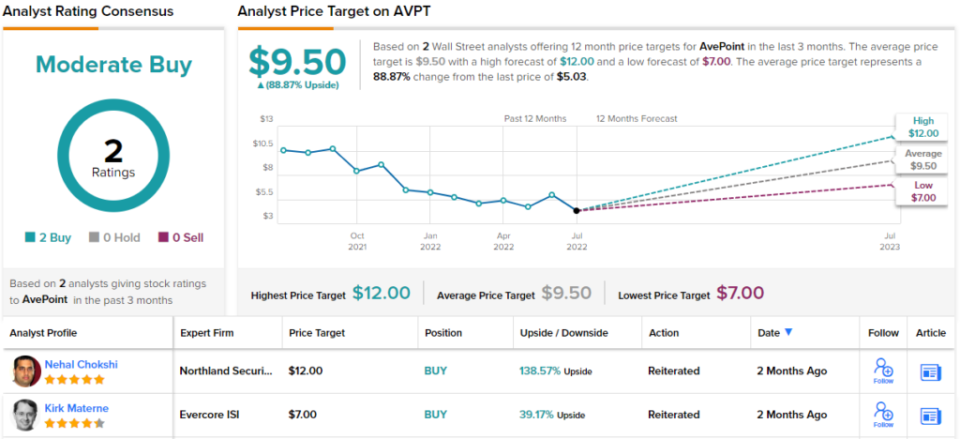

These feedback assist Chokshi’s Outperform (Purchase) score, whereas his $12 value goal implies a 138% upside within the subsequent 12 months. (To look at Chokshi’s observe report, click on right here.)

Each of the latest analyst evaluations on this inventory are optimistic, making the Reasonable Purchase consensus score unanimous. The shares are promoting for $5.03 and their $9.50 common value goal suggests an upside of 89% this yr. (See AvePoint’s inventory forecast at TipRanks.)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.