Espionage is back in the news…

Recent leaks about the war in Ukraine are a cause for concern. They cast doubt on Ukraine’s abilities to sustain its efforts.

There are also indications that the U.S. is spying on Russia, and even on allies like South Korea.

Revelations that the U.S. spies on its allies are always met with shock. Skeptics seem to forget we spend billions on the ability to listen to phone calls around the world. It would be wasteful if we didn’t use that technology.

Likewise, there is shock that our intelligence services know a lot about what’s going on inside the Kremlin. Unfortunately, Russia also has sources within our government that provide sensitive information.

It’s always been that way. And it always will be. Intelligence officers will always rely on the same tools.

In recent years, market analysts borrowed many of these tools. Among my favorites is the way the Federal Reserve has replaced Lenin as the target of Cold War-style espionage.

Espionage is both a lot simpler and a lot more complicated these days. The internet makes access to information much easier. At the same time, it’s created a lot more information to sift through.

Right now, analysts are stuck in the Cold War-era of espionage tactics to forecast the Fed’s next move. These tactics, however won’t work.

We must use different tactics to analyze the Fed’s next move and how it will impact markets. Further, we must find a way to invest differently in this era of higher interest rates and volatility. I’ll show you both ways today.

From Photos of Lenin to Lights in the Fed Building

During the Cold War, analysts reviewed pictures from the Soviet Union’s annual May Day parade. Soviet leaders watched the parade from Lenin’s tomb.

Analysts compared photos of the leaders, like the one below, with the previous year’s image to determine Lenin’s closest associates.

(Source: IdeaGuide.ru.)

This shows Stalin surrounded by his inner circle. Whoever was closest to him was next in line for a promotion … maybe.

Stalin also had a habit of killing his closest associates. Many people disappeared from one year to the next.

Analysts used this technique to predict who was moving up and down in the chain of command. Some analysts have applied similar techniques to analyze the Fed.

In the early 2000s, they watched then-Chairman Alan Greenspan walk into the Fed building. They claimed policy changes were announced on days when his briefcase was thick.

Then in 2008, analysts started looking at the Federal Reserve building in New York City as they left work. The Fed’s offices are located a few blocks from the New York Stock Exchange.

If lights were on in the building after regular work hours, the rumor mill lit up. The theory was that Fed officials were working on a problem.

These days, we simply overanalyze every word in Jerome Powell’s speeches to forecast policies. Of course, the Fed’s words are almost always the same. Officials acknowledge that inflation is high. They insist they will continue fighting inflation.

Still, during and after each speech, analysts react. Most seem to say they believe the Fed is almost ready to stop raising rates. A few weeks later, the Fed raises rates and the whole game begins again.

That’s where we’re at now. It took strong jobs data last Friday for traders to become more confident that the Fed will raise rates again.

With a lower-than-expected CPI print yesterday, the question hangs in the air once again.

Fortunately, we don’t need to rely on what analysts think or say.

We can watch what traders are doing with real money — which I’ve always found to be a far better forecasting tool.

Always Follow the Money

Many analysts simply read the probability of the rate hike the CME futures exchange makes readily available. But that’s a volatile number. It changes rapidly based on the latest data release, headline or market action.

A better approach is to calculate the weighted probability based on all open contracts. This shows less volatility.

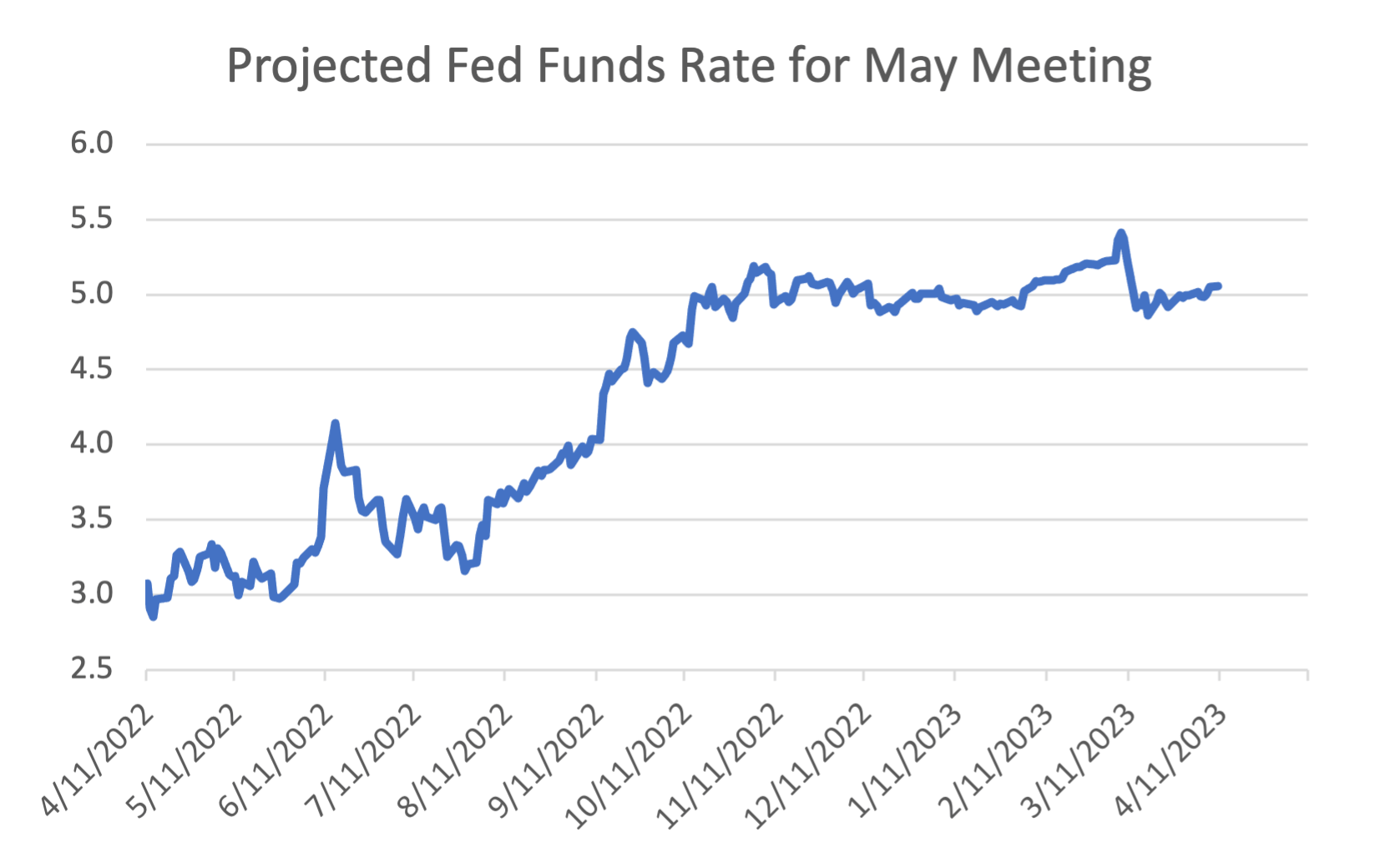

We can see the projections for the Federal Funds rate for the May 2023 meeting below…

(Source: CME.)

Fed funds are a short-term interest rate. Traders expect the Fed to raise the rate to a range of 5% to 5.25% on May 3. We can see that, just a year ago, traders expected the federal funds rate to be at 3%.

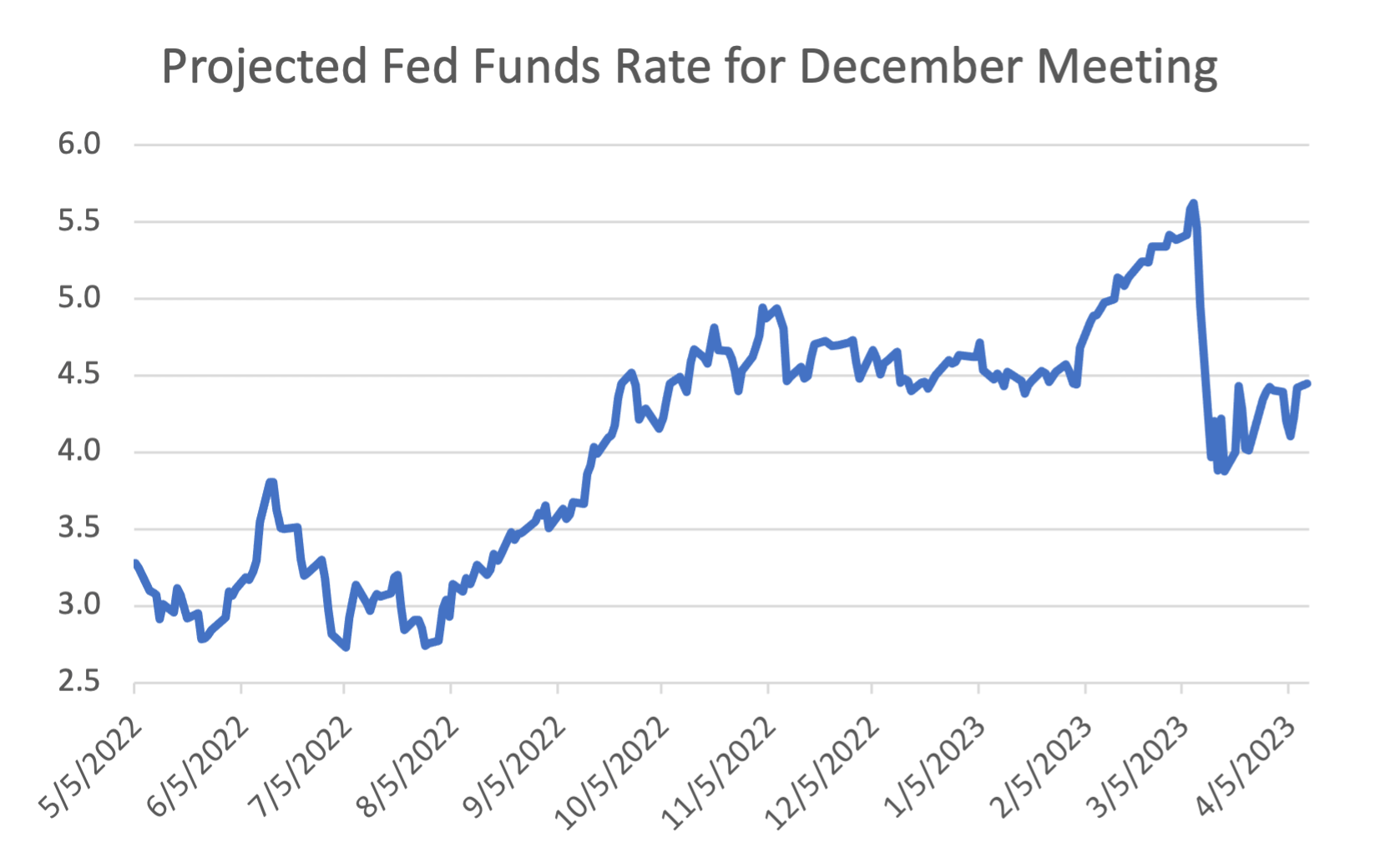

But more important than the next meeting is Fed policy for the rest of the year. The next chart, which shows expectations for the December meeting, shows traders are pricing in two rate cuts before the end of the year. Fed Funds should be between 4.5% and 4.75% in December.

(Source: CME.)

Market action of the past year might have you think this is good news for the stock market. It might be. But it’s definitely bad news for the economy.

The Fed is raising rates to fight inflation. A drop in rates implies inflation will be lower. But it also implies the economy will be slowing.

Interest rates are the price of money. When the economy grows, demand for money grows. This means more businesses and consumers want loans. So banks raise interest rates.

Declining rates are the exact opposite. The economy contracts. Demand for money slows. And interest rates fall.

The Fed broke this simple model in the last decade. Rates stayed low to battle crises, and perceived crises, so long that it simply became the status quo. The high inflation of the last two years showed this approach was no longer sustainable.

Now it’s back to basics. Interest rates reflect economic growth. And lower rates are a sign of trouble.

I understand that “the coming recession” is perhaps the most anticipated recession in history. But it’s also all but certain we’ll get a recession. We must prepare.

There are plenty of ways to do that. But you shouldn’t jump to the most extreme option. For example, socking all your money under your mattress, or in gold bullion buried in the backyard. I wouldn’t recommend that.

Instead, you should look at this bear market as an opportunity — even if it lasts for longer than you anticipated.

Many stocks are trading at cheap valuations for the first time in many years. Higher interest rates are washing out the weak businesses and forcing strong businesses to make the decisions that will make them last.

It’s not simple to find these needles in the proverbial haystack. But Adam O’Dell has built a way for you to start your search.

If you enter your email on this page, he’ll send you a list of candidate stocks that passed the initial test of his Stock Power Ratings system. If you read his Banyan Edge article last Friday, you’ll know that these are all small-cap stocks as well — the kind that outperform all others after bear markets and recessions.

In the weeks to come, Adam, will whittle down these stocks down to just a handful that he believes could make 500% gains this year. To follow along as he does this, go here.

Regards, Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

Mike Carr mentioned the art of espionage, which got me thinking. If we really did have spies inside the Federal Reserve, would we just be disappointed?

Despite all evidence to the contrary, we like to believe that the people pulling the puppet strings of our economy know what they’re doing.

If we could actually be a fly on the wall to hear what goes on in their meetings, rather than just read the (presumably) sanitized meeting minutes, I think I would be more depressed than worried.

My mental image is the men and women of the Fed Committee sitting around a table, shrugging at each other, not really knowing what to do next.

At any rate, let’s talk about inflation … and what the Fed is saying about it.

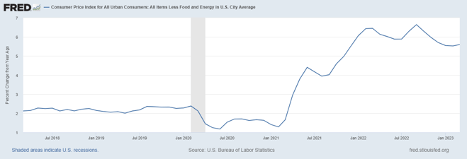

Consumer Price Index (CPI) inflation came in at 5% for March, which is its lowest monthly print in two years. Core CPI, which excludes food and energy, was a little higher at 5.6%.

It’s hard to argue that core CPI is trending lower. It’s been stuck at around 3.5% all this year and has yet to really break down, like the more volatile price inflation in food and energy.

The Fed tracks a variant of core consumer inflation: the Personal Consumption Expenditures Price Index. This index more or less follows the same trend. And this is the inflation stat they aim to hold at 2%.

To that end, the minutes from the March 21 to 22 meeting were released yesterday. They read that inflation “remained well above the Committee’s longer-run goal of 2%,” and that “the recent data on inflation provided few signs that inflation pressures were abating at a pace sufficient to return inflation to 2% over time.”

Gee, ya think?

Look, food and energy prices lowering is a major positive. Those were the budget items really pinching American households the hardest, so it’s good to see at least a little relief there. I don’t want to minimize that.

But the Fed targets core inflation, and core inflation is being stubbornly sticky.

I have a few ideas as to why that is … and I’ll share those with you in tomorrow’s edition of The Banyan Edge.

So stay tuned!

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge