guvendemir

Thesis

American Airlines Group (NASDAQ:AAL) is a holding company whose primary business activity is the operation of a major network air carrier, providing scheduled air transport for passengers and cargo. The regional carriers provide scheduled air transportation under the brand name “American Eagle”. The cargo division provides a wide range of freight and mail services, with facilities and interline connections available across the globe

During the pandemic, the airline industry was one of the worst to hit due to a complete stoppage in air travel. AAL, in particular, suffered one of the hardest because it experienced a huge 62% fall in revenue, which it has barely recovered in FY 22. However, it remains to be seen whether this recovery is only a temporary phenomenon or whether the growth for AAL will take off at this stage.

Even though the airline has seen rising cash flows and profitability, it is currently facing major issues in two channels of expenditure – labor and fuel. The workers of American Airlines have been pressuring the senior management about providing pay raises, and the prolonged Russia-Ukraine war has also led to increasing fuel costs. As a result, the prospects are highly uncertain for the airline giant.

Catalyst

Wage Negotiation Issues with Employees

American Airlines has gotten into repeated issues with employees, which involved them getting into negotiations regarding wage payment. The problem is particularly pertinent for American Airlines due to multiple reasons.

One of them is that due to the COVID-19 pandemic, the cash reserves of AAL have reduced considerably. For example, the cash ratio of AAL is currently only 12.71%. Therefore, AAL is currently finding it difficult to finance any wage increases. To add to the problems, its competitor Delta Airlines has already offered a 5% raise, and the DAL employees are among the most well-paid ones. A report by Reuters states that the pay raise of Delta Airlines comes at a time when there is an industry-wide shortage of workers and a faster-than-expected rebound of the demand for air travel. American Airlines currently finds itself in a dilemma of whether to maintain profitability by reducing costs or retain employees by offering pay raises.

Glassdoor

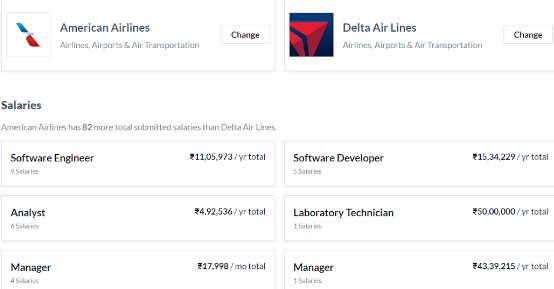

To understand the level of importance that wages play for an airline company, the following are the statistics that provide us with the breakup of operating expenses for American Airlines for FY21. Note that here data from FY21 has been presented since data from FY22 was not available.

Statistica

As we can see above, salaries, wages, and benefits take up a large portion of American Airlines’ expenses. The next biggest category is aircraft fuel, which is little more than half of total wage expenses. Therefore, American Airlines is currently in a tricky position as it already faces very high labor costs, which could only increase further due to the labor protests the airline faces as its peers in Delta Airlines are paid more. Based on the graph above, we can say that employee wages take up 33% of the operating expenses. Therefore, based on the current value of operating expenses, if AAL were to offer a 10% increase in wages, that would translate to a 3% increase in operating expenses, leading to a 150% drop in net profits based on AY22 estimates. Increasing pay raises would reflect lower retained earnings (which is already less than $-8 billion as of FY22). Conversely, letting go of workers would lead to lower revenue leading to the same outcome.

It is also to be noted that AAL had previously gone bankrupt in 2011 in order to cut labor costs in the face of high fuel prices and low travel demand. The current conditions are almost replicating the conditions (as explained in the upcoming sections of this report) in 2011. Therefore, all indicators are currently pointing towards a very ominous conclusion.

Rising Fuel Costs Due to Russia-Ukraine Conflict

The Russia-Ukraine conflict has disrupted the global fuel supply, translating into higher prices of crude oil and other forms of fuel. One of the sectors to have been hit by this is the airline industry, where jet fuel is one of the key inputs for the business. As illustrated in the previous graph, aircraft fuel is the second largest source of the operating expense of American Airlines.

However, a bigger problem that has resulted for American Airlines is the increase in fuel costs. The graph illustrates the portion taken up by fuel. An estimate by the

For 2022, the International Air Transport Association (IATA) had estimated airlines would lose $11.6 billion because fuel prices reached north of $78 per barrel.

IATA

The Russian invasion of Ukraine took place in February 2022. Post that, the jet fuel prices rose by almost 100% till May 2022, after which the prices fell to 150% of the Feb 2022 level during the last quarter of FY23. Therefore, the current prospects are not bright in terms of profitability of the airline industry. When we look at profitability, we notice that the COGS increased by 33% from AY21 to AY22. However, the increasing demand for air travel (evident in revenue growth at around 60%) was sufficient to cover this increase in operating expenditure. The result was a much slower growth in net income.

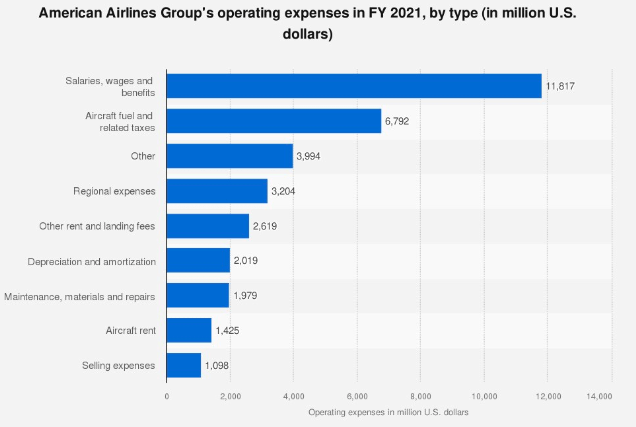

Google Sheets

As visible above, EPS experienced a massive fall in 2020 when the airline industry virtually closed down due to the pandemic. Post the pandemic, the net income was increasing rapidly from its low until 2022, when it experienced large increases in operating expenditures resulting from increased fuel prices. The EPS value has not yet risen back to the 2018 level and is expected to experience a continuous but slight decline or remain at a stationary level with no prospect of growth.

However, the fuel prices have reduced significantly since the high levels during the mid of 2022. Though that has contributed to improved profit margins, the fuel prices have not yet rebounded to the pre-war levels which is adding to the cost pressures of American Airlines. Though the prospects around fuel costs may be sanguine, I believe that there is a perennial risk present of fuel prices rising again or staying at the same level which is exacerbated by the high losses that they faced during the pandemic which dried its profitability and its working capital has been negative for the past four years.

Even though this is a situation applicable to all airline service companies, the situation is especially worse for American Airlines because its two primary cost channels are facing upward pressure, which could imply very uncertain outcomes for the future of the company. However, the high fuel price is likely only a short-term risk for American Airlines because the oil market is likely to readjust, and prices are likely to fall, which would likely reduce the operating expenses.

However, prospects are not entirely bleak for American Airlines and one such indication is that its operating cash flows turned positive in 2021 after the pandemic and has been growing ever since. In FY22 it was $2,173m and the TTM is $4,996m. It had previously reached a low point of $-6,543m in FY20. The positive cash flows are an indication of the growing profitability of American Airlines (which rose from $-1,993m in FY21 to $127M in FY22) with air travel demand rebounding. However, I personally believe that one must be cautious observing the growing profits because AAL is as yet riddled with problems like wage negotiation, uncertain fuel prices, etc which could lead to increased expenditure and reduced profitability. Therefore, I would recommend a more conservative approach in estimating growth of future profitability and cash flows, given the current problems facing the airline and no indication of a positive demand shock as yet.

Valuation

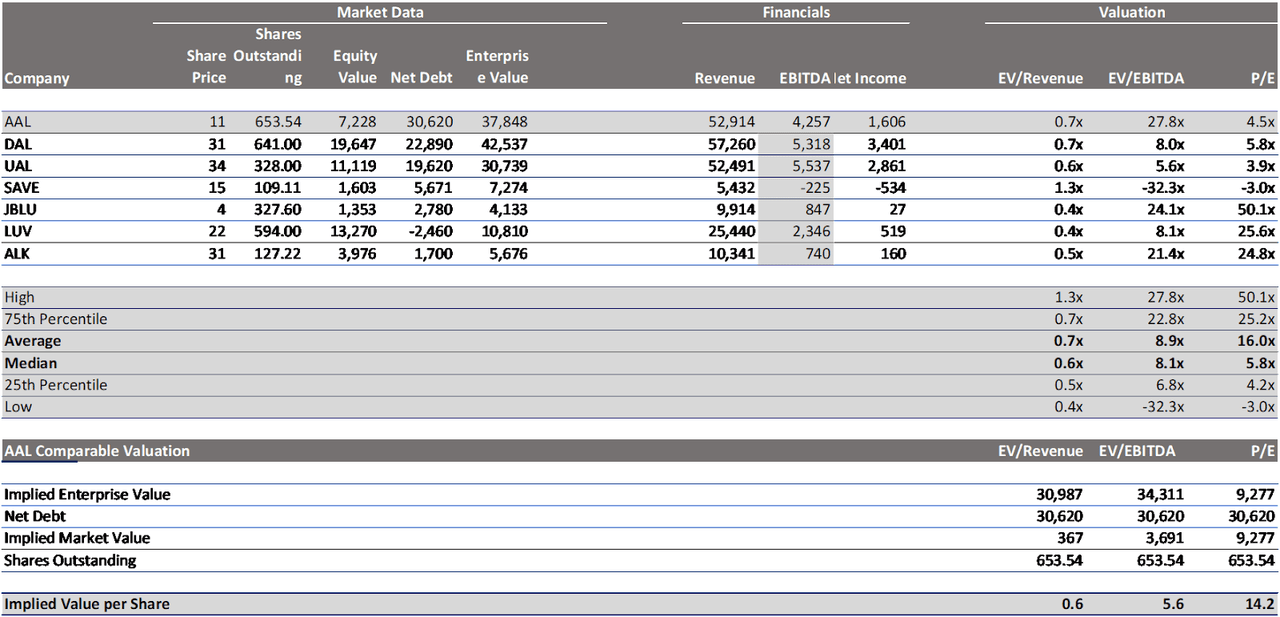

In order to undertake a valuation of American Airlines, I have undertaken relatively comparable valuations. I have gathered data on other airline companies like Delta Airlines, United Airlines, etc, which operate in the same industry. Below is an image of my comparable valuation.

Google Sheets

After calculating the respective multiple values like EV/Revenue, EV/EBITDA and P/E of each company, I calculated the value of the median value of the multiplier. I used that value in order to estimate the enterprise value of AAL using the sales and EBITDA figures of AAL. I subtracted net debt to get the implied market cap and, from there, calculated the value per share.

My model results in an average Fair Value/ Price Target of $5.8, suggesting that the stock is currently overvalued. I could not run a DCF valuation on American Airlines because it has been facing negative free cash flows in all years except for 2021 (when it did not undertake any capex and was facing growth in OCF).

Conclusion

Based on the previous analysis, the prospects of AAL are not very bright at the moment. Though recovery is expected from the massive dip in financials during the pandemic, the recovery is yet to be full-fledged.

However, the stock is not providing a very optimistic picture in the current period. A closer look at some burning internal issues ongoing for AAL also provides a very pessimistic view of the current outlook for the airline giant. For example, the AAL is currently facing demands for pay raises from its employees, which is already the corporation’s largest expenditure source. To make things worse, the Russia-Ukraine conflict has also resulted in increased fuel prices, which is the second largest source of expenditure for the airline. When we undertake a quantitative analysis of the stock, the fair value turns out to be significantly below the market price. Overall, my recommendation for the stock would be a SELL.