zimmytws/iStock through Getty Photos

Once we final lined America First Multifamily Traders, L.P. (NASDAQ:ATAX) we have been unimpressed with the valuation. Since we anticipated rates of interest to rise on the lengthy finish, we have been searching for a pointy drop in tangible guide worth for this one. We rated it at a maintain, noting that this was simply grazing our “promote zone”.

There stays room for ATAX to maneuver down and catch as much as these as buyers worth within the precise adjustments to earnings and guide values. At 1.20X-1.25X our estimated worth to tangible guide worth, this falls very near our promote zone. We price it impartial for now.

Supply: Curiosity Price Modifications Will Influence 2022

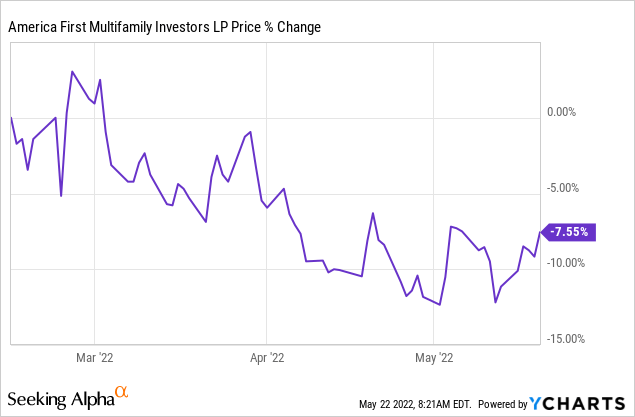

ATAX delivered a weak efficiency from that time and at its trough was down about 12% from that article date.

We have a look at the panorama at this time after the not too long ago launched Q1-2022 outcomes with a broader scope of getting tax-advantaged earnings.

ATAX & Mortgage REITs

Our key cause for staying out, needed to do with costly valuations. This was not readily obvious because the guide values had not been marked down, but. We did get that although in Q1-2022 because the mortgage bond selloff picked up steam.

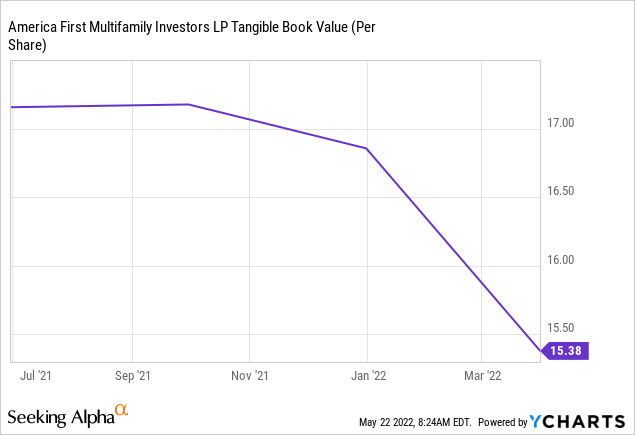

Tangible guide worth dropped a stable 10% per share. As we had beforehand defined, ATAX stays one of many few actual property investments the place tangible guide worth could be very near NAV. The majority of its property embody mortgage income bonds versus bodily actual property. The previous is mirrored at truthful worth based mostly on GAAP, whereas the latter is nowhere near its truthful worth underneath the identical system.

One different means to take a look at ATAX is to consider it as a far much less leveraged mortgage REIT.

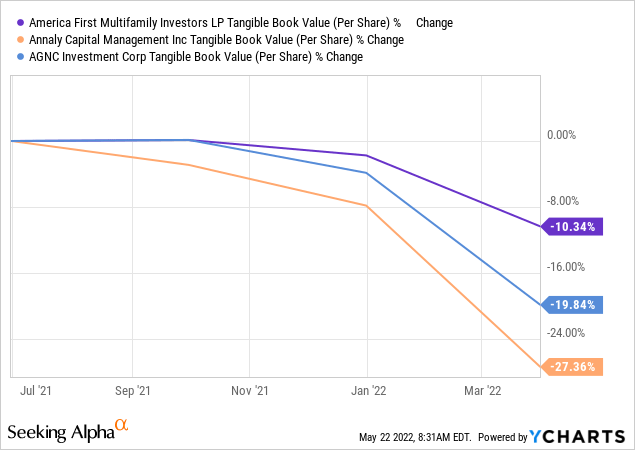

Under you’ll be able to see the drop in tangible guide worth per share for ATAX, AGNC Funding Corp. (AGNC) and Annaly Capital Administration, Inc. (NLY) over the past 12 months.

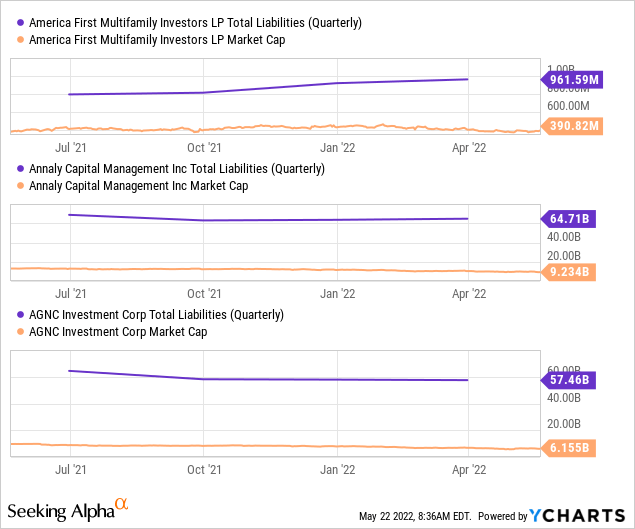

ATAX’s tangible guide drops far much less, regardless of utilizing much less hedges, because it makes use of means much less leverage. You’ll be able to see this by analyzing whole liabilities to market capitalization.

The drop in tangible guide worth whereas notable within the case of ATAX, possible overstates the injury to some extent. A key cause is that ATAX additionally owns precise residences and people possible are appreciating in worth over time. That isn’t mirrored within the falling tangible guide worth. Underneath GAAP we truly see the reverse the place depreciation pushes this side of the asset decrease. ATAX truly booked a big acquire on sale of a property throughout Q1-2022.

In March of this 12 months the Vantage at Murfreesboro property was offered for a product sales worth of $78.5 million or roughly $273,000 per unit. This transaction returned $12.2 million in authentic contributed capital to us together with $17 million in capital good points and most popular return realized upon sale. Our general return of the property was at 2.69 instances a number of of invested capital.

Supply: Q1-2022 Convention Name Transcript

Therefore NAV is larger than tangible guide worth and certain nearer to $17.00 in our opinion.

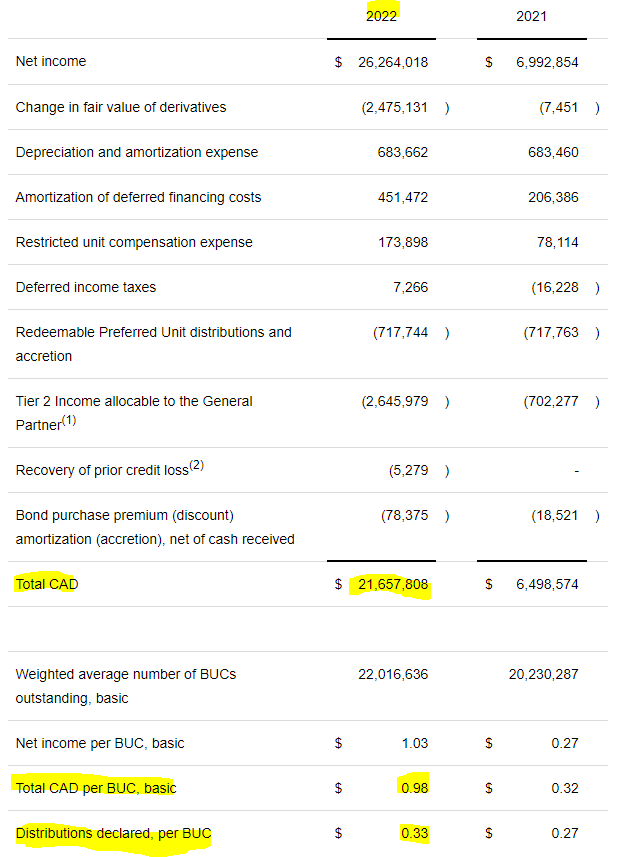

One different side that went rather well for ATAX was the money generated in the course of the quarter. This was possible an outlier quarter, however nonetheless, the 3X protection of the distribution was very spectacular.

– (ATAX Q1-2022 Outcomes)

This mix of decrease leverage and actual property makes ATAX an attention-grabbing different to mortgage REITs.

Valuation & Outlook

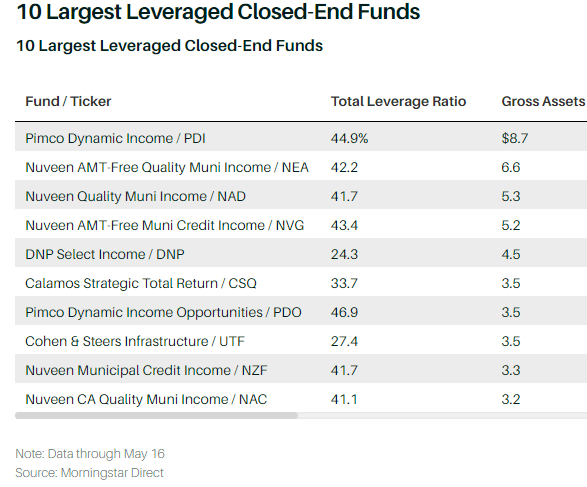

Traders hate paying taxes and that’s most likely the rationale we see that half of the most important leveraged closed finish funds give attention to muni bonds.

Morningstar

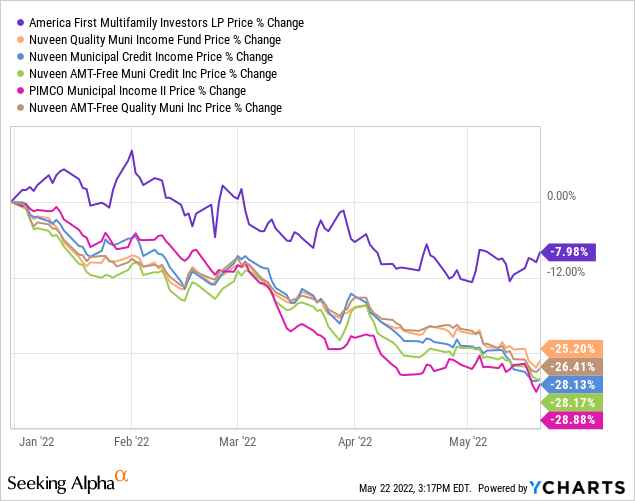

Curiously, these all together with Nuveen AMT-Free High quality Muni Earnings (NEA), Nuveen High quality Muni Earnings (NAD), Nuveen AMT-Free Muni Credit score Earnings (NVG) & Nuveen Municipal Credit score Earnings (NZF), have all fallen about 25%. PIMCO Municipal Earnings II (PML), which isn’t within the listing above, however common nonetheless, has dropped virtually 30%.

ATAX is a substitute for even this house as the majority of its earnings is definitely shielded from taxes. That benefit does include a Okay-1 although. Whereas we have now seen buyers do every kind of foolish antics to keep away from a Okay-1, we do not suppose these are remotely as scary as everybody makes them out to be. ATAX’s partially tax-shielded earnings additionally got here with a greater yield and decrease volatility than these funds.

How We Performed It

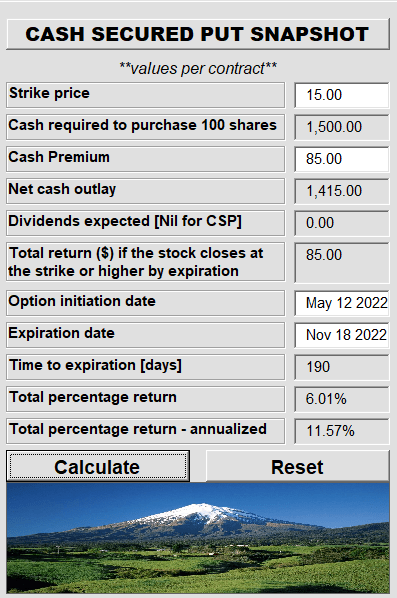

ATAX now trades at about 1.1X tangible guide worth (utilizing numbers from Q1-2022) however realistically, we’re once more nearer to 1.15X, due to additional declines in mortgage bond values in Q2-2022. In a really perfect world, we’d need to decide this up underneath the tangible guide worth and after rates of interest have completed all of the injury that they will. On the latter side, we’re little extra relaxed as we predict a great deal of the injury has been completed. After all, the worth is much greater than tangible guide, so we took a barely totally different method. We determined to promote the $15.00 Money Secured Places for 85 cents on Might 12.

Trapping Worth

This provides us an important danger adjusted entry at $14.15, ought to ATAX commerce under $15.00 on November 18, 2022. The yield on that is additionally fairly aggressive with the inventory itself.

The principle benefit although, is the nice buffer between the strike worth and the inventory worth. This reduces us the volatility of our portfolio in the course of the worst of instances and permits us to solely wind up buying at the absolute best worth. On the present worth we stay impartial on the inventory however do notice that we’d purchase this instantly underneath $15.00/share.

Please notice that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it’s not. Traders are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.