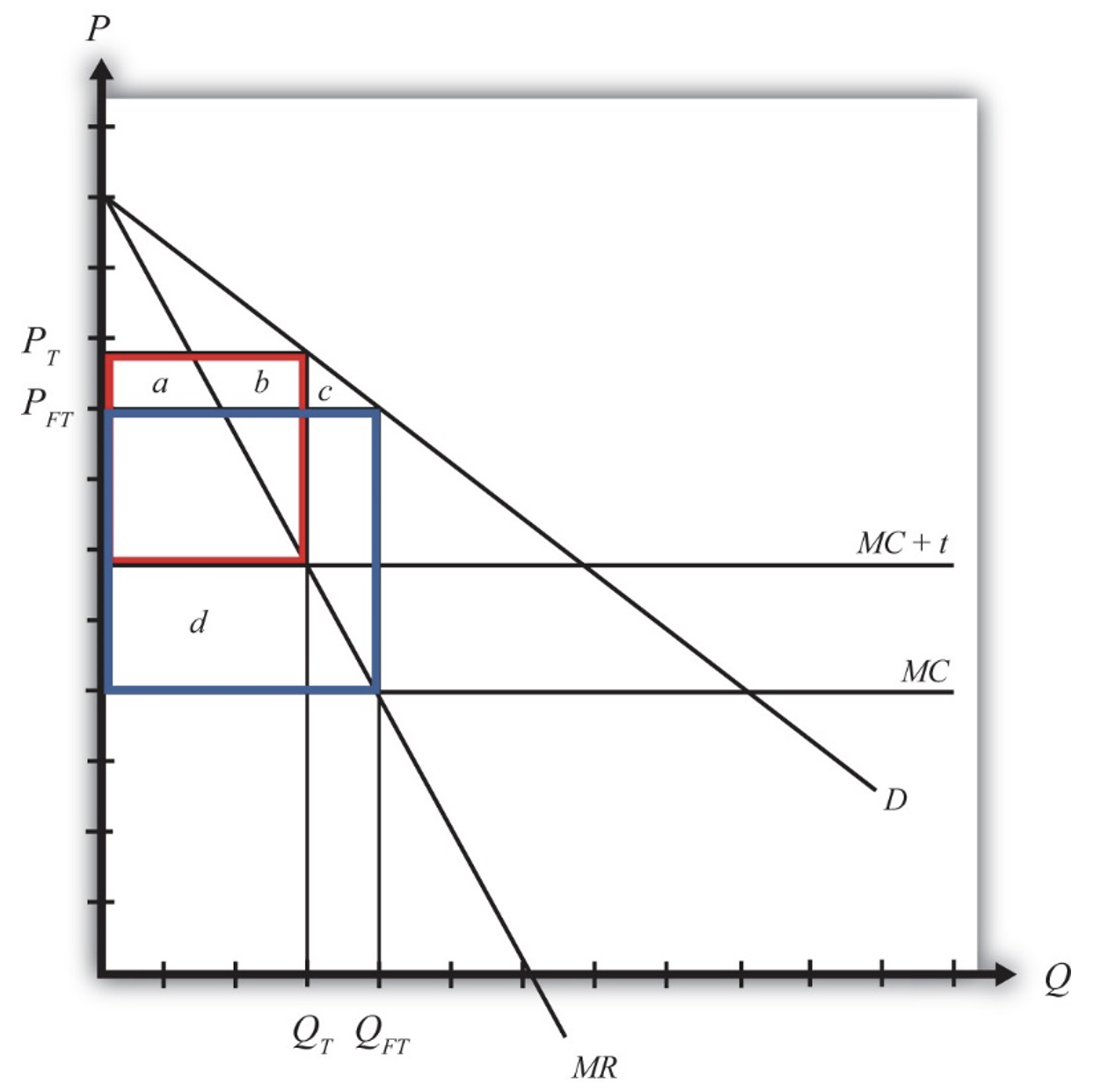

Since his first presidential run in 2016, Donald Trump has championed a shift towards financial insularity. Whereas his first time period was marked by a protectionist agenda, he has taken it to new heights since returning to workplace on January 20 by making tariffs, commerce wars, and nationalist rhetoric central to Washington’s financial playbook.

The president and his advisors body his America First commerce coverage as measures to guard American business and jobs. It is a strategic miscalculation. America is combating yesterday’s battles whereas ignoring its strongest present financial asset — its dominance within the international companies financial system.

Traditionally, the US has at all times stayed forward of the worldwide financial curve. It led the world into industrialisation within the second half of the twentieth century whereas a lot of the globe remained agrarian.

At present, it stands on the forefront of the digital financial system, whereas many different nations are nonetheless centered on manufacturing. But, as an alternative of reinforcing this ahead momentum, the present coverage method represents a shift backwards. Such a shift might isolate the US from its aggressive benefit in a quickly globalising companies sector.

Take into account the numbers: In keeping with the Bureau of Financial Evaluation, in 2023, the US exported $1.03 trillion in companies and imported $748.2 billion, leading to a considerable commerce surplus. The nation accounted for 12.5% of world service exports, far surpassing some other nation.

These numbers make it obvious that even at its present commerce deficit general continues to draw political ire, the US runs an enormous commerce surplus in companies. The US has a transparent and sustained lead in areas like finance, cloud computing, greater schooling, consulting, leisure, and rising sectors corresponding to AI and software-as-a-service (SaaS).

On the coronary heart of this dominance in companies are the so-called “Magnificent 7” firms: Apple, Amazon, Microsoft, Alphabet, Meta, Nvidia, and Tesla. The seven tech giants had a mixed market cap of $17.6 trillion on the finish of final yr, four-and-a-half instances the dimensions of India’s GDP.

These firms will not be simply tech titans. They’re trendy commerce powerhouses, producing monumental worldwide income by digital infrastructure, Synthetic Intelligence (AI) platforms, cloud companies, autonomous techniques, and international logistics. These corporations thrive not in closed economies, however in open, related markets. Commerce obstacles would solely restrict their attain and cut back the aggressive edge the US presently enjoys.

But, the Trump administration appears decided to use an outdated industrial-age playbook to a Twenty first-century digital financial system. The implications of such protectionism are already turning into clear. Whereas smaller economies have often made concessions beneath strain, bigger buying and selling companions are more and more pushing again.

Canada, Mexico, and the European Union, traditionally amongst America’s closest allies, have signalled frustration with Washington’s tariff-first method and will quickly flip towards one another and different partnerships if tensions escalate additional.

Strategic alignments in Asia are shifting in actual time. Simply final week, the overseas ministers of China, Japan, and South Korea, three nations that after sat uneasily in the identical room, met in Tokyo to sign deepening regional cooperation. “Our three nations have a mixed inhabitants of almost 1.6 billion and an financial output exceeding $24 trillion. With our huge markets and nice potential, we are able to exert vital affect,” Chinese language overseas minister Wang Yi stated after their assembly.

Whereas the US financial system stays the biggest on this planet at round $30 trillion, the formation of other commerce alliances might undercut America’s financial leverage.

If these traits proceed, the fallout received’t simply be geopolitical. America’s thriving companies ecosystem, which depends on seamless digital commerce, open requirements, and regulatory cooperation, would be the first casualty. Tariffs and isolationism received’t defend this sector. They’ll undermine its progress and international attain. As an example, India is the biggest marketplace for Fb, with almost 380 million customers, greater than all the inhabitants of the US. WhatsApp, one other Meta-owned platform, has over 538 million customers within the nation.

If New Delhi had been to close down entry to Fb and WhatsApp, it wouldn’t simply be a home disruption; it might deal a big blow to a serious US tech firm. In such a situation, it’s the US financial system and its innovation ecosystem that might in the end really feel the ache.

Because of this the US must be shaping, not shunning, the foundations of the fashionable international financial system. The following financial hegemon received’t be the nation that builds the tallest tariff wall, however the one which writes the foundations of digital engagement.

Sadly, Trump’s political philosophy is rooted in grievance. He portrays a world during which America is being exploited by different nations, and People are forged as the final word victims.

That is actually ironic. The US is the nation that championed free commerce and the worldwide change of products and companies. These rules have helped it rise to unparalleled heights in almost each subject of human endeavour. For America to show its again on these beliefs wouldn’t solely be self-defeating; it might carry profound penalties for it within the international financial order.

America’s biggest power at present lies not in retrenchment however in innovation, openness, and management in companies. Quite than enjoying defence, it’s time to steer with a strategic imaginative and prescient.

Washington should pivot away from protectionist nostalgia and champion a commerce agenda that leverages its unmatched international benefits. It should proceed to construct networks, not partitions.

Frank F Islam is an entrepreneur, civic chief, and thought chief primarily based in Washington DC. The views expressed are private