Marjan Laznik/E+ via Getty Images

Euphoric markets tend to get deals done. We saw another offer recently from the Brookfield family that came on the footsteps of two other purchases. Brookfield Infrastructure Corporation (BIPC) first bought out Triton International Limited. (TRTN). Then Brookfield Renewable Partners (BEP) took a small renewable asset portfolio off from Duke Energy (DUK). Last week we learned that Brookfield Reinsurance (BNRE) offered $55 for American Equity Investment Life Holding Company (NYSE:NYSE:AEL).

We look at this deal from both parties perspective and tell you the likelihood of the deal getting through.

The Company

AEL, through its wholly-owned operating subsidiaries, focuses on the sale of fixed index and fixed rate annuities. Their goal is to help provide individuals preserve their retirement dollars and also to provide a secure, predictable income they cannot outlive. The industry is currently getting a tailwind from higher interest rates, which improves the margins on newly sold policies. The stock had been through some turbulence prior to this offer. Prosperity Group made and then withdrew its offer as AEL did not give them the time of the day.

Prosperity is withdrawing its proposal to acquire American Equity for $45.00 per share. Given American Equity’s refusal to engage and our desire to proceed only on a constructive basis, Prosperity has no interest in continuing to pursue our proposed transaction at this time.”

Source: Seeking Alpha

AEL divided 12% on that day as investors suffered from the rug pull. The new offer though has some solid credentials.

Brookfield Reinsurance delivered a letter to the board of directors of AEL setting forth a proposal to acquire all of the outstanding shares of common stock of AEL not already owned by Brookfield Reinsurance for aggregate consideration of $55.00 per AEL share.

As consideration for each AEL share, shareholders will receive $38.85 in cash and a number of Brookfield Asset Management Ltd. (BAM) (BAM:CA) class A limited voting shares (“BAM Shares”) having a value equal to $16.15 based on the unaffected 90-day VWAP as of June 23, 2023, resulting in total consideration of $55.00 per AEL share.

Source: Seeking Alpha

BNRE has offered more than 20% higher than the offer from Prosperity. One could argue that the market conditions are a bit better today than when the former offer came through, but there have certainly been more stresses on the financial sector since then. BNRE also owns 20% in AEL already. This is key as BNRE likely has a finger on the pulse of AEL board members. AEL can also not dismiss a 20% existing shareholder as easily as they would dismiss Prosperity. We give this deal a 95% plus chance of getting done.

Who Benefits From This?

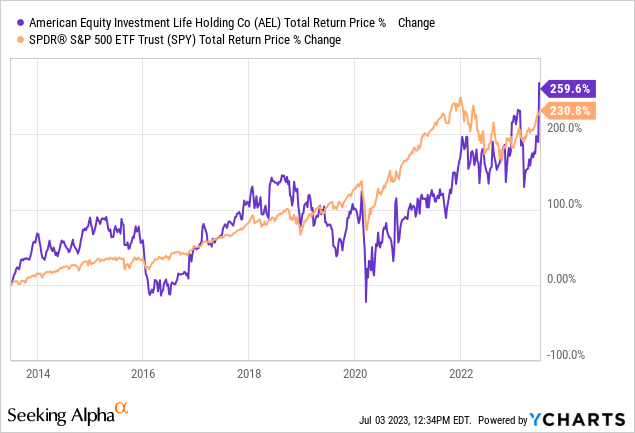

AEL exiting at $55 would not be the worst thing for the stock holders. Very few financial sector stocks have beaten the S&P 500 over the last decade. If this deal does go through, AEL will have achieved that.

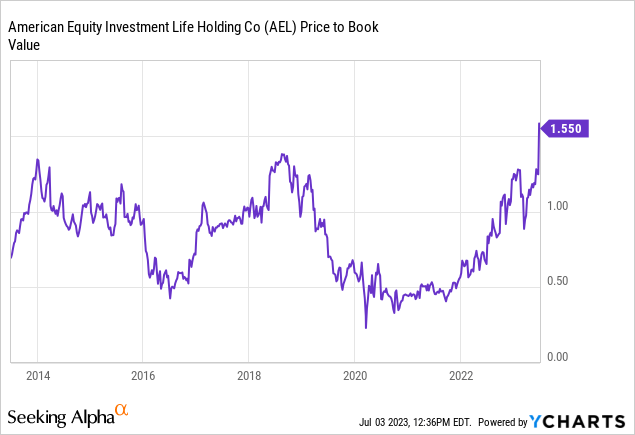

AEL would be taken out near 1.6X on a price to book value, a number that would be higher than the highest achieved by the company in the last decade. Again, not a bad exit from a valuation perspective.

What About The Other Side?

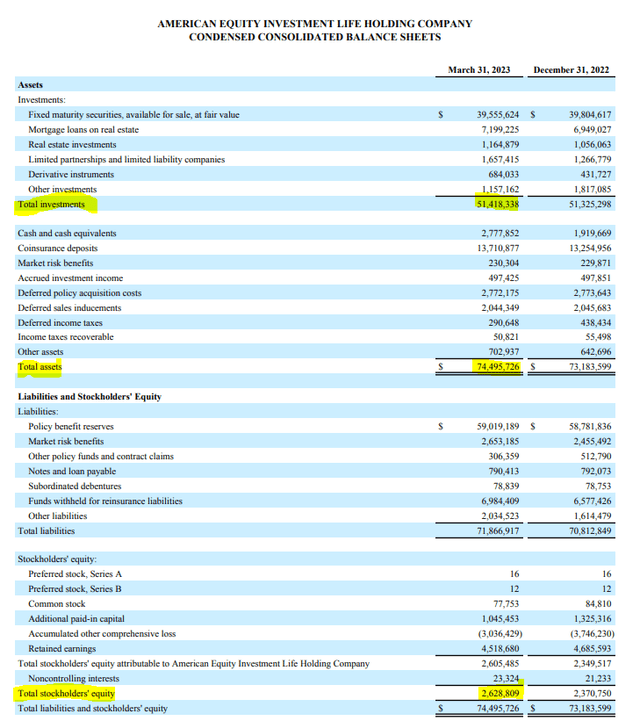

BAM shares will be issued but BAM will not participate in the equity investment or have any exposure to the insurance liabilities. The shares issued will come from Brookfield Corporation’s (NYSE:BN) holdings in BAM. BAM will get the benefit here of becoming AEL’s investment manager. On last check, AEL has a huge asset base, far in excess of its public market capitalization or shareholder equity.

AEL Balance Sheet

This is standard in the case of life insurance companies and the key number here is the $51 billion investment portfolio. BAM will be managing that and over time it will become part of its Fee-Related-Earnings or FRE portfolio. Assuming the standard 25 basis points of FRE, this could add an additional $125 million to revenues and potentially $115 million to earnings. Most marginal revenue translates into earnings at BAM at this stage of the company growth.

How To Play It?

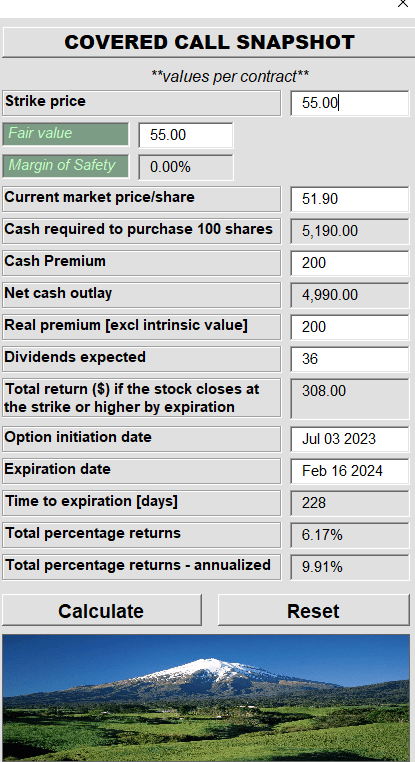

The deal likely goes through at or near the current offer price. If BNRE made the offer, they likely won’t shy away from paying a little extra if AEL presses on it. In fact they might have expected that and made the initial overture with the idea they would raise it later. With AEL stock trading at $52.00 as we write this, how can one play it? Assuming it goes through at $55.00 within 9 months, you do stand to make $3.00 and the small dividend. While that is good, it does not beat the risk-free rate by enough. We prefer to play this on the AEL side with a covered call. As shown below the “yield” is 9.91% annualized.

Author’s Calculator

But this ignores the appreciation to $55.00 from the current strike. Your total returns should be slightly more than double what is shown from the covered call portion (assuming the deal closes by then). Further this also captures some of your upside should the final offer be revised higher. Since the bulk of the offer is cash, an equity portion does not present a material risk.

On the Brookfield side, we are warming up the BN (and BNRE for that matter, the shares are equivalent) at or near the $30 mark. We recently initiated a starter position there with covered calls. We think that is a far better value than BAM shares trading at 24X earnings.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.