Justin Sullivan

Thesis

Superior Micro Gadgets, Inc. (NASDAQ:AMD) inventory has recovered remarkably from its July lows because the market anticipated a strong Q2 launch. Nonetheless, its post-earnings momentum has stalled considerably after surging by way of July.

In our earlier article in June, we posited that AMD might stage one other low earlier than recovering. We had prompt traders look ahead to a deeper pullback nearer to $70 earlier than pulling the purchase set off. Subsequently, we aren’t stunned that AMD staged its July backside at our posited ranges, in step with the market’s backside.

We consider AMD’s underlying metrics, robust execution, and market share acquire potential augur nicely for its medium-term re-rating on the present worth ranges. As well as, its worth motion has additionally probably bottomed out on its long-term chart as AMD seems in the direction of its knowledge middle and embedded segments to proceed gaining share quickly. Subsequently, we’re assured that the improved shopping for sentiments on AMD point out a re-rating, which ought to assist carry shopping for momentum additional.

In consequence, we reiterate our Purchase ranking on AMD. However, we posit that AMD will probably face near-term draw back volatility, given its fast surge from its July lows. Subsequently, traders can think about ready for a pullback first earlier than including publicity.

AMD’s Diversified Enterprise Helps Overcome Client Headwinds

The current client spending headwinds, exacerbated by worsening macros, have additionally buffeted AMD. In consequence, administration revised its Q3 PC outlook from a decline within the high-single digits to the mid-teens, as discrete graphics additionally upset. But, AMD carried out admirably within the knowledge middle and embedded segments because it continued to achieve share towards Intel (INTC).

The headwinds towards NVIDIA (NVDA) within the discrete GPU phase aren’t trivial. Regardless that NVIDIA highlighted its troubles in a prelim Q2 launch in early August, the challenges might beset it for the remainder of H2’22. A DIGITIMES report in August highlighted:

Taiwan’s main graphic playing cards suppliers have estimated their 2022 shipments to fall 40-50% on 12 months resulting from a pointy lower in demand for cryptomining purposes, with costs additionally trending downward. Accordingly, Nvidia’s revenues for each second-half 2022 and the entire 12 months are estimated to fall at a tempo past creativeness, the sources indicated. – DIGITIMES

Subsequently, AMD’s means to achieve share steadfastly towards Intel is a superb hedge towards the patron headwinds, serving to undergird its valuations. Notably, the prelim report from Omdia prompt AMD persevering with its server market share features, reaching 22.7% in Q2. In distinction, Intel noticed its server market share fall additional to 69.5% in Q2, down from Q1’s 72.7%, as AMD and Arm structure chips gained floor.

AMD CEO Dr. Li Su additionally alluded to its excellent efficiency in knowledge middle in response to an analyst query on market share within the current earnings name. She additionally sees extra potential for additional features as AMD stays “under-represented.” She articulated:

I do know you guys have been asking about [market share] for some time. So I feel your math is within the ZIP code [of around mid-20%] from our standpoint. And we’re happy that we’re gaining share. And we are going to proceed to give attention to that going ahead. I feel we proceed to see vital development alternatives as we go into the second half of the 12 months and into 2023 simply given our robust product positioning. We see Milan persevering with to ramp into the second half of the 12 months, after which we see Genoa coming in in the direction of the tip of the 12 months into 2023. So we’re a bigger piece of the market, however we’re nonetheless underrepresented. And the visibility with our clients, particularly our giant cloud clients, second half of this 12 months into subsequent 12 months is superb. (AMD FQ2’22 earnings name)

We’re assured that AMD’s excellent execution underneath Dr. Su’s exceptional management offers clear income visibility into AMD’s near- and medium-term development cadence. Subsequently, we’re quietly assured that the corporate ought to stay on observe to fulfill its 20% income CAGR goal over the medium-term, regardless of going through fairly intense client headwinds by way of H2’22.

As AMD continues gaining share by way of its knowledge middle and embedded phase, it ought to assist mitigate the challenges seen in its consumer and gaming phase (primarily its discrete GPU). Moreover, AMD’s steering appears considerably conservative, and Dr. Su highlighted that its estimates had de-risked the headwinds from the PC enterprise. Nonetheless, we’re assured that administration is on prime of the scenario and urge traders to remain on observe, as AMD ought to emerge stronger from it.

AMD’s Worth Motion Suggests Close to-Time period Consolidation

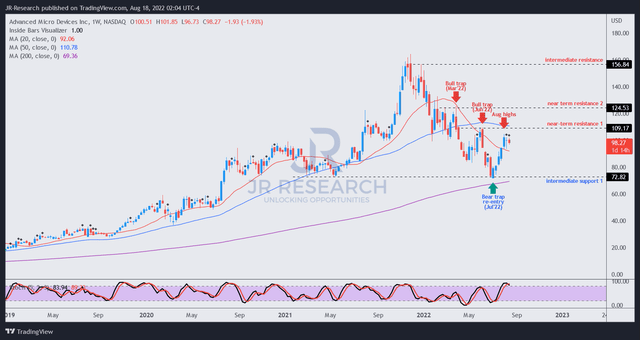

AMD worth chart (weekly) (TradingView)

As seen above, AMD fashioned its July lows near its intermediate help of $70, as we posited in our earlier article. We’re assured that AMD has probably staged its medium-term backside, in step with our evaluation of the market’s medium-term bottoming course of.

Nonetheless, the fast surge from its July lows has stunned us. Additionally, AMD’s shopping for momentum has stalled post-earnings, which means that the market had anticipated a strong card pre-earnings, resulting in the fast restoration.

We posit {that a} near-term consolidation in AMD is wanting more and more probably, because the market digests the bullish momentum from its July lows, given its overbought breadth and momentum indicators.

Therefore, traders can think about including extra aggressively at its subsequent significant pullback.

Is AMD Inventory A Purchase, Promote, Or Maintain?

We reiterate our Purchase ranking on AMD.

We’ve re-rated AMD, requiring decrease free money circulate yields, as we’re assured that the market has lifted the shopping for sentiments over it. Coupled with the corporate’s strong execution and market share features visibility, we urge traders to make use of potential draw back volatility so as to add publicity, as AMD is just not costly.